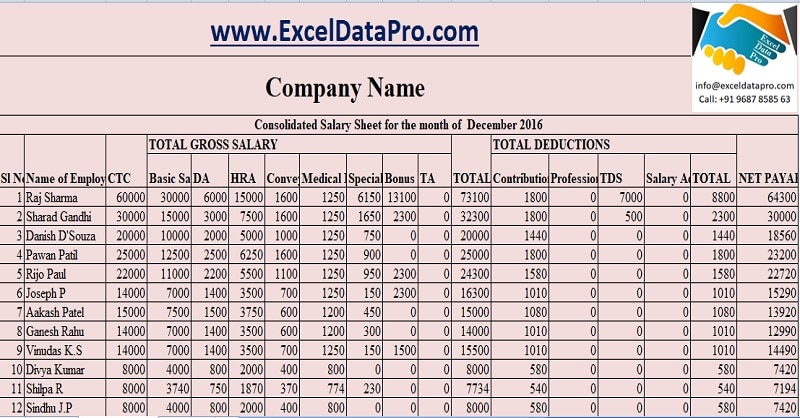

Salary Sheet is a ready-to-use template in Excel, Google Sheets, OpenOffice Calc, and Apple Numbers that helps you easily calculate the salary.

It is a payroll document in which you can record payroll data for multiple employees along with a Salary slip prepared according to Indian rules of Employment, which includes provident fund and employee allowances.

Table of Contents

What is A Salary Sheet?

A salary Sheet is a document that includes complete details of the amount payable to an employee for work done during a particular period. In addition, it contains details like employees’ basic pay, allowances, deductions, overtime, etc.

The payroll or salary sheet is the Human Resource document companies use to calculate their employees’ salaries. It is also known as payroll or payroll sheet. HR maintains financial records of employees, like wages, salaries, deductions, bonuses, holidays, leaves, sick leave, etc., in Payroll.

Generally, Payroll is made daily for wages, weekly, biweekly, or monthly for salaries. However, it differs from one period to another as it is calculated based on actual working days. Thus, each month working days, overtime, leaves, and other variables differ for each employee.

Formula To Calculate Salary

Take-Home Salary = Basic Salary + Allowances – Deductions.

Download Salary Sheet Template

Hr and Payroll staff needs to micro-manage employee payroll data, including basic salary, HRA, TA, Conveyance, Leave details, provident fund deductions, etc.

We have created an automated Salary Sheet Template with predefined formula. You can prepare multiple employees’ salaries within minutes with this template’s help.

This template is available in 4 file formats – Excel, Google Sheets, Open Office Calc, and Apple Numbers. Click on the button below to download the desired format:

Excel Google Sheets Open Office Calc Apple Numbers

Click here to Download All HR & Payroll Excel Templates for ₹299.

The functioning and formulation in all four file formats are the same except for the spellnumber function, as it is not supported in OpenOffice Calc, Google Sheets, or Apple Numbers.

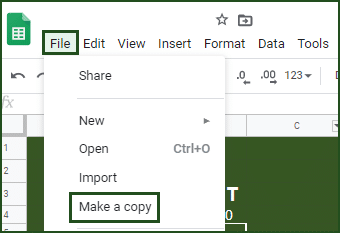

Important Note: Save the file on your Google Drive using the “Make a Copy” option from the File menu to edit and customise the Google Sheet.

Additionally, you can download other HR and Payroll related templates like Salary Slips, Attendance Sheets, Weekly Timesheets, and much more.

Let us discuss the contents of the template in detail.

Contents of Salary Sheet Template

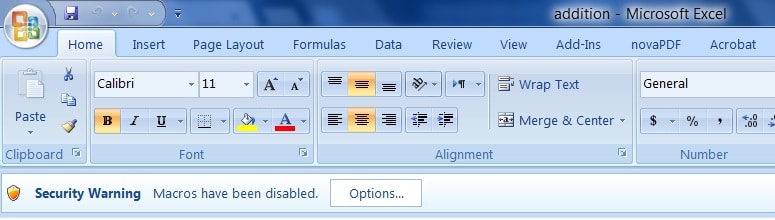

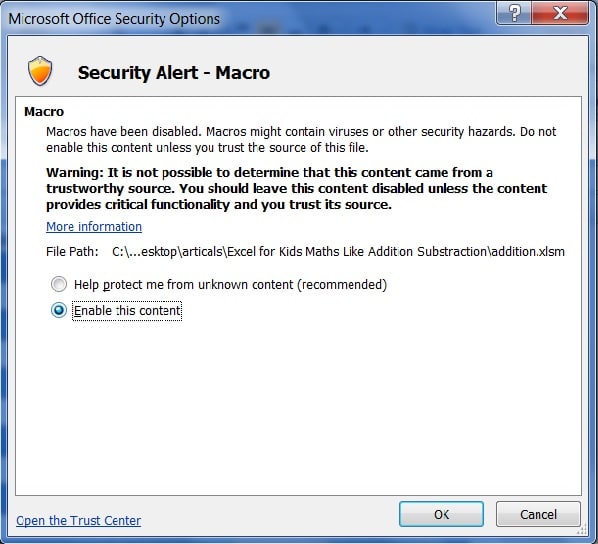

Note: After you download the Excel and open the office template, don’t forget to enable the content in the security warning pop-up below the ribbon as shown in the images below:

The salary Sheet template consists of the following three sheets: Employee Database, Consolidation Sheet, and Employee Salary Slip

Employee Database

The database sheet consists of the master data, where the data of each employee will be entered. Major data in this sheet needs to be entered one time.

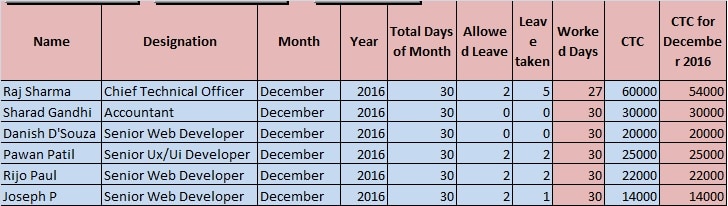

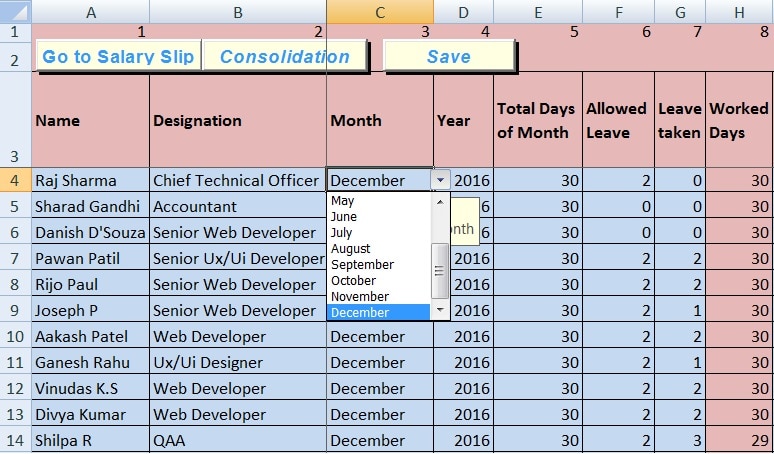

The first section includes employee details such as name, designation, salary month, allowed leaves, leaves are taken, and working days.

You can select the month and year of salary from the dropdown list. When the user selects the month and year for the first employee, it automatically displays the same for other employees. We have kept a provision of 20 employees. If you want to increase employee salaries, you can drag the same using the fill handle.

The user can select the total days of the month (30, 31, 28, or 29) from the dropdown list. When the user selects the month and year for the first employee, it automatically displays the same for other employees.

Allowed leaves are different according to the designation and company policy. Hence, you need to enter individually.

Insert actual leaves availed by the employee, and the template automatically calculates the working days. The allowed leaves are deducted from the total leaves, which is how the actual working days are calculated. The template uses the “=IF(G4>=F4, E4-G4+F4, E4)” formula to calculate the working days.

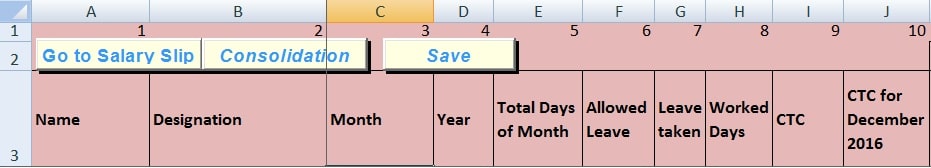

Insert CTC for each employee as per the employee contract. CTC = Direct benefits + Indirect benefits + Saving Contributions. For more information on CTC, click here.

CTC is calculated based on working days. Hence, the template calculates the CTC proportionately according to the working days for that particular month. The template uses “IF(H4=0, “”, ROUND(I4/E4*H4, -1))” formula.

Components of Salary

The Salary has three major components: Basic Pay, Allowances, and Deductions.

Basic Pay/Basic Salary

The basic salary is the fixed amount to be paid to an employee in addition to any allowances or subtraction of any deductions. Bonuses, overtime, dearness allowance, etc., are not a part of basic pay. For more information about Basic Salary, click here.

The template auto-calculates the basic salary based on CTC. Usually, it is 40% or 50% of the basic salary. The basic Salary is proportionate to the working days. It uses the following formula to calculate the basic salary “=IF(H4=0, “”, ROUND ($J4/E4*H4*50%, -1))”.

Next comes the allowances section. Allowances are an employer’s financial benefits above the Basic Salary to his employees. These allowances differ based on company policy, industry, job profile, and department. The template adds all the following amounts to form the gross salary.

Dearness Allowance

DA or dearness allowance is an allowance that the employer pays its employees against the price rise in the economy to reduce the impact of inflation. Employers provide DA as the cost of living adjustment allowance in India, Pakistan, and Bangladesh. Government employees, public sector employees, and pensioners get to DA.

DA is auto-calculated. DA (Dearness Allowance) is 4% to 10% of basic pay, depending on the contract. It uses the following formula to calculate DA “=IF(H4=0,” “, ROUND (J4/E4*H4*10%, -1))”. For more information on Dearness Allowance, click here.

House Rent Allowance

HRA stands for House Rent Allowance. House Rent Allowance is the amount an employer allocates to the employee as a portion of their CTC salaries. The employer decides the house rent allowance depending on different criteria like the city of residence and salary grade.

It is 50% of the basic pay for employees in a metro city, whereas, for employees in a non-metro city, it is 40%. Generally, when these rules aren’t applicable, it is 10 % of the basic salary. For more information on House Rent Allowance, click here.

House Rent Allowance is auto-calculated. Usually, it is 25%-30% of CTC. Insert the percentage in the formula as per the employment contract. It uses the following formula to calculate HRA “=IF (H4=0, ” “, ROUND (J4 / E4 * H4 * 25%, -1))”.

Conveyance Allowance

Allowance or money to compensate for an employee’s travel expenses between their residence and workplace is Conveyance Allowance. It is also known as transport allowance.

You need to insert the conveyance allowance in the formula as per the employee contract. The conveyance working column calculates the conveyance amount based on employee attendance.

It uses the following formula to calculate the conveyance allowance “=IF(H4=0, ” “, ROUND (N4/E4*H4, -1))”. Furthermore, if the employee’s working days are 0, then it will display 0.

To learn more about Conveyance Allowance, click here.

Medical Allowance

Medical Allowance is a fixed allowance that an employer pays its employees as a part of their salary to meet their regular medical needs. The employer credits a fixed amount as a medical allowance and the salary to the employee’s account every month.

Medical allowance is calculated based on applicability to employees as per the contract. Therefore, it will calculate if you have selected yes in the medical allowance column at the end. Otherwise, it will display 0.

Furthermore, if the employee’s working days are 0, it will display 0. It uses the following formula to calculate the medical allowance “=IF(H4=0, ” “, ROUND(P4/E4*H4,-1))”.

For more information on medical allowance, click here.

Special Allowance

The Special Allowance is auto-calculated by deducting the basic pay and other allowances. The special allowance is a fixed allowance given to employees to meet certain requirements over and above the basic salary.

The template uses the following formula to calculate special allowance “=IF(H4=0, ” “, ROUND(J4-T4,-1))”. You can insert it manually if it is different for each employee.

Children’s Education Allowance, Hostel Allowance, Miner’s Allowance, Outstation Allowance, Offshore Allowance, etc., are some special allowances.

Bonus Pay

Insert the bonus payment amount if it applies to any employee for any particular month. Bonus pay is an employer’s reward to his employee for their excellent work. Usually, in countries like India, Pakistan, and Bangladesh, companies pay bonuses yearly based on the organisation’s overall financial performance and are paid during festive seasons.

TA – Travel Allowance

Insert TA for the employee on spent by the employee for that particular month. TA stands for Traveling Allowance. Travelling allowance is the amount paid or allotted to an employee by the employer for travelling to another place for business purposes.

The travelling allowance includes modes of travel, accommodation, meals, and other incidentals. To learn more about Travel Allowance, click here.

All the above things compile the gross salary. Gross Salary is the total of all the components of your monthly payout before any deductions.

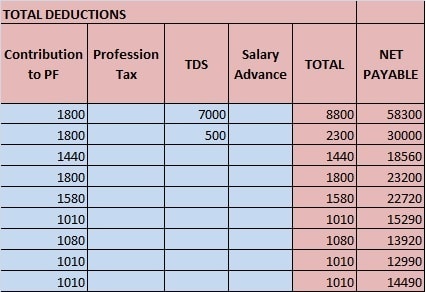

Followed by the allowances, the templates consist of deductions. Employee Deductions are the amounts subtracted from an employee’s gross pay to reach net pay. For example, the template deducts all the following amounts from the gross salary.

Employee Contribution To Provident Fund

As per Indian Labor Law, an employee has to contribute a part of the salary towards the provident fund. Currently, it is 12%. Therefore, the template uses the following formula to calculate “=ROUND (MIN (1800, IF (AG4=”Yes”, SUM(K4: L4) * 12%, 0)), -1)”.

Employee Provident fund is a type of retirement benefits scheme for salaried employees. Under this scheme, the employee makes a stipulated contribution from his salary. The government decides this percentage.

Salary Advance

Insert the amount of salary advance for each employee if applicable. When an employee draws in full or portion of salary in advance, it refers to a Salary advance. While calculating the salary, the employer deducts the same from the salary.

Professional Tax

If the professional tax is applicable, then insert the monthly amount of professional tax. Professional Tax is a tax a government levies on professionals based on their salary/monthly income. Usually, it is around Rs. 200 a month, which amounts to the maximum payable of Rs. 2500 in a year in India.

Tax-Deducted At Source

Insert the actual TDS amount. TDS stands for Tax Deducted at Source. It is the income tax that an employer deducts from the employee’s salary. The employer deposits this collected tax to the IT Department. Click here for more information on TDS, TDS Threshold, TDS Return, etc.

Subtracting the total deduction amount from the gross salary compiles the net payable salary to the employee.

