ROCE calculator is a ready-to-use excel template to calculate ROCE for any company and compare ROCE for 5 years for investing purpose. ROCE is means Return on capital employed of a business just by entering a few inputs.

In addition to that, 4 different ways to calculate EBIT and CE are also given if you don’t have EBIT or CE figures available.

Furthermore, you can compare ROCE of 5 years for any company using this template.

What is Return on Capital Employed(ROCE)?

Return on capital employed is a profitability ratio which measures the capacity of a company to generate profits from the employed in the functioning of a business.

Formula To Calculate ROCE?

You can calculate ROCE using the following formula: Operating Profit of ( EBIT) divided by Capital Employed.

The higher the return on capital employed means more the profits earned.

Where:

Operating Profit means profits earned before deducting interest and tax expenses. It is also referred to as EBIT. To understand EBIT in detail click on this link: EBIT.

AND

Capital Employed(CE) refers to the total amount of debt and equity funds of a business.

ROCE Calculator Excel Template

We have created a simple and useful ROCE calculator Excel template with predefined formulas. Just enter a few details and you can derive ROCE of a company as well as compare ROCE of 5 years.

Click here to download the ROCE Calculator Excel Template.

You can download other useful templates like Portfolio Analysis With BSE Bhav Copy, Income Tax Calculator FY 2018-19 and Loan Amortization Template.

Contents of ROCE Calculator Excel Template

This template consists of 3 sections:

- ROCE Calculator.

- EBIT & CE Calculations (4 Ways).

- Comparative ROCE (5 Years).

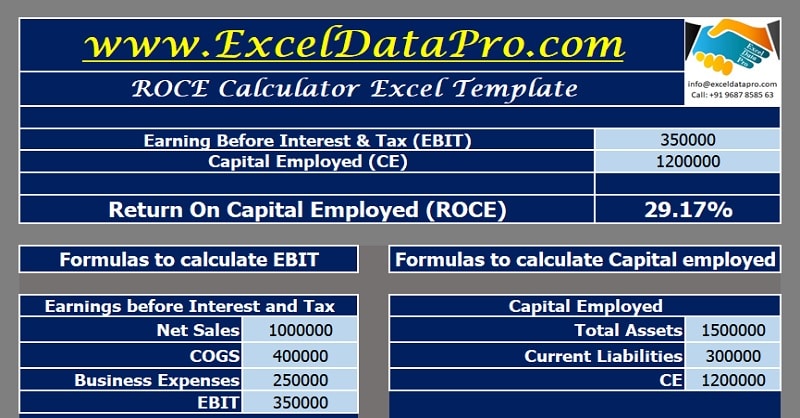

ROCE Calculator

In this section, insert EBIT(Earnings Before Interest and Taxes) and CE(Capital Employed) amounts to derive ROCE of any company.

Many times it happens that EBIT and CE figures aren’t available in annual reports or financial statements. In such cases, you can calculate both in 4 different ways that we will discuss in the below section.

As soon as you enter the EBIT and CE amounts, the template automatically calculates ROCE by applying the above-mentioned formula.

EBIT & CE Calculations (4 Ways)

When the value of EBIT and capital employed is not directly known, the first step is to calculate EBIT and capital employed. To do so here are 4 ways to calculate both EBIT and CE. You can use any combinations to derive ROCE.

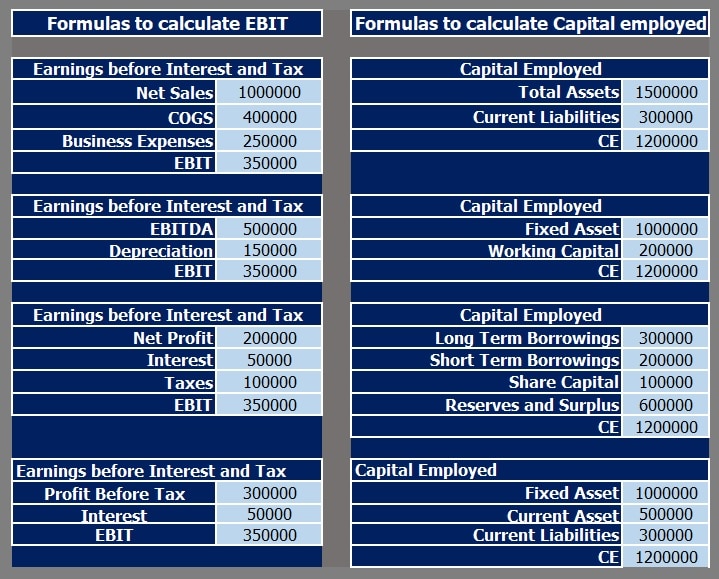

Calculating Operating profit(EBIT)

To calculate Operating Profit or EBIT, you will require elements of the Profit and Loss Account. You can calculate EBIT in 4 different ways as follows:

- EBIT can be derived by subtracting COGS(Cost of Goods Sold) and other business expenses from the Net Sales of the company. Other Business Expenses include employee benefit expenses, other expenses, and depreciation.

Thus, EBIT= Sales – COGS – Other Business Expenses - The second way to derive EBIT is by subtracting depreciation from EBITDA assumed that EBITDA already includes other income.

Thus, EBIT= EBITDA- Depreciation. - You can also derive EBIT by adding Interest and Taxes to the Profit After Tax amount of the company.

Thus, EBIT= PAT+ Interest+ Depreciation. - The fourth way to calculate EBIT is by adding the Interest amount to Profit Before Tax of the company.

Thus, EBIT= PBT+Interest.

All the above 4 ways for calculating EBIT have been added to the template which helps you to easily calculate EBIT.

Calculating CE(Capital Employed)

We require the elements Balance Sheet of a company to calculate Capital Employed. You can calculate CE in 4 ways which are as follows:

- You can derive CE by subtracting Current Liabilities from Total Assets of the company.

Thus the formula is:

CE = Total Assets- Current Liabilities. - You can also find the Capital Employed by adding Fixed Assets and Working capital of a company where Working capital is current assets minus current liabilities.

Thus the formula is:

CE = Fixed Assets + Working Capital. - The third way to derive CE is by Adding Share Capital, Equity Reserves, Long and Short Term Borrowings of a company.

Thus formula is:

CE = Share Capital + Equity Reserves + Long Term Borrowings + Short Term Borrowings. - The fourth way to calculate CE is the extension of the second method where Current Assets and Current Liabilities are taken into consideration.

Thus the formula is:

or CE = Fixed Assets + Current Asset – Current Liabilities.

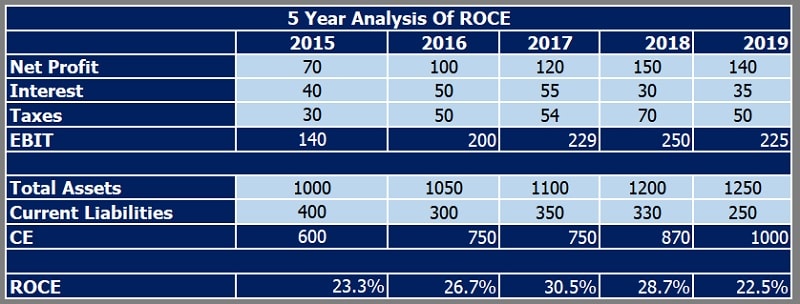

Comparative ROCE (5 Years)

In this section, you can compare the ROCE of consecutive 5 years of any company to observe the profitability of a company.

Enter the required data for calculation of EBIT and Capital employed from the financial statements for all the 5 years. The template will calculate ROCE for all those years and give you the comparison of the company’s profitability over those 5 years.

The line items will be entered by taking into account the representation of financial statements based on industry standards.

Uses of ROCE Ratio

- ROCE helps in comparison with the relative profitability of businesses after considering the capital employed in business.

- Useful for making investment or acquisition decisions related to any businesses.

- It nullifies the impact of leverage when ROE doesn’t portray the actual profitability.

- It is a better substitute to return on equity when analyzing the business.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply