FV Function calculates the future value of an investment/security based on a constant interest rate. You can use FV Function with either periodic, constant payments, or a single lump sum payment.

In other words, FV function returns the future value of an investment based on an interest rate and a constant payment schedule.

The FV function is an inbuilt function in Excel which falls under the category of Financial Functions. It can be used as both a worksheet function and a VBA function in Excel.

You can enter the FV function as part of a formula in a cell of a worksheet.

As a VBA function, you can use this function in macro code that is entered through the Microsoft Visual Basic Editor.

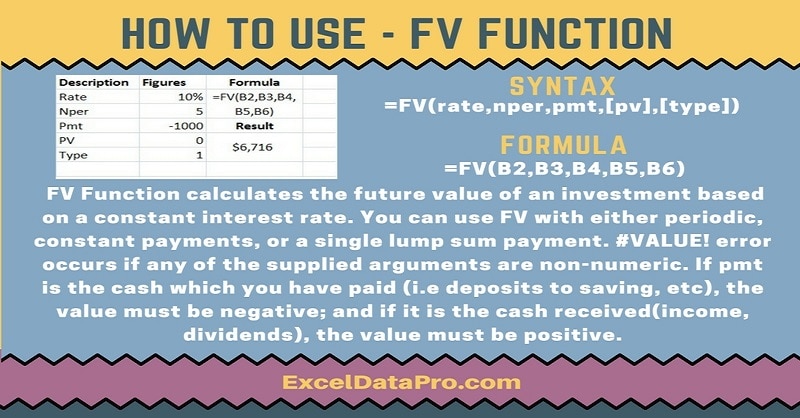

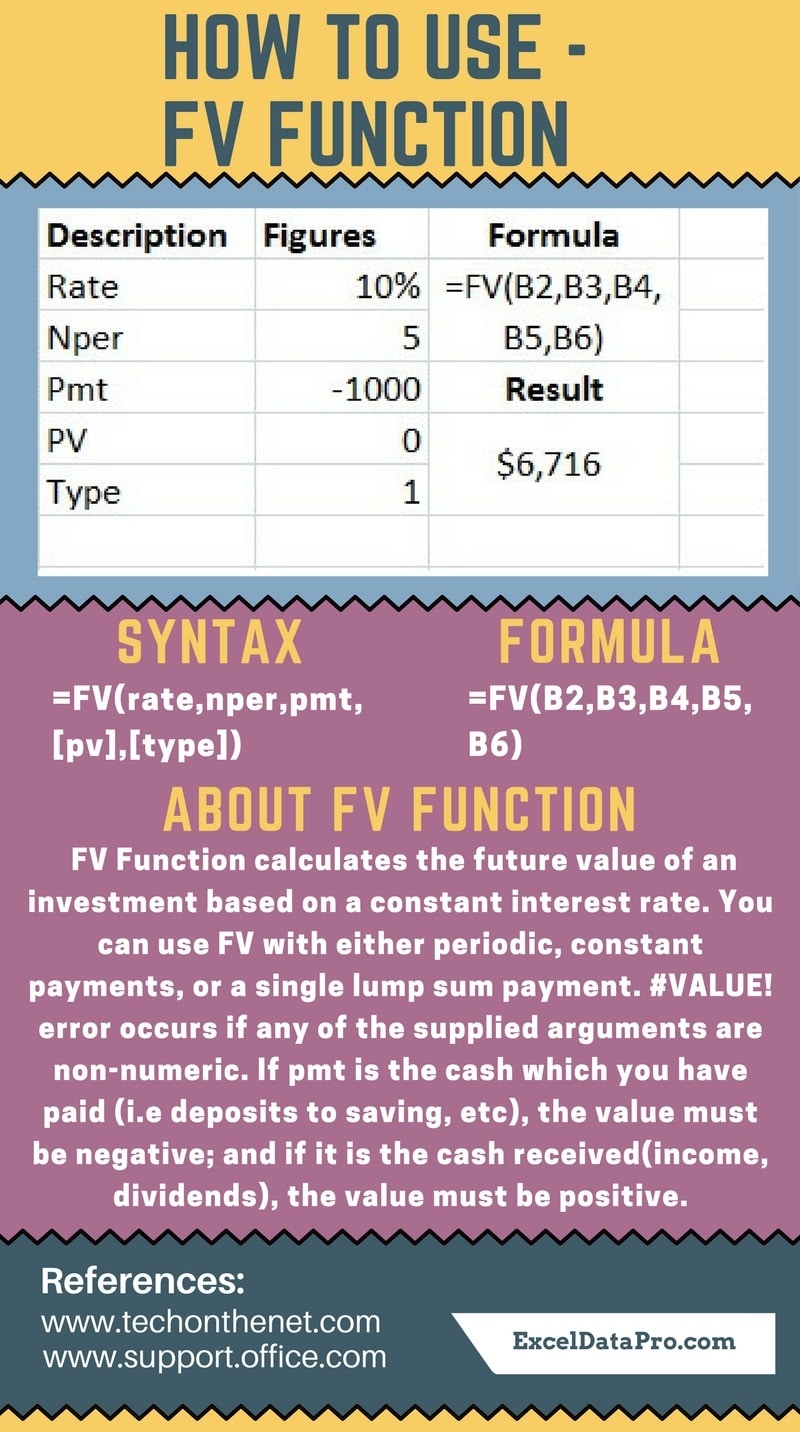

Syntax for FV Function

=FV(rate,nper,pmt,[pv],[type])

Arguments

Rate: The interest rate per period.

Nper: The total number of payment periods in an annuity.

Pmt: The payment made each period; it cannot change over the life of the annuity.

Typically, pmt contains principal and interest but no other fees or taxes. If pmt is omitted, you must include the pv argument.

Pv: The present value, or the lump-sum amount that a series of future payments is worth right now.

If pv is omitted, it is assumed to be 0 (zero), and you must include the pmt argument.

Type: The number 0 or 1 and indicates when payments are due. If the type is omitted, it is assumed to be 0. 0 means at the end of the period and 1 means at the beginning of the period.

PV and Type both arguments are optional.

I have created the infographics for the FV Function. With the help of these infographics, you can easily learn step by step process for using this excel functions.

Furthermore, Excel consists of many inbuilt functions which are helpful in the analytical and statistical study of number.

Simply follow the instructions in the infographics below:

You need to be consistent about the units you use for specifying rate and nper.

If you make monthly payments on a 4-year loan at 12% annual interest, then you must use 12% divided by 12 for rate and 4 multiplied by 12 for nper.

If you make annual payments on the same loan, use 12% for rate and 4 for nper.

For all the arguments, cash paid like deposits to savings will be represented by negative numbers. Whereas cash received such as dividend checks will be represented by positive numbers.

#VALUE! error occurs if any of the supplied arguments are non-numeric.

To learn other function like ACCRINT, AMORLINC and ZTEST Functions, please click on the name of the function.

Additionally, you can download other accounting templates like Break Even Analysis Template, Salary Sheet Template and Invoice with GST Template from here.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply