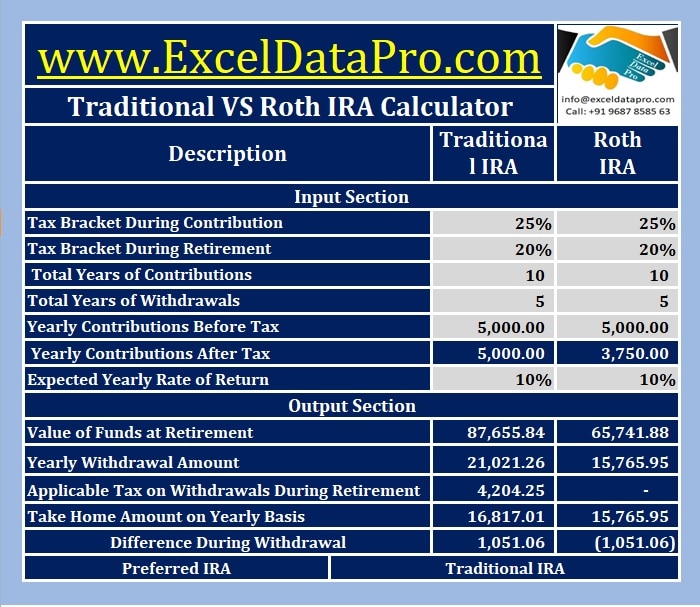

Choosing the right IRA affects your and your family’s long-term savings as well as retirement goals. Traditional VS Roth IRA Calculator helps you to easily compare the outputs of investing in these IRAs.

It is necessary for us to understand the difference between Traditional IRAs and Roth IRAs. This will help you choose the best IRA that matches to your goals.

Contribution to Traditional IRAs decreases your taxable income in the contribution year. Whereas the contributions to Roth IRAs are taxable during the contribution year.

The withdrawals during retirement in Traditional IRAs are taxable, but the withdrawals during retirement years in Roth IRAs are tax-free.

Roth contributions and not earnings can be withdrawn tax-free and penalty-free at any time even before the age of fifty-nine and a half years.

Considering many points like above and for comparison purpose, we have created Traditional VS Roth IRA Calculator in Excel.

Just enter few details and it will automatically derive the amount of withdrawal each year during retirement.

This template can be helpful to individuals, couples filing jointly, head of household and also for consultants.

Click here to download Traditional VS Roth IRA Calculator in Excel

You can download excel templates like Traditional IRA Calculator, Roth IRA Calculator and Income Statement Projection and much more for easy calculations.

Let us discuss the contents of the template in detail.

Content of Traditional VS Roth IRA Calculator

Traditional VS Roth IRA Calculator is a comparative study of Traditional as well as Roth IRAs.

As usual, the header section consists of the company or individual name, heading of the template and logo as per the requirement.

There are 3 main columns. Column headings are Description, Traditional IRA and Roth IRA.

In description column, the details pertaining to contribution years, Contribution amount, value at retirement etc are given.

Whereas the other two contain amounts with respect to detail in the description column.

This template consists of following sections:

- Input Section

- Output Section

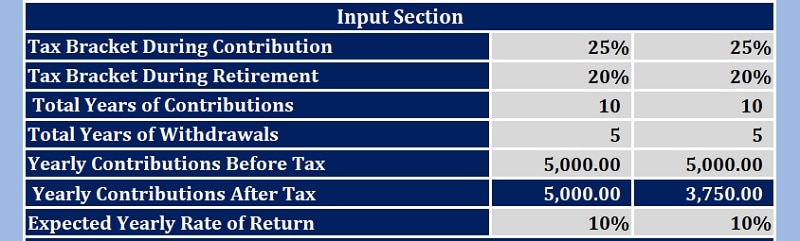

1. Input Section

Input section consists of following descriptions and their respective amounts.

Tax Brackets: Enter the tax bracket applicable to you currently and the expected tax bracket during retirement.

Years: You need to enter the years you want to contribute and the years you need to withdraw.

Contribution Amounts: Contribution amounts are subject to tax deductions. Hence, enter your contribution amount.

If the tax is applicable in contribution years then it will automatically calculate in the cell below.

As we know, contribution to Traditional IRAs are tax-free and Roth IRAs are subject to tax during contribution years.

Expected Rate of Return: Usually the rate of return is between 1%-10%.

Your part is done here.

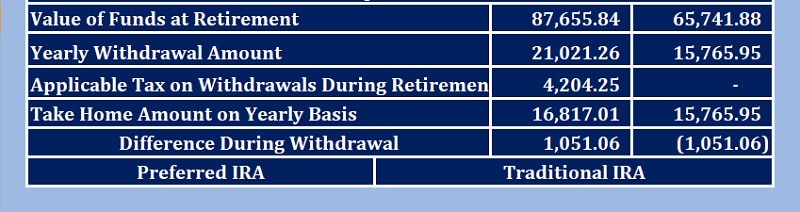

2. Output Section

Output section consists of the following description of results and their amounts:

Value of Funds at Retirement: The value is derived using the FV Function. The FV function calculates the future value of an investment/security based on a constant interest rate.

Yearly Withdrawal Amount: This value is derived using the PMT Function. It gives you the yearly amount you will withdraw for the number of withdrawal years given in input section.

Tax on Withdrawal: Withdrawals in Traditional IRAs are taxable according to your tax bracket during retirement years. Whereas the withdrawals in Roth IRAs are tax-free during retirement years.

Take Home Amount: Take home amount is the amount less of tax(if applicable) during retirement years.

The amount of Traditional IRA changes as a tax is applicable and the amount in Roth IRA remains the same as no tax is applicable.

Difference: The template calculates the difference in the withdrawal amount between Traditional and Roth IRAs.

Preferred IRA: This cell will automatically display the name of the IRA paying higher withdrawal amounts. It is configured using IF statements.

Tentative amounts for a sample calculation have been entered in the template. This will help you understand the template easily.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply