Balance Sheet Horizontal Analysis Excel Template is a ready-to-use template to compare and analyze the change between 2 years of accounting data of the balance sheet.

What is Horizontal Analysis?

Horizontal analysis is the technique of evaluating financial statements to know the changes in the amounts of corresponding financial items over a period.

Whereas in the Vertical Analysis each amount from all 3 major categories of accounts viz; assets, liabilities and shareholder’s equities are represented as the proportion of the total balance of the respective account.

It is also known as trend analysis, a very useful tool for evaluating the trending situations of a company.

The sole purpose of this is to see the difference by comparing the information with bracketing periods. This data is further used to investigate the reasons behind the difference.

In Horizontal Analysis, two or more accounting years(periods) data of the Balance sheet is used for comparison.

Usually, the earliest accounting period is used as the base period. All the items from the later accounting period are compared with the respective items of the base period.

How to Perform Horizontal Analysis?

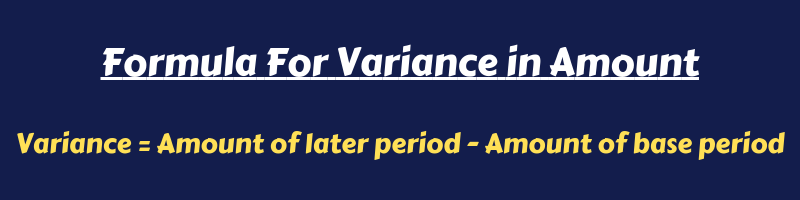

This is a two-step process. First of all, you will have to find the difference/variance of the similar items in the base and later period. The following formula is used to calculate the variance:

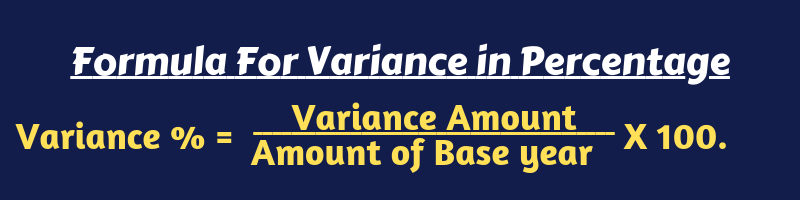

Secondly, you will have to find the difference percentage of the variance of the items on the Balance Sheet for the base and later period. The following formula is used to calculate the Variance percentage:

Balance Sheet Horizontal Analysis Excel Template

We have created a Balance Sheet Horizontal Analysis Template with predefined formulas. You can use this for conducting the financial analysis of businesses.

It can be helpful to Accounting professionals, individual investors and auditors to evaluate the change in Balance sheet figures over a period of time.

You just need to input the respective amounts of the balance sheet in the light blue columns. The template automatically does the horizontal analysis for you.

Click here to Download Balance Sheet Horizontal Analysis Template.

Click here to Download All Financial Analysis Excel Templates for ₹299.

You can download other financial analysis templates like Cost Sheet With COGS, Break-Even Analysis, Sales Revenue Analysis, Balance Sheet Vertical analysis, and Ratio Analysis from our website.

Let us discuss the contents of the Balance Sheet Horizontal Analysis Template in detail.

Contents of Balance Sheet Horizontal Analysis Excel Template

This template consist of 3 major sections:

1. Header Section

2. Assets Section

3. Liabilities and Shareholder’s Equity Section

1. Header Section

The first row consists of Company Name followed by the heading of sheet ” Horizontal Analysis of Balance Sheets along with years of comparison.

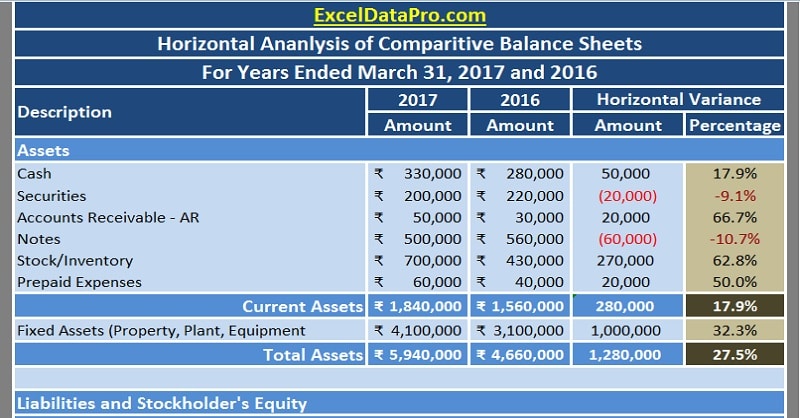

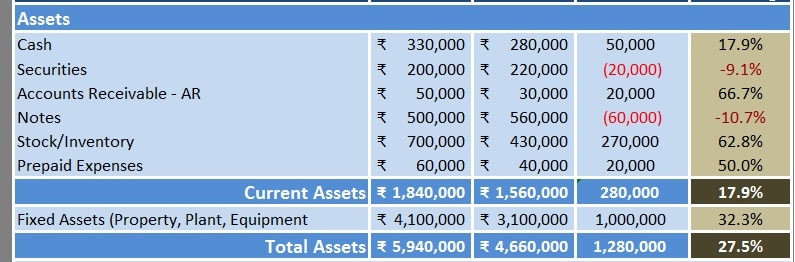

2. Assets Section

Asset Section consists of the current assets and fixed assets of the company.

Current assets include cash and other cash equivalents like Accounts receivables, securities, inventory, and prepaid expenses. Fixed assets include property, plant, and equipment.

The Variance/difference of both the years of all the items of the asset category shows the increase or decrease in the asset as compared to the past year.

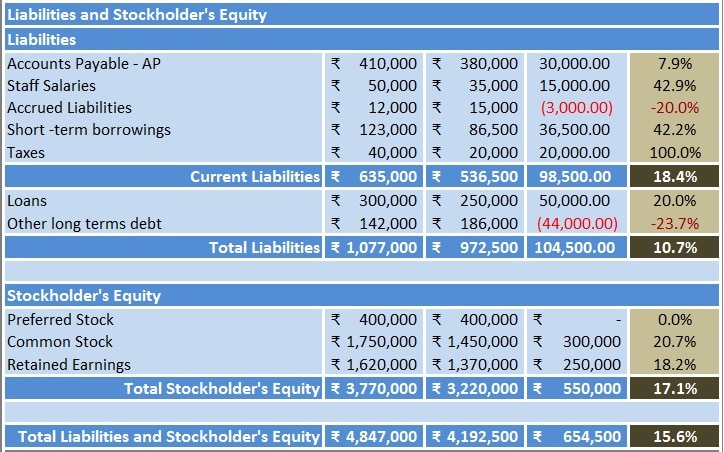

3. Liabilities and Shareholder’s Equity

a) Liabilities: Liabilities include accounts payable, staff salaries, accrued liabilities, short-term borrowings, and unpaid taxes.

b) Shareholder’s Equity: Shareholder’s Equity includes preferred stock/owners equity, common stock/public Equity and retained earnings.

The subheading included here are as per the balance sheet data we have taken. It differs from cases to cases. You can add or remove subheadings are per your requirement.

Benefits of Horizontal Analysis

1. The Horizontal analysis performs the assessment of relative changes in different items of the balance sheet over a period of time.

2. It shows the behavior of revenues, expenses, etc of the financial statements for comparative periods.

3. With Horizontal Analysis, the impact of operational activities is visible on the company’s financial condition during the period under review.

Thus, performing Horizontal Analysis helps in many ways, especially when we are planning to investment or buying a business.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply