Business Net Worth Calculator is a ready-to-use excel template to calculate the total worth of any company by evaluating its total assets and liabilities.

What is Net Worth?

Net worth is the total market value of any individuals, companies, corporations. In simple words, Net Worth the company’s wealth after paying everything that it owes to others.

Formula To Calculate Net Worth

Total assets include cash, investment, Accounts Receivables, and other asset accounts.

Total Liabilities include all payments like loans, Accounts Payables, mortgages and other things that you owe to others.

Net Worth Calculator Excel Template

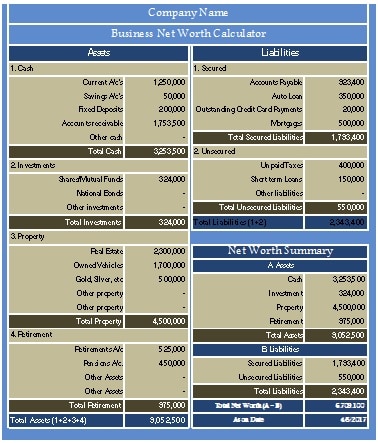

We have created a Net Worth Calculator Excel Template with predefined formulas. Just enter the closing or current balances of all assets and liabilities accounts. The template automatically calculates the net worth for you.

The net worth calculator can be useful to accounting professionals, assistant accountants, Auditors, etc.

Click here to Download the Business Net Worth Calculator Excel Template.

Click here to Download All Financial Analysis Excel Templates for ₹299.

To download other financial analysis templates like Cost Sheet With COGS, Break-Even Analysis, Sales Revenue Analysis, and Ratio Analysis from our website

Let us discuss the content of the Business Net Worth Calculator in detail.

Contents of Net Worth Calculator

The template consists of 4 sections as given below:

1. Header

2. Assets

3. Liabilities

4. Net Worth Summary

1. Header Section

This section consists of the company name and heading of the sheet.

2. Assets

Assets are the things of financial value that a company owns. The assets of a company include bank balance, cash balance, and accounts receivable. It also includes investments, real estate, equipment or inventory that a company owns.

The Asset section is consists of 4 parts:

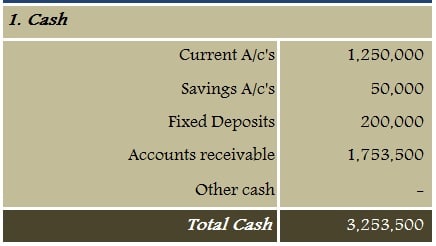

Cash – Cash in hand, Cash in current or savings accounts, Fixed Deposits, Accounts receivables, etc in this section.

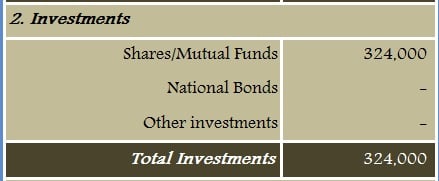

Investments – Input the investments like invested in shares and stocks, bonds, etc held by your company.

Property – Property includes both movable and non-movable property. It includes real estate, vehicles, and bullion (gold and silver).

Add the value of the real estate properties with their current market value. Whereas the company-owned vehicles are evaluated on their current price.

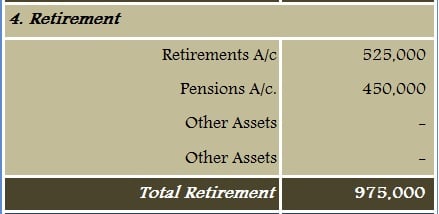

Retirement – Here in this part you need to enter Retirement related amounts in their respective accounts. For example, Retirement or Pension accounts.

3. Liabilities

The liability of a company means the financial debt or obligations to pay which arises during the course of its business operations. It is the amount that a company owes. It will include its suppliers, banks or other financial institutes.

Liability section is further divided into two parts

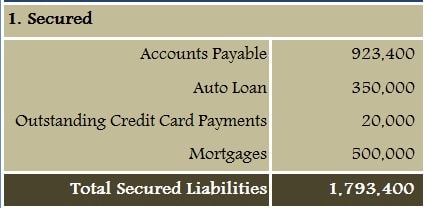

Secured Liabilities – Secured liabilities include Accounts payable, auto loans, credit card payments, etc.

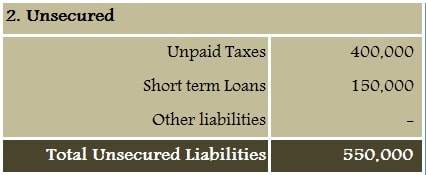

Unsecured Liabilities – Unsecured Liabilities include short-term loans without security, unpaid business taxes like VAT, GST, etc.

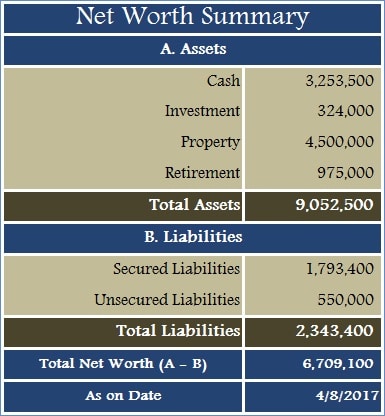

4. Net Worth Summary

You can calculate financial net worth by subtracting your financial liabilities from your financial assets.

Business Net Worth = Total Assets – Total Liabilities.

Where Assets = Total Cash + Total Investment + Total Property + Total Retirement and Liabilities = Total Secured Liabilities – Unsecured Liabilities.

Lastly, the template shows the date on which the Net Worth is calculated. You don’t need to change the date as it has been configured using the TODAY function. Thus, it automatically updates the current date of the system.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply