Under the GST regime, registered taxpayers will have to maintain GST Purchase Register in order to calculate their Input Tax Credit and hence define their tax liability.

As per the GST Law, a registered person is liable for ITC on the purchase of goods and services.

Any money spent on capital goods in the form of GST, you will get back in the form of ITC.

When you make sales, you will collect the GST on the goods or services. For the purchase of raw material and other purchases, you have paid an amount of GST.

At the end of the month, you will have to just pay the difference between GST paid and GST collected.

For more information on ITC click on the link below:

GST Purchase Register Excel Template

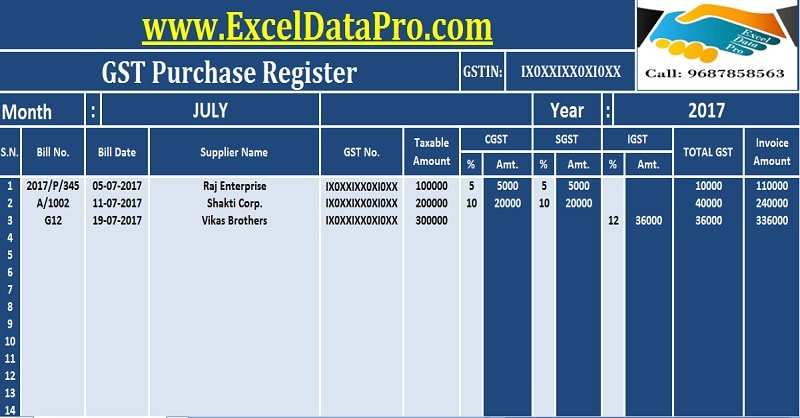

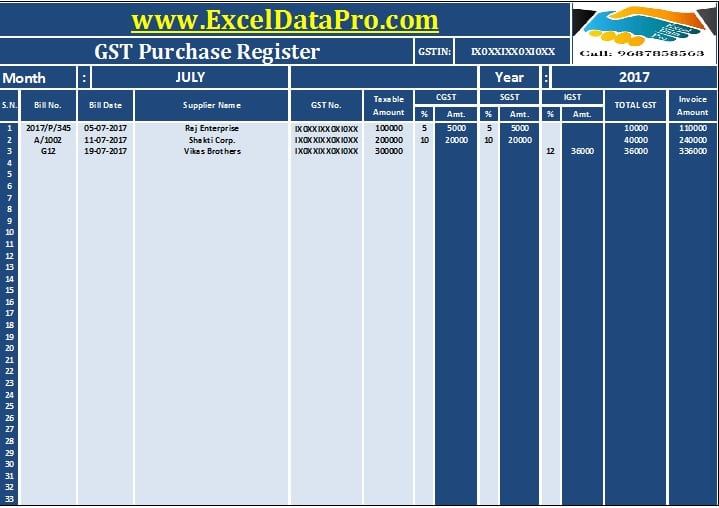

We have created an excel template for the GST Purchase Register to maintain the records of all your GST leviable purchases.

This template is helpful to all small traders, wholesalers, etc.

Click here to Download GST Purchase Register Excel Template.

Click here to Download All GST Excel Templates for ₹299.

You can also download other GST templates like GST Bill of Supply, GST Payment Voucher, and GST Export Invoice from here.

Let us discuss the content of the template in detail.

Contents of GST Purchase Register

This template contains 2 sections:

- Header Section

- Purchase Details Section

1. Header Section

The header section consists of your company name, address, GSTIN, the header of the Sheet “GST Purchase Register”, month and year for which it is prepared.

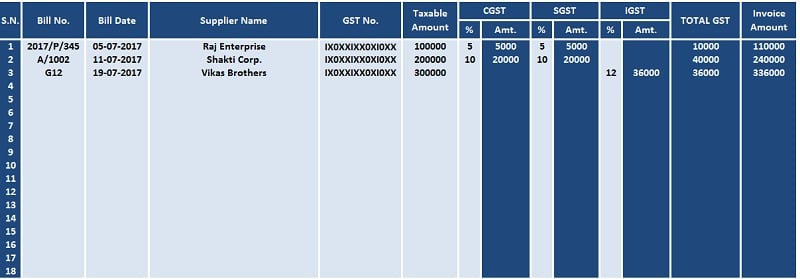

2. Purchase Details Section

The purchase details sections consist of the following subheadings:

Sr.No.: Serial Numbers.

Bill No: Bill number of the purchase is entered here. The series of bill numbers will be different from different suppliers.

Bill Date: Date of issue of the purchase bill.

Supplier Name: Name of the registered company from which the purchase was made.

GST No.: GSTIN of the supplier. If the supplier is not registered you will have to pay the GST under RCM.

Taxable Amount: Amount of invoice less of discount on which tax is applicable.

CGST, SGST, and IGST: Just enter the applicable tax percentage tax of Central, State or Integrated and it will auto calculate the amount.

Total GST: Total GST = CGST + SGST + IGST.

Invoice Amount: Invoice amount = Taxable Amount + CGST + SGST + IGST.

Lastly, the total of each column is made at the end of the column.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.