Employee Overtime Calculator is a ready-to-use template in Excel, Google Sheets, and OpenOffice Calc that helps you easily calculate overtime.

Table of Contents

What is Overtime?

For an hourly employee, Overtime refers to the extra amount of time an employee spends for works in addition to its regular working hours. In other words, any hours that employee works exceeding their scheduled work-time is overtime.

Overtime is common or even mandatory for employees in industries like construction, IT, Event Management, etc.

Overtime Rules

Normal working differs from industry to industry and even company to company. Some companies have 8 hours and some have 10 hours. Companies determine normal working hours depending on the job type and by the best practices of a profession.

Countries define Labor laws considering the overtime to prevent employees from being forced to work long hours. These laws even contain regulations of compensation for overtime.

Usually, 1.5 times also known as time and half is offered to employees. In some cases, it is offered double of regular hourly pay.

Furthermore, the overtime federal law obligates employers to pay a rate that is greater than the standard wage for regular hours.

It is 40 hours per week in most countries including the U.S. Thus, it is mandatory for the employer to compensate each hour exceeding the normal threshold.

What is Overtime Pay?

Overtime Pay means the amount compensated for hours or days worked more than the maximum limit mentioned in your contract or set by federal/provincial law.

Usually, small companies and factories require managing the employee hours for the payment of overtime. It sometimes becomes a tedious job. Let us discuss how to calculate employee overtime.

How To Calculate Overtime?

There are two types of employees: Hourly Employees and Salaried Employees. The calculation of overtime differs for both categories.

Usually, you can use the formula given below to calculate the overtime pay. But it may differ according to geographical locations or organization./

Hourly Employee

Use the following formula to calculate overtime pay for an hourly employee:

Overtime Pay = Regular pay X 1.5 X number of extra hours

Example

If an employee works 2 hours more than his decided limit, the calculation will be as below:

$20(Regular pay/hour) X 1.5 X 2 hours = $60 Overtime Pay

Salaried Employee

The calculation of overtime for a salaried employee is different. First of all, we need to find his pay per day and then find his pay per hour.

Formula to Calculate Hourly Pay

Hourly Pay For Salaried = Yearly Salary / 2080 hours

OR

Hourly Pay For Salaried = Monthly Salary / 160 hours

Example

If a salaried employee works 2 hours more than his decided limit, where his salary is $2,000. As per the Fair Labor Standard Act (FLSA), An employee whose salary is below $684 per week, is eligible for overtime pay. This limit has been recently increased to $684 from $455.

Thus, the calculation will be as follows:

