Definition – 401k Retirement Plan

A 401k retirement plan is a type retirement plan that can only be sponsored by an employer, in which employees can save and invest a specific portion of their paycheck before taxes.

This plan has been named after the section 401(k) of Internal Revenue Code.

In a 401k plan, the employee can control how the money is invested. Most 401k plans offer a variety of mutual funds, stocks, bonds, money market investments etc.

Withdrawals from a 401k retirement plan before the age of retirement causes penalties. Taxes are paid at the time of withdrawal.

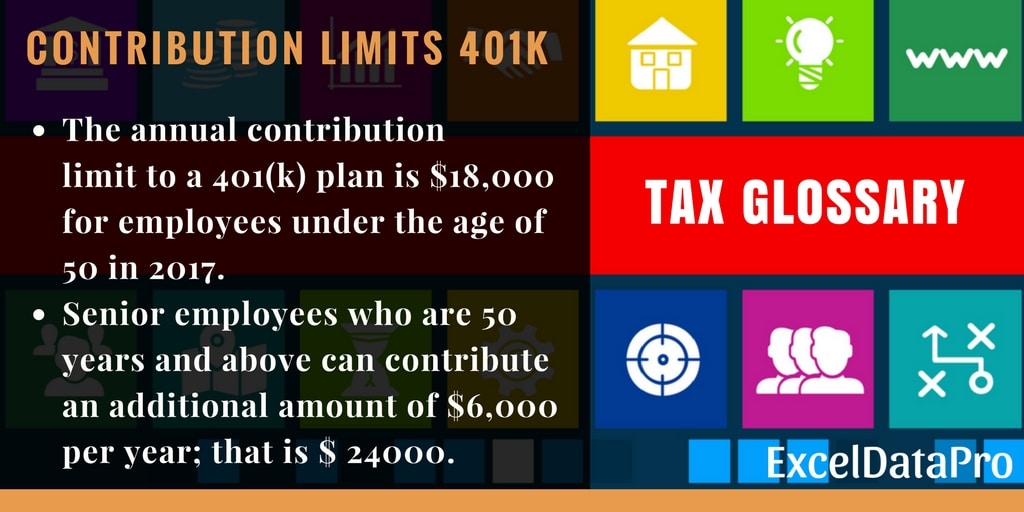

Contribution limits for 401k Retirement Plan For the Year 2017

The annual contribution limit to a 401(k) plan is $18,000 for employees under the age of 50 in 2017.

Senior employees who are 50 years and above can contribute an additional amount of $6,000 per year; that is $ 24000.

As an employee, you can contribute to 401(k) and an IRA both in the same year. While leaving the job, an employee can roll over the money in 401(k) to an IRA.

Benefits of taking 401k Retirement Plans

- Tax Saving.

- As contributions are pre-tax the saving money becomes easier.

- As the income is decreased due to the pre-tax contribution which decreases your taxable income. Thus, decreasing your tax liability.

- Additional retirement savings other than IRAs.

401k plans are beneficial in many ways and thus a great way to save for your retirement. Ask your employer today about the 401k plans offered by them.

You can download excel templates like Simple Tax Estimator, Itemized Deductions Calculator, and Income Statement Projection for easy tax calculations.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply