Employee Provident Fund Calculator is an important document for HR Professionals. They require calculating the retirement benefits for employees retiring in their organization.

These calculations are based on EPF and MP (Employee Provident Fund and Miscellaneous Provisions) Act 1952 in India. For more details, you can visit the website EPFindia.com.

Table of Contents

What is EPF?

EPF is a retirement benefits scheme available for all salaried employees introduced by the EPFO under the supervision of the Government of India. EPFO is the Employees Provident Fund Organisation of India.

EPF is a saving platform that helps employees to save a proportion of their salary every month. Employees can use it in the event either they are unemployed, unable to work, or at the time of retirement.

As an employee, we would like to know how much provident fund has been accumulated during the years of service.

For the Financial year 2019-2020, the pre-fixed rate of interest offered by the EPF scheme is 8.55%. This rate changes according to decisions made by EPFO.

Eligibility for EPF

Registering with EPFO is mandatory by the labor law for all organizations with more than 20 employees to register with the EPFO.

It is obligatory for the employees with a salary below Rs 15000 per month to register for EPF. Furthermore, employees having a salary above the prescribed limit can register for EPF with prior permission from the Assistant PF Commissioner and mutual acceptance between the employee and his employer.

EPF Contribution

The Employee Provident Fund is built with monetary contributions by both; employees and their employer from the salary every month. Both contribute 12% of the employee’s basic salary including dearness allowance. Minimum Contribution amount is 12% of Rs. 15000 that is Rs. 1800.

The entire 12% of the employee contribution along with 3.67% of the employer goes to the EPF account. Whereas the remaining 8.33% of the employer contribution goes to the Employee Pension Scheme.

Example When Basic + DA less than or Equal To Rs. 15000

Mr. X has a CTC of Rs. 20,000 where his basic is Rs. 14,500 including Dearness Allowance.

Employee Contribution: 12% x 15000 = Rs.1,800/-

According to the Law, the 12% Employer contribution will be divided into 2 parts: 8.33% to EPS 3.67% to Employee Provident fund.

Even if the employees Basic including DA is less than Rs. 15000 the employer contribution will be calculated on Rs. 15000.

Employer Contribution: Rs.15,000 x 3.67% = Rs.550.50 and 15,000/-x 8.33% = Rs.1249.50.

Example When Basic + DA Greater Than Rs. 15000

If Mr. X has Basic Pay + DA is Rs 25000.

Employee contribution: 12% x 25000 = Rs 3000

Employer Contribution: Generally, the 12% Employer contribution amount to Rs. 3000. As per the Law, EPS will be calculated on Rs. 15,000. 8.33% = 1250. The remaining amount (3000-1250) Rs. 1750 will be paid to the EPF.

Benefits of EPF Scheme

Employees who register for EPF are eligible for a series of benefits. These benefits ensure financial stability and security for the employee.

Given below is the list of benefits that an employee can avail after registering with the EPF scheme:

- The EPF offers a pre-fixed interest on the deposits.

- 8.33% of the employer’s contribution to the Employee Pension Scheme making your retirement healthy and easy on maturity.

- The EPF also acts as an emergency fund in hard times or during times of unemployment.

- An employee can take a tax exemption for the PF amount under Section 80C of the Indian Income Tax Act.

- Earning through EPF are also tax-free up to 1.5 lacs.

- The EPF also allows partial withdrawal for higher education, constructing a house, wedding expenses, or medical treatment purposes.

Download Employee Provident Fund Calculator Template

We have created an Employee Provident Fund Calculator in Excel with predefined formulas. You just need to enter a few details and the sheet automatically calculates the PF up to 35 years.

This template helps to calculate the year-wise contributions of the employee and the employer along with the yearly interest amount on Provident Funds.

Excel Google Sheets Open Office Calc

Click here to Download All HR & Payroll Excel Templates for ₹299.

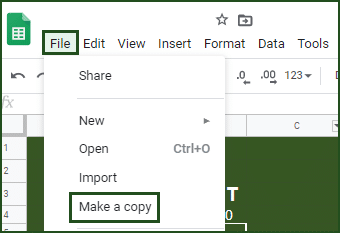

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Additionally, you can download other HR documents like Salary Sheet With Attendance Register, Employee Mileage Log, and many more templates given on the left bar.

Let us discuss the contents of the template in detail.

Contents of Employee Provident Fund Calculator

The EPF calculator template consists of 3 sections: Header Section, Employee Detail Section, and Provident Fund Calculation section.

Header Section

The header section consists of the company name, company logo, and heading of the sheet ” Employee Provident Fund Calculator”.

Employee Detail Section

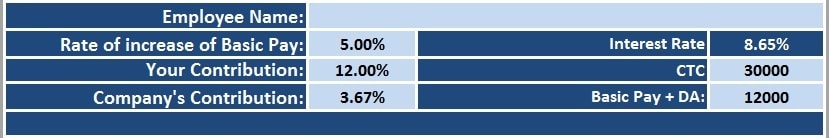

This section consists of the following employee details:

Employee Name: Name of the employee.

Yearly Rate of increase in Basic pay: An estimated yearly % rate of increase in Basic pay.

Percentage of Employee Contribution to EPF: Percentage of Basic salary contributed by Employee.

Percentage of Employer/Company Contribution to EPF: Percentage of Basic salary contributed by Employer.

Interest Rate: Interest rate by govt. on these savings. Currently approved percentage is 8.65 %.

Year-wise Provident Fund Calculation section

Year-wise Provident Fund Calculation section consists of 8 subheadings as follows:

Year: Total Year of service

Opening Balance: Starting from the first year, this column displays the balance at year-end.

Basic Pay + DA: This column shows each year’s basic pay. From the second year as per the estimated increase percentage the basic pay increases. If basic pay + DA is less than 15000 then enter Rs. 15000 as per the EPF Act.

The formula applied here is Basic pay of previous year X 5 %.

Employee Yearly Contribution: As per the EPF and MP Act the employee contribution is 12 % of the Basic Salary.

Employee contribution = (Basic Pay + DA) X 12% X 12 months

By using the fill handle function of excel, copy the formula till the end.

Company Yearly Contribution: Employer or company’s contribution to EPF is 3.67 % according to the EPF and MP Act.

Employer Contribution = (Basic Salary + DA) X 3.67% X 12 months

Use the fill handle to copy the same formula till the end.

Total Contribution: Total Contribution for that year = Employee Contribution + Employer Contribution.

The rate of Interest: The government fixes the rate of interest. The current rate for EPF is 8.65% per annum.

Closing Balance: This column shows the closing balance at the end of the year including the previous years.

Closing Balance = Opening Balance of the year + Total Contribution of the current year X 8.5 %

In the end, the total amounts of employee contribution, employer contribution, the total contribution, and the balance with current EPF balance with interest are displayed.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Frequently Asked Question

If an employee is working in more than one company how his membership is regulated?

The employee’s membership is recognized separately for each establishment. He will have different PF Account or member IDs.

Can an employer deduct employee’s share of contribution from the wages of employees?

No, an employer cannot deduct an employee’s share from his wages. Such deduction by the employer is a criminal offense.

How to determine the contribution of an employee who is paid wages on a daily/weekly/biweekly basis?

The wages paid in a calendar month will be taken to determine the contribution due to employees who are paid daily/weekly/biweekly.

Can an employee registered with EPF contribute more than 12%?

Yes. An employee can pay voluntary contributions over 12%. The total amount of contribution of the voluntary and mandatory amount cannot be more than Rs.15000.

Can an employee refuse the payment of contribution to the EPS?

As the Pension contribution is done from the employer’s share. Hence, no chance of any consent or refusal arises by an employee.

What is the time limit for the withdrawal of Provident Fund dues?

The time limit is only in the case of resignation from service. Therefore, Superannuation will not be included. An employee needs to wait for 2 months for the withdrawal of the PF amount.

How long an employee can continue his EPF membership?

There is no restriction of any period for an employee concerning EPF membership. Even after leaving a company, an employee can continue the EPF membership.

Can the EPF account earn any interest if an employee doesn’t make any contribution?

If an employee doesn’t make any contribution to the PF account for 3 consecutive years, then the account will not earn any interest.