Future Value Calculator is a ready-to-use excel template that calculates the deflated value and inflation-adjusted future value of an investment for a specific period.

Additionally, it calculates the deflated value of an investment over a specific period. Moreover, it calculates inflation-adjusted return for a single deposit as well as multiple deposits over a specific period.

All you need to do is just enter a few details and it will automatically calculate it for you.

Generally, you can easily calculate the future value of an investment using FV Function in excel. You need to provide only 3 arguments: Investment amount, period and rate of return.

In economics, the inflation rate is the rate at which prices increase over time. It results in a fall in the purchasing value of money. In simple terms, it is the devaluation of money which decreases the purchasing power.

Smart investors always take into consideration the inflation rate while investing in bigger projects. The main reason behind doing this is that the return that investor gets after the return period based on a return rate will have less purchasing power than that of present value.

Adjusting the return according to the expected inflation rate gives you a brief idea of purchasing power at the completion of the project.

Inflation-Adjusted return is also helpful to individuals for planning their retirement. It helps you define the amount you need to save for your retirement to maintain the same lifestyle during the retirement period.

Future Value Calculator Excel Template

To simplify the process, we have created a simple and easy Future Value Calculator that you can use to calculate the deflated future value of money and inflation-adjusted return for your investments.

Click here to download the Future Value Calculator Excel Template.

Additionally, you can also download other financial analysis templates like NPV And XIRR Calculator, CAGR Calculator, ROCE Calculator ROE Calculator Portfolio Analysis With BSE Bhav Copy, Income Tax Calculator FY 2018-19 and Loan Amortization Template from our website.

Let us understand the contents of the template and how to use it.

Contents of Future Value Calculator Excel Template

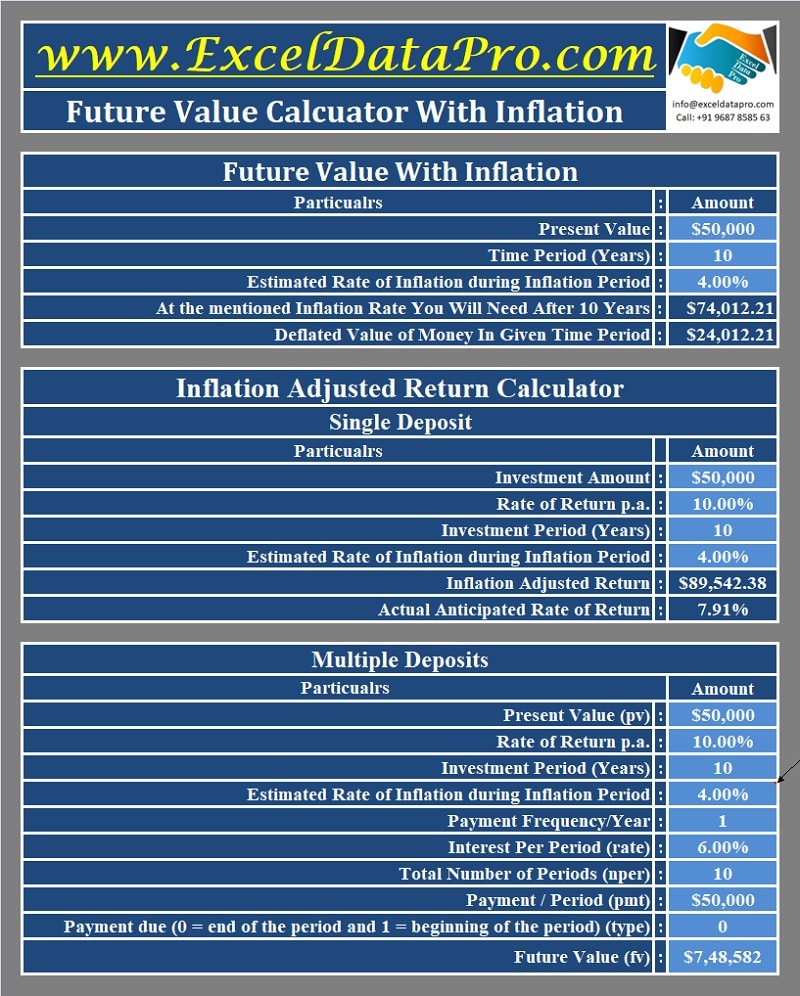

This template consists of 3 Calculators: Future Value With Inflation, Inflation-Adjusted Return For Single Deposit and Inflation-Adjusted Return For Multiple Deposits.

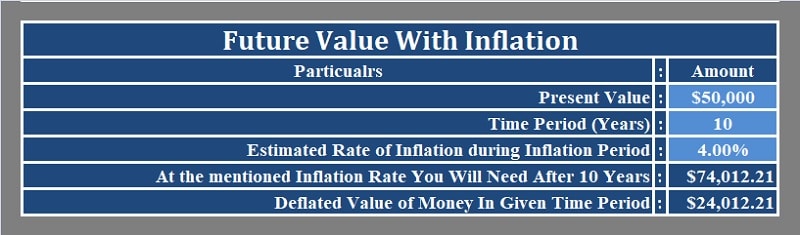

Future Value Calculator With Inflation

Insert the following details:

Present Value

Period

Estimated Inflation Rate

Providing these details, the template automatically calculates the amount of money you will need in the future after the specified period.

The template applies the following formula to calculate the future value:

Present Value X (1 + Expected Inflation Rate) ^ Period

Furthermore, the template also displays the deflated value of money in the given period. It uses the following formula:

Inflation-Adjusted Future Value – Present Value

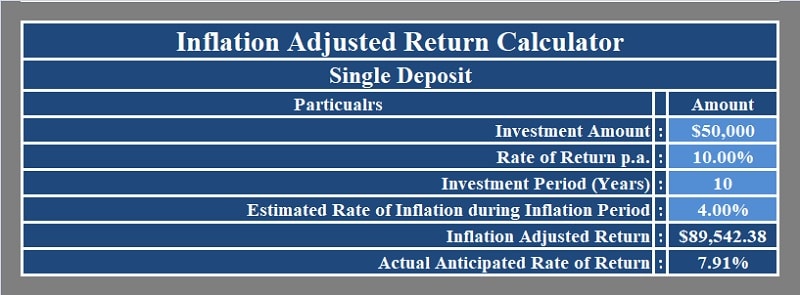

Inflation-Adjusted Return Calculator For Single Deposit

This section is helpful to investors/businessmen making a single investment in a particular project for a specific period with an expected rate of return. It calculates the future value and the actual rate of returns after adjusting the rate of return with the inflation rate.

Enter the following details:

Investment Amount

Rate of Return Per Annum

Investment Period

Estimated Inflation Rate

Providing the above details, the template will calculate the Inflation-adjusted return and also the actual rate of return.

Adjusted-Inflation Return is calculated using the following formula:

= FV(Rate of Return – Inflation Rate), Period, 0, -Investment Amount, 0)

The template calculates the Actual Rate of Return using the following formula:

(Future Value – Present Value) / Present Value / Period

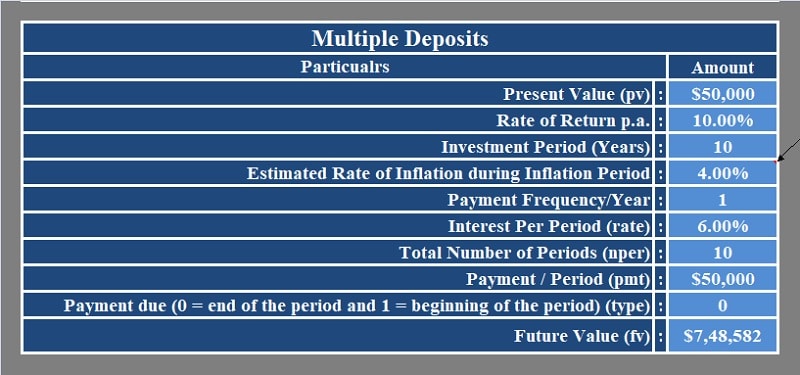

Inflation-Adjusted Return Calculator For Multiple Deposit

This section is helpful to individuals and investors making a periodic investment in a particular MF or savings portfolio for a specific period with an expected rate of return.

Insert the following details:

Present Value

Rate of Return

Investment Period

Rate of Inflation

Payment Frequency Per Year

Payment Per Period

Select the payment type from the drop-down list. The template calculates the actual rate of return by subtracting the inflation rate from the actual rate.

Similar to the above section, this section also calculates the future value adjusting the rate of return with the inflation rate.

Adjusted-Inflation Return is calculated using the following formula:

= FV(Rate of Return – Inflation Rate), Period, Payment Per Period, Investment Amount, At the end of Period Value)

This template can be helpful to individuals, retire planners, business investors as well as mutual fund investors to have an exact idea of the value of the return.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.