Many queries have been generated asking the Performa LUT (Letter of Undertaking) provided by Exporters to the government for exporting goods without payment of GST or providing Bond.

Norms for exports under GST regime have been eased. Now exporters can export goods against LUT without paying GST or Bond.

GST council announced vide Notification No. 37 /2017 – Central Tax, that exporters can now export against LUT without paying GST or Bond.

Earlier, eligibility for LUT was very hard and very few exporters qualified for it.

Paying GST and then taking the refund of the said amount also caused blockage of money for exporters as the refunds were delayed.

Whereas in Bond also a bank guarantee has to be furnished to government again creating an unnecessary blockage of funds.

We have created a Performa LUT (Letter of Undertaking) in MS Word. This template can be helpful to exporters.

Click here to download Performa LUT (Letter of Undertaking) in MS Word

Click here to Download All GST Excel Templates for ₹299.Just add your relevant details in the performa and print it on your company letterhead.

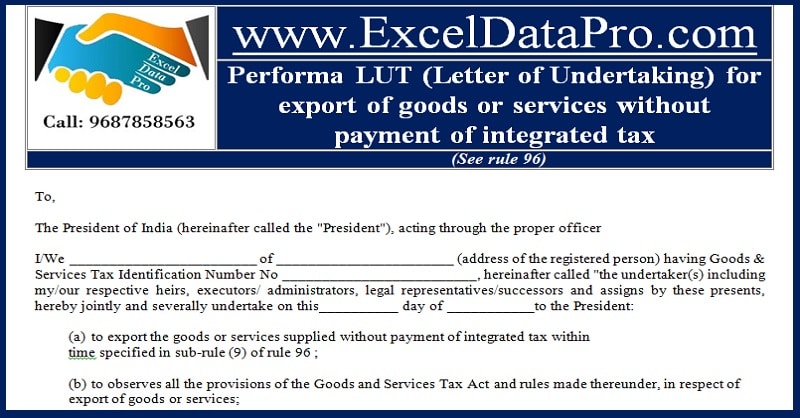

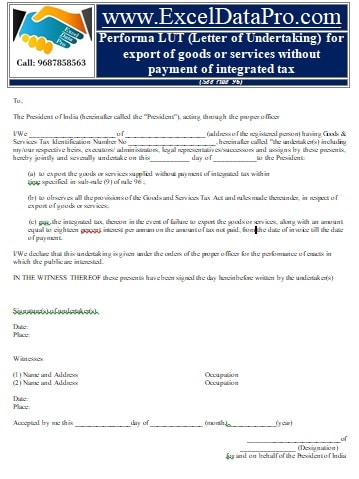

Let us discuss the contents of the performa in detail.

Contents of the Performa LUT (Letter of Undertaking)

Letter of Undertaking is a commitment provided by an exporter to the department that he will obey all the rules and regulations in relation to the exports of goods and services.

You need to file it through form GST RFD – 11, LUT and other relevant documents.

This performa is given on GST portal in PDF format in the download section.

Our performa LUT is in editable MS word format. Just download the performa, remove the above table of the header section, fill in your company details and print it on your company letterhead.

Note: Settings of printers are different for different printers. Please check it on plain paper before printing it on company letterhead.

Source:

To know the step by step process of Filing LUT click on the link below:

Step By Step Guide To File LUT For Exports Without IGST

You can download GST templates like GST TRAN-1, GST Input Output Tax Report, and GST Export Invoice from here.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.