Utilize our professionally designed Billing Statement Templates, available in Excel, Google Sheets, and OpenOffice Calc formats, to efficiently generate client outstanding reports.

These templates facilitate the rapid preparation of multiple customer billing statements, significantly reducing the time required for this essential task.

Our Billing Statement Template consists of Accounts Receivable amounts. You can prepare this statement for a particular customer along with their payment history.

Table of Contents

What is a Billing Statement?

A Billing Statement is a formal financial document that consolidates a customer’s or client’s accounting details and billing status into a single, comprehensive report.

This document serves as an invaluable tool for tracking invoices and maintaining an up-to-date record of outstanding amounts related to goods or services provided on credit.

In essence, a Billing Statement functions as a periodic Accounts Receivable statement for a specific client or customer. The frequency of these statements is determined by the company’s credit policy and may be issued weekly, bi-weekly, or monthly, depending on the organization’s financial management practices and client relationships.

Purpose of Billing Statement

The primary objective of a Billing Statement is to maintain rigorous oversight of receivables. Prolonged outstanding accounts or receivables can significantly impede a business’s cash flow, potentially leading to financial difficulties. By regularly submitting Billing Statements to clients, companies can facilitate timely collections and maintain a healthy cash flow.

Furthermore, these statements play a crucial role in defining and refining credit periods for clients. By analyzing payment patterns and outstanding balances, businesses can make informed decisions regarding credit terms, potentially adjusting them to optimize cash flow and minimize financial risk.

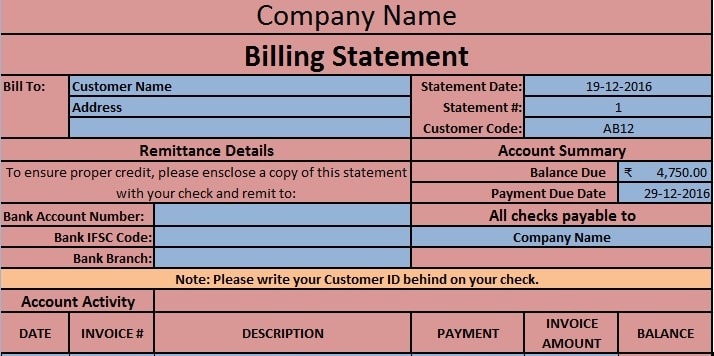

What is included in a billing statement?

A billing statement consists of the following:

Customer Information: This section provides detailed customer data, including the customer’s name, unique identification number, and complete address.

Billing Statement Details: Here, you’ll find the specific Billing Statement number and the date of issuance, ensuring proper documentation and tracking.

Supplier’s Remittance Details: This crucial information includes the company’s bank details, facilitating the customer’s payment process.

Accounts Summary: This section displays the summary of the outstanding amount along with the due date of payment.

In addition to the above, the billing statement consists of invoice and payment details.

Invoice Details: This section itemizes each invoice, including the date of issue, invoice number, and a brief description of the goods or services provided.

Payment Details: A record of all payments made against respective invoices, providing a clear picture of the customer’s payment history.

Outstanding Balance: This column displays the remaining balance for each invoice, allowing for easy identification of unpaid amounts.

Signature Section: The document concludes with a designated area for authorized signatures, adding a layer of authenticity and formality to the statement.

Billing Statement Template (Excel, Google Sheet, and OpenOffice)

We have created a Billing Statement Template that has professional looks. You can customize it according to your needs as and when required. This template is useful if you are receiving regular bi-monthly or monthly payments from that customer.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

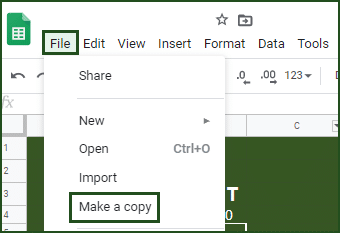

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Apart from that, you can also download other Accounting templates from our website like Accounts Payable, Accounts Receivable, Invoice Excel Templates, and Inventory Control Excel Template, etc.

Let’s discuss the Billing Statement in detail.

Content Billing Statement Template

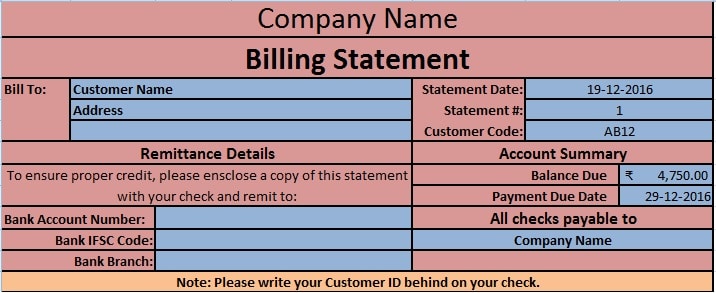

Billing Statement Template contains two sections as mentioned below: Heading Section and Data Input Section

Header Section

This Section includes headings like Company Name, Billing Statement, Customer Name, etc as shown in the above image.

Just after that, there is the Remittance section. Remittance includes all details like your Bank details like Bank Name, Bank A/c number, and Branch Code, etc.

Next to the Remittance section on the right-hand side is the Account summary. This section includes subheadings like Balance due, the due date of payment, and other payment-related instructions.

Below the Account summary come the Notes, where you can put notes for your customer as required.

I have put here a note for the customer to include their customer id behind the check.

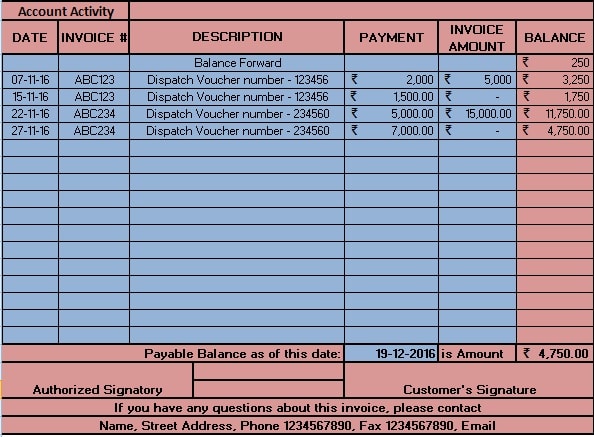

Data Input Section

This section consists of columns with headings such as Date, Invoice Number, and Payments, as depicted in the referenced screenshot.

The balance amount is calculated by subtracting the payment amount from the total invoice amount. The previous balance from prior billing periods is also reflected in the final column.

It is crucial to note that to maintain accuracy in receivables, invoice amounts should not be repeatedly included for the same invoice.

Following these entries, the Total Balance Amount as of the statement issue date is prominently displayed.

The bottom of the template provides space for authorized signatures from both the issuer and the recipient of the Billing Statement.

Finally, contact information for the Accounts Department is provided. Customers with discrepancies or queries related to the statement are encouraged to contact this department for resolution.

We extend our gratitude to our readers for their support across various social media platforms, particularly Facebook.

If you have any queries or questions, share them in the comments below and I will be more than happy to help you.

Frequently Asked Questions

What is the difference between a billing statement and an invoice?

An invoice serves as a legal obligation for payment of specific products or services purchased. In contrast, a Billing Statement presents a comprehensive summary highlighting the outstanding balance across multiple invoices, providing a broader view of the customer’s financial standing with the company.

What is the accounting effect of a billing statement?

A Billing Statement does not directly affect accounting records. It functions primarily as an informative summary of invoices and corresponding payments, serving as a communication tool rather than an accounting entry.

How to define the credit policy for our customers?

You can define the credit policy for your customers by counting the number of days in the payment is made after issuing the invoice. If you have a smart accounts receivable sheet, you can easily do that. To count days in excel you need to subtract TODAY Function from the due date.

Leave a Reply