GST TRAN-1 form is used to claim the credit of input of taxes (VAT, Excise, etc) paid under the pre-GST regime issued by the Central Board of Excise and Customs.

We all are concerned about the input credit of taxes that we have paid while purchasing, inputs, raw materials, semi-finished goods, etc under the old regime. These taxes are available as an input credit on 30th July.

CBEC has released 2 transition forms GST TRAN-1 and GST TRAN-2, to help businesses carry forward their input tax credit.

We have created an Excel Template for the GST TRAN-1 form to simplify the filing of this return. This form is filled online on GSTN Portal.

Click Here to Download GST TRAN-1 Return Excel Template

Click here to Download All GST Excel Templates for ₹299.

You can also download other GST templates like GST Bill of Supply, GST Payment Voucher, and GST Export Invoice from here.

Let us discuss the contents of this template in detail.

Contents of GST TRAN-1 Excel Template

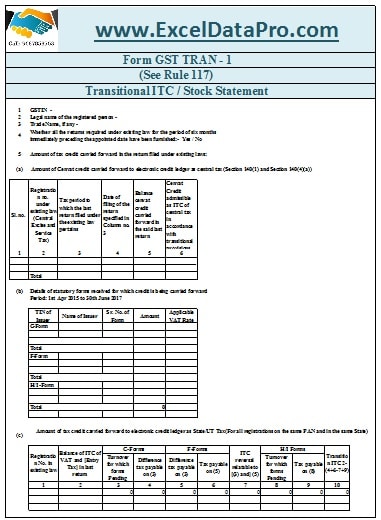

This form GST TRAN-1 consists of a total of 12 points which are explained below:

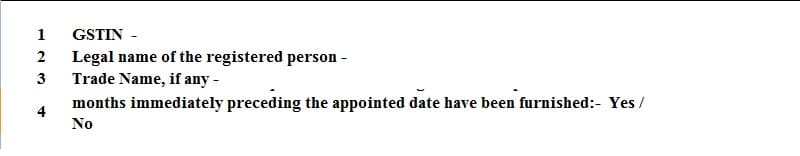

1. GSTIN: Your GSTIN number. It is auto-populated.

2. Legal Name of Registered Person: Your registered legal name in full. Auto populated.

3. Trade Name: Name of your company if you are using any Trade Name.

4. Confirm that you have submitted ALL the returns required under existing law for the past 6 months: Here you need to select Yes or No from the drop-down.

Closing Balance of CENVAT or VAT can be taken as a credit in your current our GST electronic ledger if and only if returns of the previous six months are already filed under the old regime.

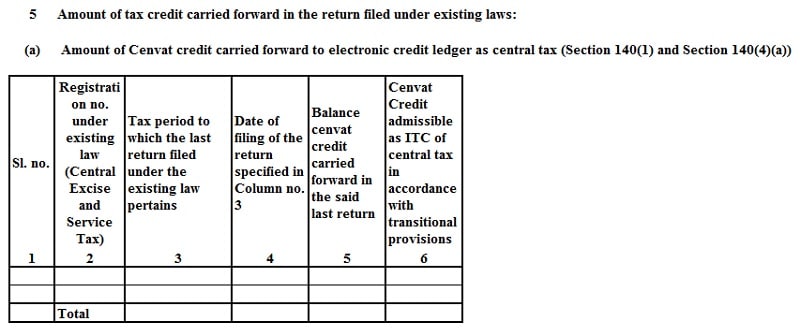

5. Amount of tax credit carried forward in the return filed under existing laws:

a) Amount of cenvat credit carried forward to the electronic credit ledger as the central tax ( Central Excise and Service Tax) Section 140(1) and Section 140(4)(a).

You need to enter the amount of CENVAT in rupees, if you are registered as a manufacturer or service provider and have the closing balance of CENVAT in the return filed period ending June 30th, 2017.

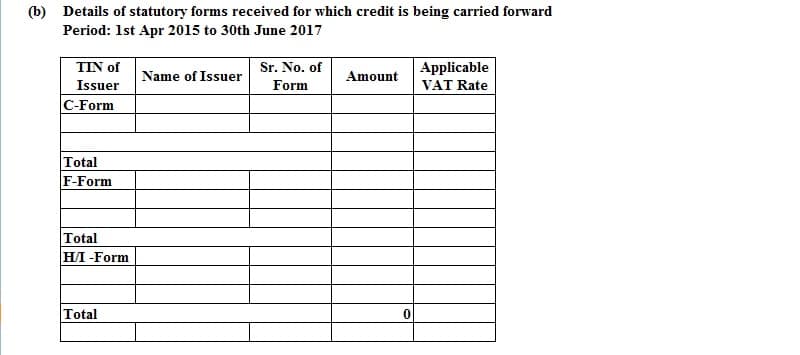

(b) Details of statutory forms received for which credit is being carried forward

Enter the details of C-Form, F-Form and H/I-Form like a TIN of issuer, Name of Issuer, Serial number of Form, amount and applicable VAT rate.

(c) Amount of tax credit carried forward to electronic credit ledger as State/UT Tax(For all registrations on the same PAN and in the same State)

Persons registered under any State VAT having pending C-Form, F-Form, H-form or I-Form are required to pay the differential tax.

This differential tax is deducted from your input credit available in the last return under the old regime. The balance will be transferred to the GST ledger.

Enter details of such pending forms in this section.

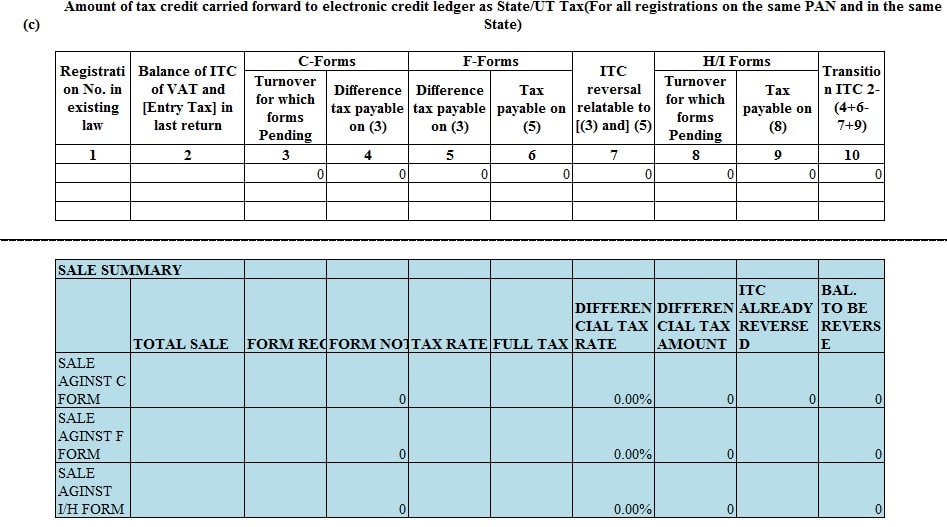

6. Details of capital goods for which un-availed credit has not been carried forward under existing law (section140 (2)).

Here you need to provide details un-availed input credit on capital goods.

By any chance, if you haven’t been able to fully claim input credit of such taxes till 30th June, then such can be claimed by reporting here.

(a) Amount of duties and taxes on inputs claimed as credit excluding the credit claimed under Table 5(a)

Record the amount of un-availed credit of CENVAT on capital goods which need to be carried forward to the electronic ledger as the central tax.

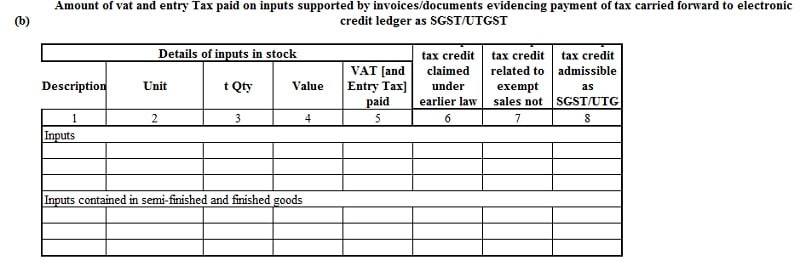

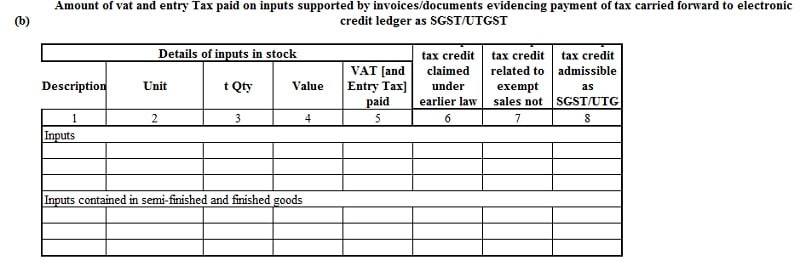

(b) Amount of vat and entry Tax paid on inputs supported by invoices/documents evidencing payment of tax carried forward to electronic credit ledger as SGST/UTGST

Enter the amount of un-availed input credit. It is the one that you want to carry forward to electronic credit ledger as State/UT tax.

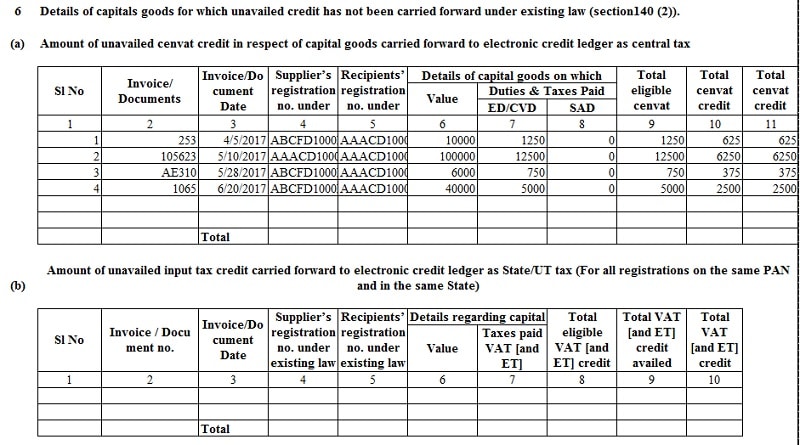

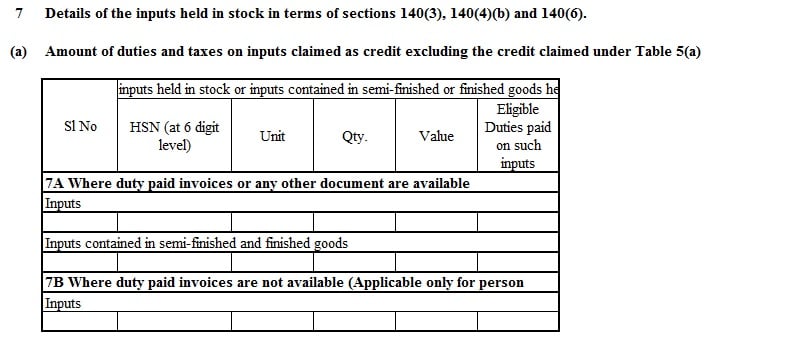

7. Details of the inputs held in stock in terms of sections 140(3), 140(4)(b) and 140(6).

This portion applies to businesses currently registered under GST but unregistered under the old regime, manufacturing exempted goods, providing exempted services, providing works contract service, a first/second stage dealer, a registered importer or depot of a manufacturer.

(a) Amount of duties and taxes on inputs claimed as credit excluding the credit claimed under Table 5(a)

In this section fill the details of duty paid invoices or other documents for inputs. You can also add inputs contained in semi-finished and finished goods by a manufacturer or a service provider.

The credit of excise duty or service tax will be an input tax credit of CGST.

(b)Amount of vat and entry Tax paid on inputs supported by invoices/documents evidencing payment of tax carried forward to electronic credit ledger as SGST/UTGST

To be filled only by those who are not manufacturer or service provider and unregistered in the old regime, which means to be filled by dealers or traders. Such a person has to file a TRAN-2 return also.

(c) The stock of goods not supported by invoices/documents evidencing payment of tax (credit in terms of rule 1 (4)) (To be there only in States having VAT at a single point)

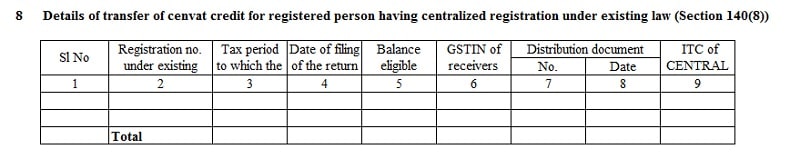

8. Details of transfer of cenvat credit for registered person having centralized registration under existing law (Section 140(8))

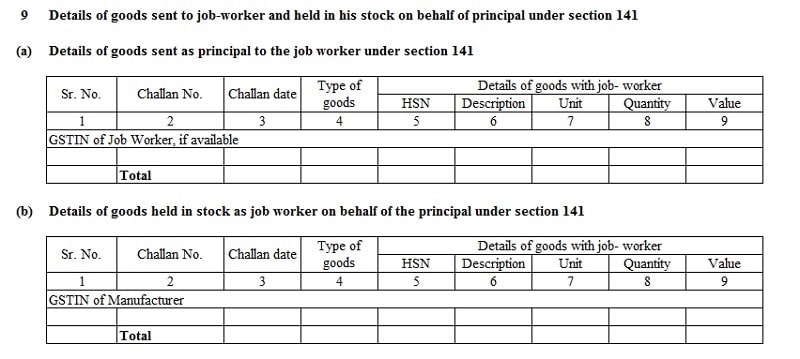

9.Details of goods sent to job-worker and held in his stock on behalf of principal under section 141

(a) Details of goods sent as principal to the job worker under section 141

The principal who has sent the goods to the job worker has to fill this section.

(b) Details of goods held in stock as a job worker on behalf of the principal under section 141

This section must be filled by you if you are a job worker and have goods pertaining to the principal.

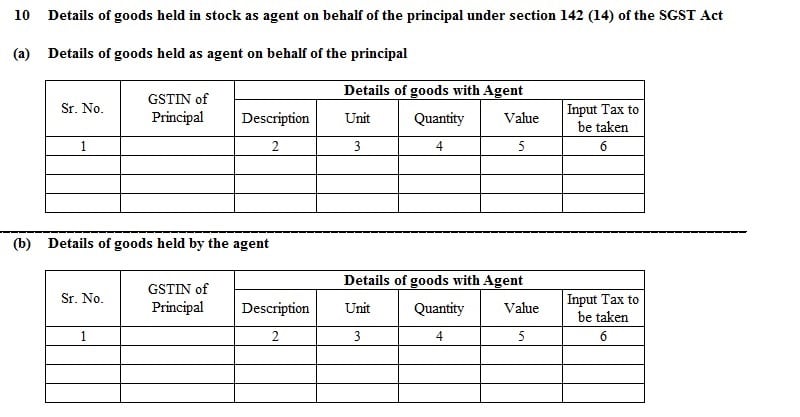

10. Details of goods held in stock as an agent on behalf of the principal under section 142 (14) of the SGST Act

According to section 142 subsection 14 says, “If any goods or capital goods belonging to the principal are lying at the premises of the agent on the appointed day, the agent can take credit of the tax paid on such goods or capital goods.”

(a) Details of goods held as an agent on behalf of the principal

If you are an agent and holding stock on behalf of the principal must give details of unsold stock available with you as on 30th June 2017.

(b) Details of goods held by the agent

If you are a principal then you need to provide details of unsold stock with your agents as on 30th June 2017.

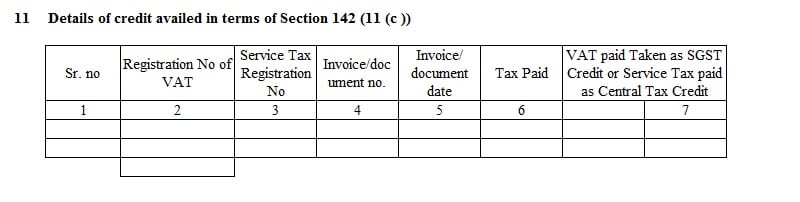

11. Details of credit availed in terms of Section 142 (11 (c ))

In this section, if you are a works contractor then you are entitled to take credit for VAT & Service Tax previously paid under the old regime until 30th June 2017.

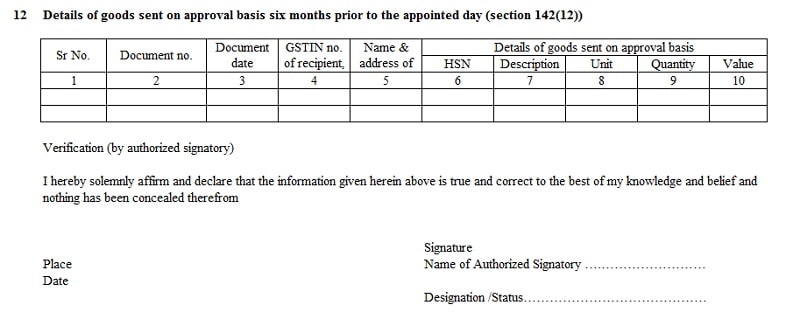

12. Details of goods sent on approval basis six months prior to the appointed day (section 142(12))

Enter details of goods sent for approval basis within 6 months prior to 1st July 2017.

In the end, sign the declaration as to testify that the details are correct.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

i have submitted tran1 form but could not file it by 27-12-2017 now when i file gstr3b the screen says since you have not filed tran1 you cant file gstr3b for dec 2017 pl help me what i should do to rectify this mistake so that i can file my gstr3b in time

Till now there is no resolution to your problem. You need to contact GST people. Tweet on GST twitter handle, Email them. They can provide you the solution. last option is to visit GST office. Don’t delay. Penalties will increase with time.

WE DID NOT FILED THE TRAN-1, THERE IS DUE DATE EXTENDED FOR TRAN-1 BUT WE ARE UNABLE THE OPEN THE TRAN-1 IN OUR WEBSITE, SO PLEASE SUGGEST IN THIS

You need to check with GST department. Now the last date might have passed.