Cost Sheet Template is a ready-to-use template in Excel, Google Sheet, OpenOffice Calc, and Apple Numbers that helps you to define the selling price of your products.

This template can be an effective tool for General Managers, Higher management of production units for defining the product prize, and keep the monitor the cost.

Additionally, this template can be useful for new startups, production units, or any other small business for cost management purposes.

Table of Contents

What is A Cost Sheet?

A Cost sheet is a periodic accounting document that is prepared to know the outcome and breakup of costs for a particular accounting period.

It shows various components of the total cost of a product. It will classify and analyze the components of the cost of a product.

This document helps in ascertaining the selling price of a product. In other words, the bifurcation of total cost in the form of a statement refers to a cost sheet.

Methods To Prepare Cost Sheet

You can prepare a Cost Sheet is based on Historical Costs and Estimated Costs.

Historical Cost: A Historical Cost sheet includes the actual cost for a past period.

Estimated Cost: A Estimated Cost sheet includes costs before the commencement of production. Such a cost sheet is useful in quoting the tender price of a job or a contract.

We use data from the financial statement to prepare a cost sheet. Thus, the reconciliation of cost sheets and financial statements is a must at a regular interval.

Purpose of Cost Sheet

The main objective of the cost sheet is to ascertain the cost of a product. This sheet helps you fix the selling price of a product or service.

Thus, it is also helpful in controlling the cost of a product it is necessary for every manufacturing unit.

Moreover, it helps in taking important decisions by the management. Decisions such as to make changes in product or raw material, deciding prices or to retain/replace an existing machine, etc.

Elements of Cost Sheet

There are 5 major elements of Cost Sheet. These elements include Prime Costs, Work Costs, Production Costs, COGS, and Sales Costs.

Prime Costs

Prime costs are the direct expenses related to production such as labor and raw materials. Indirect costs such as utilities, delivery costs, etc will not be included in prime costs.

Work Costs

Work Costs include indirect expenses such as utilities, manages salaries, delivery costs, and other administrative expenses that support the production.

In simple terms, the sum of all the following expenses equals to Factory Costs or Work Costs:

- Factory Rent

- Electricity Charges

- Indirect Material Expenses

- Other Indirect Wages

- Salaries of Production Heads/Supervisors

- Other Salaries

- Factory Insurance

- Depreciation of Factory

Production Costs

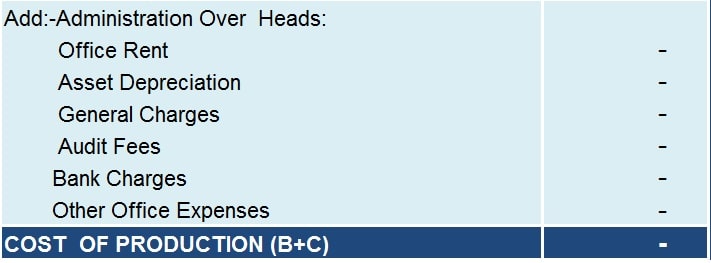

Adding administrative expenses to Factory costs equal Production costs. These administrative expenses include office rent, asset depreciation, audit fees, bank charges, and other miscellaneous office expenses.

Cost of Goods Sold (COGS)

The cost of goods sold is the cost of the products that a retailer, distributor, or manufacturer has sold. It is the amount of money spent by a company on its labor, materials, and overheads to manufacture/purchase products of the goods that are sold to customers during the year.

COGS = Total cost of production + Opening stock of the Finished goods – Closing stock of the finished goods.

Sales Costs

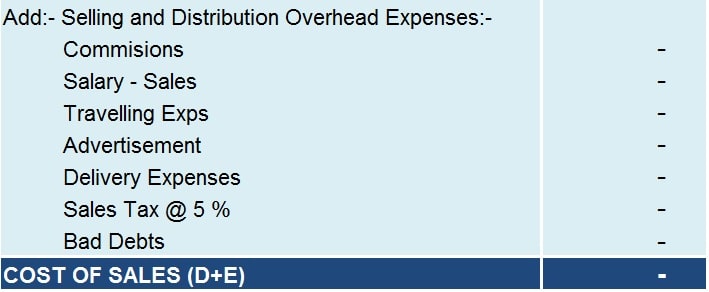

Sales Costs are the direct and indirect expenses for selling and distribution of produced goods. These expenses include commissions, salaries of sales staff, traveling expenses, advertisement, delivery expenses, sales tax, bad debts, etc.

Cost Sheet Template

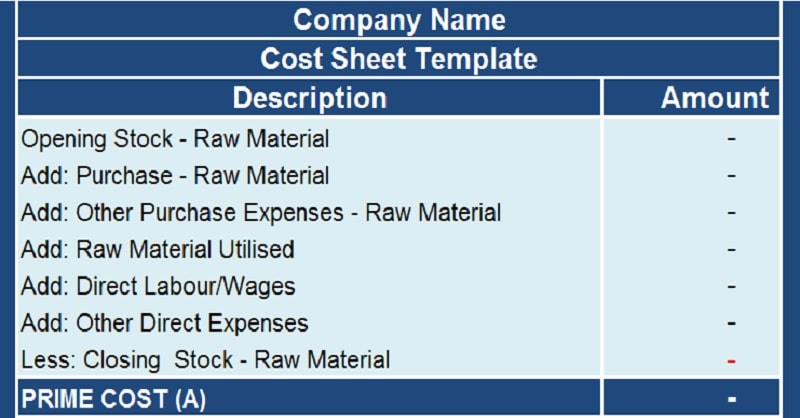

We have created an easy to use Cost Sheet Template with predefined formulas. Just by entering data you can estimate or calculate your cost with the help of this template.

Excel Google Sheets Open Office Calc

Click here to Download All Financial Analysis Excel Templates for ₹299.

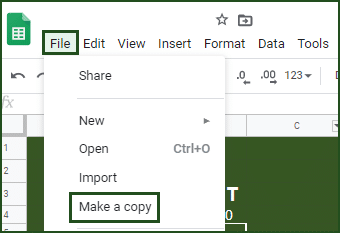

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Additionally, you can download other Financial Analysis Templates like Business Net Worth Calculator, Sales Revenue Analysis Template, Break-Even Analysis, etc.

Let’s discuss the template contents in detail.

Contents of Cost Sheet Template

Cost Sheet template consists of six major sections:

- Prime Cost

- Factory or Works Cost

- Production Cost

- Cost of Good Sold (COGS)

- Cost of Sales and

- Total Sales

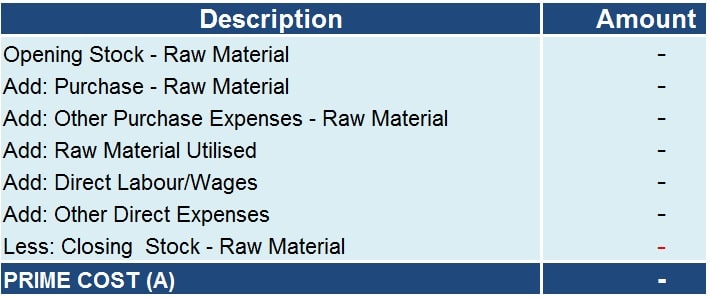

Prime Cost

Prime cost represents the aggregate of the cost of material consumed, productive wages, and direct expenses.

Thus, Prime Cost = Direct material + Direct Wages + Direct expenses

Where;

Direct material = Material purchased + Opening stock of material – Closing stock of material.

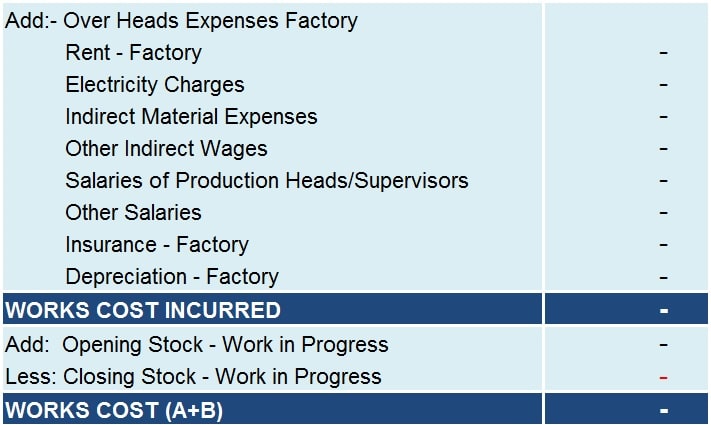

Factory Cost or Works Cost

The factory overheads consist of the cost of indirect material, indirect wages, and indirect expenses incurred in the factory.

Factory cost is also known as works cost, production, or manufacturing cost.

Hence, Factory Cost = Prime cost + Factory overheads.

Where;

Factory Overheads = Rent + Salaries + Depreciation + Other Factory related expenses.

In the process of production, some units remain to be completed at the end

of a period. These incomplete units are known as work-in-progress.

Hence, at the time of computing factory cost, it is necessary to adjust the opening and closing stock of work in progress.

Cost of Production

Adding Office and administrative overheads to the factory cost or work cost gives you the total cost of production.

Cost of Production = Factory Cost + office and administration overheads.

Where;

Office Overheads = Administration and other office related charges which will include Rent, Office expenses, General Charges, etc.

Cost of Goods Sold (COGS)

All the goods that a unit produces aren’t sold in the same period.

Usually, we have stock of finished goods in the opening and at the end of the period.

Add the cost of opening stock of finished goods to the total cost of production in the current period. Furthermore, deduct the cost of closing stock of finished goods from it.

COGS = Total cost of production + Opening stock of the Finished goods – Closing stock of the finished goods.

Cost of Sales

Adding the selling and distribution overheads to the COGS will give you the Cost of Sales.

Cost of Sales= Cost of Goods sold + Selling and distribution overheads.

Sales

Excess of sales over total cost is termed as profit. When total cost exceeds sales, it is termed as Loss. Add the profit margin is to the total cost. It derives the Sales figure.

Sales = Total Cost + Profit.

Advantages of Cost Sheet

- It provides a complete breakup of production costs that helps the business to curb unnecessary expenses.

- The cost sheet helps to fix the selling price.

- A cost sheet also helps the management to decide its production policy.

- It assists the management in submitting price quotations to its clients as well as preparing estimates for tenders.

- It helps to define the total cost of production and also cost per unit.

We thank our readers for liking, sharing, and following us on different social media platforms, especially Facebook.

If you have any queries or questions, share them in the comments below and I will be more than happy to help you.

Frequently Asked Questions

How is the prime cost calculated?

Prime cost is the sum of all the cost of production that a business incurs directly in regards to the manufacture of goods.

Which expenses are included in the direct costs?

Direct costs include expenses such as software, equipment, and raw materials. It can also include labor that is related to a specific product, department, or project.

What are the overhead costs?

Overhead costs refer to the ongoing business expenses not directly related to the production of a product or service. In simple terms, they are expenses that a company incurs to support the business.

Are bad debts included in the cost sheet?

Yes, bad debts are included in the Cost sheet. They are treated as selling overheads.

Is sales tax included in the cost sheet?

Yes, sales tax is a part of the cost sheet. You need to include taxes like Sales tax, excise duty, customs duty to the Cost of Material. Moreover, Income Tax is a Financial liability and thus is not included in the Cost Sheet.

What are the items excluded from the cost sheet?

- Company’s Income tax or advance tax.

- Dividends paid to shareholders.

- Discounts on issues of shares and debentures.

- Underwriting commission payment made.

- Capital losses of the business.

- Expenses related to the purchase of fixed assets by the company.

- Losses made on the sale of fixed assets by the company.

- Interest on capital.

How do you calculate the cost per unit sheet?

To calculate the cost per unit, divide the total cost of production by the number of units produced.