Employee TA Reimbursement Template is a ready-to-use template in Excel, Google Sheet, and OpenOffice that helps you to record your travel expenses for reimbursement purposes.

This template is useful to employees and companies where the travel expenses are reimbursed on an actual basis.

Table of Contents

What is the TA?

Employees are entitled to TA reimbursement for their official travels. TA stands for Traveling Allowance. Traveling allowance is the amount paid or allotted to an employee by the employer for traveling to another place for business purpose.

The traveling allowance includes modes of travel, accommodation, meals, and other incidentals. Traveling Allowance is an additional sum of money apart from the salary given to the employee when he/she travels to other places for business purposes. Thus, the amount is not deducted from the salary of the employee.

TA Payment Policies

Companies pay TA either in advance before the travel or reimburse after the travel has been made. It depends on company policy, employee rank, workplace policies, etc.

Moreover, many companies pay on a per diem basis. It means that a fixed amount is paid per day for such traveling for business purposes. This is used when traveling is very frequent. It also safeguards the company from misuse of the money.

From an employer’s point of view, actual reimbursement is beneficial to the organization. This prevents the misuse of the company’s money.

Whereas from an employee’s point of view the advance is better. When the company pays in advance, the employee has the opportunity to spend economically and save some money.

Components of TA Reimbursement Form

Usually, in a small or medium-sized company, the reimbursement of TA includes modes of travel, accommodation, meals, and other incidentals.

But in larger corporates, there are many more details as follow:

Airfare

Rail transportation

Rental vehicles

Conference registration fees

Mileage expenses

Rental vehicle expenses

Lodging (commercial)

Meals (per diem)

Business meals

Business expenses

Parking

Telephone calls

Tolls

Visa, passport fees, and immunizations

Other business expenses.

Different companies have their predefined formats for reimbursement of TA.

Employee TA Reimbursement Excel Template

We have created a ready to use Employee TA Reimbursement Template in Excel with predefined formulas.

This template is useful for employees to claim reimbursements of their TA as and when they travel for the business purpose.

Excel Google Sheets Open Office Calc

Click here to Download All HR & Payroll Excel Templates for ₹299.

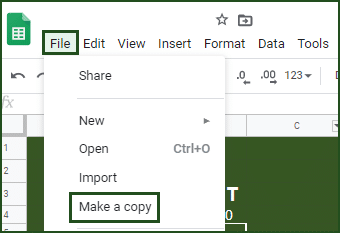

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Additionally, you can download other HR and Payroll Templates like Employee Evaluation Template, Weekly Timesheet, Job Candidate Tracker, and much more.

Let us discuss the contents of the template in detail.

Contents of the Employee TA Reimbursement Template

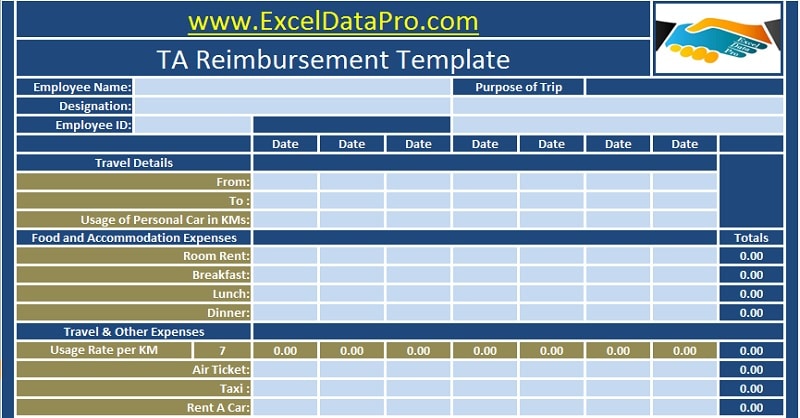

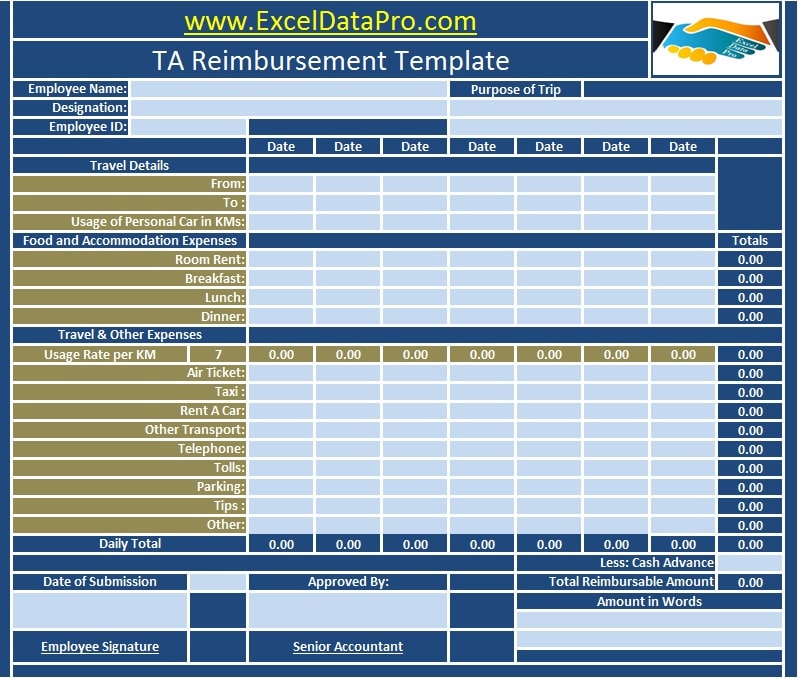

This template consists of 6 sections: Header Section, Employee Details Section, Travel Details Section, Food and Accommodation Expenses Section, Travel and Other Expenses Section, and Approval Section.

The header section consists of the company name, company logo, and heading of the sheet “TA Reimbursement Template”.

Employee Details

Employee details section consists of general details like employee name, employee id, designation, department, and purpose of the trip.

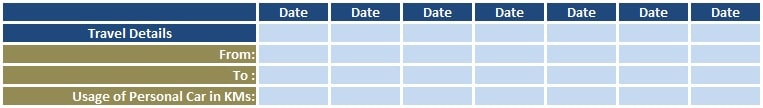

Travel Details

Trave details section consists of data for each day, From and To Travel destinations.

If you are using your vehicle for the official travel then you need to enter kilometers for a daily run.

Once you add the kilometers the sheet will automatically multiply it with the usage rate and displays the result in the travel expenses section.

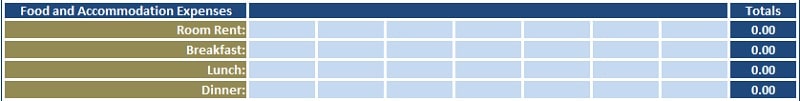

Food and Accommodation Expenses

This section consists of expenses related to room rent, daily breakfast, lunch, and dinner.

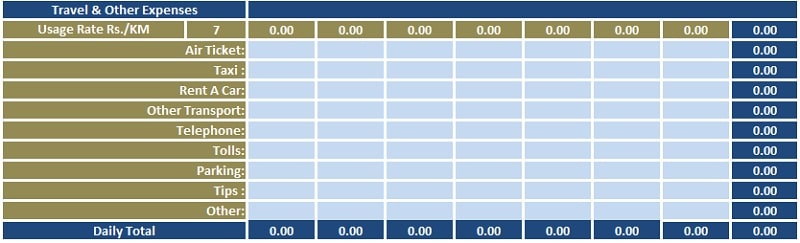

Travel and Other Expenses

The travel and other expenses section include all expenses related to travel. It includes expenses of air tickets, taxi charges, rent a car, parking, etc.

If you are using your vehicle for travel, you need to mention the daily run in the travel details section.

If you mention the daily run and rate in the respective column, it will automatically calculate the mileage for you.

The template shows both; daily totals as well as weekly totals of each head of expense. With this template, you can claim up to 7 days of travel expenses.

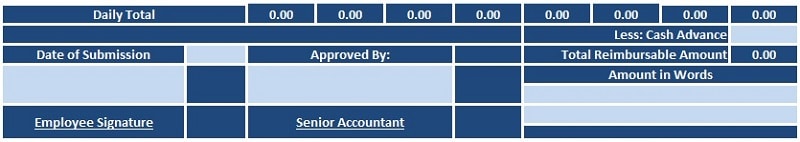

Approval Section

In the end, there is an approval section. This section consists of final calculations. If you have received any advances from the company you need to mention them in the cell below totals.

Total Reimbursable amount = Sub-Total – Advances.

Furthermore, it includes the signature boxes for the claiming employee and the approving authority.

Note: Keep in mind to claim the travel reimbursements well in time. Usually, previous fiscal year reimbursements are non-claimable.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Frequently Asked Questions

What does a company travel policy contain?

Business travel policies vary from business to business. Usually, it includes the approval process, clarifications of expenses to be reimbursed, non-reimbursable expenses, the threshold of expenses (amount allowed), and other general rules.

Actual reimbursement or Per Diem. Which one is better?

Per Diem system creates a win-win situation for both employee and employer. The employer pays a fixed amount per day. On the other hand, the employee is free to use that amount as per his convenience and can save a portion out of it. Moreover, in the per diem system, the employer doesn’t need to keep records of receipts. This also saves time for the accounting department.

Whereas, in the actual reimbursement system, it is hectic for both employees as well as employers. The employee will need to keep the receipts for approval and the accounting department’s work will also increase. Hence, the Per Diem system is better.

Does the business travel allowance vary from employee to employee?

Yes, the business travel allowance varies from employee to employee. The first and foremost difference is on the basis of employee grade. The manager will have a higher amount whereas the executive will have a lower allowance amount. Moreover, it also differs on the basis of other factors such as the nature of travel (domestic or international) and travel mode (bus, train, company vehicle, flights).