Salary Arrears Calculator is a ready-to-use template in Excel, Google Sheet, and OpenOffice to calculate month wise salary arrears with salary break-up.

Moreover, with the help of this template, you can calculate salary arrears up to 35 years for an employee. Just insert the desired amounts and the template will automatically calculate the arrears for you.

Table of Contents

What Does It Mean By Salary Arrears?

The word “Arrears” means previous partial or full overdue of any payments. Salary Arrears means the previous salary dues that an employer pays during the current month or year.

In simple terms, salary arrears are the delayed either the differential payment of incremental salary or full payment normal salary after the due date.

Reasons for Salary Arrears

Usually, these delays can be either natural or artificial. Natural causes include delay in opening a bank account, payment system failures, etc. Whereas artificial causes include, lawsuits, delayed promotions, etc.

An employee’s bank account process took 2 months to open. Thus, he/she receives 2 month’s salary in arrears. It is an example of natural causes.

An employee is due for promotion and not promoted for any company reason. Later on, the company decides to pay him the difference in salary for that delayed period. It is an example of artificial causes.

In simple terms, Salary Arrear is the difference between current and incremental salary.

Let us understand it with an example.

Example

Anuj’s is having a salary of 10,000 salaries. He files a lawsuit for not getting a promotion for a period of time or for some valid reason.

Anuj wins the case. The court instructs the company to pay salary arrears for the past year on a new pay scale which is demanded by Anuj.

Previous Salary Breakup of Anuj = 5,000 Basic + 2,000 HRA + 1,000 DA + 1,000 Conveyance + 1,000 Medical

New Salary Breakup of Anuj = 8,000 Basic + 3,000 HRA + 2,000 DA + 2,000 Conveyance + 2,000 Medical

The total of the previous salary already paid is 10,000 per month and the total of newly approved salary is 17,000.

Now there are 2 scenarios that can be taken into account:

Scenario 1 – Complete Salary Arrears

If the company hasn’t paid a single rupee during that period. In this case, he is entitled to the following:

17,000 X the total number of unpaid months.

Scenario 2 – Partial Salary Arrears

He is paid as per the previous salary that is 10,000. Now he is eligible for the difference of pay.

(17,000 – 10,000) X the total number of partly paid months.

Salary Arrears Calculator Template (Excel, Google Sheet, OpenOffice)

To simplify the process of calculating arrears we have created a simple and easy Salary Arrears Calculator with predefined formulas.

You just need to enter the previous and newly approved amounts under each head of the salary. The template will automatically calculate the difference and provide you with the amount of Salary Arrears.

Excel Google Sheets Open Office Calc

Click here to Download All HR & Payroll Excel Templates for ₹299.

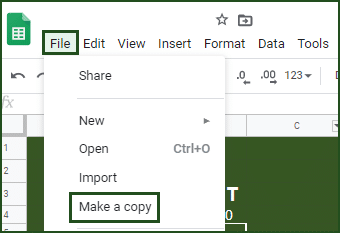

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

How To Use Salary Arrears Calculator Template?

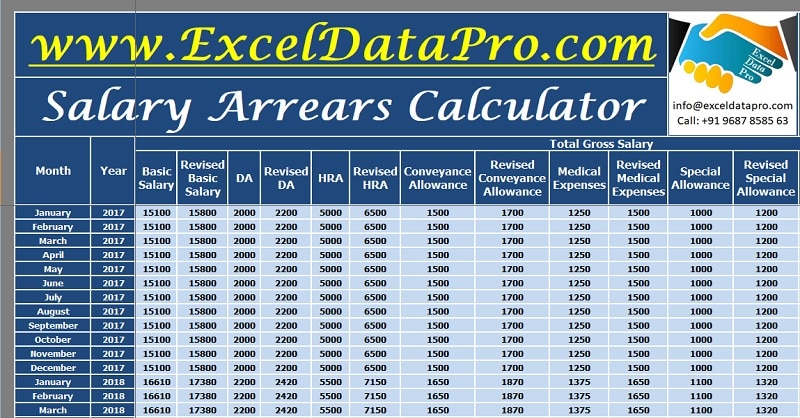

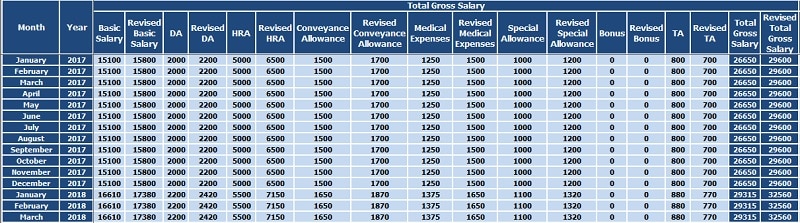

This template consists of 3 sections: Total Gross Salary, Total Deductions, and the Differential Arrears.

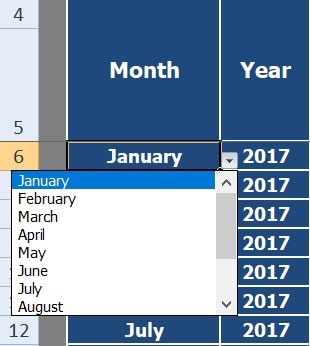

The first 2 columns are for Month and Year. To select the month use the drop-down list. All 12 months starting from January to December.

