The Personal Budget Template is a ready-to-utilize spreadsheet available in Excel, Google Sheets, and OpenOffice formats, designed to assist individuals in effectively managing and planning their personal finances.

This article presents the Personal Budget Excel Template, complete with graphical representations and predefined formulas. For a Corporate Budget please click here.

Table of Contents

What is Personal Budget?

A personal budget is a financial plan that allocates an individual’s income towards routine expenses, ultimately facilitating savings or debt repayments. It is a structured approach to monitoring and controlling one’s financial inflows and outflows.

Budgeting is similar to dieting. During dieting, we make a schedule of what we eat and try to reduce the extra pounds that we have put on.

Similarly while Budgeting, we track our incomes and expenditures to decrease/cut-down unnecessary or unwanted expenses.

Why Personal Budgeting Is Important?

Usually, people neglect budgeting in personal financing. As a result, we even don’t know when we cross the borderline. Our spending increases more than our incomes and we start to accumulate debt.

Here are a few things budgeting helps in:

- It enables individuals to maintain eye over their spending patterns, promoting financial discipline.

- In the absence of a deficit, budgeting aids in achieving financial goals, such as acquiring assets (e.g., vehicles, homes, gadgets), luxuries.

- Moreover, budgeting helps you to plan a better retirement.

- Effective budgeting can assist in debt management, including loans, mortgages, and credit card balances.

- As budgeting helps grow our savings, you can use that money for developing skills in this competitive job markets.

- Accidents, severe illness, disability, or job loss don’t inform us before coming. These things are sudden. In case you don’t have proper money planning you will have to suffer or else increase debt. With personal budgeting, you can have money for such unexpected emergencies.

- Monitoring budgets helps identify and eliminate wasteful expenditures, optimizing resource allocation.

- Creating a budget will decrease your stress levels by ensuring preparedness for upcoming expenses, eliminating financial surprises.

- It provides you with financial freedom.

- Retire early. You start thorough planning, management, and investing money from your savings you can plan your retirement.

- You can manage your money and make early repayments of your loans and save on interests.

Ultimately, a personal budget is a framework for efficient money management, aimed at achieving a healthy balance between savings and debt.

Thus, budgeting is very helpful and should be an important part of our financial management.

Components of a Personal Budget

A personal budget consists of three main components: Income, Expenditure, and Savings.

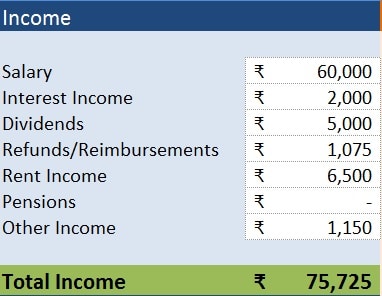

The income component encompasses all sources of revenue, such as salaries, pensions, reimbursements, dividends from stock market investments, rental income, and others. It is crucial to account for all income streams to ensure an accurate financial overview.

The expenditure component is divided into fixed and variable expenses. Fixed expenses are recurring and consistent in amount, such as loan EMIs, mortgage payments, 401K and insurance premiums.

Variable expenses, on the other hand, fluctuate in amount each month, including groceries, fuel, transportation, entertainment, gifts, and shopping.

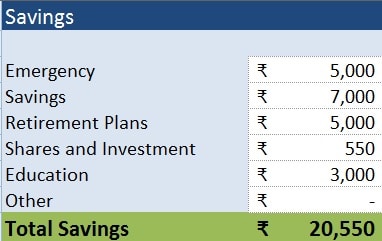

The savings component involves allocating funds towards financial goals, such as retirement plans, emergency funds, investments, or education expenses. This component is essential for building a secure financial future and achieving long-term objectives.

Personal Budget Template (Excel, Google Sheet, OpenOffice)

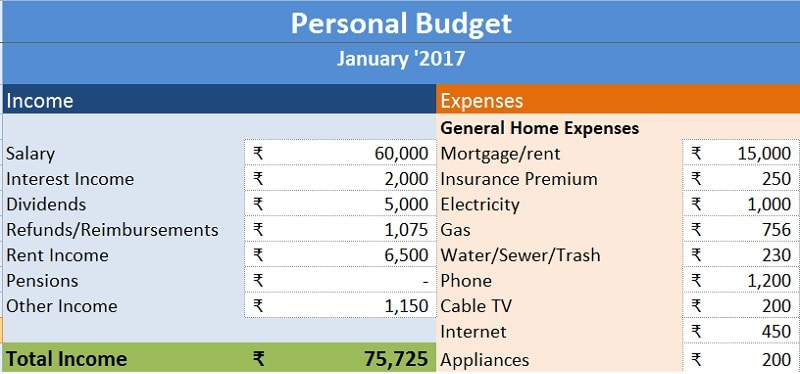

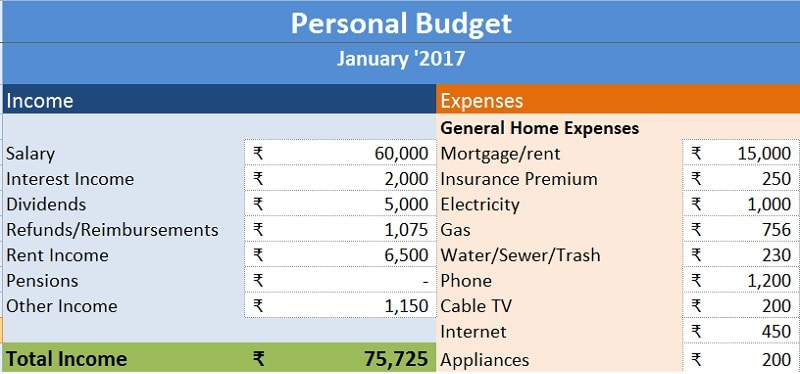

We have created a Personal Budget Template with predefined formulas and a graphical overview of the financials.

Excel Google Sheets Open Office Calc

Click here to Download All Personal Finance Excel Templates for ₹299.

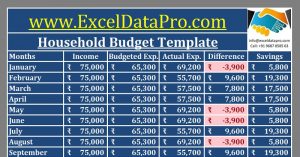

You can also download personal finance templates like Debt Reduction Calculator, Monthly Household Budget, and Loan Amortization Template from our website.

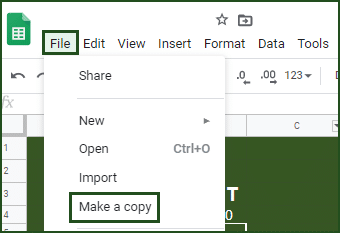

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

This template is useful to everyone but especially for working individuals and students.

Let us discuss the contents of the Personal Budget Template in detail.

Contents of Personal Budget Template

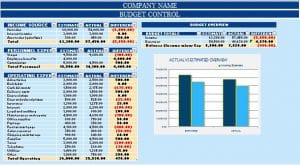

This template consists of 5 sections: Header Section, Income Section, Savings Section, Expenditure Section, and Graphical Overview Section.

Header Section

This section displays the heading of the Personal Budget Template and the month for which the budget is prepared.

Income Section

In this section, users must input all their income-generating sources, including salaries, dividends, interest income, rental income, and others.

Savings Section

The Savings Section allows users to allocate funds for general savings, emergency funds, retirement savings, and other customizable savings goals.

Expenses Section

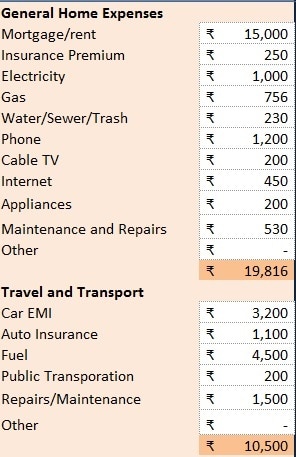

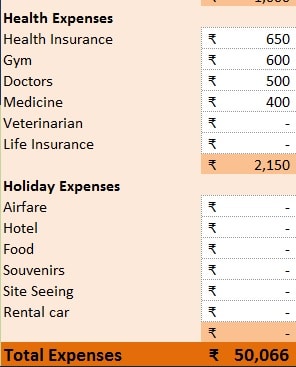

This section consists of subcategories of expenses like general expenses, Travel, family expenses, recreation expenses, health expenses, and holiday expenses, etc.

General Expenses include rent, insurance, utility bills, ISP bills, maintenance, etc.

While travel expenses include car EMI, Auto Insurance, fuel, public transport, and maintenance of personal vehicles.

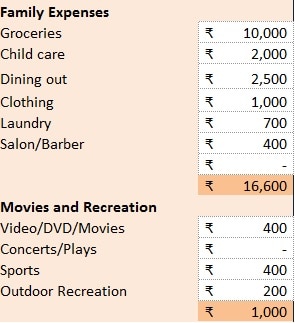

Family expenses consist of groceries, childcare items, laundry, clothing, etc.

Recreation expenses will include movies, DVDs, concerts other outdoor activities.

Health expenses include health insurance, gym fees, doctor’s fee, medicines, etc.

Holiday expenses include airfare, hotel, food rent a car, etc.

Graphical Overview

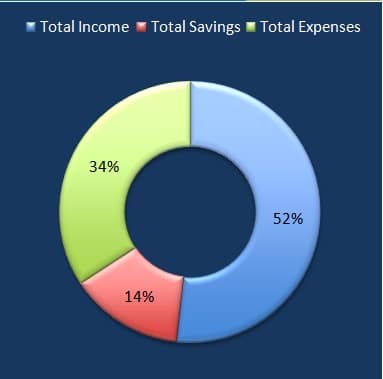

The graphical Overview section consists of the difference between incomes and expenses along with savings and how much more one can save additionally.

This overview will give you an idea to plan for early loan repayment or debt clearance. you can also plan for the purchase of an asset-based on these savings.

Both income and expenditure are shown graphically. The percentage-wise share of income, expenditure, and savings is also shown in the pie chart format.

Personal Budget Results

There are three kinds of budget results, Surplus, Balanced, and Deficit. The surplus budget means Actual expenditure is less than the estimated. Balanced Budget means that the estimated and actual expenditure is equal. A deficit Budget means that the actual expenditure is higher than the estimates.

If your budget is a surplus budget, then profits can be anticipated. Whereas if your budget is balanced, then we need to improve the execution. But if our budget is a deficit budget, then high debts and losses can be expected. This eventually leads to bankruptcy.

Thus, we need to prepare, plan, and execute a budget plan that helps us to acquire a surplus budget.

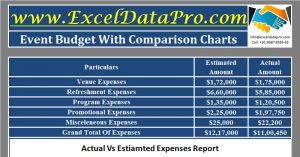

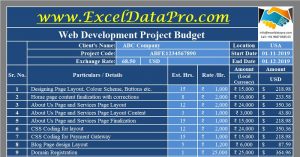

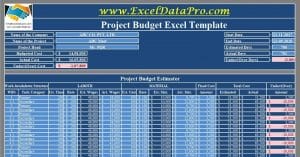

Other Budget Templates

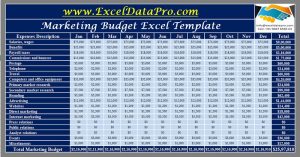

Business Budget Templates

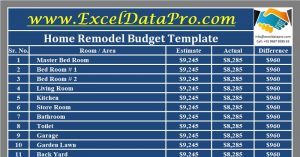

Personal Budget Templates

Personal Budgeting Tips

Few personal budgeting tips that can help you simplify budgeting:

- Identify your purpose: Establishing a predefined purpose, such as controlling overspending, debt repayment, or planning for a significant event (e.g., wedding or child’s birth), can provide motivation and direction.

- Use positive language: For individuals who perceive the term “budget” as restrictive, using alternative terminology such as “spending plan” or “saving project” can foster a more positive mindset.

- Choose your budgeting method: There are seven types of budgeting methods available; selecting the one that best aligns with your financial situation and goals can enhance the budgeting experience.

- Differentiate between needs and wants: Prioritizing expenses that fulfill essential needs over discretionary wants can optimize resource allocation.

- Prepare for emergencies: Maintaining an emergency fund can prevent panic and avoid unnecessary debt or loans during unexpected circumstances.

- Automate recurring payments: Setting up automatic payments for recurring expenses can help avoid late payment penalties and maintain a consistent financial routine.

- Review subscriptions regularly: Periodically evaluating and eliminating redundant subscriptions for similar services can reduce unnecessary expenses.

- Revise and optimize: Regularly reviewing and adjusting the budget can help identify opportunities to increase savings and accelerate debt clearance.

We thank our readers for liking, sharing, and following us on different social media platforms.

Moreover, if you have any queries or questions, share them in the comments below. I will be more than happy to help you.

Frequently Asked Questions

What is a good personal budget?

A good personal budget should consistently result in a surplus, enabling the distribution of excess funds towards savings, investments, and achieving long-term financial goals.

What are the 7 types of budgeting methods?

The 7 types of budgeting methods are as follows:

- The Balanced Money Formula or 50:30:20 Ratio Formula

- Cash-Only Spend Formula.

- Zero-Based Formula.

- 6o:10:10:10 Ratio Formula Or 60% Solution Formula.

- Automated Banking Formula or No Budget Formula.

- Value-Based Formula.

- Mixed Formula.

What is the 30-day rule in budgeting?

The 30-Day Rule is a method to control spending habits. It suggests that when the desire to make a purchase arises, individuals should wait for 30 days before acting on the impulse. If the urge to buy persists after 30 days, the purchase can be made; otherwise, it should be avoided. This rule helps curb unnecessary spending and promotes mindful consumption.