Ready-to-use Invoice templates in Excel, Google Sheets, and Open Office Calc in different formats according to a different industry, different languages, and different currencies. This will help you to issue an invoice to your customer for the goods or services provided.

You can issue these templates you can issue an invoice with minimal entry. Template fetches most data from the client’s list and product list automatically. You just need to select everything from the dropdown list and only enter the quantity of the product.

Table of Contents

What is an Invoice?

Invoice is a commercial document that a seller issues to his customer for the supply of goods or rendering services. It is a legal binding of receipt of payment from the customer. It is also known as bill

In other words, it is a document issued by a seller to the buyer for a transaction. It consists of details of services or goods supplied along with rates of services provided or per-unit price of goods.

Purpose of Issuing an Invoice

Any business issues Invoice for the following purposes:

- Record the sale of goods or services.

- Serves as a legal document for the right to payment.

- Document income for tax and accounting purposes.

- Review Sales performance by employees.

Components of an Invoice

An invoice must consist of the following things:

- Supplier Name and Address.

- Invoice Number.

- Issue Date.

- Purchase Order Number or Delivery Challan Number if applicable.

- Buyer’s Name and Address.

- Invoice Payment Date in case of Credit Invoice.

- Delivery Address if different from Buyer’s Address.

- Details of Supply of goods or services like the description of goods, price per unit, Line total, and Invoice Summary.

- Payment Terms and Conditions (Optional).

Types of Invoices

There are many different types of invoices that can you can send to customers based on the nature of the sale. Here are 7 types of invoices that businesses generally use.

Standard Invoice: Standard invoice is a basic invoice that small and medium-sized businesses use to bill their customers for their goods/services. It consists of the description of the goods/service, the price per unit, and the Total invoice cost.

Credit Memo: A Credit Memo or Credit Note is a document that a seller sends to the buyer for reducing the amount that the buyer owes that was miscalculated in the earlier invoice.

Debit Memo: A debit memorandum or Debit Note is a document that a seller issues to a buyer for increasing the amount a buyer owes against miscalculation or other circumstances.

Proforma Invoice: A pro forma invoice is a document a seller sends to the buyer before the shipment or delivery of goods. It includes the details of purchased items along with shipping weight and transport charges.

Progressive Billing Invoice: Progress invoicing or progress billing is an invoice that a business uses to invoicing a client incrementally against completion of the agreed percentage of work for a complete project.

Recurring Invoice: An recurring invoice similar to a standard invoice. It is merely an invoice that a seller sends to the same customer at regular intervals which consists of the same invoice details.

Collective Invoice: A collective invoice is a type of invoice that includes goods or services rendered to the customer at the agreed-upon billing period.

Invoice Templates

We have created 25 different Invoice Templates with predefined formulas to help you prepare invoices with the least efforts. Click on the button to download the desired Invoice format.

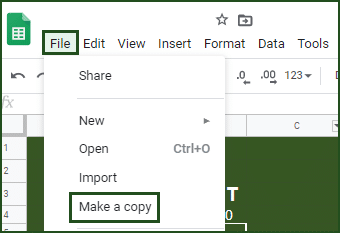

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Let us discuss each template in detail.

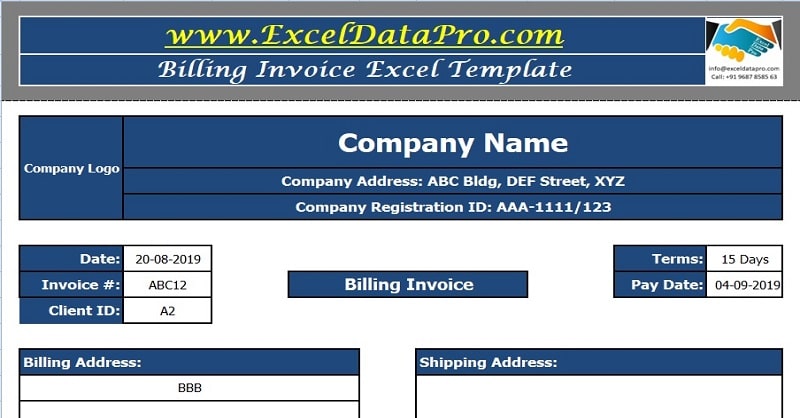

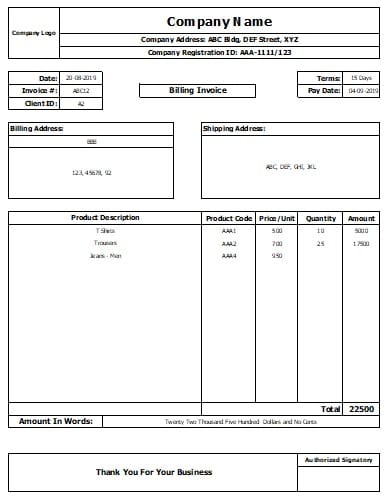

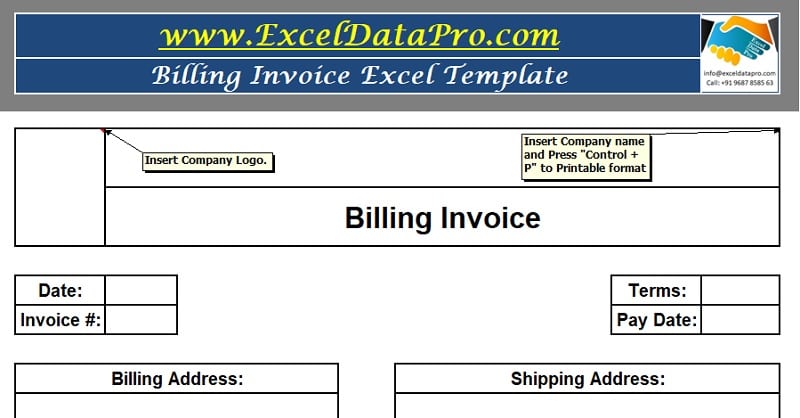

Billing Invoice Template

Billing Invoice Excel Template a simple ready-to-use excel template to professionally bill your clients with minimal efforts. Only one-time entry for products and clients.

