Definition: MAGI – Modified Adjusted Gross Income

MAGI – Modified Adjusted Gross Income is a calculation of an individual’s income. It is used to determine eligibility for premium tax credits in income tax, for getting financial help or Medicaid.

It is calculated by taking your AGI (Adjusted Gross Income) and adding back several deductions.

These deductions can be student loan deductions, Deductions of IRA contributions, foreign income, deductions of foreign-housing, adoption expenses and deductions for higher-education costs.

How to Calculate MAGI?

There are two steps to calculate MAGI. First, you need to AGI and then add certain deductions such as student loan interest, tuition, rental loss and IRA contributions.

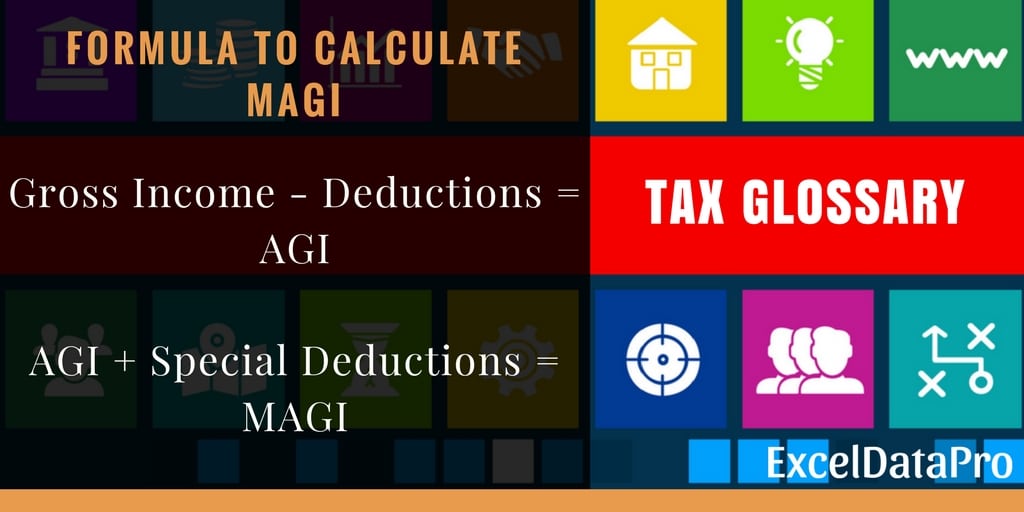

The formula to calculate MAGI is as follows:

GI(Gross Income) – Allowable Deduction = AGI

AGI + Special Deductions = MAGI

Gross Income: GI is your total income earned from various sources which include wage, interest, rent, capital gains, etc.

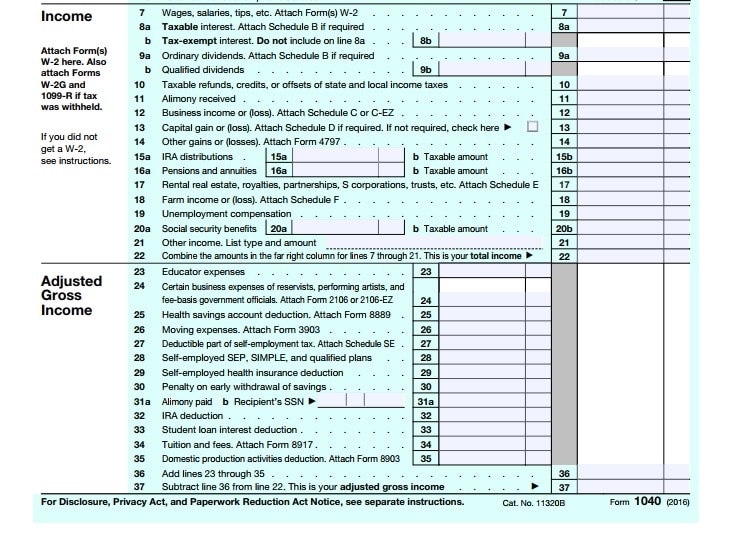

Allowable Deductions: These deductions include contributions to a retirement plan, student loan interest, health insurance payments of self-employed persons etc.

You can find the list of these allowable deductions in tax form 1040.

AGI: Gross income less of allowable deductions will provide your AGI.

Special Deductions: Special deductions include student loan deductions, Deductions of IRA contributions, foreign income, deductions of foreign-housing, adoption expenses and deductions for higher-education costs.

Thus, you derive your MAGI.

Conclusion

Usually, MAGI – Modified Adjusted Gross Income and AGI – Adjusted Gross Income of an individual are similar.

- A small difference can affect an individual’s overall tax return.

- Higher MAGI reduces the deductions of IRA contributions, sometimes even to zero.

- Higher MAGI will help you get certain benefits of Affordable Care Act.

You can also download other related templates like Traditional IRA Calculator, Roth IRA Calculator and Income Statement Projection in Excel.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.