With recurring requests from our readers as well as authorities for making Pre GST and Post GST Price Comparison Template in excel, today we have created an excel template for the same.

GST was implemented on July 1st, 2017. It has been around 3 months now.

The main objective behind GST was to provide good and services at a lower price to the end consumer.

According to our study, there has been a less impact on prices after GST.

The reason behind it is that the benefit of input credit is not being forwarded to the end consumer.

We have created an excel template for Pre GST and Post GST Price Comparison Template.

This can be helpful to Individuals, manufacturers, wholesalers, retailers and even to the anti-profiteering department to compare price in pre-GST as well as Post GST regime.

Click here to Download Pre GST and Post GST Price Comparison Template.

Click here to Download All GST Excel Templates for ₹299.You can download GST templates like GST TRAN-1, GST Input Output Tax Report, and GST Export Invoice from here.

Let us discuss the contents of the template in detail.

Contents of Pre GST and Post GST Price Comparison Template

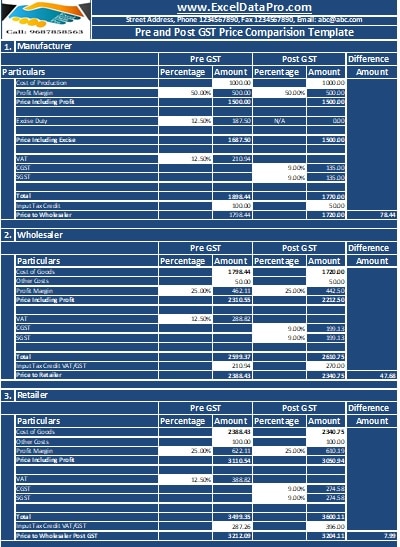

This template consists of 4 sections:

- Header Section

- Manufacturer Section

- Wholesaler Section

- Retailer Section

Important Note: Just enter the amount in white boxes only. all other amounts cells are pre-formulated and will make calculations automatically.

1. Header Section

As usual, the header section consists of the name of the company, address of the company, logo, and heading of the sheet ” Pre GST and Post GST Price Comparison Template.”

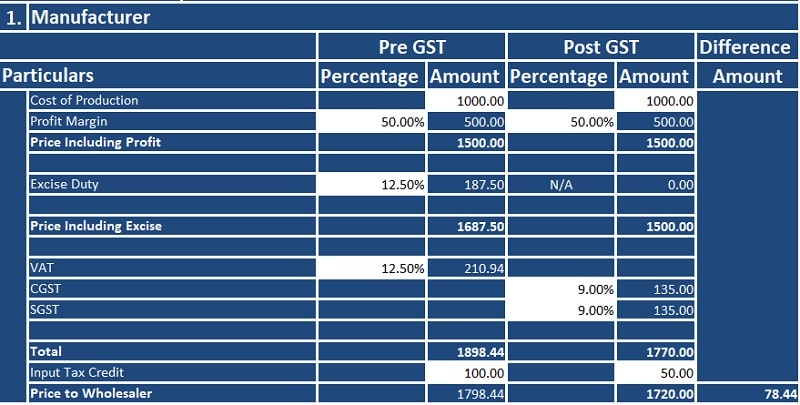

2. Manufacturer Section

In manufacturer section, there are calculations of Excise Duty which was applicable in the pre-GST regime.

Calculations of Pre GST Regime

Cost of Production + Profit = Price Including Profit.

Price Including Profit + Excise Duty = Price Including Excise. (In earlier regime Excise duty paid was not provided as input.)

Price including Excise + VAT = Total.

Total – Input of VAT = Price To Wholesaler.

Now let us see the calculations of Post GST Regime.

Calculation of Post GST Regime

Cost of Production + Profit = Price Including Profit.

GST has removed Excise and thus excise has been included in GST itself.

Price including Profit + GST = Total.

Total – Input of GST = Price To Wholesaler.

As you can see in the below image, The price difference between Pre-GST and Post GST is around Rs. 78.44.

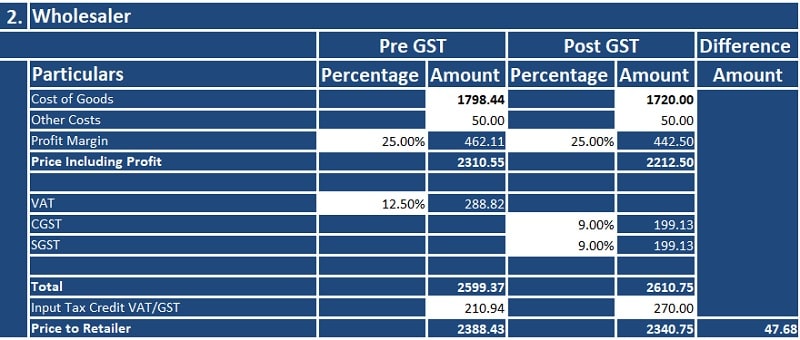

3. Wholesaler Section

Excise is applicable only in manufacturing and so it is not included in wholesaler section. All other calculations are similar to the above.

Calculations of Pre GST Regime

Cost of Goods + Other Cost + Profit = Price Including Profit.

Price Including Profit + VAT or Other Taxes = Total

Total – Input of VAT = Price To Retailer.

Calculation of Post GST Regime

Cost of Production + Other Costs + Profit = Price Including Profit.

GST has removed VAT and VAT have been included in GST itself.

Price including Profit + GST = Total.

Total – Input of GST = Price To Retailer.

There is a price difference between Pre-GST and Post GST of Rs. 47.68.

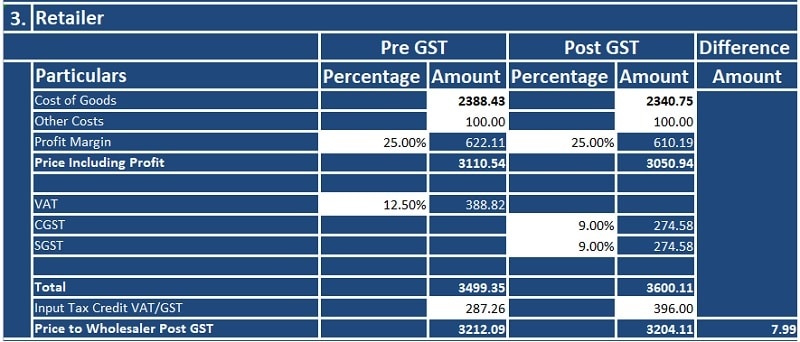

4. Retailer Section

Calculations of the retail section are similar to wholesale section.

Calculations of Pre GST Regime

Cost of Goods + Other Cost + Profit Margin = Price Including Profit.

Price Including Profit + VAT or Other Taxes = Total

Total – Input of VAT = Price To End Consumer.

Calculation of Post GST Regime

Cost of Production + Other Costs + Profit = Price Including Profit.

GST has removed VAT and VAT have been included in GST itself.

Price including Profit + GST = Total.

Total – Input of GST = Price To End Consumer.

As shown in below image, there is a price difference between Pre-GST and Post GST of Rs. 7.99 to the end consumer.

This all is applicable to some sectors only. Many other sectors are feeling the heat and things are getting costly.

For example, earlier the textile industry was not taxable, textile products are becoming costlier than the pre-GST regime.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.