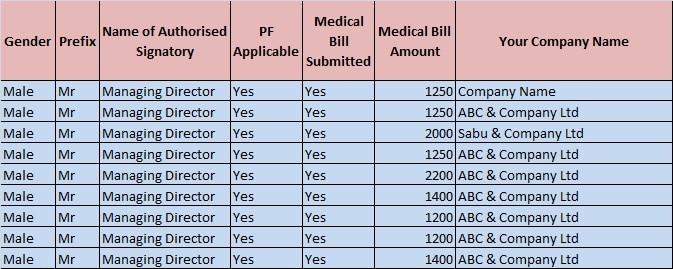

General Information

Select the gender and prefix of the employee from the dropdown list. Also, select the authorized signatory of the department for each department if it differs from the dropdown list.

Select “Yes” if PF is applicable. Select “Yes” if the employee has submitted the medical bills. If the user selects “No”, the template will not add the medical allowance to the salary.

Given above are details preparing the salary according to the Indian Salary structure.

The user needs to enter data only in blue-coloured cells. The pink-coloured cells contain predefined formulas. You need not enter data in pink colored cells. See the image below:

In this sheet, some data input columns have a drop-down menu, which makes it easier for the user to select and enter data. For example, month, Year, Title, Gender, etc., are in the drop-down menu. See the image below:

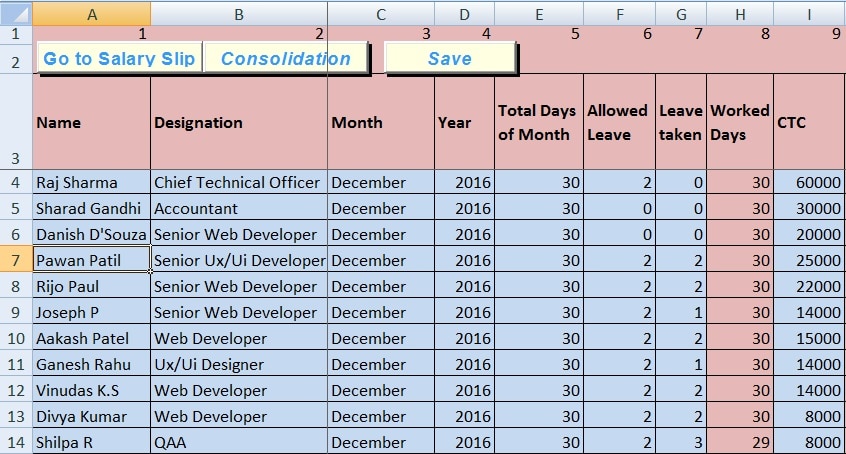

The template consists of buttons at the top of the sheet for easy navigation in, as shown below:

After entering data in the Database Sheet, click the “Consolidation” button. It will navigate you to the Consolidation Sheet.

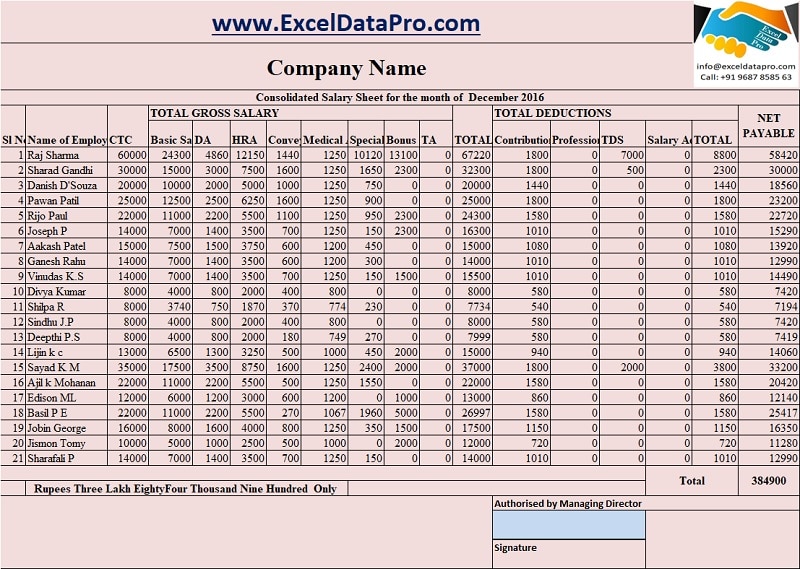

Consolidation Sheet

The consolidation sheet consists of a month-wise sheet of salary data entered into the Database Sheet. This sheet links the Database sheet to each cell and automatically fetches the date from the Database sheet. You don’t need to enter any data into this sheet.

