The Checkbook Register Excel Template is a comprehensive, pre-formatted document available in Excel, Google Sheets, and OpenOffice Calc. This versatile tool is designed to assist individuals and businesses in efficiently tracking and reconciling their bank accounts.

By utilizing this template, users can maintain a vigilant oversight of their financial transactions, thereby minimizing the risk of incurring unnecessary expenses such as interest charges or penalties.

Table of Contents

What Is A Checkbook Register?

A Checkbook Register serves as a critical financial document for maintaining accurate records of bank balances for both personal and commercial accounts. In essence, it functions as a ledger, meticulously documenting all monetary inflows and outflows associated with a specific checking account. This systematic record-keeping facilitates the process of bank reconciliation, ensuring that one’s personal records align with the official bank statement.

The significance of a Checkbook Register in financial management cannot be overstated. It provides users with a clear and concise overview of their financial status, enabling them to monitor the sources and destinations of their funds, as well as maintain an up-to-date awareness of their current balance.

Purpose of Maintaining A Checkbook Register

Many a time, it happens that bank officials commit some mistakes. If you maintain Checkbook Register, you can identify those errors and get them corrected.

Additionally, you can also prevent bouncing back of checks due to the unavailability of balance. Thus, avoiding unnecessary fees charged on your account.

Checkbook Register Template

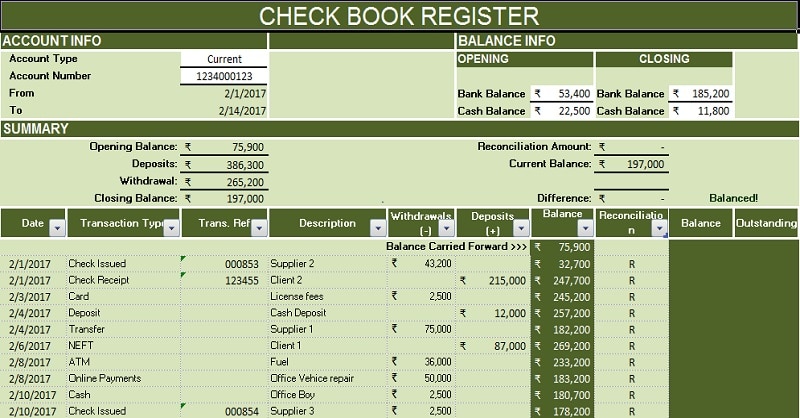

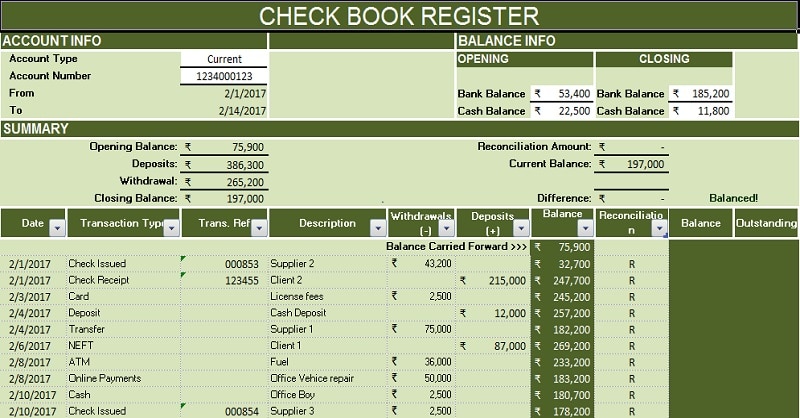

We have created an easy to use Checkbook Register Excel Template with predefined formulas. Just insert your bank transaction daily and easily reconcile at the end of every month.

This template can be helpful to individuals, accounting professional,s, and students. You can use this template to keep a track of all your income and expenditures.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

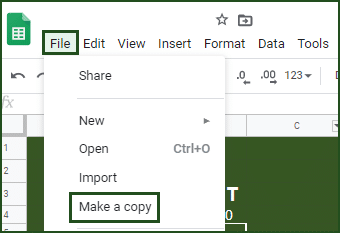

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Additionally, you can download other accounting templates like Accounts Payable Template with Aging, Accounts Receivable Template with Aging, and Cash Flow Template.

Content of Checkbook Register Template

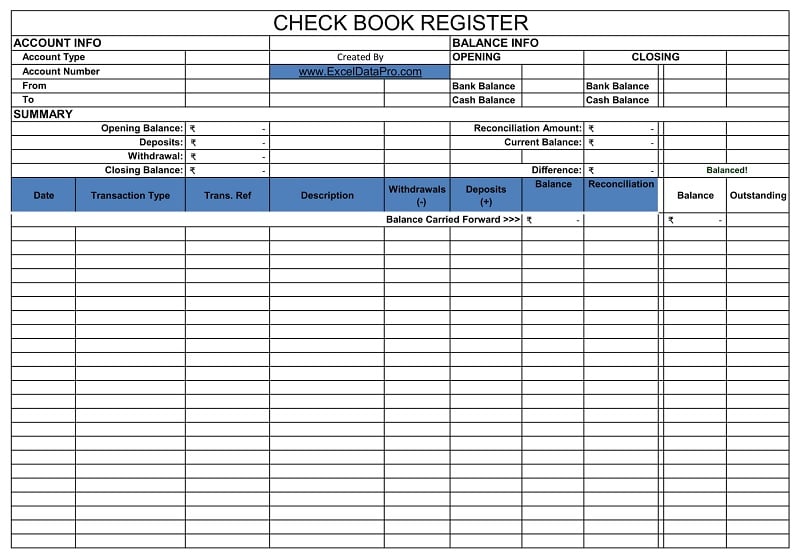

This template consists of 2 worksheets: Datasheet and Checkbook Register

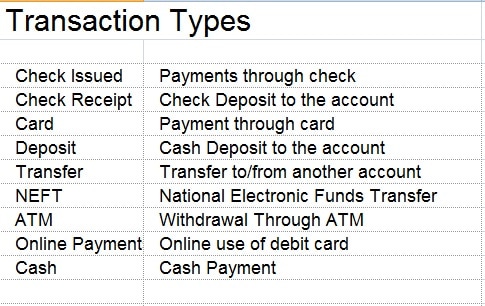

The Datasheet consists of lists of the type of transactions. This list is used for creating the dropdown menu in the Checkbook Register Template.

Checkbook Register

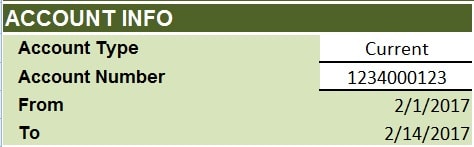

At the top, there is the heading of the sheet. Insert the following Account Information:

Type: Specify the account type (e.g., Checking, Current, Savings, Personal)

Number: Enter the corresponding account number

From: Start date (Formula: =A15, referencing the first date in the data input section)

To: date (Formula: =MAX(A15:A41), referencing the last date entered)

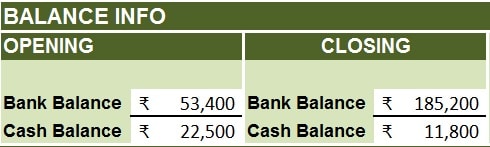

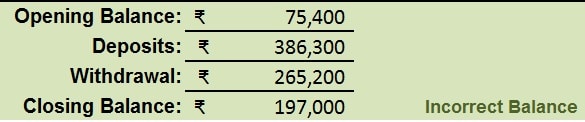

Insert opening and closing balances in the balance info section on the right side.

Opening: Initial balance of Bank and Cash as per records

Closing: Final balance of Bank and Cash as per records

In addition to the above, it consists of the summary section. It displays all balances automatically as it contains predefined formulas. Hence, you don’t need to input any data.

Opening Balance: Reflects the opening balance from the Balance section

Deposits: Total of Deposits column in the Data input section

Withdrawal: Total of Withdrawals column in the Data input section

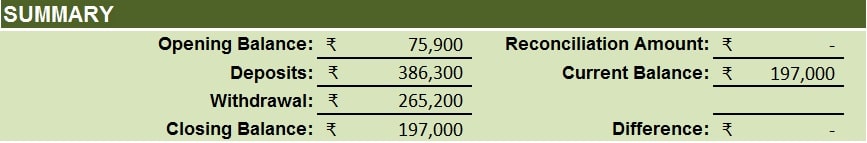

Closing Balance: Reflects the closing balance from the Balance section. If inconsistent with the data input section, it displays “Incorrect balance”

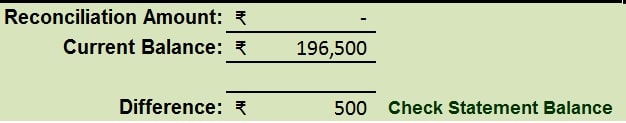

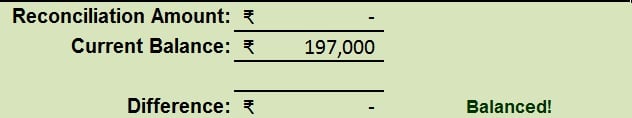

Reconciliation Amount: Displays outstanding entries marked with “R”

Current Balance: Displays the ending account balance based on user-entered data

Difference: Shows any discrepancy. Displays “Check Statement” if a difference exists, or “Balanced” if not

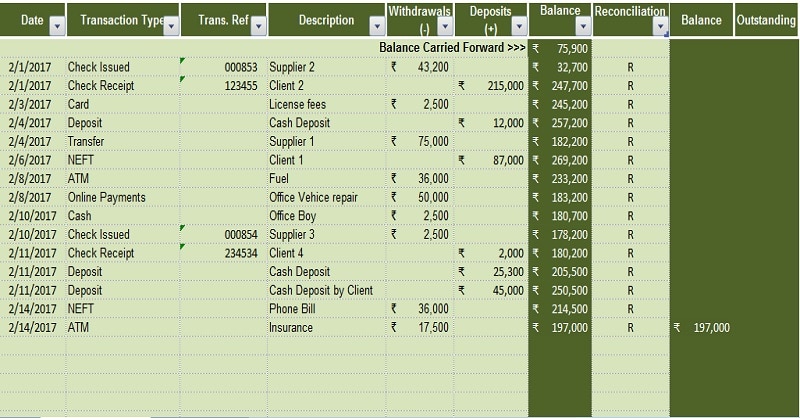

Checkbook Entry Section

In this section, the user needs to enter the transaction details as and when they occur during the period.

It contains the following column headings:

Date: Date of transaction

Transaction Type: Contains the Transaction types like deposits checks issued, checks receipt, ATM, NEFT, etc. You can select the type of transaction from the drop-down menu.

Trans. Ref: You can put any reference or check numbers in this column.

Description: Description of the payment or receipt

Withdrawals: All the withdrawal entries are to be entered in this column.

Deposits: All the deposit entries are to be entered in this column.

Balance: Balance will show you the balance after each transaction by adding or deducting the deposits and withdrawals.

Reconciliation: In this section, you need to enter “R” if you find the entries in the bank statement.

Balance and Outstanding: No entries are to be made. These cells are given predefined formulas. The balance column shows the end balance and the Outstanding column shows the non-reconciled entries.

Printable Checkbook Register

Click here to download the Printable version of the Checkbook Register.

Let’s discuss the template contents in detail.

How To Balance A Checkbook Register?

- Find the current balances.

- Record all inward and outward transactions.

- Define the type of transaction and add a description to each transaction.

- Reconcile and match transactions with your bank statements weekly, biweekly, fortnightly, or monthly.

We thank our readers for liking, sharing, and following us on different social media platforms, especially Facebook.

If you have any queries or questions, share them in the comments below. I will be more than happy to help you.

Frequently Asked Questions

What does it mean to balance your checkbook?

Balancing a checkbook refers to the process of ensuring that all transactions recorded in your personal checkbook register correspond accurately with those listed on your official bank statement.

How often should you balance your checkbook?

While monthly balancing is generally recommended, the optimal frequency may vary depending on the volume of transactions. Some individuals or businesses may find it beneficial to balance their checkbooks on a weekly or bi-weekly basis to maintain more precise financial control.

What is the danger of not balancing your bank account?

When you don’t balance your checkbook regularly, it increases the risk of penalties and unnecessary charges by the bank. It also puts forth the risk of being overdrawn while your account has sufficient funds.

How to record Interest Earned as well as service charges in a checkbook register?

Interest earnings and service charges, which are typically applied based on the bank’s account policies, should be recorded during the reconciliation process of your checkbook register. This ensures that these entries align with the bank’s official records and maintains the accuracy of your personal financial documentation.

A very nice piece of work!

Is it possible to mark transactions as cleared, but not reconciled? Thanks.

Everything possible dear. You need to customize the format and insert the formulas and columns for the same.

Is it possible to easily change the units to dollars (to change the pounds sign to dollar signs) on this form? Thanks so much!

Yes, you can change to any currency you want. Dollars, Pounds, Yen any currency. To do this either right click and click on format cell and choose the currency format or by going to currency in the ribbon menu. Thanks

Balance and Outstanding: No entries are to be made. These cells are given predefined formulas. Balance column show the end balance and Outstanding column shows the non-reconciled entries. how we put formulas in chek register in =BALANCE……………Column is Empty till and show balance on ends….if we customize sheet work…thanks if you reply

Hi Luqman, couldn’t understand what you are saying or what you want. Please specify in details what exactly is your query.

Hi bro. m using your template as above for chek book register… here we some new banks accounts but in same excel file when we used copy option for next bank on new sheet the balance formula column shows same figure as we calculate in first sheet(template module). the new banks accounts sheet linked with first sheet only = Balance column???? meanwhile other columns work properly new posting….

my query is just this that how we put Balance column separate in new sheet work in proper i think you understand now better….thanks for reply…

Hi Luqman, I tried doing the same thing that you have mentioned in your query. But in my files, it changes the amount according to the differences. You might be doing a mistake. You might have not changed the opening balance as well as closing balance figures on the top right side of the sheet in the new sheet.

السلام علیکم محترم فہیم صاھب

میرے خیا ل میں آپ میری بات سمجھ گئے ہیں لیکن اظھار مشکل ہے۔ بات یہ ہے کہ میں چیک رجسٹر کو ایک ہی ورک بک میں استعمال کرنا چاہتا ہوں جس میں ہر شیٹ پر نیا بنک اکا ونٹ بنا نا ہے جس پر بیلنس کالم جو ریکینسائل کے بعد والا کالم ہےمیں بیلنس وہ فرسٹ شیٹ سے لیتا ہے اوپننگ بیلنس بھی ٹھیک ہیں اور کلوزنگ بھی جو

اوریجنل ہے دیپازٹ اور ود ڈرال کےبعد والا بیلنس بھی ٹھیک کام کرتا ہے لیکن میری خواہش یہ ہے کہ آپ مجھے یہ بتا دیں کہ اس کی سیٹنگ کیس ہوگی جبکہ اب میں ہر بنک کے لیے علیحدہ علیحدہ ورک بک بنا رہا ہوں کافی دوستوں سے پوچھا لیکن سمجھ نہیں آتا ۔۔۔۔۔ شکریہ

Hi Fahim Lashkaria,

Many thanks for your sharing and teaching. It definitely very useful.

I would like to double check the formula of J11 (The message “Check Statement” next to Difference)

The current formula of J11 is =IF(H11=0,”Balanced!”,IF(H8=0,”Check Statement Balance”,””))

It means that H11=0, then it should be “Balanced”;

However, I don’t understand why H8=0, then it should “Check Statement”

I think H8 is smaller or bigger than 0, then it should “Check Statement”

I cannot get the logic. Would you please further explain it?

Many thanks

Best Regards

Raj

Will check and revert.

Nice Job sir, thank you very much, may God give you many more knowledge.

Thanks for the appreciation and the prayers.

Hello, Mr. Fahim Lashkaria

Concerning all accounting templates for 199, is there any other payment type possible. I can mail a cheque. Will it be acceptable?

And also are all the accounting templates interconnected or not?

All the templates are independent and not interconnected. It is a bundle of templates clubbed together for simple and easy download so that the reader can get all at once. Where are you located so that I can provide with payment options?

Was looking for a simple checkbook register to replace the paper one we have used. Loved the formulas built into yours. However, once we get past the colored areas, the formulas and formatting are no longer active. Do you have a cheat sheet on how to propagate the rows with the formatting and formulas?

Hey Jerry.

No cheat sheet required. Just before you end the color area right click on the colored area and insert rows. This will take the same format below. For Formulas to work click on the last cell with the formula and copy-paste the same to the newly added rows.

Dear Sir, I want one solution, can you make a single template for whole accounting work (Like Check Book, Bank Book, Cash Book, Income-Expenditure Details, Balance Sheet in one template and they are inter connect for other. Check Book connect to Bank Book, Cash Book, Income-Expenditure Details, Balance Sheet) if its possible, please send to my Email (tarunsharma199307@gmail.com)

Currently, we dont have any such template. If anything such will be made in the future, we will surely update you.

Dear Sir,

Thanks a lot for doing such a great job to make things easy for the type of people like me who do not know much about excel. Your readymade excels sheets are so good and simple to use. By the way, I would like to have your other templates. But I am in South Korea, so I do not know how to pay for it. Kindly let me know.

Thanks a lot with a great appreciation for your work.