A registered supplier needs to issue a GST Credit Note to his customer when:

- The taxable value or the tax charged in the original invoice exceeds the taxable value or the tax payable in accordance with such supply. In simple terms, if your previously issued invoice is over billed.

- The goods are returned by the customer against the respective invoice.

Earlier we have posted articles related to all types of Invoices and Vouchers under the GST regime as follows:

- GST Invoice Template.

- GST Bill Format for non-taxable goods.

- GST Invoice Format for Retailers registered under Composition Scheme.

- GST Receipt Voucher.

- GST Payment Voucher.

- GST Refund Voucher.

- GST Debit Note.

All the above Invoices and Vouchers are prepared according to the rules defined by the government in the GST Law 2017.

Rules of GST Credit Note

1) A revised tax invoice referred to in section 31 and credit or debit note referred to in section 34 shall contain the following particulars:

- The word “Revised Invoice”, wherever applicable, indicated prominently.

- Name, address, and GSTIN of the supplier.

- Nature of the document.

- A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters -hyphen or dash and slash symbolized as “-” and “/”respectively, and any combination thereof, unique for a financial year.

- Date of issue of the document.

- Name, address and GSTIN or UIN, if registered, of the recipient.

- Name and address of the recipient and the address of delivery, along with the name of State and its code, if such recipient is un-registered.

- Serial number and date of the corresponding tax invoice or, as the case may be, bill of supply.

- The value of taxable supply of goods or services, the rate of tax and the amount of the tax credited or, as the case may be, debited to the recipient.

- Signature or digital signature of the supplier or his authorized representative.

AND

(2) Every registered person who has been granted registration with effect from a date earlier than the date of issuance of the certificate of registration to him may issue revised tax invoices in respect of taxable supplies effected during the period starting from the effective date of registration till the date of issuance of the certificate of registration.

Provided that the registered person may issue a consolidated revised tax invoice in respect of all taxable supplies made to a recipient who is not registered under the Act during such period.

Provided further that in the case of inter-State supplies, where the value of a supply does not exceed two lakh and fifty thousand rupees, a consolidated revised invoice may be issued separately in respect of all recipients located in a State, who are not registered under the Act.

AND

(3) Any invoice or debit note issued in pursuance of any tax payable in accordance with the provisions of section 74 or section 129 or section 130 shall prominently contain the words “INPUT TAX CREDIT NOT ADMISSIBLE”.

Source: www.cbec.gov.in

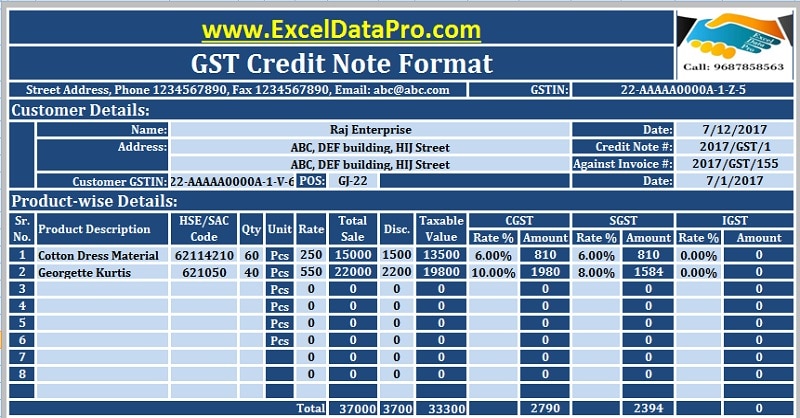

GST Credit Note Format

We have created GST Credit Note in Excel following the above guidelines provided by the Government. Enter your company name, address, logo etc and start issuing the credit note.

It is helpful to issue the credit note to your clients against discrepancies in the invoices issued earlier with relevant CGST, SGST, and IGST Computations.

It is useful for all dealers, distributors, traders, wholesalers, accounts assistant, accountants etc.

Click here to Download GST Credit Note Format In Excel Under GST 2017.

Click here to Download All GST Excel Templates for ₹299.Additionally, you can download other accounting templates like Salary Sheet, Simple Cash Book, and Accounts Payable Excel Templates from here.

Let us discuss the contents of the template in detail.

Contents of the GST Credit Note Format

The Credit Note Format Excel Template consists of 4 sections

- Header Section.

- Customer Details Section.

- Product and Tax Details Section.

- Summary and Signature Section.

1. Header Section

As usual, the header section consists details like the company name, company address, company logo, GSTIN and the document heading “GST Credit Note”.

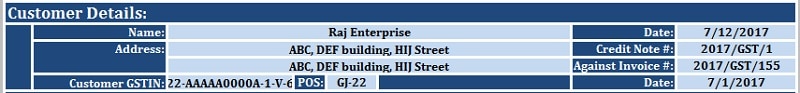

2. Customer Details Section

In this section details of a customer such as the name of the customer, address, GSTIN, Credit Note Number, Place of Supply (POS), the date of issue, the invoice number and the invoice date against which the document is issued.

3. Product Details Section

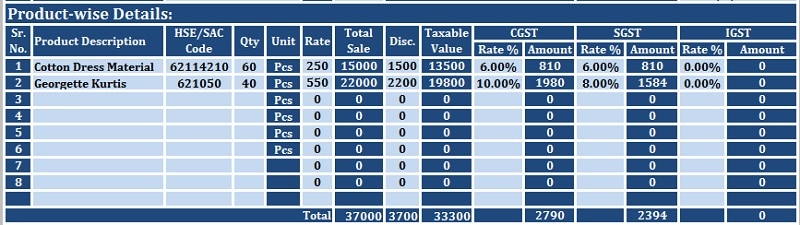

Product and Tax section consists of the columns similar to your Tax Invoice mentioned below:

Sr. No.: Serial number of the products.

Product Description: Product desctiptions like size, color, dimensions etc.

HSN/SAC Codes: HSN stands for Harmonized System Nomenclature code of Goods and SAC stands for Services Accounting Code of services.

It is mandatory to mention them in your every document under GST regime.

Find HSN Code for your product from the pdf file attached below:

Download link: HSE Codes for GST Enrollment

Find SAC Code for your product from the pdf file attached below:

Download Link: SAC Codes for GST

Qty: Quantity of goods supplied.

Units: Units like pieces, bags, meters etc.

Rate: Rate of your product.

The Total Sale: Auto calculated column. Total Sale = Quantity X Rate.

Disc.: Discounts if applicable.

Taxable Value: Taxable value column is auto calculated. The Total Sale – Discount = Taxable Value.

CGST: All the tax columns have 2 subdivisions. Rate of CGST applicable and the amount of CGST. The percentage rate is entered manually. This column is also auto calculated. Taxable Value X Rate of CGST.

SGST and IGST: Similar to CGST, both SGST and IGST have the same formats. The respective rates of SGST and IGST are entered manually and the Amount= Taxable Value X Rate of SGST/IGST.

Note: When IGST is applicable, CGST and SGST will not be collected.

Totals: The total of each column for summary has been made.

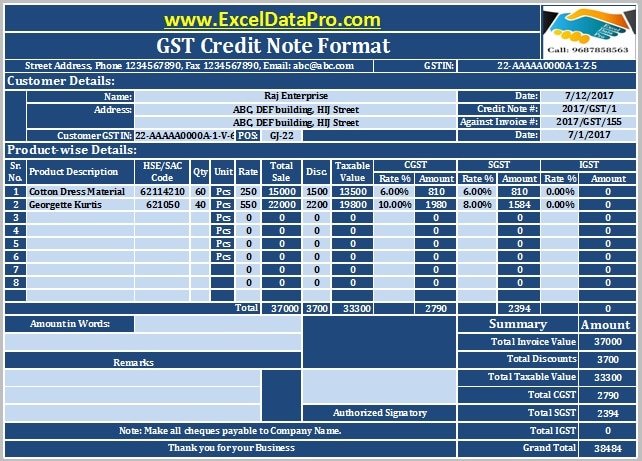

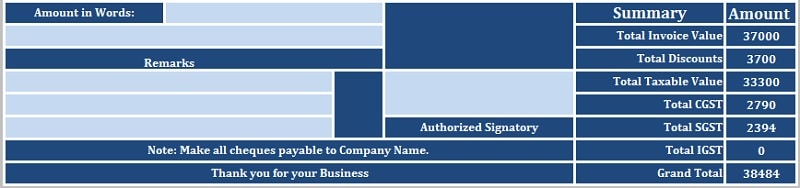

4. Summary and Signature Section

Summary and signature section consists of billing summary and their computations along with the signature box for authorized signatory, remarks, and business greetings.

Taxable Value = Total Invoice Value – Discounts.

Grand Total = Total Taxable value + CGST + SGST + IGST.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

I am a Pharma Distributor, and whuld like to know, What is the format of GST Credit Note an Unregistered Retailer should Use. Similarly, If a composition Registered Retailer can Use the same GST Credit Note format as of Registered (Regular) Retailer?

What care should a Distributor should take while issueing GST Credit Note to a (non-registered/Composition/Regular) Retailer?

I ain’t able to get understand your query. What basically is your question about? Please call us or email your query through our Contact Form.

IF CREDIT NOTE AMT. IS MORE THAN TAXABLE INVOICE AMT

THEN WHAT IS RULE FOR GSTR1 ABOUT IT

PARTY IS UNREGISTERED AND AMT IS APPROX RS.10000

SALE WAS MADE INTRA STATE

As per accounting, the credit note cannot be more than invoice amount. Can you please elaborate your case in detail.

Sir plz solve my doubt. Let say there are 4 sales invoice issued of Rs. 25/- each by us. Total sales Rs 100/-. Purchaser returns goods amounting 60/- without giving the details of original invoice against which the goods have been returned and issues only 1 Dr. note. How this will be adjusted in GSTR-1 while filling the details of Cr. note bcoz while filing gstr-1 the amount of 60/- will not be able to adjust itself if we will give details of only 1 invoice as the single invoice value is 25/- only . Are we liable to issues more then 1 credit notes? or is there any different treatment ?

Every invoice has different items. 1. Make a credit note of that particular against that item. Your reporting of each item will be settled. For example, say your client has returned goods worth Rs. 60 (Inv-1=15, Inv-2=15, Inv-3=10, Inv-4=20) the make Credit notes accordingly and settle your books of account. Or else if the items are in common or say one type of product then you make 2 credit notes of 25 each and one of 10. It is not you who should worry. It should be your client because if he makes 1 debit note of sixty his books of accounts don’t match. Your client has to make different debit notes.

For Cancellation of Invoice, how to Fill in Credit Note. Do we have to enter the invoice amount or leave it blank?

Cancellation can be two ways: IF not submitted the GST return for the invoice period directly void or delete it. If GST Return already filed then issue a credit note of the same amount to mentioning the invoice number.

RCM on transport is still on may’2018.

CAClub: Tax payable under Reverse Charge Mechanism (RCM) under section 9(4) of the CGST Act, 2017 was deferred up to 31.03.2018 vide Notification No. 38/2017 – Central Tax (Rate) dated 13th October 2017. Liability to pay tax has been further deferred until 30.06.2018 and a Group of Ministers will look into the modalities and ensure smooth implementation without causing inconvenience to Trade and Commerce.