In this article, we will discuss the Roth IRA Calculator. This calculator helps you to decide the amount of contribution amount you need to put in Roth IRA to achieve your retirement goals.

In our previous article, we have discussed the Traditional IRA Calculator.

As we know, IRA stands for Individual Retirement Account.

A Roth IRA is yet another type of individual retirement account. Investing in Roth IRA is different from Traditional IRA.

In Roth IRA, you are not entitled to any tax deduction in contribution year, whereas in traditional IRA you are entitled to tax deductions in contribution year.

You get no tax break but your earnings and withdrawals during retirement are tax-free.

To know more about Roth IRA from IRS website click on the link below:

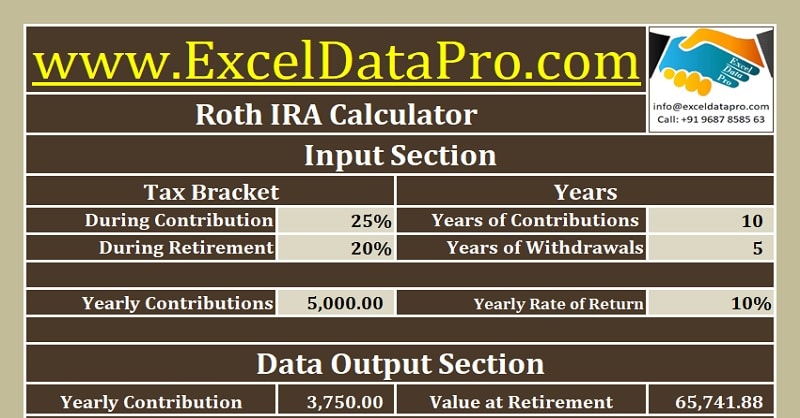

We have created a ready to Roth IRA Calculator in Excel with predefined formulas. You just need to input your contribution years, contribution amount and few other details. It will automatically calculate the results for you.

Roth IRA Calculator helps to set your retirement goals and choose the amount you need to invest for achieving them.

Click here to Download Roth IRA Calculator Excel Template

You can also download other related templates like Business Net Worth Calculator, Startup Cost Calculator, and Income Statement Projection in Excel.

Let us discuss the contents of the Roth IRA Calculator in detail.

Contents of Roth IRA Calculator

Similar to Traditional IRA Calculator, this calculator also consists of 3 sections:

- Header Section

- Input Section

- Output Section

The difference is only in the contribution amount. As your contribution amount is taxed, the actual amount contributed is less in Roth IRA.

1. Header Section

The header section of the heading of the sheet ” Roth IRA Calculator”.

If you are an advisory company, you can use this template by putting your logo and company name on top.

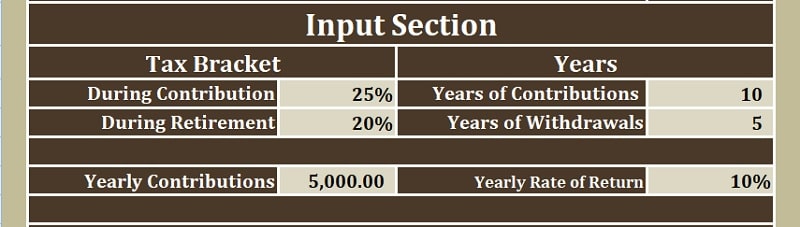

2. Input Section

All the headings in this section are same as Traditional IRA. In other words, you need to provide same details as in the case of Traditional IRA.

You need to provide the following details:

Tax Bracket: Under this heading, there are two subheadings. First is your current tax bracket and tax bracket at the time of retirement.

Tax brackets are decided by federal authorities. It is feasible to choose a higher bracket. Because we don’t know what will happen during those ten years of contribution.

Years: Here you have to enter the number of years you are planning to contribute and the number of years you want the withdrawals.

In terms of retirement planning, it is considered better to start soon, so that you can retire early. It is highly preferable that you plan an IRA as soon as you begin your career.

Yearly Contributions: Yearly contributions means the amount you will invest on yearly basis.

We have taken the contribution amount as $ 5, 000, which is almost $ 417 a month.

Yearly Rate of Return: As per your retirement goal you need to choose the investment plan. Different plans have a different yearly rate of return.

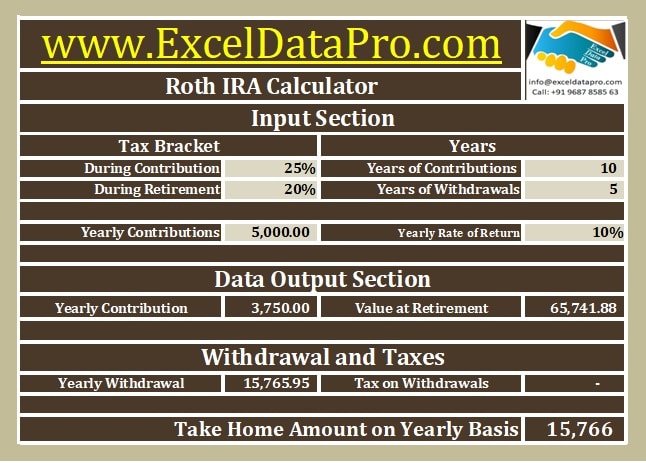

3. Output Section

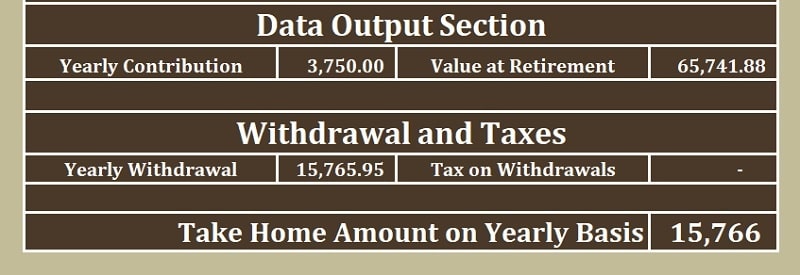

Output section will display the results in respective cells according to the amounts, years and rate of return entered in the input section.

Yearly Contributions: As the contributions aren’t tax-free in Roth IRA, tax applicable during the contribution will be deducted from this amount.

$ 5,000 – $ 1,250 = $ 3,750. Thus, $ 3,750 is your yearly contribution amount.

Value At Retirement: It is the total amount you will have the time of retirement.

The same formula that was applied to Traditional IRA for Value at retirement is given here. It is calculated using the FV function of excel.

The formula applied here is =FV($G$9,$G$6,-D12, 1).

Yearly Withdrawal: As you contribute for 10 years and reach the year of retirement, you will get an amount every year for 5 years.

The formula applied here is =PMT($G$9,$G$7,-G12,0,1).

Tax on Withdrawals: As discussed above the earning and withdrawals are tax-free in Roth IRA, no tax deducted on withdrawal is NIL.

Take Home Amount: Take home yearly amount is the amount of withdrawal.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Looked at your Roth Excel calculator. Looking for a Roth Conversion calculator in Excel. Have what a finished product looks like in a PDF format. However do not have a workable Excel template nor the calculations. Can you help with this?