We present four ready-to-use types of Cash Book templates available in Excel, Google Sheets, and Open Office Calc formats. These templates are designed to facilitate the regular recording of routine cash transactions within a company.

By entering transactions on either the debit or credit side, the templates will automatically calculate the cash on hand, ensuring accuracy and efficiency in financial management.

These templates are particularly beneficial for accounting professionals, including accountants, accounts assistants, and small business owners who require a streamlined method for tracking cash flow.

Table of Contents

What is a Cash Book?

A Cash Book serves as a record of cash transactions conducted by a company on a daily or regular basis. It functions similarly to a ledger account; however, it eliminates the necessity of maintaining a separate cash account within the ledger.

The Cash Book acts as a subsidiary ledger that captures all forms of cash receipts and payments, including bank deposits and withdrawals. At the end of each month, the accountant consolidates these transactions into the general ledger. This practice not only simplifies record-keeping but also enhances the accuracy of financial reporting.

The best-known practice of business is to weekly compare the bank related transaction with the bank statement or perform a bank reconciliation to avoid mismatch of balances. You can use our Bank Reconciliation Statement Excel Template for this purpose.

In larger organizations where cash transactions occur in high volumes, the Cash Book is often divided into two distinct journals: the Receipt Journal and the Disbursement Journal.

Conversely, smaller businesses typically maintain all cash transactions within a single Cash Book due to their lower transaction volume.

Records entered into the Cash Book are always arranged in chronological order, facilitating easier reconciliation of cash balances when necessary.

It is essential to record all cash receipts on the debit side while documenting all payments and expenses on the credit side of the Cash Book.

Main Features of a Cash Book

- Cash Book records only Cash & Bank transactions.

- It records transactions in chronological order.

- The cash column cannot have a credit balance.

- It is a subsidiary as well as a principal book of accounting.

Types of Cash Book

There are 4 types of Cash Book.

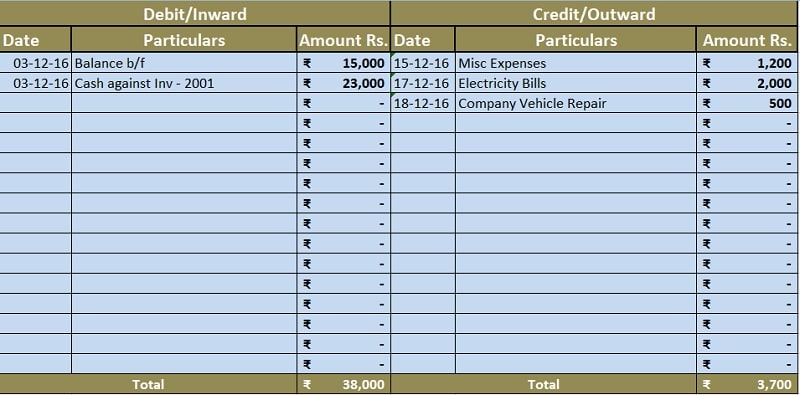

Single Column Cash Book

The Single Column Cash Book is a document that records inward and outward cash transactions without accounting for discounts or taxes. It consists of two sides: debit and credit. This format is often referred to as a simple cash book.

Double Column Cash Book (Discounts)

For businesses that provide discounts during cash transactions, the Double Column Cash Book with Discounts includes an additional column dedicated to discounts received or paid. This allows for more precise tracking of financial adjustments related to discounts.

Double Column Cash Book (Tax)

Similar to the simple cash book, this version incorporates an extra column for tax calculations, which may include Goods and Services Tax (GST) or Value Added Tax (VAT). Users can modify this template to accommodate any other applicable taxes based on their regional requirements.

Triple Column Cash Book (Discounts and Tax)

The Triple Column Cash Book is designed for businesses whose daily transactions involve both discounts and tax calculations. This comprehensive format includes additional columns specifically for discounts and tax amounts, enabling detailed tracking of financial activities.

Download Cash Book Templates

We have created ready-to-use excel templates with predefined formulas for each type of Cash Book. Let us understand the content o each template in detail.