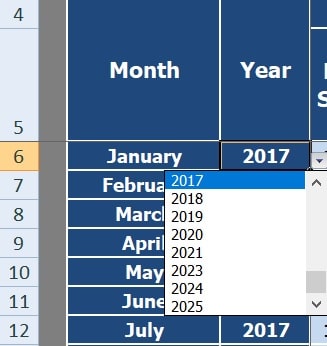

Similarly, to select the year, use the drop-down list.

Years Starting from 1990 to 2025. You can calculate the arrears for about 35 years using this template.

Create A Drop-down List in Excel In Just 3 Easy Steps

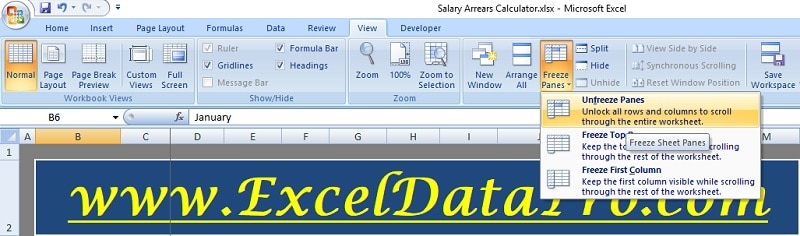

Top panes have been frozen using the Freeze Panes Function. Select the cell from where you want to freeze.

Go to Ribbon -> View -> Click on “Freeze Panes”

Total Gross Salary Calculation

Gross Salary is the total amount of salary without any kind of deductions. Components of gross salary differ from country to country as well as company to company. It consists of heads according to Indian salary markups:

Basic Salary

Dearness Allowance (DA)

House Rent Allowance (HRA)

Conveyance Allowance

Medical Allowance

Special Allowance

Bonus Pay

Travel Allowance

There are 2 columns for each head. One is for inserting the actual amount and the second for the revised amount. In the end, there are 2 columns; Total Gross Salary and Revised Total Gross Salary.

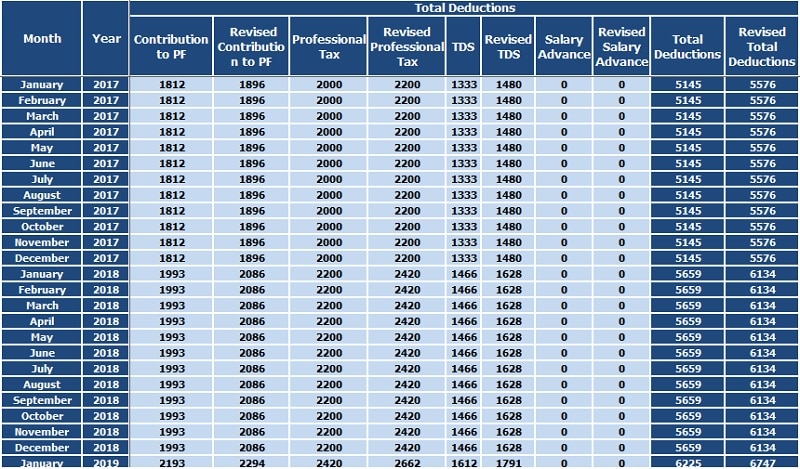

Total Deductions Calculations

Deductions include a contribution to PF, Professional Tax, TDS (Tax Deductions at Source), and Salary Advances (if any).

Similar to the gross salary section, this section also has 2 columns for each head. Insert the current amount in the first column and the revised amount in the second.

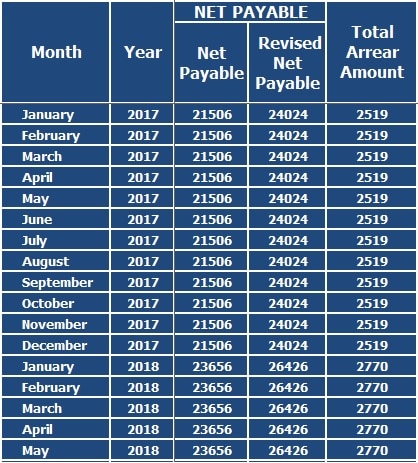

Differential Salary Arrears Calculations

The Net payable salary and revised Net salary are calculated using the below-given formula:

Net Salary/Revised Net Salary = Total Gross Salary – Total Deductions

Thus, the Net salary is the amount payable to the employee/you. Whereas, the Revised Salary is the incremental amount that the company has to pay.

Therefore, the difference between these amounts is the salary arrear to be paid by the employer/company to the employee/you.

We thank our readers for liking, sharing, and following us on various social media platforms.

If you have any queries or suggestions, please share in the comment section below. We will be more than happy to assist you.

Frequently Asked Questions

Is PF applicable to salary arrears?

Yes, PF is applicable to salary arrears. But, no interest or penalty will be applicable if the employer or employee pays the PF for the arrears within 15 days of its payment.

Is TDS applicable to Salary Arrears?

Yes, TDS is applicable to salary arrears. The employer has to deduct tax as per the applicable income slab rate while paying the salary arrears. Moreover, the employer is responsible for depositing the TDS collected into the government treasury within the due dates.

How to save tax on Salary Arrears?

Under Section 89(1) of the Income Tax Act, any citizen to claim the tax benefit for salary received in arrear, gratuity received for past services extending a period of not less than 5 years but less than 15 years, compensation on termination of employment, and payment of commutation of pension. You need to fill Form 10E to avail of the benefit.