What is Employee Mileage Log?

Employee Mileage Log is the document that records the miles run in personal or company for the business purpose and is submitted along with the Mileage Reimbursement Form. This template can be helpful for reimbursement as well as federal income tax purpose.

When an employee travels on his personal or company vehicle he has to maintain a record for the same for mileage reimbursement. The reimbursement can be against the fuel bills or predefined the mileage rates of the company.

Business persons planning to claim mileage deduction can claim the deduction in two ways, Standard Mileage deduction or Actual Mileage Deduction. This template can be helpful for calculating the actual mileage.

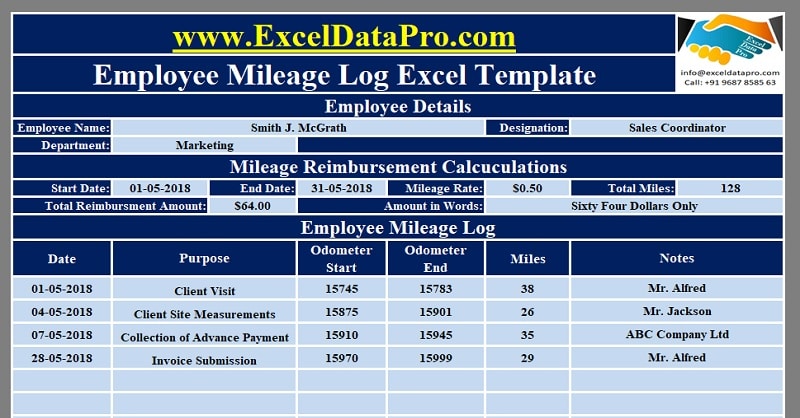

Employee Mileage Log Excel Template

We have created a simple and ready-to-use Employee Mileage Log Excel Template with predefined formulas. You can use it as a mileage log as well as the reimbursement form.

You just need to enter your odometer start and end figures and it will automatically calculate the mile run for you. Additionally, it will also calculate the amount of reimbursement if you have entered the mileage rate.

Click here to download Employee Mileage Log Excel Template.

Click here to Download All HR & Payroll Excel Templates for ₹299.You can also download the blank printable format of this from the link below:

Employee Mileage Log Printable Format.

You can also download other HR & Payroll Templates like Employee Resignation Schedule, Salary Sheet, Salary Slip, Job Candidate Tracker etc from here.

In addition to the above, if you are an Apple Mac user then you can download Apple Numbers Templates from the link below:

Let us discuss the contents of the template in detail.

Contents of Employee Mileage Log Excel Template

This template consists of 3 section:

- Employee Details

- Mileage Reimbursement Details

- Employee Mileage Log

1. Employee Details

In this section, you need to enter employee name, designation and department details.

2. Mileage Reimbursement Details

This section consists of reimbursement details like Start Date and End Date of the Log, Mileage Rate, Total Miles and Total Reimbursement amount in figures and words.

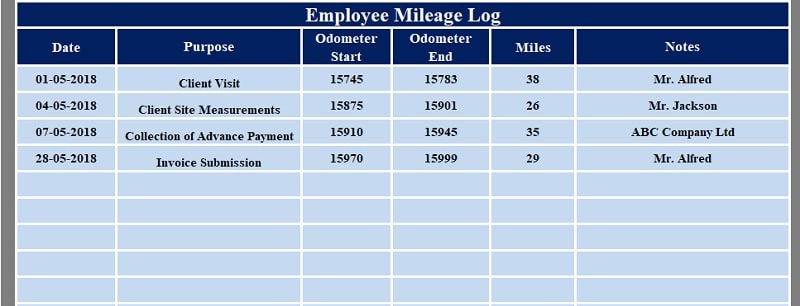

3. Mileage Log

Employee Mileage Log consists of following columns:

Date: Date on which the trip was taken.

Purpose: Purpose of the trip.

Odometer Start: The figures displayed on the odometer at the time of the start of the journey.

Odometer End: The figures displayed on the odometer at the time of the end of the journey.

Notes: Here you can record any specific details of the trip or the client’s details according to your requirement.

This Employee Mileage Log can be helpful to employees and business owner to log their mileage for income tax as well as reimbursement purposes.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.