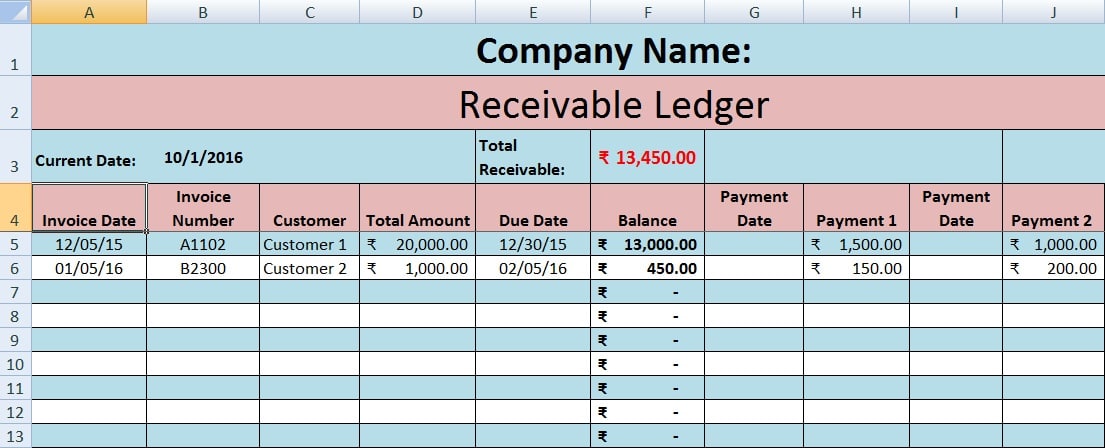

The Accounts Receivable Template is a comprehensive, ready-to-use tool available in Excel, Google Sheets, and OpenOffice Calc, designed to facilitate the management of customer invoices and payments. This template provides an efficient means for businesses to keep track of outstanding invoices and payments received.

To utilize the template, simply insert your company name at the top, and you can begin recording transactions immediately.

The template allows for the documentation of payments received and provides insights into both invoice-specific outstanding amounts and the total accounts receivable outstanding.

Moreover, it features multiple payment columns for each invoice, enabling users to record partial payments against invoices, thus enhancing flexibility in payment tracking.

Table of Contents

What is Accounts Receivable?

As per Wiki

Accounts receivable is a legally enforceable claim for payment held by a business for goods supplied and/or services rendered that customers/clients have ordered but not paid for. These are generally in the form of invoices raised by a business and delivered to the customer for payment within an agreed time frame.

In simple terms, accounts receivable ledger consists of the list of debtors to whom we have rendered a service or supplied goods along with details like invoice number, date of invoice, date wise payments received and outstanding receivables from a particular client or all in general.

Role of Accounts Receivable

Accounts receivable handles the following functions:

- Issuing accurate invoices for goods or services rendered.

- Recording invoices into the respective customer accounts.

- Matching prices with purchase orders or delivery challans to ensure accuracy.

- Reporting any discrepancies and issuing debit or credit notes as necessary.

- Ensuring timely collections in accordance with payment terms or contractual agreements.

- Compiling a list of outstanding invoices that are overdue.

- Reporting settled invoices against collections made.

- Reconciling invoice and payment statements between the company and its customers.

In addition to the above, the accounts receivable department also verifies purchases and prepares aging analysis reports apart from customer management.

Accounts Receivable Process

The process of managing accounts receivable typically involves four key steps:

- Establishing Credit Practices: Setting clear guidelines for extending credit to customers.

- Invoicing Customers: Generating and sending invoices promptly after goods or services are delivered.

- Tracking Accounts Receivable: Monitoring outstanding invoices and payments diligently.

- Accounting for Accounts Receivable: Recording all transactions accurately in financial statements.

Furthermore, the accounts receivable department collaborates closely with the sales department to ensure seamless payment collections while minimizing the risk of bad debts or prolonged outstanding accounts.

Accounts Receivable Journal Entries

Journal Entries for Sales

Account Receivable A/C – Debit

To Sales A/C – Credit

Journal Entries For Payments Received

Cash or Bank A/C – Debit

Account Receivable A/C – Credit

Journal Entries For Payments Received With Discounts

Cash or Bank A/C – Debit

Sales Discount A/C – Debit

Account Receivable A/C – Credit

The sum of both credit amounts must be equal to the debit amount.

Journal Entries For Sales Return

Sales Return A/C – Debit

Accounts Receivable A/C – Credit

Accounts Receivable Template

We have developed a user-friendly Accounts Receivable Template that incorporates predefined formulas and formatting. Users can easily record date-wise invoices along with their corresponding payments. The template provides real-time visibility into both outstanding invoices and total accounts receivable at any given moment.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

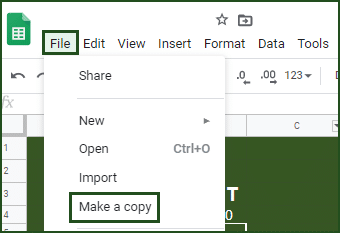

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Furthermore, when invoices are outstanding for longer periods, they refer to accounts receivable aging. You can download and use our ready-to-use Accounts Receivable Template With Aging.

You can download other accounting templates like Cash Book, Petty Cash Book, and Purchase Return Book.

Let us understand the contents of the template in detail.

Contents of Accounts Receivable Template

This template consists of 2 sections: the Header section and the Data Input section.

Header Section

Header section consists of the following:

Row 1: Space to enter your Company/Business Name (Cells A1 to K1). These cells are merged for clarity.

Row 2: Title of the sheet (Cells B2 to K2). Options include “Accounts Receivable Ledger” or “Debtors Ledger.”

Row 3: Several headings as outlined below:

- Subheading for Current Date in cell A3.

- Cell B3 will automatically display the current date using the formula =TODAY(), which updates based on system date changes—saving time on manual updates.

- Subheading for Total Receivables in cell E3.

- Cell F3 will show the total receivables amount calculated from data below using =SUM(F5:F23).

Data Input Section

Dat Input section consists of the following:

Row 4: Subheadings for data entry as illustrated below:

Invoice Date, Invoice number, Customer name, Total Amount of Bill, payment 1, and payment 2 and their respective date are details to be put while entering data.

For the Due date, you can set a function that automatically calculates several days for you and show the exact date of payment.

For this, you need to set a function like this = cell address which contains date + Number of days for allowed. Here in our sheet, it is 60 days.

Thus, the formula entered is =A5+60. Copied to all cells below by simple copy-paste, this will apply the same settings to all cells.

Moreover, it calculates the balance by deducting the total amount of invoices minus the total of all the payments. It uses the following formula: =D5-SUM(H5+J5+L5+N5+P5+R5+T5+V5+X5+Z5+AB5+AD5)

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Frequently Asked Questions

What are 3 classifications of receivables?

You can classify receivable in the following 3 categories:

- Accounts Receivable

- Notes Receivable

- Other Receivables

Are accounts receivable an asset?

Yes, accounts receivable is classified as an asset. It represents amounts owed by customers to a business and can be converted into cash upon reaching maturity. Furthermore, accounts receivable are reported as current assets on a company’s balance sheet.

What does it mean by the term Creditor Days?

Creditor days indicate the average duration it takes for a business to settle its obligations with trade suppliers.

What type of account is bad debt recovery?

Bad debt recoveries pertain to payments received by a business for debts previously written off as uncollectible. These recoveries should be reported under “Other Accounts Receivable.”

How do you record bad debt?

To record bad debt, you would typically debit Bad Debt Expense and credit Allowance for Uncollectible Accounts.

Is bad debt liability or asset?

Bad debt is classified as a contra asset account because it reduces the overall amount reported as accounts receivable on financial statements. It is recorded under operating expenses on the Income Statement.

What are the two methods of accounting for bad debts?

Bad debts can be accounted for using one of two methods:

- Direct Write-off Method

- Allowance Method