Furthermore, all these templates are available in 3 file formats – Excel, Google Sheets, and Open Office Calc. Click on the icon button to download the desired format. The functioning and formulation are the same in all three formats.

Lets us discuss each template in brief.

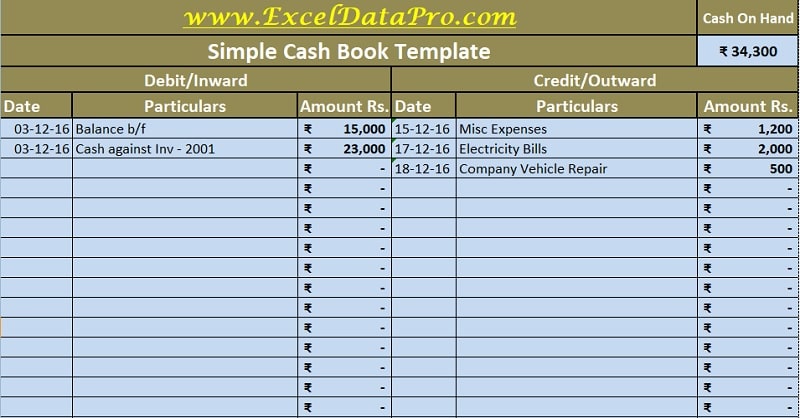

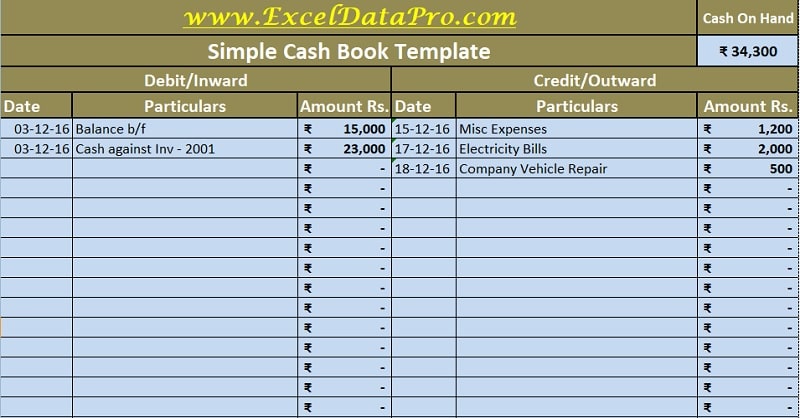

Simple Cash Book Template

We have created a ready-to-use Simple Cash Book Template which helps you to easily record and reconcile your cash transactions.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

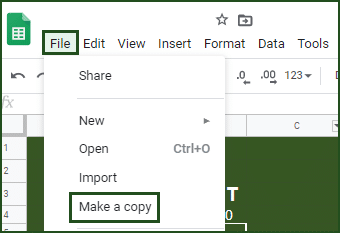

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Contents of Simple Cash Book Template

The first row is for the company name and second for the title of the template. The Cash on Hand balance amount is displayed on the right-hand side.

The formula applied here is the total of Debit/Inward – the total of Credit/Outward; =(C21-F21).

There are 2 sides Debit and Credit. Both sides consist of 3 columns each: Date, Particulars, and Amount.

To record a transaction, insert date, Particular, Amounts on Debit/Inward, or Credit/Outward side.

In the end, the total of the amount column for both; Debit and Credit side is given using the SUM Function.

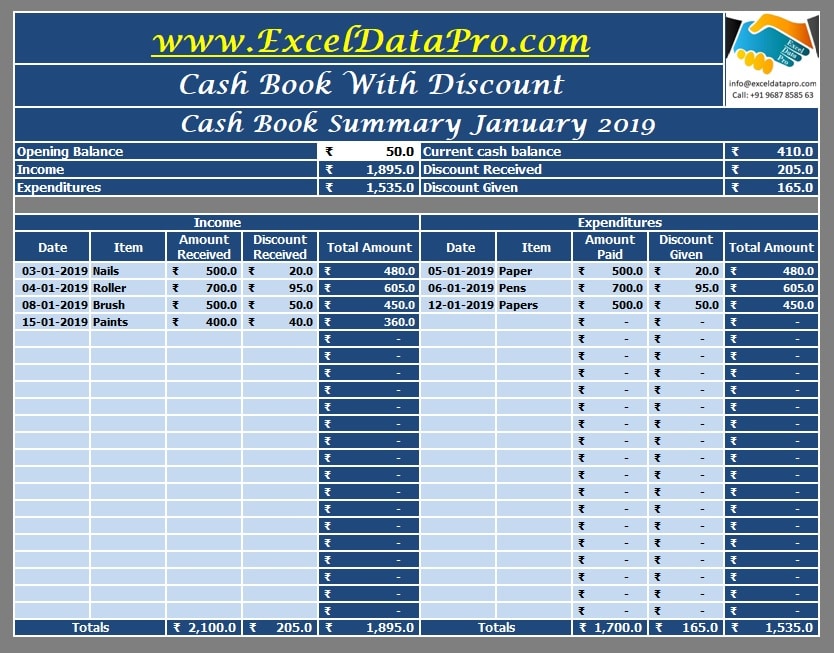

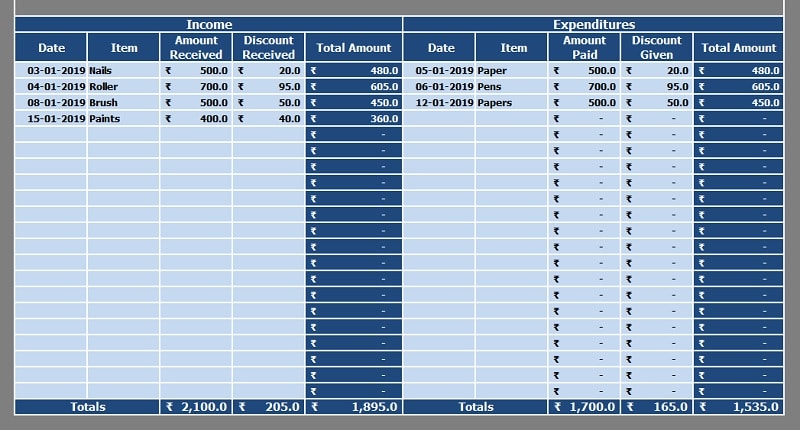

Cash Book Template With Discount

We have created a ready-to-use Cash Book With Discount Template which helps you chronologically easily record and reconcile cash transactions with discounts.

Excel Google Sheets Open Office Calc

Contents of Cash Book Template With Discount

It consists of 3 sections:

- Header Section

- Summary Section

- Data Entry Section

The header section consists of Company name, template title, and logo.

Enter the opening balance manually. The summary section consists of a summary of the total transactions. It will display the opening balance, current income after deducting discounts, current expenditure amount after the discounts.

It will also display the amounts of discounts received and discounts given on total transactions.

The data entry section has 2 sides, debit, and credit. Both the sides consist of the following 5 columns:

Date

Item

Amount Received/Paid

Discount Received/Given

Total Amount

The last line consists of totals of the amount and a discount column for ready reference. These amounts also reflect in the summary section.

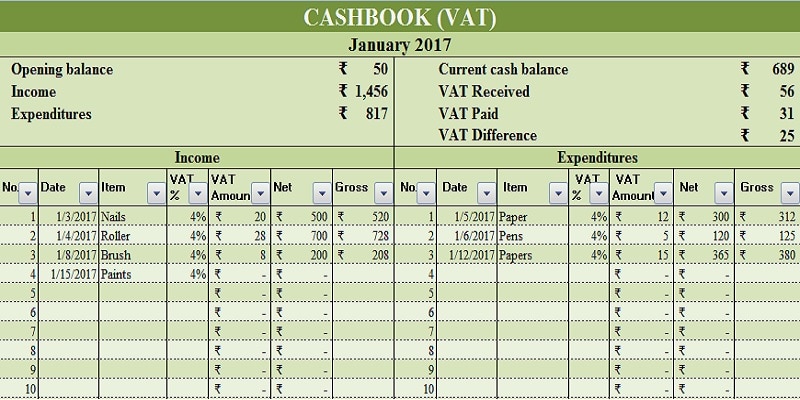

Cash Book Template With Tax (VAT/GST/Sales Tax)

We have created a ready-to-use Cash Book with VAT calculations. With this Cash Book Template, you can efficiently and easily record the daily transactions with VAT. Furthermore, it generates transaction wise and tax percentage-wise reports in a few clicks.

Excel Google Sheets Open Office Calc

A value-added tax (VAT) is a type of general consumption tax that is collected incrementally, based on the value-added, at each stage of production. In some countries, it is known as goods and services tax.

The VAT is ultimately paid by the end consumer. Dealers collect VAT on their sales, retain the tax paid on their purchases. Thus, the difference between the VAT received and VAT paid is calculated. The balance of VAT is paid to the Government.

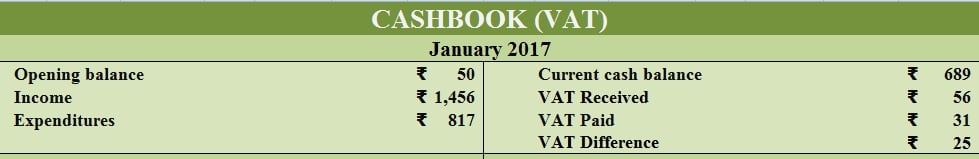

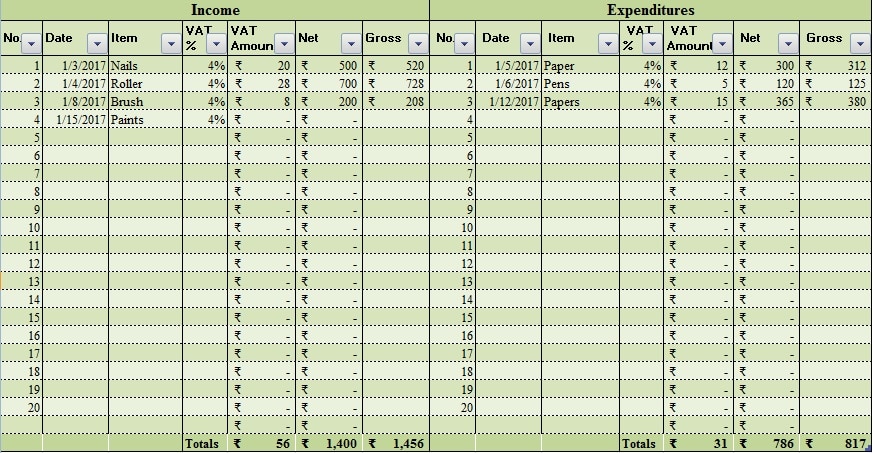

Content of Cash Book Template With VAT/GST/Sales Tax

This template consists of two sections:

- Header Section and

- Data Input Section

In the Header section, the first row consists of the Heading of Book Cash Book (VAT), and the second-row consists of the Current Month.

The summary includes Opening Balance, Income, Expenditures, Current Balance, VAT received, VAT Paid, and the difference of VAT. Thus, all the above computations are linked to the cell showing totals of the respective head in the table.

This section has 2 parts; incomes and expenditures. Both have the same columns with similar headings and formulas.

It contains the serial number, date, item, VAT %, VAT Amount, Net Amount, and Gross Amount. You need input date, item, VAT %, and the Gross amount paid or received. VAT Amount and Net Paid or received is calculated automatically.

Note: The formula applied for Net Amount is =Table2[[#This Row],[Gross]]*100/104. The simple unitary method of Mathematics is applied.

If you change the VAT % then u need to change the last part of the formula. The last part of the formula is (100+Vat %). So if your VAT % is 5 or 7 then the last number changes from 104 to 105 or 107 respectively.

All the subheadings in the data input section are created with a table. Thus, it allows you to generate a VAT % wise, date wise, etc query/report as required.

You need to simply click on the drop-down button in a subheading and select the criteria of the report.

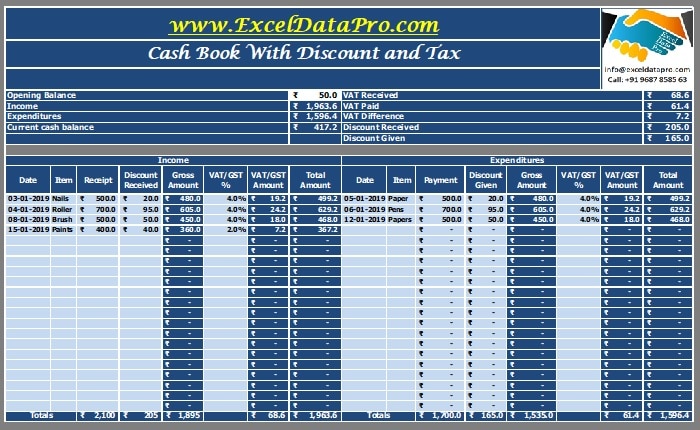

Cash Book Template With Discount and Tax

We have created a ready-to-use Cash Book With Discount and Tax which helps you to record your inward and outward transaction with discounts and taxes.

Excel Google Sheets Open Office Calc

Contents of Cash Book Template With Discount and Tax

Similar to Cash Book with Discount Template, this template also consists of 3 sections:

- Header

- Summary

- Data Entry

The header section consists of the company name, logo, and title of the template.

Similar to Cash Book With Discounts, you need to enter the opening balance manually. This section consists of the totals of the following amounts:

Income

Expenditure

Current Cash Balance

VAT Received

VAT Paid

Difference

Discount Received

Discount Given

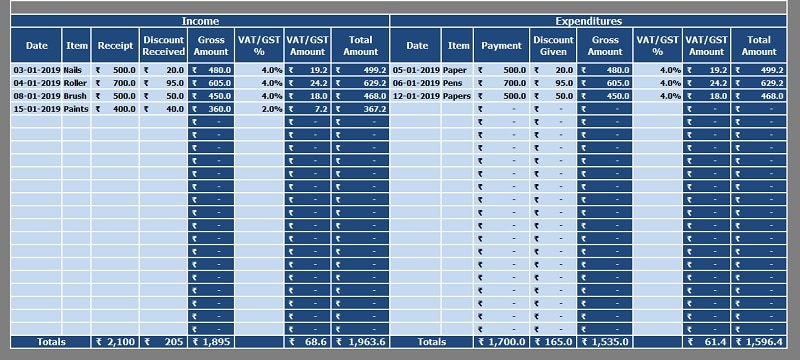

The data entry section consists of the 2 main sections; Income and Expenditure. Both section consist of the following columns for entering transactions:

Date

Item

Receipt/Payment

Discount Received/Paid

Gross Amount

VAT/GST %

VAT/GST Amount

Total Amount

Lastly, a columnar total of each head is given in the last row.

Advantages of A Cash Book

- Maintaining a cash book is a reliable and proven method of recording all cash transactions.

- You can set up the triple column cash books that it identifies the amounts of GST/VAT/Sales tax in separate columns so that you can account for them and report to the respective tax department.

- A properly maintained cash book helps you to keep an eye on your daily cash flow.

- It helps to analyze the breakdown of income and expenses.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Frequently Asked Questions

What is the main cash book?

The main cash book functions as a general ledger that records all cash transactions over a specified period.

Are capital drawings a cash book item?

No, capital drawings are not included within the scope of items recorded in the Cash Book.

Is the Cash Book considered a real account?

Yes, it qualifies as a real account that documents all cash receipts and payments made by a business during an accounting year.

What is LF in the cash book?

LF stands for Ledger Folio number; it serves as a reference number used for organizing books into various sections.

What is a 3 column cash book?

A triple-column cash book features three monetary columns on both debit and credit sides encompassing amounts related to cash receipts/payments along with discounts or bank amounts.

How is the cash book balance calculated?

Formula to calculate Cash Book Balance is Cash Balance = Opening Balance + Receipts – Withdrawals