Hourly Pay = $2,000 / 160 = $12.50

Overtime Pay = $12.50 X 1.5 X 2 = $37.50

Employee Overtime Calculator Template

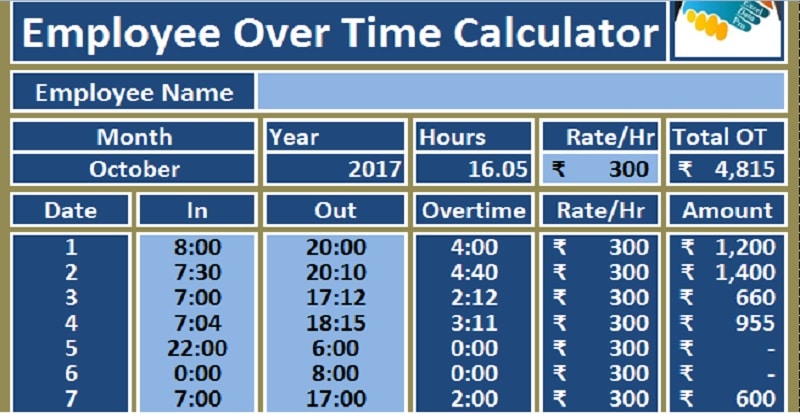

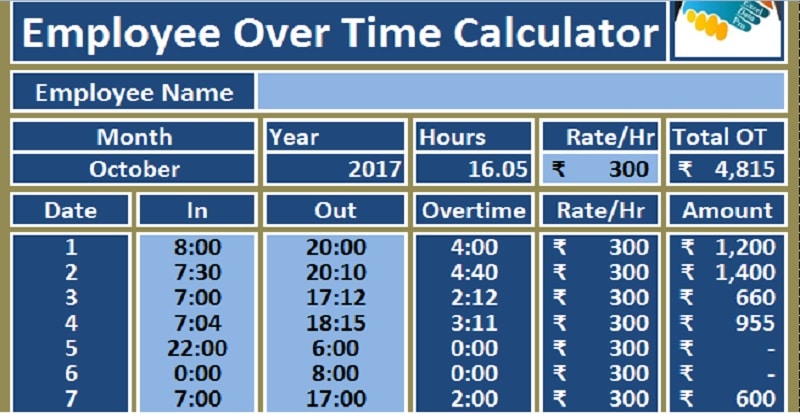

We have created an Overtime Calculator Excel template with predefined formulas. You can easily and efficiently calculate overtime. Just enter the In and Out time along with the overtime rate and it will automatically prepare the pay sheet for you.

Excel Google Sheets Open Office Calc Apple Numbers

Click here to Download All HR & Payroll Excel Templates for ₹299.

Additionally, you can download other HR Templates like Salary Sheet, Attendance Register, Gratuity Calculator, etc.

Let us discuss the contents of the template in detail.

Contents of the Employee Overtime Calculator Template

This template consist of 3 sections: Header Section, Summary Section, and Data Input Section.

Header Section

The header section consists of the company name, company logo, and heading of the sheet “Employee Overtime Calculator”.

Summary Section

The summary section consists of the following subheadings:

Employee Name: Name of Employee.

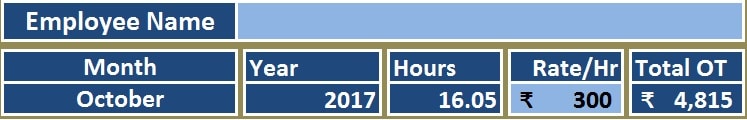

Month: Select the month from the drop-down list.

Click on the link below to learn how to easily create a drop-down list.

How to create a drop-down list in 3 easy steps.

Year: Enter year.

Hours: This cell will display the total number of hours worked by the employee for the whole month.

Rate/Hr: Enter the rate per hour for overtime.

Total OT: Total OT shows the total amount of Overtime earned by the employee.

Data Input Section

The Data Input section consists of the following subheadings:

Date: The date from the 1st of every month till the end is displayed here.

In: Employee In time is entered here.

Out: Employee Out time is entered here.

Overtime: The template automatically calculates the number of hours worked more than the limit.

The formula applied here is =IF(OR(D11=””,F11=””),””,(IF(D11>”12:00″,”00:00″,(“24:00”-D11)+F11))-“08:00”)

We have set the limit to 8 hours. You can change it by changing the last part of the formula.

Rate: Rate per hour of Overtime.

Amount: This column displays the total amount of overtime per day.

In the end, totals of monthly overtime hours and amounts are displayed.

Overtime Exemptions

As per FLSA,

Most employees in the United States be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one-half the regular rate of pay for all hours worked over 40 hours in a workweek.

However, FLSA excludes certain jobs from overtime compensation. The Fair Labor Standards Act determines exempt jobs. These include executive, administrative, professional, outside sales employees, and some of the IT sector employees.

Moreover, the employer needs to fulfill many requirements to consider an employee as exempt. Let’s take an example of administrative employees.

To qualify for the administrative employee exemption, all of the following tests must be met:

- The employee salary should not be less than $684 per week.

- The employee’s primary duty must be the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers.

- The employee’s primary duty includes the exercise of discretion and independent judgment with respect to matters of significance.

To know more about these exemptions click on the link below to download the FLSA explanation:

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Frequently Asked Questions

What are normal hours yearly, monthly, and weekly for a salaried person?

The normal hours are 2080, 160, and 40 respectively for a salaried person.

Can we say no to overtime?

Your employer can ask you to work extra hours even if your contract doesn’t include it. You have a right to say no but if you say no without a good reason it will damage your relationship.

Is straight time overtime legal?

Yes, it is legal but subject to conditions. The employers who offer straight-time overtime must comply with federal wage and hour laws. According to the law, an employer needs to pay all overtime at a rate equal to one and a half times their regular pay for every hour over 40 hours per week to all nonexempt employees in the U.S.

How many hours make you full time?

According to general HR standards, an employee working 30-40 hours or more per week is considered a full-time employee. But a part-time employee is the employee who works less than 130 per month or less 30 hours per week.