With the release of government for exports against LUT without paying GST or Bond vide Notification No. 37 /2017 – Central Tax. The IGST Act governs exports and imports of goods and services under the GST regime.

Note: LUT stands for Letter of Undertaking.

Previously, the eligibility for furnishing LUT was for those who have received a minimum of 10% inward remittances of foreign currency of the export turnover.

Additionally, it should not be less than 1 crore rupees in the preceding financial year.

Thus, very small number of big exporters qualified for providing the LUT.

For sending goods against a bond and not paying GST, an amount in form of bank guarantee had to be put forth by the exporter to the government which caused unnecessary blockage of funds.

Hence, the LUT is very important in case of export of goods or services without payment of IGST.

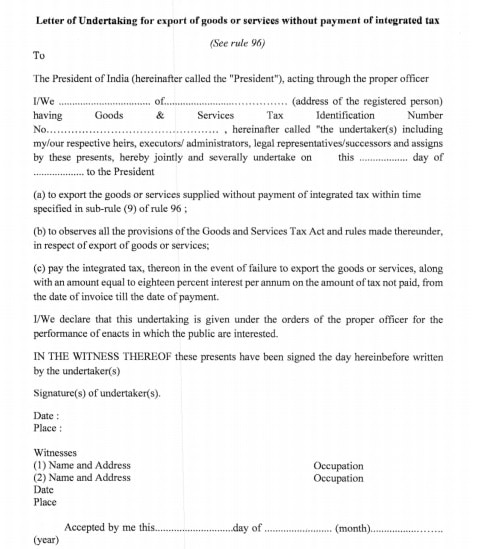

Letter of Undertaking is a commitment provided by an exporter to the department that he will obey all the rules and regulations in relation to the exports of goods and services.

You need to file it through form GST RFD – 11, the prescribed format of GST RFD – 11 and other relevant documents.

Let us discuss the step by step procedures for filing LUT for exports under GST.

Step By Step Guide to File LUT for Export Without IGST

1. To Check Jurisdiction and eligibility for filing Letter of Undertaking

FIrst and foremost, you need to check the as to which document has to be filed in terms of prescribed conditions.

Secondly, you have to check the applicable jurisdiction according to the assessee’s area. A mistake in this might lead to rejection.

2. Documentation for Letter of Undertaking

In case of Letter of Undertaking, you will require following documents along with GST RFD – 11.

Documents For LUT :

- FORM RFD 11 on company letterhead

- UT 1 bond on stamp paper

- Authority letter

- Other supporting documents like PAN, export license etc.

In addition to all the above documents, you have to prepare a second set of duplicate copy of the same.

3. Personal Visit the department

Now comes the physical part. You have to get your documents verified by the relevant officer.

Note: You must go to the proper officer according to your jurisdiction to avoid any rejections or resubmissions.

4. Receive Acknowledgment from Department

After filing the LUT, You need to receive an acknowledgment of submission of documents from the officer. shall be issued on the basis of which the officer shall issue the signed letter after 2 to 3 days.

Officer will issue the signed letter within 2-3 days on the basis the submission of documents.

You can download GST templates like GST TRAN-1, GST Input Output Tax Report, and GST Export Invoice from here.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

how the LUT invoice looks like, Do i need to mention the GST number in that invoice, Can you please help.

There is no such thing as LUT invoice. In your normal Export invoice just mention note stating that the supply is made against LUT approval without IGST.

Do we have to follow now the above-mentioned steps?

or can I apply for LUT directly from GST website?

YOu can directly apply on GST Website. In some areas, manual submission is required. SO you can follow these steps.

sir

we are manufacturers and trading goods to our customer out side India

After some time, we are taking material from manufacturers and sending to our customer under LUT Programme.

our doubt is the manufacturer can raise the invoice to us without GST.

Manufacturers how can claim the tax above invoice. If any notification, please share us.

Alternatively manufacturer can raise invoice by putting 0.1% tax and that tax can take against our Export invoice documents

if the manufacturer is in SEZ he can issue a non-GST invoice otherwise not. The manufacturer will issue a GST invoice and will claim this output tax against his own purchase. It has nothing to do with your export transaction.