If you enter the month or year in the database sheet wrong, it will not display in the consolidation sheet for that particular month.

You can print a monthly report of salary for approval from higher management. Once the signing authority approves the salary, you can pay the employee by cheque or direct bank transfer.

Click on the “Go to Salary Slip” button to navigate to Salary Slip Sheet to print individual salary slips for employees.

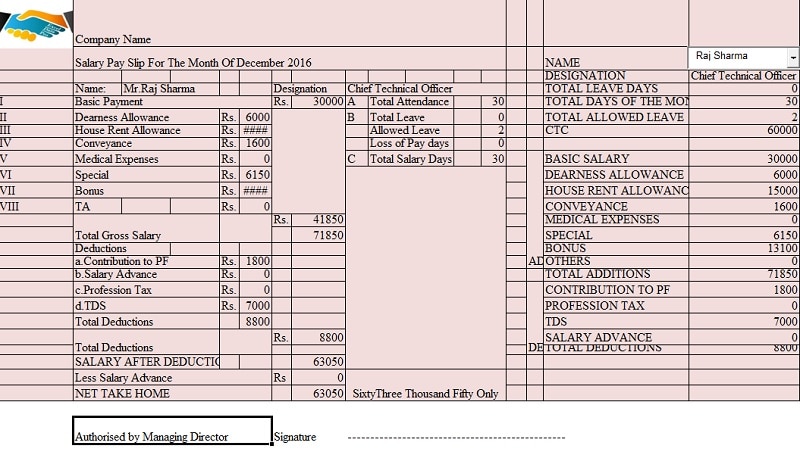

Salary Slip

The salary slip sheet uses the VLOOKUP Function to program the sheet. On the extreme right, select the employee’s name from the drop-down list. The template displays the salary data of the respective employee. Click on the print button to print the Salary Slip.

Your Payroll process is complete. This template is very user-friendly and easy to use for everyone. This template can be helpful for Accounts assistants, Office admins, HR Assistants, Executive Assistants, etc., for preparing salaries.

If you want to make only a Salary slip without keeping the data, use our ready-to-use Corporate Salary Slip Template.

Frequently Asked Questions

What Are Payroll Expenses?

Payroll Expenses include salaries, wages, bonuses, commissions, EFB, PF, EPS, company contributions such as a company-paid health plan, and the company-paid portion of taxes.

An employer pays the payroll expenses to its employees in the form of salary/wage for their services/work and associated expenses such as employee benefits and state and federal payroll taxes.

What is Gross Salary?

Gross Salary is the salary amount, including all benefits and allowances, before any deductions. In simple terms, Gross Salary is the total of all the components of your monthly payout before any tax deductions. Gross Salary = Basic Salary + Allowances + Benefits. For more information on components of Gross Salary, click here.

What is Net Pay or Take Home Salary?

The net pay or the take-home pay is the salary/wages of an employee that remains after all deductions(taxes, health insurance, benefits, etc.) have been subtracted. In simple terms, Net pay is the amount an employee receives after all taxes/deductions during a particular pay period.

How To Calculate Overtime?

Overtime Pay means the amount compensated for hours or days worked more than the maximum limit mentioned in your contract or set by federal or provincial law. Click here to get the formula for calculating Overtime.

How much percentage of CTC is the Basic Salary?

The basic salary is usually 40% – 50% of CTC.

How much percentage of Basic Salary is Dearness Allowance(DA)?

Dearness Allowance is usually 5% to 10% of the Basic Salary.

On which amount is the PF deduction calculated?

PF is calculated on Basic Salary.