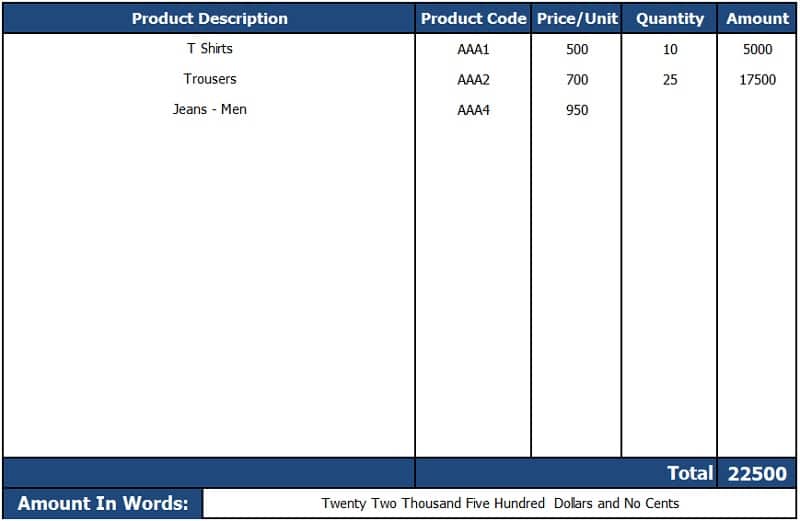

You just need to select customer id and it will update all customer details. Select the product and it will automatically update product code and product price. Insert the quantity and the invoice displays line total and column total.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

This template can be useful to small businesses, freelancers, and consultants.

Contents of Billing Invoice Template

This template consists of 4 sheets: Billing Invoice Template, Products, Clients, and Ink Saver Printable Format.

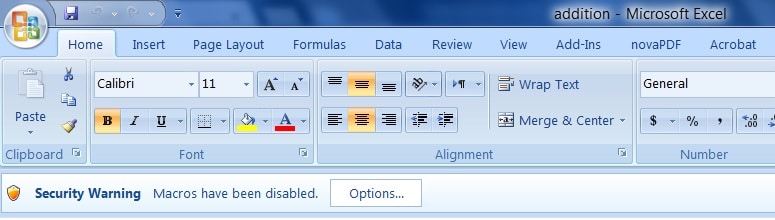

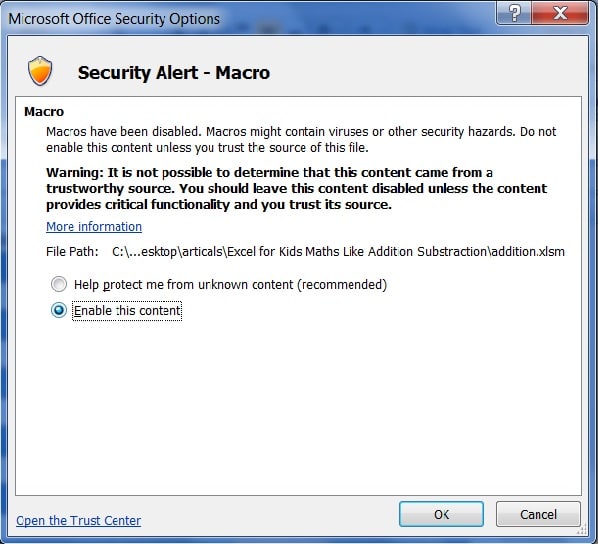

When you download the file and open it a Security Warning will be displayed “Macros have been disabled”. Click on “Options”.

Select “Enable this content” and click OK.

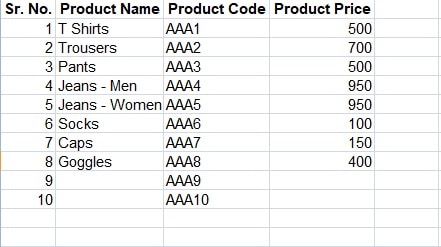

Insert your product details along with product code and its price in the price sheet.

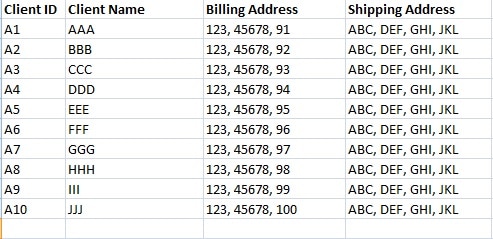

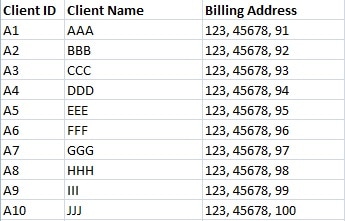

Add your existing clients in the client sheet along with their Client Code, Client Name, Billing Address, and Shipping Address if applicable.

In the Billing Template, insert your Company Logo, Company Name, Address, and your Company Registration ID at the top.

Date cell will display the current date using TODAY Function. Invoice #, you need to enter according to your requirements.

Enter the number of days in the Terms cell. It will auto-calculate the due date of the Invoice and display in “Pay Date”.

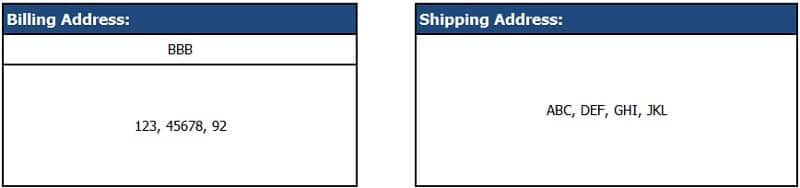

Moreover, select the Client Id from the dropdown list and it will fetch the required data from the client file.

Furthermore, select the product name from the list and the template fetches the product code and product price from the product sheet. Insert the quantity and the template calculates the line totals and column totals for you.

In addition to that, the template displays the Amount in Words in 5 currencies. US Dollars, Great Britain Pound, Japanese Yen, Saudi Riyal, and UAE Dirhams.

The following formula is used =SpellNumberEDP(J37, “GBP”).

For the US leave ” ” blank, Great Britain Pound use “GBP”, Japanese Yen use “YEN”, Saudi Riyal use “SAR” and for UAE Dirham use “AED”.

The Billing Invoice consists of colored cells. If you want to print an environment-friendly and Ink Saver print then use the last sheet to print Ink Saver Printable Format.

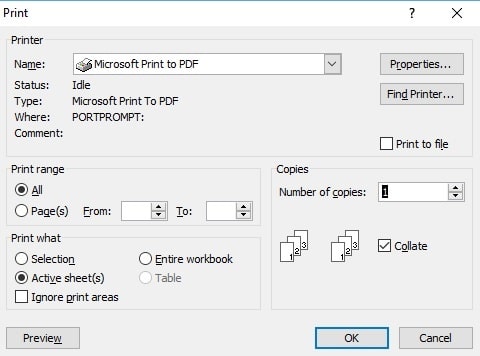

Press “Cntrl + P” to print the invoice and sign at the end of the invoice given below the authorized signatory.

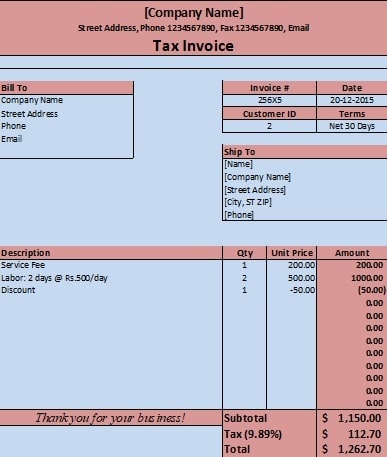

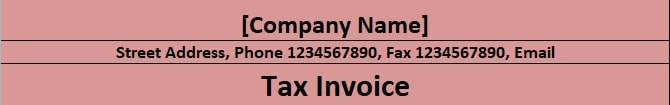

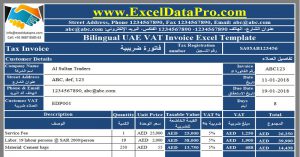

Tax Invoice Template

Tax Invoice is a ready-to-use excel template with predefined formulas to help you issue a tax invoice to your clients according to the taxation applicable in your country.

Insert your percentage of taxation in it and it will automatically calculate the final invoice amount for you.

Excel Google Sheets Open Office Calc

Let us discuss the contents of the template in detail.

Contents of Tax Invoice Template

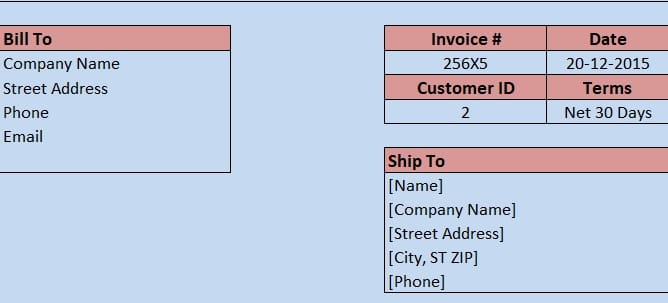

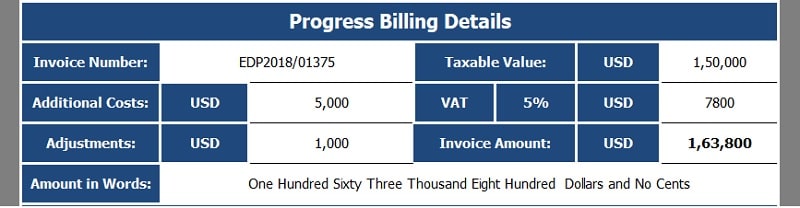

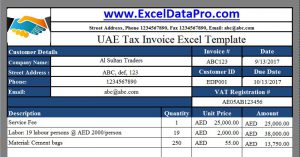

This template consists of 4 sections: Supplier Details, Customer Details, Product Details, and Billing Summary.

Enter Company/Business Name, Company Address, Phone No., Fax, Email address, and other relevant details in the Supplier Section. Insert heading “Tax Invoice” or “Bill”.

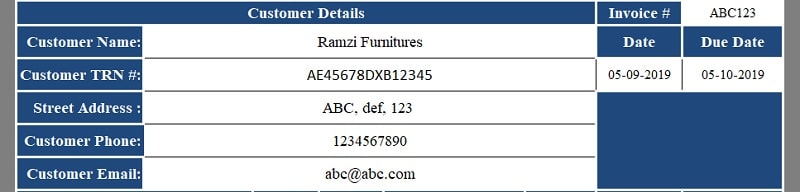

Insert details of the customer like customer name, invoice #, date, customer id, the due date of the payment, and shipping information if required. See the image below for reference.

You can set the due date of the payment according to the terms with your customer. In this template, it is set for 30 days from the date of the invoice. The Formula applied here is (=H5+30) which is Date + No. of days.

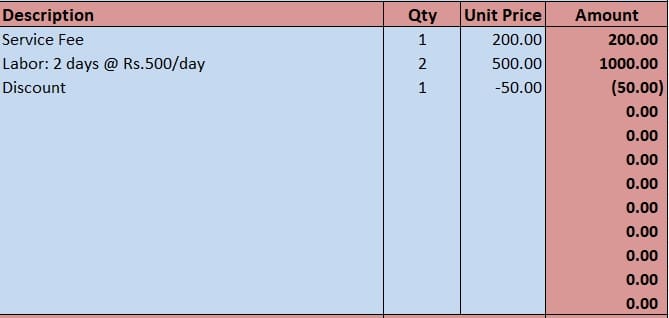

The product details section subheadings for data input like Description, Quantity, Price, and Amount. See image below:

Description, Quantity, Unit Price, Amount of Bill, and their respective are details to be put making the invoice.

Amount column = Quantity X price per unit or hours of service rendered.

Hence, following formula is applied here: =IF(F15=””, ROUND(1*G15,2),ROUND(F15*G15,2)).

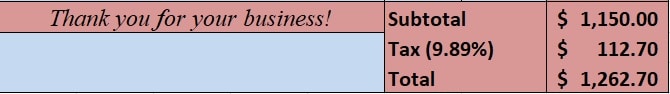

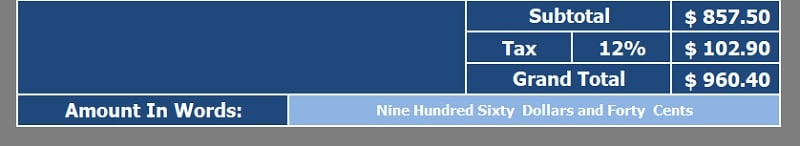

Furthermore, it calculates the subtotal by adding all the values in the Amount column. The formula applied here is =SUM(H15: H26).

Beside the TAX cell, enter the tax percentage. The percentage is multiplied with the sub-total amount of the invoice. The formula applied here is =H27*G28.

Total = Subtotal Amount + Tax Amount.

The formula applied here is =H27+H28.

You Tax Invoice is ready. Stamp with company seal if required.

Blank Invoice Format

Blank Invoice Template is a simple and ready-to-use Excel Template that helps you to issue an invoice to your customers when you don’t have any printed bill book.

Enter your company details like name, address, registration number, etc. If you want to issue a handwritten invoice, just print it or you can fill all details and directly print it.

Excel Google Sheets Open Office Calc

Let us discuss the contents of the template in detail.

Contents of Blank Invoice Format

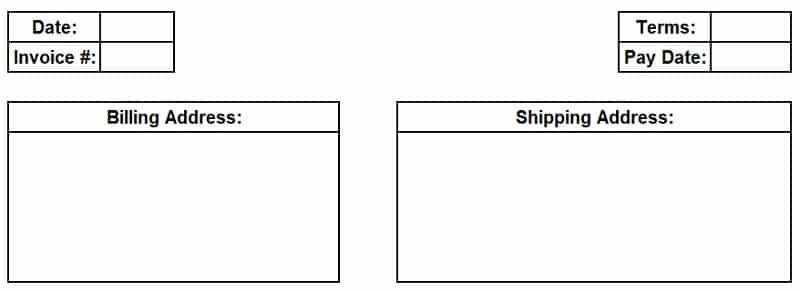

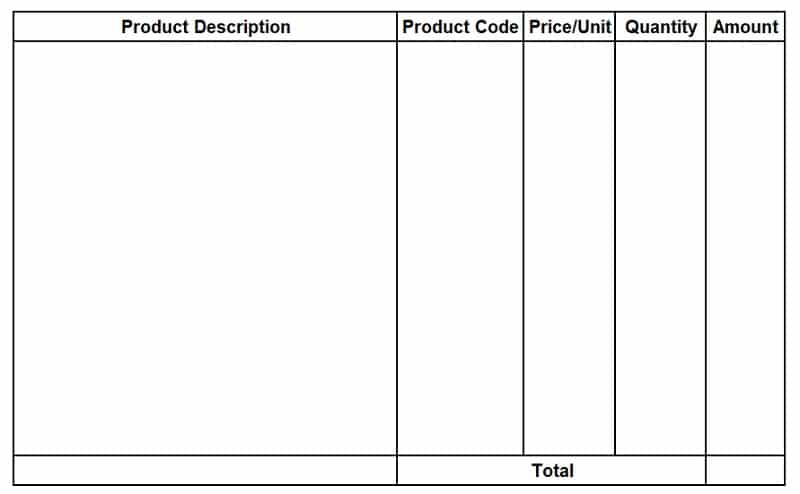

Blank invoice format consists of 4 sections: Supplier Detail Section, Customer Details Section, Product Details Section, and Signature Section.

Insert your company name, address, and logo in the Supplier details section. Arrow marks have been given on places to insert them.

The customer detail section consists of the following details; date, invoice number, terms, pay date, billing address, and shipping address if applicable.

In the product detail section, write the product name, product code (if any), Price per unit, quantity, and Amount. You can type-in or write it after taking the print.

Lastly, the signature section consists of a business greeting and an authorized signatory box. Once you have inserted the details print the invoice and sign it. That’s it. Your invoice is complete.

Hourly Invoice Template

Hourly Invoice Excel Template is a ready-to-use template in Excel helpful to freelancers to issue an invoice on an hourly basis to your clients in different currencies.

Insert your company name, logo, work description and your invoice is ready to send. You can make pdf or image of the same and send it to your client through Paypal and Payoneer.

Excel Google Sheets Open Office Calc

This template can be useful to web developers, graphic designers, and all other kinds of freelancers that work on an hourly basis.

Contents of Hourly Invoice Template

This template consists of 3 sheets: Hourly Invoice, Client Database, and Printable Hourly Invoice.

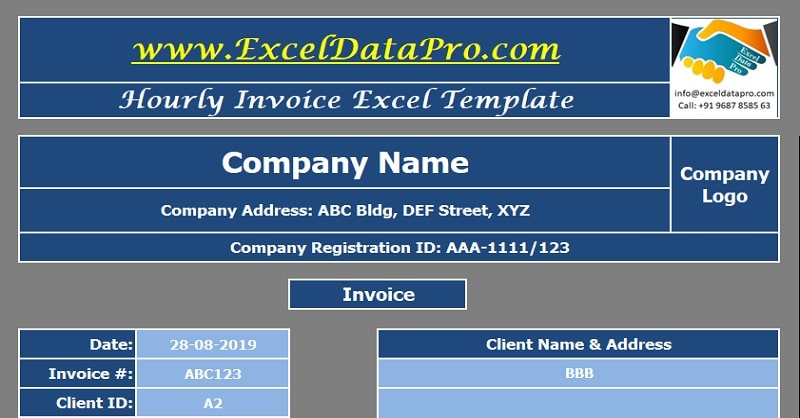

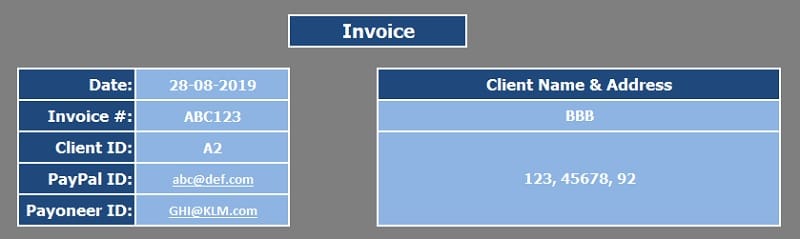

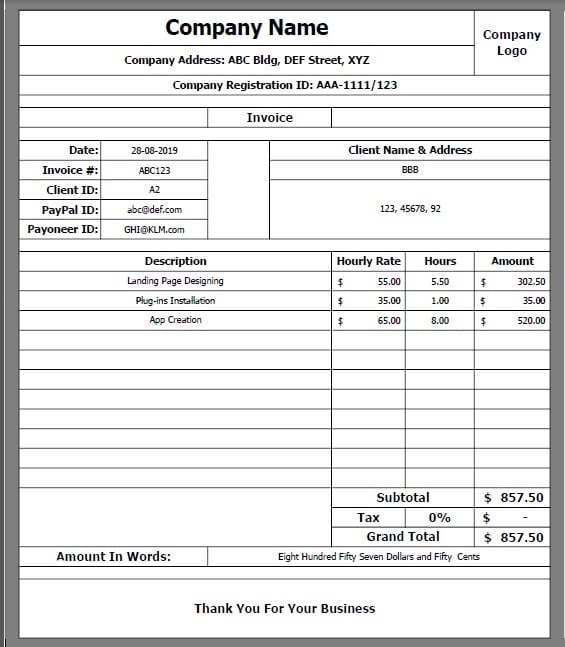

Hourly invoice template consists of 4 sections: Freelancer/Developer Company Information, Client Information, Description of Work, and Business Greeting.

At the top, insert your name or company name and address. If you are a company then insert the logo.

Enter invoice date, invoice number, and client id. Select the client id from the dropdown and it will fetch the relevant details from the client sheet.

Usually, the international payments for freelancers are through PayPal or Payoneer. Thus, you can add your payment id so that your client can easily pay you.

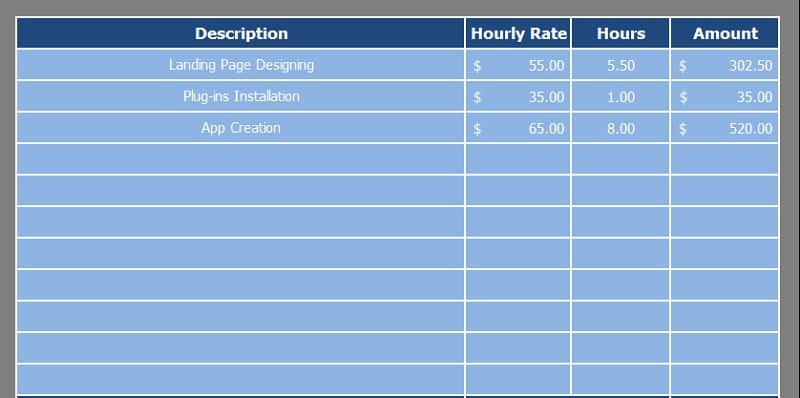

Furthermore, enter the work description that you have completed, your hourly rate, and the number of hours.

Enter the tax percentage if applicable. This will calculate the tax amount and add it to the total.

Furthermore, the “Amount in the word” consists of a VBA function to represent the amount in words. The following formula is used =SpellNumberEDP(J37, ” “).

Moreover, For the USD leave ” ” blank, Great Britain Pound use “GBP”, Japanese Yen use “YEN”, Saudi Riyal use “SAR” and for UAE Dirham use “AED”.

Your Hourly Invoice is ready. In the end, the business greeting is given.

Use “Cntrl + P” and select “Microsoft Print to PDF” to make a pdf file of the invoice. This you can add to your billing on PayPal and Payoneer.

The second sheet is for the client database. Insert all of your client’s name and details and it will fetch with the help of Vlookup in your invoice sheet. As mentioned above, select the client ID and it will fetch from this sheet.

Finally, the third sheet is the duplicate version of the first sheet, but without colors.

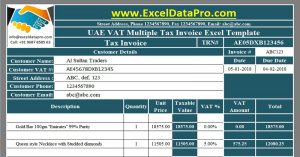

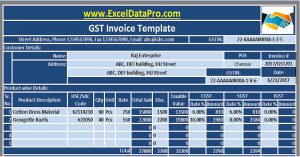

Multiple Tax Invoice Template

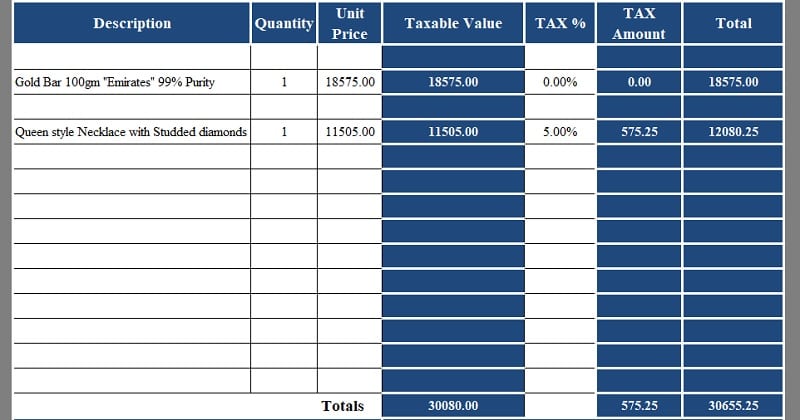

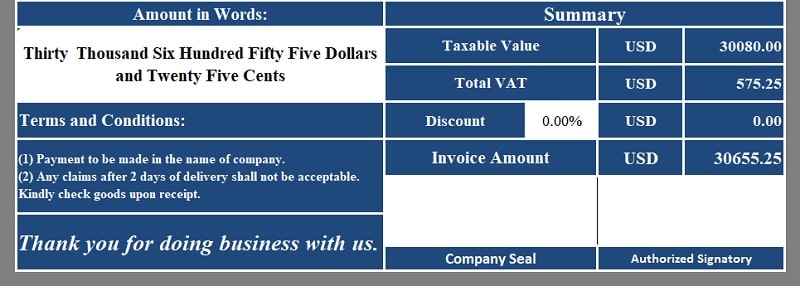

Multiple Tax Invoice is a ready-to-use Excel Template that helps you to issue an invoice for goods having different tax rates.

Excel Google Sheets Open Office Calc

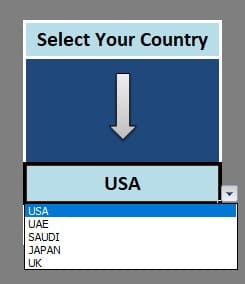

Select the country, client name, insert your product description, select the tax rate from the dropdown list and it ready to print. You can issue this invoice in 5 different currencies; USD, GBP, YEN, AED, and SAR.

Note: A security warning will appear at the top. Click on “Options” and select “Enable This Content”.

Contents of Multiple Tax Invoice Template

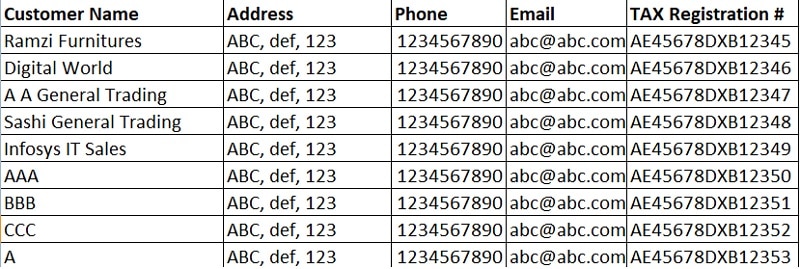

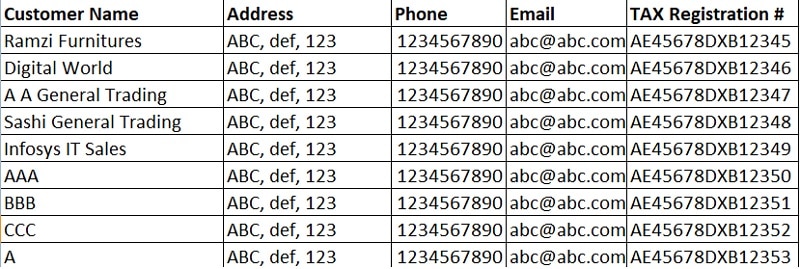

This template consists of 2 sheets: Customer Database, and Multiple Tax Invoice Template.

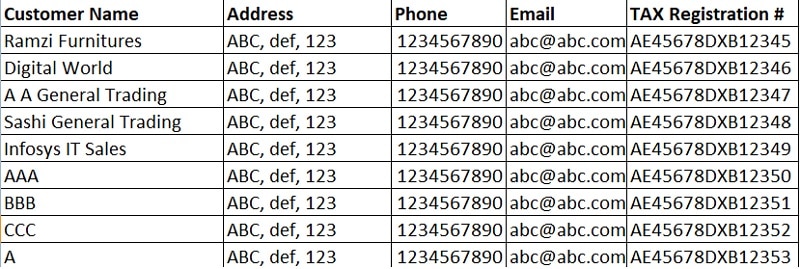

In the Customer Database sheet, insert details of all of your customers in this sheet so that you don’t have to type it every time. This is a one-time entry. Once you select the name on the template it will automatically update other details.

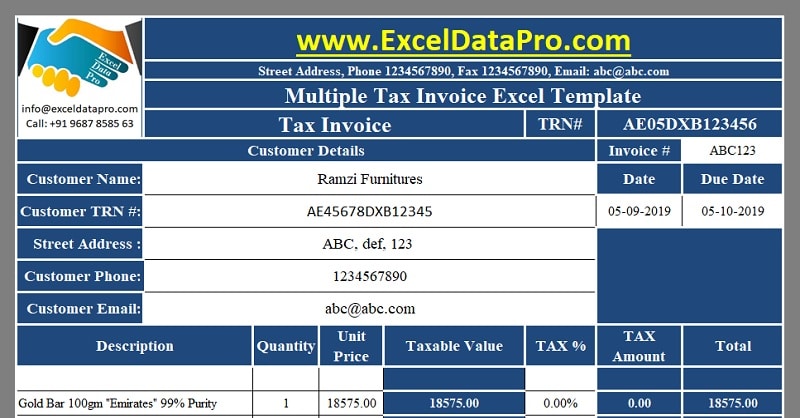

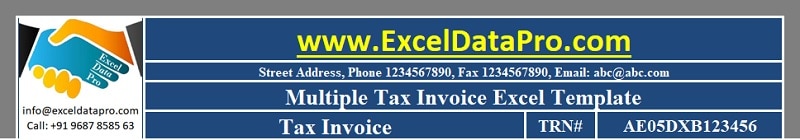

Multiple Tax Invoice consists of 4 sections: Supplier Details, Customer Details, Product Details, and Billing Summary.

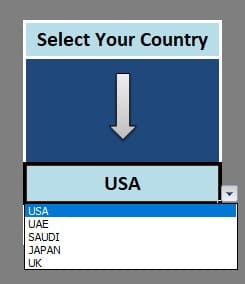

Insert your Tax Registration Number (TRN#) in supplier details. Select your country from the right-side box and it will update the currency accordingly.

Using data-validation we have created a drop-down list for the customer name. Select customer name and it will automatically fetch the details like customer TRN#, address, phone, and email from customer sheet.

Moreover, add invoice number with the series of your choice or the one prevailing in your company. It will automatically pick the current date. If you want to change it you can insert manually as per the requirement.

In addition to that, the Product Details section consists of details like product description, quantity, unit price, taxable value, tax %, tax amount, and line totals. Each line of product you can select a different type of tax percentage applicable in your industry.

The billing summary section consists of Amount in words and billing computations including a discount if applicable. Only insert the discount percentage.

In addition to that, it consists of Terms & Conditions, business greeting, company seal, and authorized signatory. “Amount in words” cell will automatically display the amount in the currency previously selected by you.

That’s it and your invoice is ready to print. Adjust the print area and print. You can also adjust the color according to your requirements.

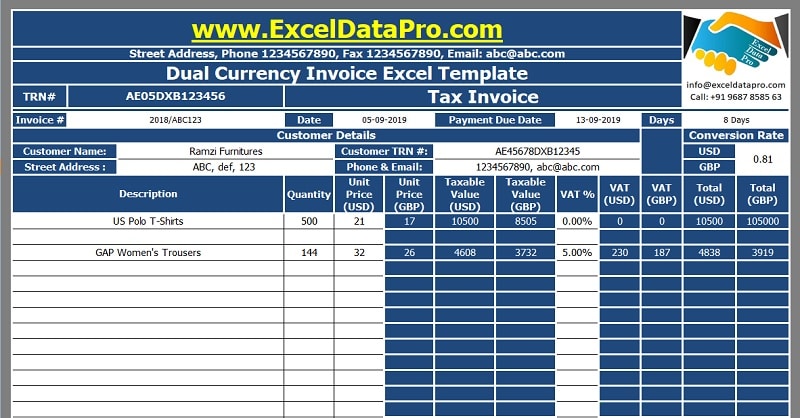

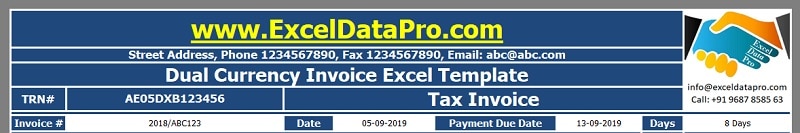

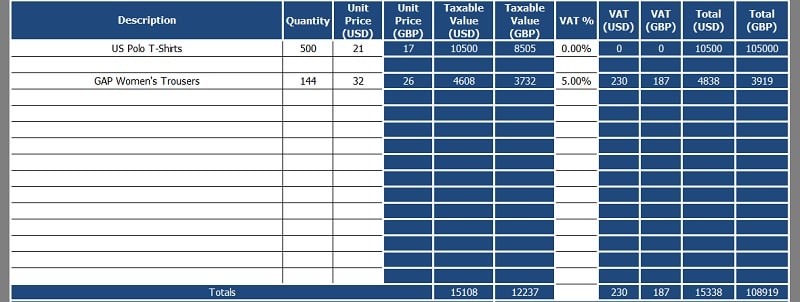

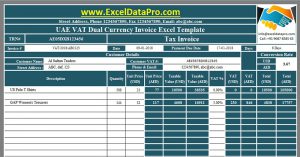

Dual Currency Invoice Template

Dual Currency Invoice is a ready-to-use Excel Template that helps you to issue an invoice for 2 different currencies.

Select client name from the drop-down list, insert your product description, enter the tax rate, and is ready to print. You can issue this invoice in 6 different currencies; USD, GBP, EUR, YEN, AED, and SAR.

Excel Google Sheets Open Office Calc

Note: A security warning will appear at the top. Click on “Options” and select “Enable This Content”.

Contents of Dual Currency Invoice Template

Similar to the above template, this template also consists of 2 sheets: Client Sheet, and Dual Currency Invoice Template.

In the Client sheet, insert name, address, phone number, email, and tax registration number so that you don’t have to type it every time. Select the name on the invoice template and it will fetch all the details.

Dual Currency Invoice consists of 4 sections: Supplier Details, Client Details, Product Details, and Invoice Summary.

Insert your company name, address, telephone, and Tax Registration Number (TRN#) in supplier details.

Enter the invoice number. It automatically picks the current date. If you want to change the date then insert manually. It will calculate the payment date and payment days automatically.

Select customer name from the dropdown and it will automatically fetch the details like customer TRN#, address, phone, and email from client sheet.

Insert both the currencies and the applicable conversion rate.

In the product details section, insert product description, quantity, and unit price in USD. The template calculates the taxable value in both currencies.

In addition to that, insert tax % and it calculates tax amount in both currencies along with the line totals. Each line of product you can select a different type of tax percentage if applicable in your industry.

The invoice summary section consists of Amount in words, terms & conditions, signature and approval section. The invoice summary also includes a cell for a discount. Insert percentage if applicable or else leave blank.

Invoice summary and “Amount in words” both display the amounts in both the currencies. In this template, we have selected GBP and USD.

You can choose from the above mentioned 6 currencies and it will display the amount in words for the same. Your invoice is ready to print.

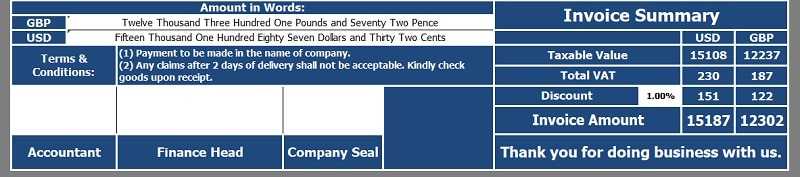

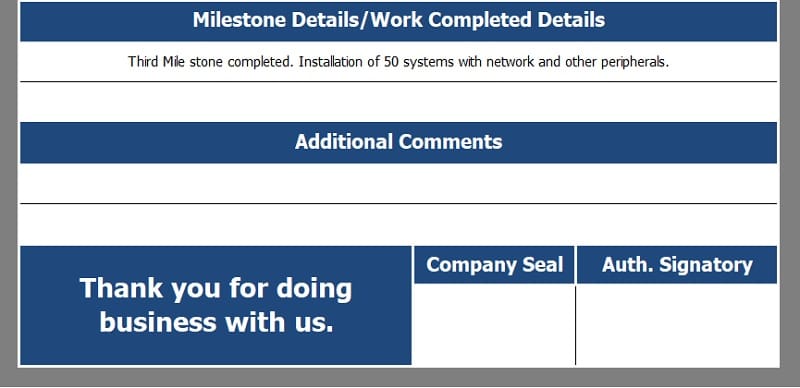

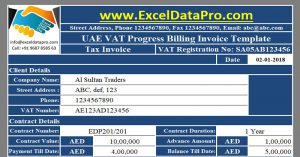

Progress Billing Invoice Template

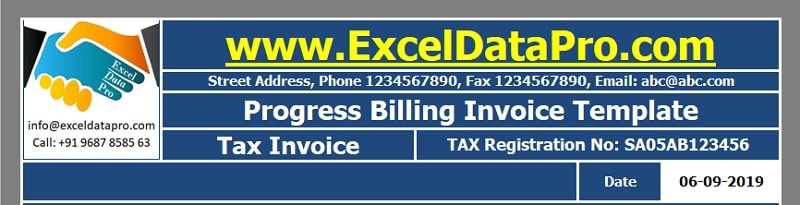

Progress Billing Invoice is a ready-to-use Excel Template to obtain part payment of the total contract amount from your clients as agreed in the contract. Just enter your company credentials in the header section and start using this template.

Excel Google Sheets Open Office Calc

When you download and open this template, a security warning appears at the top. Click on “Options” and select “Enable This Content”.

Select the country, client name, insert your product description, select the tax rate from the dropdown list and it ready to print. You can issue this invoice in 6 different currencies; USD, GBP, EUR, YEN, AED, and SAR.

Progress Billing Invoice is different from standard invoicing. Whereas under progress billing, due to long contract duration and bigger payment amounts the customer releases payments at different stages as agreed in the contract.

Construction contractors, architects, landscapers, interior designers, IT system providers, consultants, etc use progress billing.

Let us discuss the template in detail.

Contents of Progress Billing Invoice Template

This template consists of 2 sheets: Client Sheet, and Progress Billing Invoice Template.

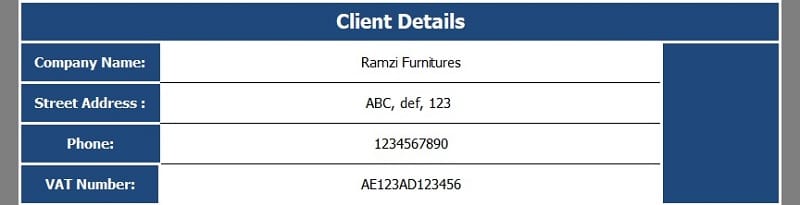

The Client sheet consists of the client name, address, phone number, email, and tax registration number. You don’t have to type it every time. Select the name on the invoice template and it will fetch relevant details.

You have to do it only one-time or whenever a new customer is enrolled insert his name and it will appear in the drop-down list.

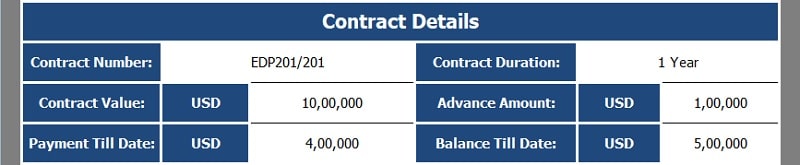

Progress Billing Invoice consists of 5 sections: Company Details, Client Details, Contract Details, Progress Billing Details, and Milestone and Additional Information.

In the company details section, enter your company name, address, telephone, and Tax Registration Number (TRN#).

The template picks the current date automatically. If you want to change the date then insert manually.

The client name cell consists of a drop-down list. Select from the drop-down list and it fetches the details like customer TRN#, address, phone, and email from client sheet with the help of Vlookup function.

Enter contract number, duration, value, advance amount, payments to date, and balance to date in Contract details.

Progress billing detail consists of invoice number, additional costs, adjustments, Taxable value, Tax %, invoice amount, and Amount in words.

When you choose your country the currency will change and eventually the amount in words displays in that respective currency. You can choose 6 currencies; USD, GBP, EUR, YEN, AED, and SAR.

In the Milestone section, you have to mention the milestone which is you complete as per the contract. Additional Information consists of any remarks related to billing or extra costs.

The invoice is ready to print. You can also adjust the color according to your requirements. After printing it, stamp it with the company seal and take the sign of the authorized personnel.

Other Country-Specific Invoice Templates

In addition to 7 Invoice Templates given above, below are 18 country-specific invoice templates.

UAE VAT Invoice Templates (8 Invoices)

GST India Invoice Templates (10 Invoices)

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Frequently Asked Questions

Is an invoice a receipt?

No, an invoice is not a receipt. Invoice is a legal binding of goods supplied to the buyer whereas the receipts are proof of payment.

Is the invoice considered a legal document in the court of law?

Yes, An invoice is considered as a proof of supply and can be used as a legal document in the court of law under any discrepancies between the buyer and the seller.

What is invoice reconciliation?

Invoice reconciliation is the process of matching payments received against invoices via cash, bank deposits to know the settled and outstanding invoices.

Is invoicing a part or Accounts Receivable Process?

Yes, invoicing is a part of the accounts receivable process. It starts with agreeing on the billing term until the payment is received.

How to solve the discrepancy when the invoice is overbilled?

You can solve the discrepancy of overbilling by issuing a credit note.

Is it necessary to maintain the series of invoices in chronological order?

Yes, it is important to maintain the series of invoices in chronological order to safeguard the fraudulent usage of invoices.

When are dual currency invoices applicable?

Dual currency invoices are applicable when goods or services are exported to other countries. For accounting and government record purposes the local currency is mentioned. Whereas the buyer’s country currency is mentioned for their reference.