Deadline for filing Federal Income Tax return is approaching. Last minutes filing hustle can cost you money. Either you might forget some important deductions, credits and other special deductions that you could lower your tax liability on Federal Income Tax Return.

There are mainly two reasons that cause us to pay more on our federal income tax return:

- Not having the knowledge of what credits, deduction we are eligible and thus we don’t claim them.

- Having the knowledge of every deduction, but forget in a hurry to claim them.

As we all know that the deadline for filing your 2017 Federal Income Tax Return is 17th April 2018. If you have already filed your return then no need to worry, but if not you need to do it now. If you have filed the return and made it wrong, no need to worry. You can amend it.

To simplify the filing of the Federal Income Tax return, we have created 10 easy to use excel templates. You just need to enter your basic information and estimate your taxes, credits, deductions etc in just no more than an hour.

Each template has detailed information related to the respective exemption, deduction or credit with verified references from the IRS website.

The best part about the templates is that these templates are free to download and free to use with no limits. Apart from that, the calculations in the template have been explained in very simple and easy language for you to understand.

These templates can be useful to single filers, married filing jointly, head of household, tax consultants, and freelancers managing taxation and accounting for their clients.

How To Save Money On Your Federal Income Tax Return with these Excel templates?

Using this template can be beneficial for you in terms of money. Let me list some of the examples for you:

- Your Itemized deductions could be more. But you have chosen to go for Standard Deductions. Standard Deduction is a fixed amount.Hence, increasing your taxable income and resulting in paying more tax. Calculating the itemized deduction with one of our calculators will help you choose to go for Itemized Deductions or Standard Deduction.

- It is possible that you might not have used some of the available credits. I personally believe that we rehearse the tax return before filing at least twice.This will help you take maximum benefits and sometimes also make you eligible for taking a refund.

- We all see many wealthy people ending in paying no tax. How is that possible? They recruit people (CPAs, tax consultants, etc.) to find each and every bit of exemptions, credits, deductions they can claim.

There is more like this. The list will be endless. In addition to the above, we have also provided the Tax Glossary for you to understand the difficult tax terms in simple language.

Let us discuss the usefulness of these templates in short.

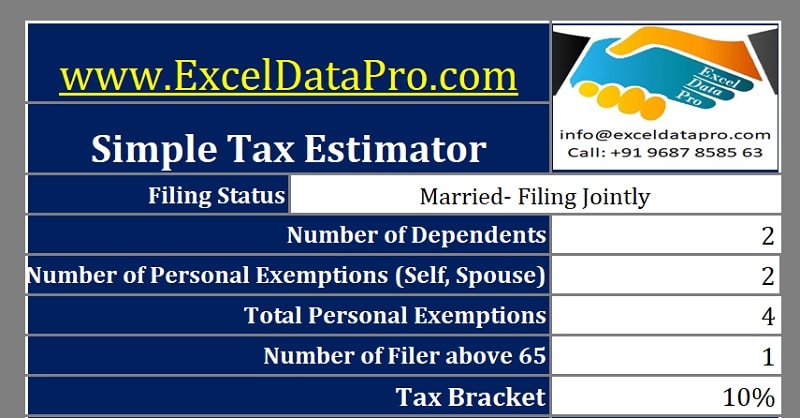

1. Simple Tax Estimator

Simple Tax Estimator helps you estimate your tax liability in general. It will give you an approximate idea of your tax liability or tax refund.

It consists of 3 sections and all the three sections are interlinked. You just have to enter the amounts applicable to you and it will calculate it.

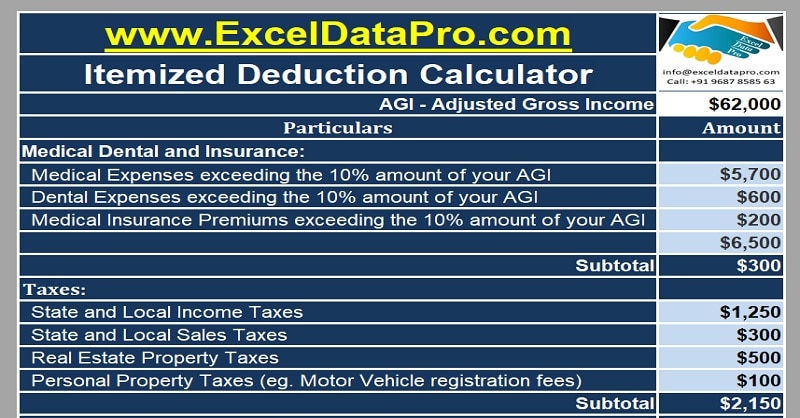

2. Itemized Deductions Calculator

Itemized Deductions Calculator helps you to choose between standard and itemized deductions. This template can be helpful in 2 ways:

- If your itemized deductions are lower than the standard deduction, you are eligible for taking a fixed amount of standard deduction that is higher, eventually decreasing your tax liability.Another benefit here is that you don’t have to provide any proofs in this deduction like it is mandatory in Itemized Deductions.

- Vice Versa to the above situation, if you find your itemized deductions more than the standard deduction amount, you can choose to go itemized deduction. This will also result in decreasing of your tax liability.

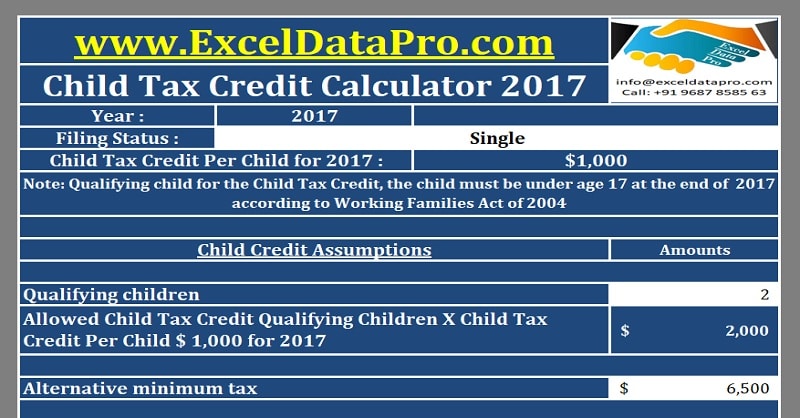

3. Child Tax Credit Calculator

Child Tax Credit Calculator will estimate the amount you can save for raising your children. This is a provision in Federal tax that allows you to get credit for the amount that you spend on your raising children.

Leaving a useful credit may again increase your liability. Thus using this template will again help you save some money on your tax bill.

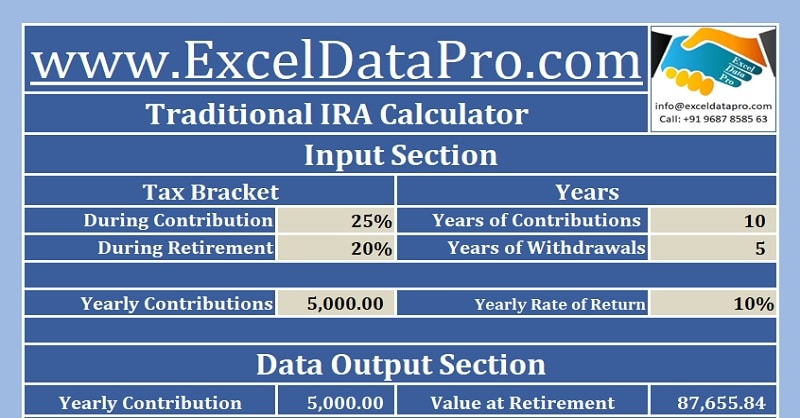

4. Traditional IRA Calculator

We all know that contributions to Traditional IRAs will decrease your taxable income. Traditional IRA Calculator will help you decide the maximum amounts you can invest and the benefits of tax that you can avail.

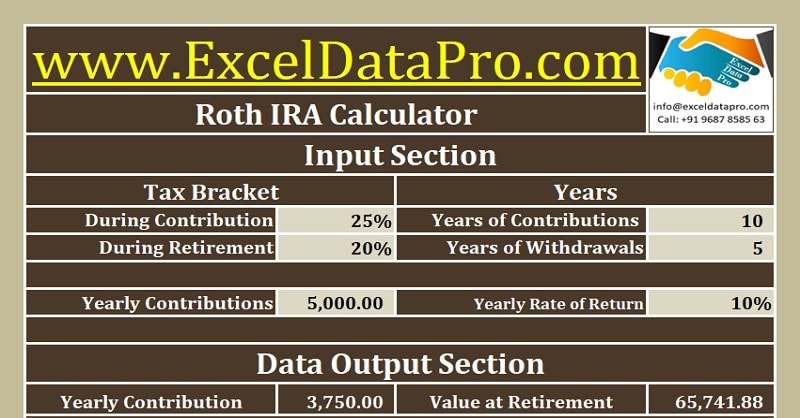

5. Roth IRA Calculator

Roth IRA another Individual retirement account that helps you decide the amount you need to invest to achieve your retirement goals. The contributions are not tax-free in Roth IRAs, but the withdrawals are tax-free.

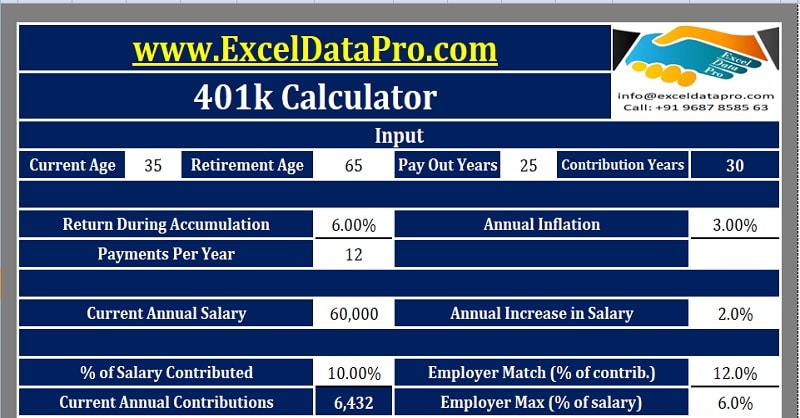

6. 401k Calculator

401K Retirement Plan can only be sponsored by an employer, in which employees can save and invest a specific portion of their paycheck before taxes. Thus, decreasing your taxable income and saving you dollars.

You can invest in a 401k along with other IRAs. At the time of leaving the jo, you can transfer the amounts to other IRAs.

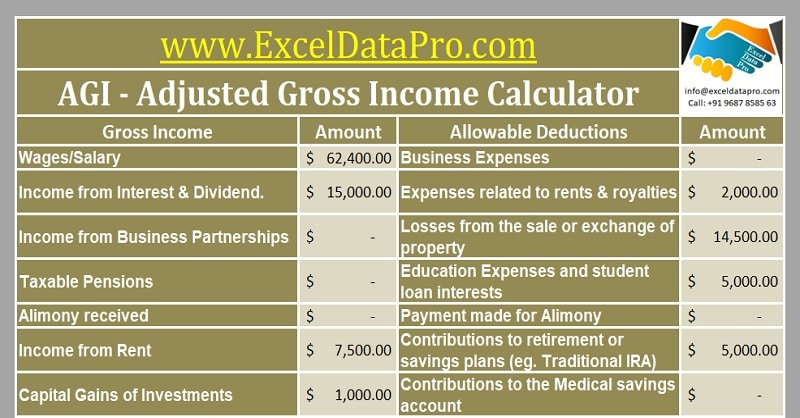

7. Adjusted Gross Income Calculator or AGI Calculator

The Adjusted Gross Income or the AGI is the basis of several tax thresholds that help you to determine the eligibility for certain tax credits and also the tax bracket.

Thus, this template can be helpful to calculate your AGI in minutes.

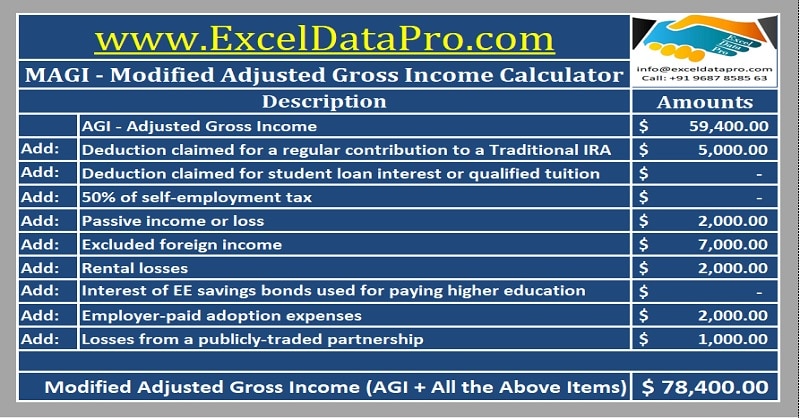

8. Modified Adjusted Gross Income Calculator or MAGI Calculator

Similar to AGI, several tax credits are also subject to the amount of your Modified Adjusted Gross Income. It also determines the eligibility of Roth IRA Contributions and other IRA deductions.

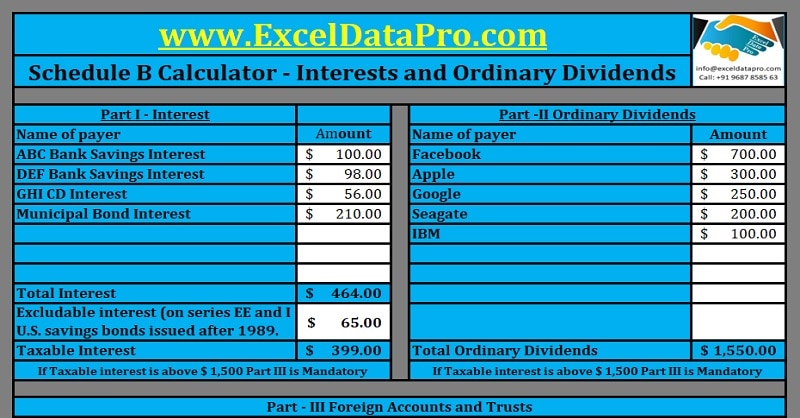

9. Schedule B Calculator

A taxpayer needs to file the Schedule B only when he/she has received interest and dividend income above a certain threshold. This template guides you through on how to file your Schedule B easily and without mistakes.

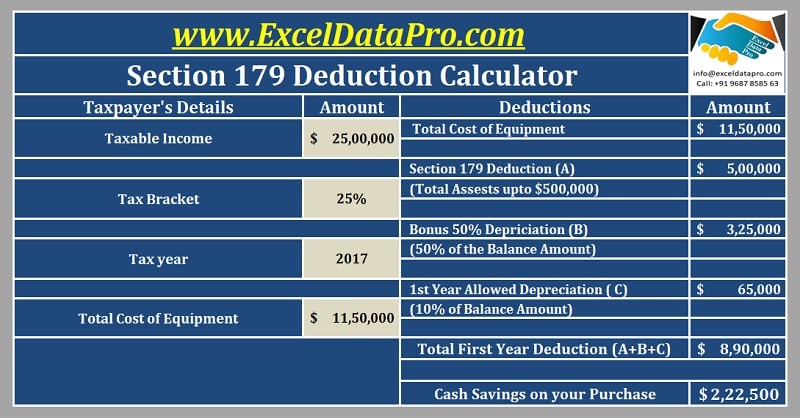

10. Section 179 Deduction Calculator

Business owners are eligible for Section 179 Deduction. It is an immediate expense deduction available to business owners on the purchase of business equipment during the tax year.

Claiming Section 179 Deduction can help you decrease your tax liability and thus saving you money. If you are a business owner and purchased a business equipment, this template will calculate the amount you can save on your tax bill.

We thank our readers for liking, sharing and following us on different social media platforms.