With GST into effect from 1st July 2017, taxpayers are looking for ready templates in order to carry on their activities. We have created a separate template for all types of GST Compliant Invoices and Vouchers in Excel.

You can find them all on our GST Templates page under the templates category in the menu.

We have put together all types of GST invoices and vouchers in one file. Simply download and start using them.

Click here to Download Ready To Use GST Compliant Invoices and Vouchers Formats In Excel.

Click here to Download All GST Excel Templates for ₹299.

Additionally, you can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

Let us discuss the contents of this excel template.

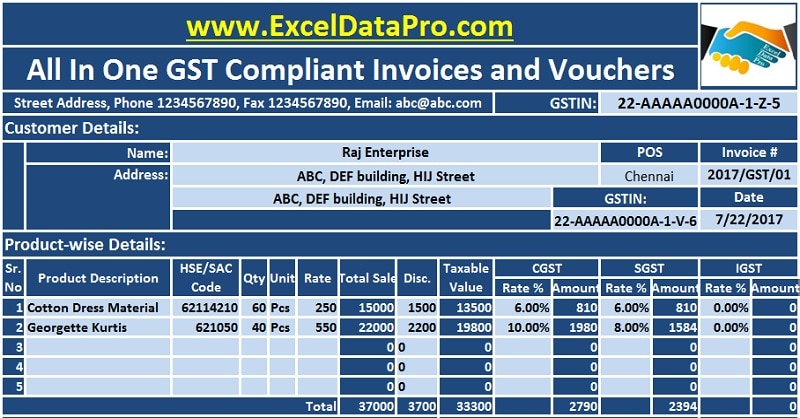

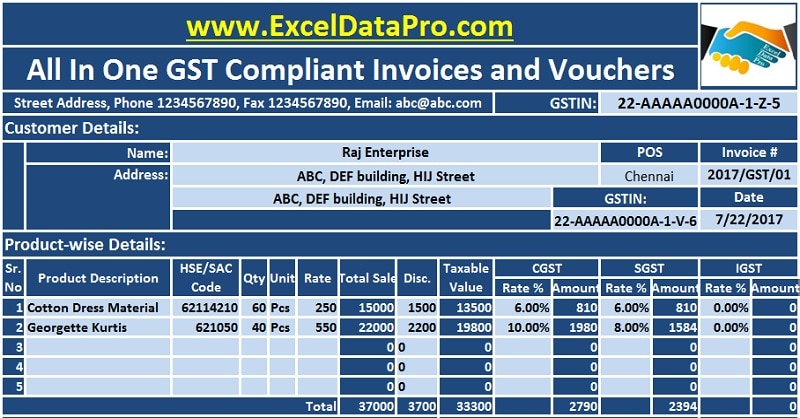

Contents of All-in-One Excel Template for GST Compliant Invoices and Vouchers Formats

This template consist of following 8 files:

- Tax Invoice

- Bill of Supply

- Receipt Voucher

- Payment Voucher

- Refund Voucher

- Debit Note

- Credit Note

- Delivery Challan

- Export Invoice

Every template below has been created in accordance with the rules mentioned on www.cbec.gov.in, the website government of Central Bureau of Excise and Customs.

To find the HSN code for your product, you can download the pdf file from the below link:

To find SAC Code for your product, you can download the PDF file from the below link:

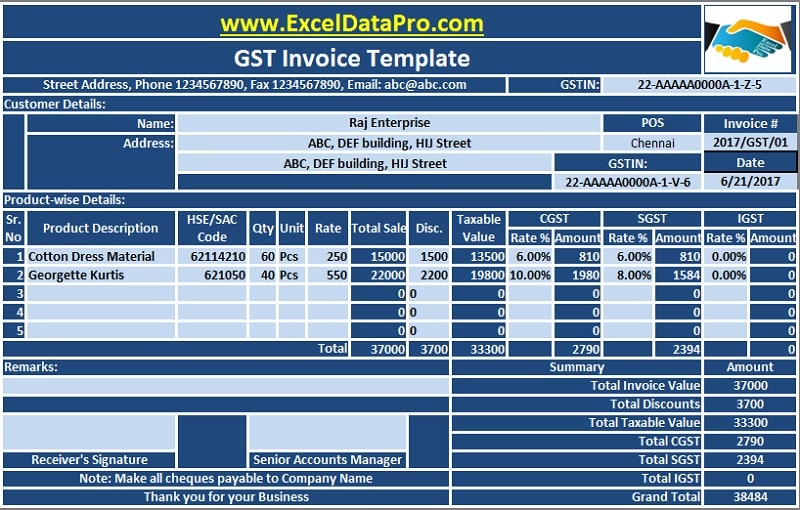

1. GST Invoice Format

Every registered business entity GST will issue GST invoice whenever the supply of taxable goods or services takes place.

Click on the link below to know more about the contents of GST Invoice.

GST Invoice Excel Template In Compliance With GST Bill 2017

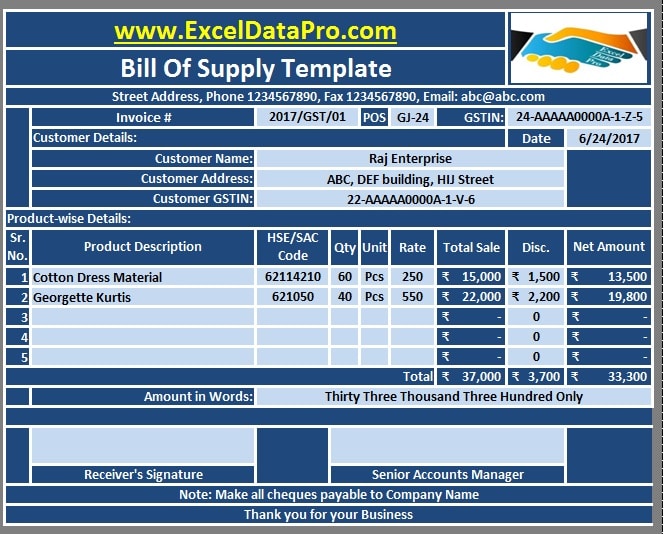

2. Bill of Supply

The GST Bill format for composition scheme holders and for the supply of non-taxable goods or services is called the Bill of Supply.

To know the details and contents of Bill of Supply, click on the link below:

GST Bill Format for Non-Taxable Goods

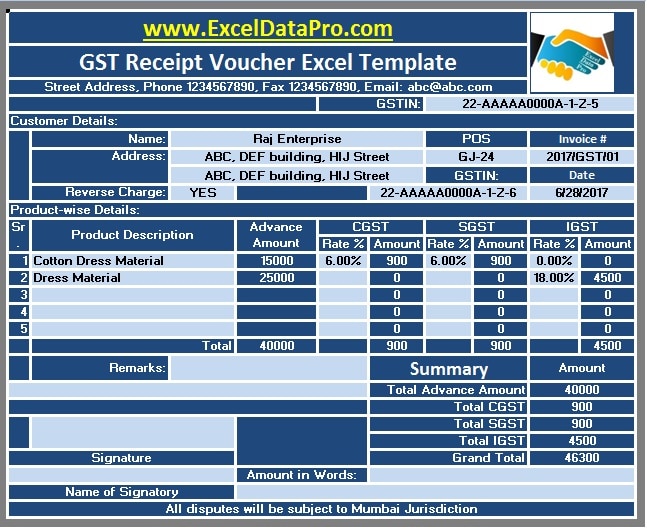

3. Receipt Voucher

A receipt voucher is issued to when the advance payment is received. It is the 3rd among the types of invoices and vouchers under the GST regime.

For more information on the details and contents of receipt voucher, click on the link below:

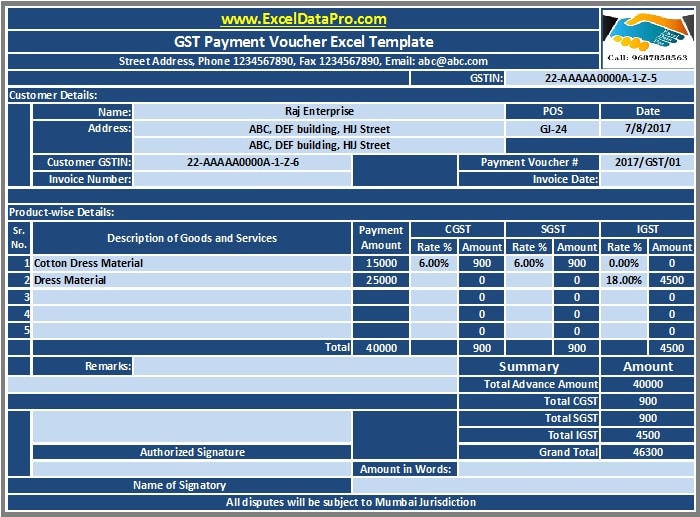

4. Payment Voucher

A customer liable to pay tax under reverse charge is required to issue a GST Payment Voucher at the time of making payment to the supplier.

The details of payment voucher are discussed in the article mentioned below:

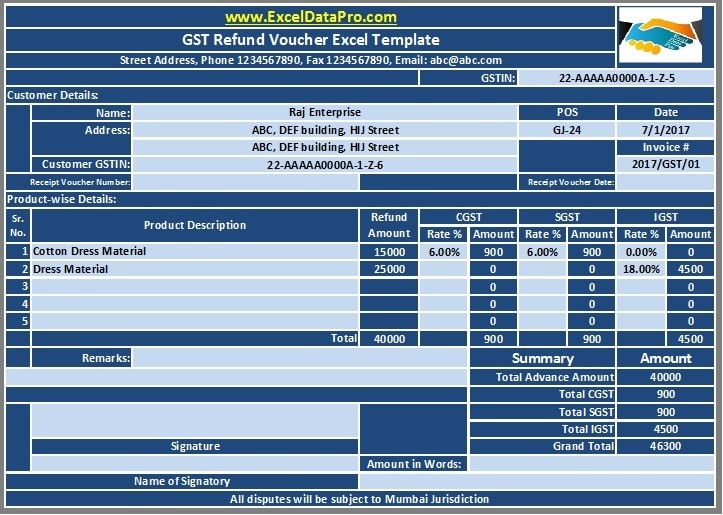

5. Refund Voucher

Refund voucher is issued against the refund of the advance payment when the supply of the goods services are not made.

The details of refund voucher have been discussed in the article mentioned below:

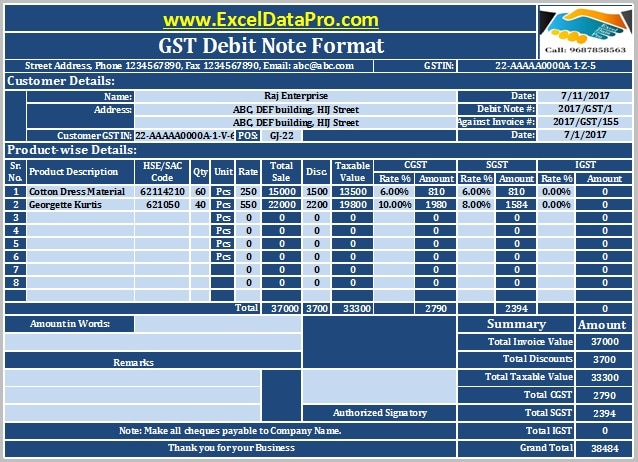

6. Debit Note

The Debit Note is issued whenever the taxable value or tax charged in the original invoice is less than the actual invoice amount.

For more information on the contents of the debit note, click on the link below:

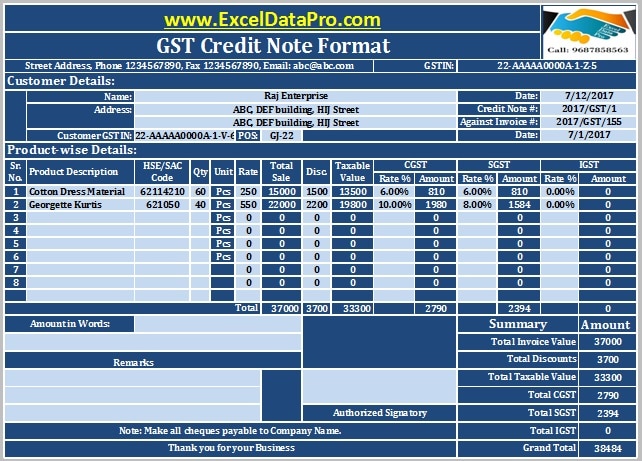

7. Credit Note

Credit Note is issued against the return of goods by the recipient or when the invoice is over billed.

View the contents and details of the Credit note on the link below:

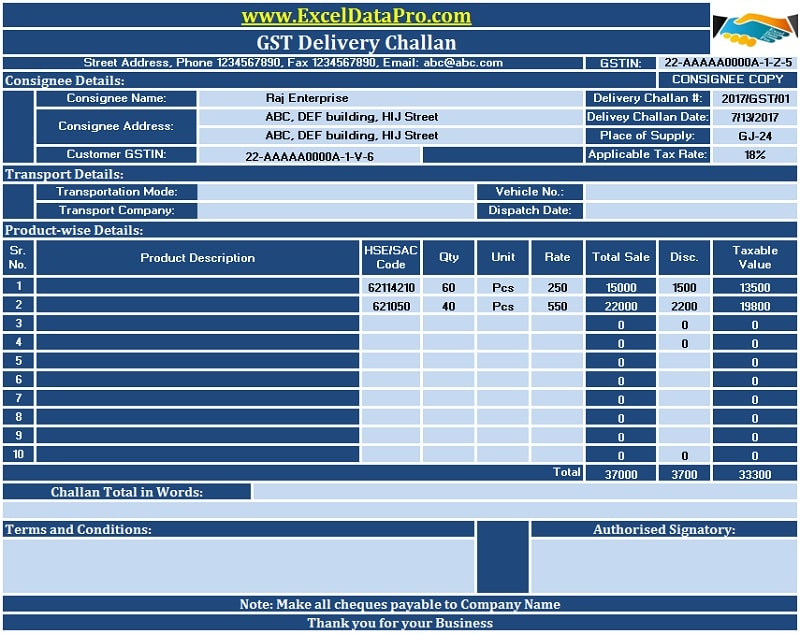

8. Delivery Challan

Delivery Challan is issued in spite of the tax invoice at the time of removal of goods for transportation for the purpose of job work, the supply of goods from primary office to branch etc.

View the contents and details of the Credit note on the link below:

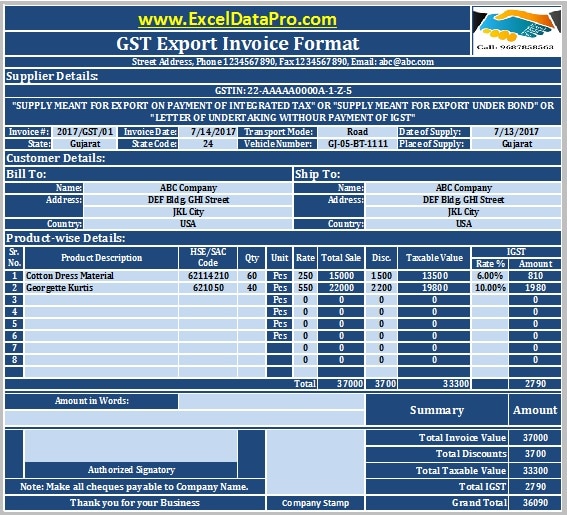

9. Export Invoice

An exporter issues an export invoice when goods or services are exported to another country from India.

Click on the link below to know more about the contents of Export Invoice:

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you

Leave a Reply