In recent years, numerous countries have implemented various taxation systems, such as Goods and Services Tax (GST) and Value Added Tax (VAT). In response to these fiscal developments and other applicable expenses, we have developed an advanced Purchase Return Book With Tax.

Previously, we issued a Simple Purchase return Book Template that solely contained basic transaction details. However, this new version offers a more comprehensive approach to managing purchase returns in the context of modern taxation systems.

What is a Purchase Return Book?

A Purchase Return Book is a subsidiary accounting ledger that records goods returned to suppliers. These returns may occur due to various reasons, including discrepancies with the original purchase order, substandard quality, incorrect quantity, or delayed delivery. This book is also referred to as the Return Outward Book in some accounting contexts.

Such discrepancies are commonplace in business operations and form a routine part of commercial transactions. Each return is documented in the Purchase Return Book under the respective supplier’s account as and when the return of goods occurs. This meticulous recording ensures accurate tracking of all returned items and their associated financial implications.

The foundation for entries in the Purchase Return Book is debit notes issued by the buyer to the suppliers.

These debit notes serve as formal documentation of the returned goods and the corresponding financial adjustments. Consequently, the supplier’s account is debited in the buyer’s books of account. This process results in a decrease in the Accounts Payable amount for the supplier whenever a purchase return is initiated, thereby maintaining an up-to-date and accurate financial record.

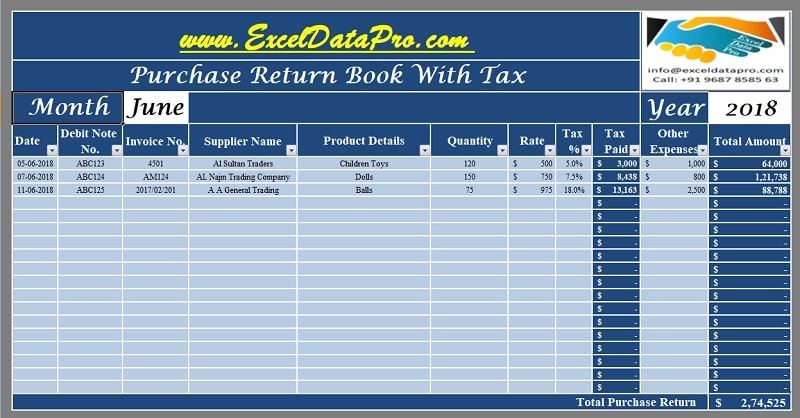

Purchase Return Book With Tax Excel Template

We have developed a user-friendly and ready-to-use Purchase Return Book With Tax, complete with predefined formulas. This template facilitates effortless recording of purchase return transactions, incorporating relevant tax considerations.

Click here to download Purchase Return Book With Tax.

Click here to Download All Accounting Excel Templates for ₹299.

You can download other accounting templates like Accounts Payable With Aging, Accounts Receivable With Aging, Petty Cash Book, and Expense Report.

Let us discuss how to efficiently use this template.

How to use Purchase Return Book Template With Tax?

Purchase Return Book Template With Tax is really a simple and easy template. This template consists of 2 sections:

- Header Section

- Data Input Section.

1. Header Section

The header section includes fields for your company name and logo, alongside the title “Purchase Return Book.” Additionally, it requires the input of the specific month and year for which the Purchase Return Book is being maintained. This temporal information is crucial for organizing and retrieving data efficiently.

2. Data Input Section

Data Input Section consists of the following columns:

Date: The date on which the goods were returned.

Debit Note No.: The unique identifier for the debit note issued.

Invoice No.: The original invoice number against which the debit note is issued.

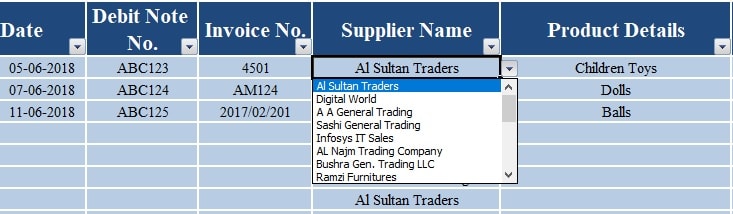

Supplier Name: A dropdown list for selecting the supplier’s name.

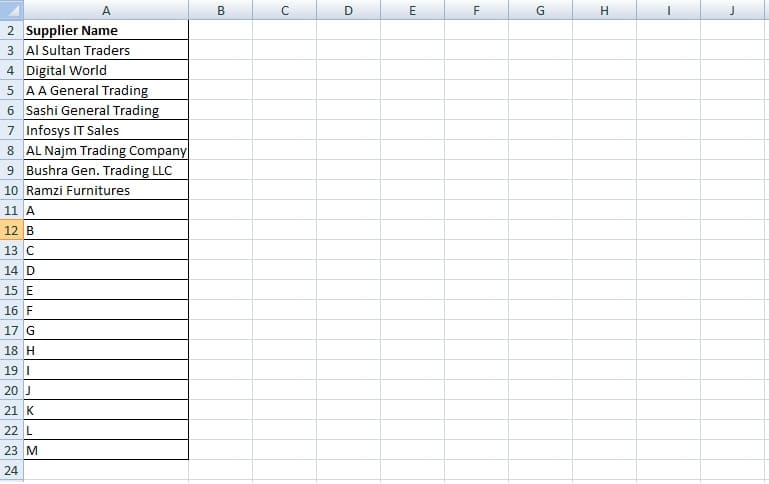

The names of suppliers can be updated in the dedicated Supplier Sheet, allowing for easy management of vendor information.

Product Details: This column is for inserting the product name, article number, or other relevant identifiers.

In cases of multiple products or varying tax rates within a single debit note, users can utilize multiple rows while maintaining the same debit note number and invoice details.

Quantity: The quantity of products returned.

Rate: The unit price of the product.

Tax %: The applicable tax percentage for the product.

Tax Paid: This column contains a predefined formula. Thus, entering the percentage in the previous column is enough. The formula applied here is:

[(Quantity X Rate) X Tax %]

If you just want to enter the tax amount leave the Tax % column blank and overwrite the formula.

Other Expenses: This column accounts for additional expenses that may be claimed from suppliers due to incorrect supply.

Total Amount: Final line total including the product price, tax, and other expenses. The formula applied here is:

[(Quantity X Rate) + Tax Paid + Other Expenses]

In the end, the Final Total of Purchase Return in that month is displayed in the last row. Sum Function is used to calculate the Purchase Return Total Amount for the respective month.

Report Printing

For managing numerous purchase return transactions and generating supplier-specific reports, two methods are available:

The first way is that you can make one sheet per supplier. The second way to do this is that you can use the table function. The Excel Template has been created using the table.

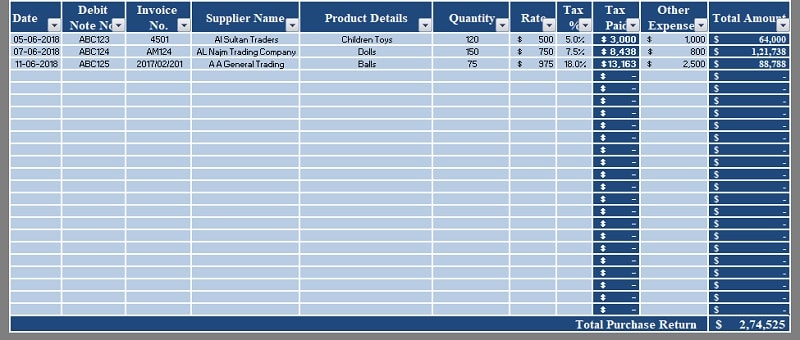

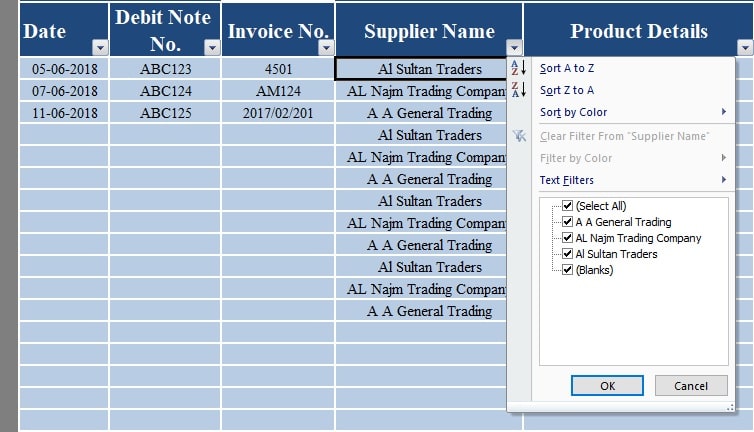

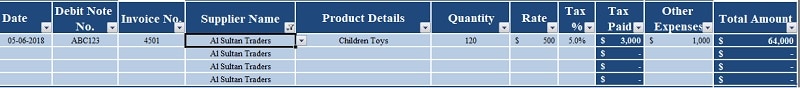

You can print reports pertaining to any column heading. Just click on the button beside the column heading. It will display a dropdown list. Select the desired date, supplier name, tax %, etc and click “OK”. The sheet will display the desired results. See images below:

Input:

Output:

It is important to note that the Purchase Return Total displayed reflects the sheet total. For supplier-specific totals, users can either select the relevant cells to view the sum in the status bar or employ the sum formula in a separate cell.

The Purchase Return Book With Tax serves as an invaluable tool for maintaining accurate purchase return records. Regular upkeep of this book is essential for avoiding discrepancies in creditor accounts and ensuring financial accuracy.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.