Startup Costs Calculator is a document which helps you to estimate the initial money required for starting up a new business.

No matter whatever the business you are planning to get into, calculating the startup costs is a must exercise. Prior Cost evaluations can save you from unwanted surprises.

If you skip any important aspect of startup and it remains unaccounted then running the business for long becomes inevitable. You might have observed many startups who haven’t made such evaluations fail to run their businesses.

Calculating the Startup Cost is the first step to take when you plan for starting a new business.

While starting a new business, successful entrepreneurs do a detailed research before getting into the business.

This research includes searching the internet, calling suppliers etc to find and evaluate all the cost are applicable to their business model.

We have created a Startup Costs Calculator with predefined formulas and categories of Investment as well as proposed Fixed and Recurring expenses. It is free to use and you can also customize it as per your need.

This template can be useful for small and mid-sized startups.

Click here to Download the Startup Costs Calculator Excel Template.

Click here to Download All Financial Analysis Excel Templates for ₹299.

You can download the same in Apple Numbers from the link below:

Startup Costs Calculator Apple Numbers Template

Let us discuss the content of the Startup Cost Calculator in detail.

Contents of Startup Costs Calculator

First and foremost is the header section. It consists of your company name and the sheet heading Startup Cost Calculator.

It contains 4 different sections as follows:

1. Investment

2. Fixed Costs

3. Recurring/Monthly Costs

4. Summary

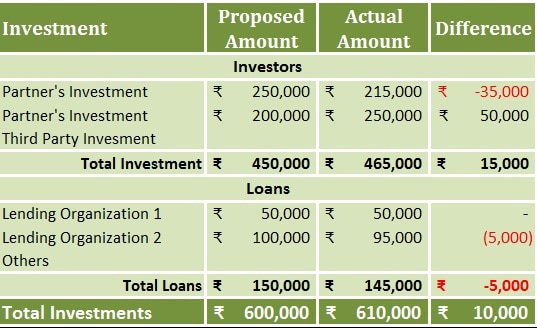

1. Investment

In this section, you can include the sources of investment. Depending on the nature of your company proprietorship/partnership, you can select it from the drop-down menu.

If you select the proprietorship from the drop-down menu then the following cell will automatically turn blank.

But if you select Partnership, then it will display partner’s investment in the cell.

There are three columns next to every subheading Proposed Amount, Actual amount and the difference. Once your finish calculating the initial costs, you can enter the actually incurred amounts.

The Difference Column will show the Surplus or deficit between the actual and proposed costs.

List the sources of investment that are available to you. Enter the amounts in Proposed amount column.

It can include capital from investors/proprietors/Partners. In addition to it, you can include loans from the financial institutes.

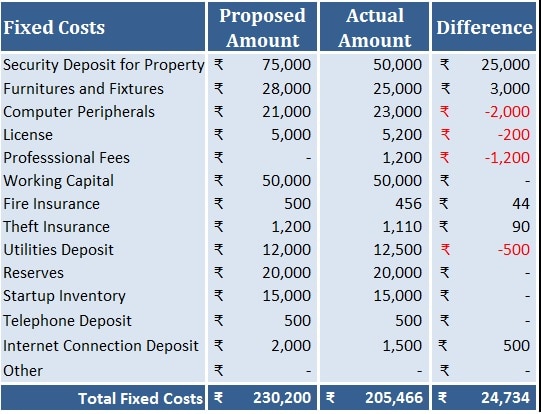

2. Fixed Costs

The nature of Fixed costs is either one time or on yearly basis. This includes the security deposits for rental property, security deposit for Utility services, furniture, fixtures, reserves and Working capital.

Working capital and the reserves are very crucial costs to be kept in mind while calculating the Startup costs.

You need to keep enough provisions of working capital in order to handle the routine operations.

It is advisable for a new startup to reserves for contingencies to avoid any last minute surprises. Keep aside enough reserves according to the risks involved in your business.

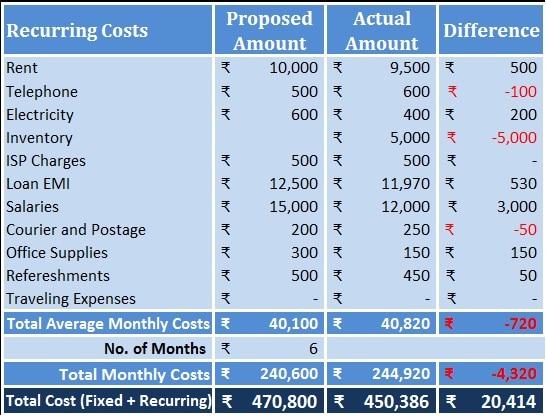

3. Recurring Costs

Recurring or monthly costs are costs which are recurring in nature. They can either be of same amount every month or different. Recurring costs includes rent, postage/courier, utility bills, office supplies etc.

While estimating the recurring costs calculate these cost for at least 6 months from the inception or up to the break even point.

Break-even Analysis helps ou know what amount of sales could lead you to generate the amount required to at least cope with your regular expenses.

We have also created The Break-even Analysis Template for you to easily calculate the Break-even point for your business.

You can download other templates like Weekly Timesheet, Salary Sheet and Checkbook Register from here.

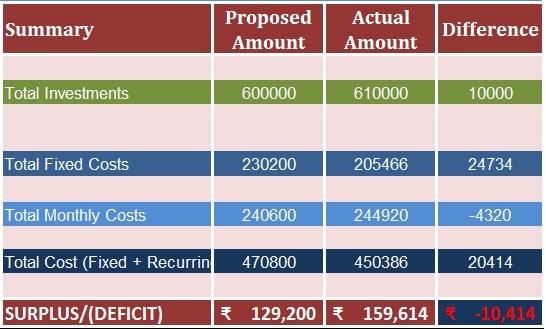

4. Summary

This section gives you the summary of the investment vs the costs. It will tell us where we are standing. If it is surplus it all good but if it is deficit you need to arrange extra funding.

Often, in the excitement of starting a new business, we sometimes spend more amount as compared to our estimates. By recording the actually incurred costs against the estimations will help you balance the things.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.