Modified Adjusted Gross Income Calculator is an excel sheet which helps you calculate your MAGI very easily and accurately.

MAGI is calculated by adding back several deductions to your AGI – Adjusted Gross Income.

Usually, MAGI is useful for determining the eligibility of Roth IRA Contributions as well as other IRA deductions. Several tax credits are also subject to your MAGI amounts.

MAGI plays an important role for Traditional IRA and Roth IRA contributions. Your deduction can be reduced or eliminated if your MAGI score is higher.

Tip to lower your MAGI: Put more money into retirement plans through work as they aren’t added back to calculate your MAGI.

You are saving more for your future and also saving on your taxes.

Thus, knowing MAGI is very important for every taxpayer.

We have created a simple and easy to use Modified Adjusted Income Calculator in Excel.

Just enter your relevant details and it will automatically calculate your MAGI. This template can be helpful to individuals and tax consultants.

Click here to download Modified Adjusted Gross Income Calculator Excel Template.

You can download excel templates like Traditional IRA Calculator, Roth IRA Calculator and Income Statement Projection in Excel for easy calculations.

To know more about MAGI click on the link below:

MAGI – Modified Adjusted Gross Income

Let us discuss the contents of the template in detail.

Content of Modified Adjusted Gross Income Calculator

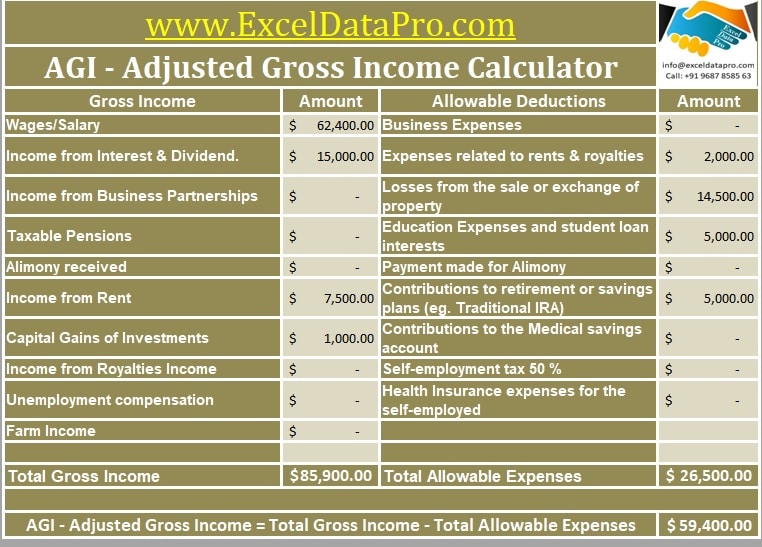

This template consists of two sheets one is the Adjusted Gross Income Calculator and other is the Modified Adjusted Gross Income Calculator.

The Modified Adjusted Calculator consists 2 sections:

- Header Section

- Data Input Section

- MAGI Calculations

1. Header Section

The header section consists of name logo and other relevant details. If you are a company, tax consultant/advisor you can add your company name and logo in the header section.

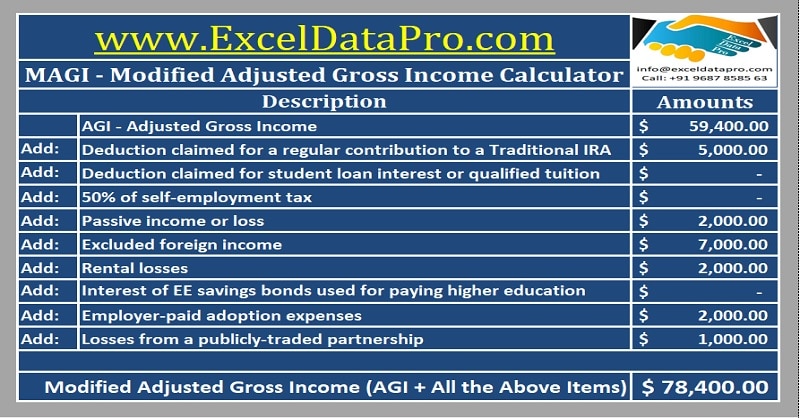

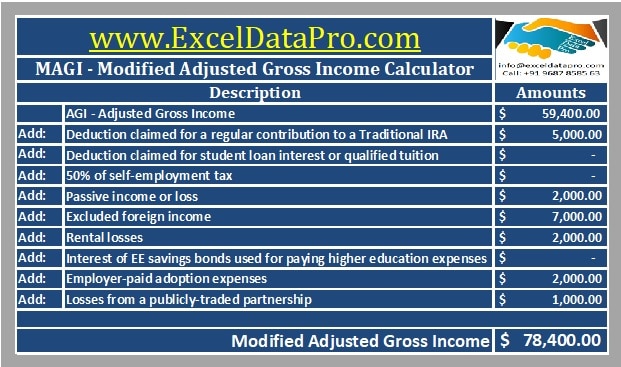

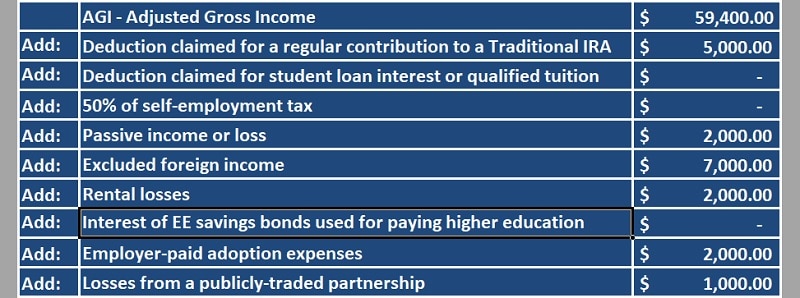

2. Data Input Section

The data input section consists of multiple items.

AGI: Adjusted Gross Income. AGI is your Gross Income less of Allowable Deductions.

Thus AGI = Gross Income – Allowable Deductions

You can find your AGI at the end of the first page of Form 1040 of Federal Tax Returns.

If you know your AGI, then you can directly add up the figure in the cell adjacent to AGI.

Don’t worry, if you haven’t calculated your AGI, just use the given Adjusted Gross Income Calculator to calculate it.

IRA Deductions: Enter the deduction claimed for a regular contribution to Traditional IRA.

Student Loan Interest Deductions: deductions claimed for student loan interest or qualified tuition.

Self Employment Tax: Taxpayers can add 50% of their self-employment tax.

Passive Incomes or Losses: If you have made any passive income or loses you can add them here.

Excluded Foreign Incomes: In AGI your foreign income is not reported. As it is your source of income you can include if you have any such income.

Rental Losses: If you have made any losses in your rental income then you can add these to your MAGI.

The interest of EE Savings Bond: Add the interest of EE savings bonds that are used for paying the higher education expenses.

Adoption Expenses: Adoption expenses paid by employers can be added here.

Losses from Partnerships: Report the losses from any publically traded partnership here in this cell.

Add the amount of the relevant cells that are applicable to you.

3. MAGI Calculations

The formula for deriving MAGI:

AGI + All the above-mentioned items in data input section.

Hence, The sum of all the above items is your MAGI – Modified Adjusted Gross Income.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.