We received requests from our readers for making Monthly GST Input Output Tax Report in which they can maintain and carry forward their previous month’s balance of ITC as well as reverse charge.

Previously we have created a template GST Input Output Tax Report for maintaining your GST sales, purchase, credit note, debit note and reverse charge etc of one month.

You first need to download our previous template to maintain your single month GST computations. You can download it from the link below:

Once you download and fill the data in the above-mentioned template, you will have to download the new Monthly GST Input Output Tax Report.

Copy the data from individual sheet to this new template and paste it into respective columns.

Click here Download Monthly GST Input Output Tax Report in Excel.

Click here to Download All GST Excel Templates for ₹299.You can download GST templates like GST TRAN-1, GST Input Output Tax Report, and GST Export Invoice from here.

Let us discuss the contents of the template in detail.

Contents of Monthly GST Input Output Tax Report

This template consists of 6 files, one for each month from July 2017 to Dec 2017.

All 6 sheets have similar columns and rows and headings.

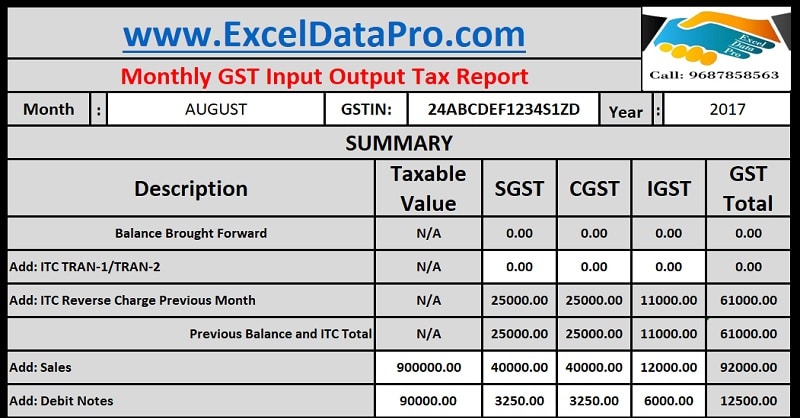

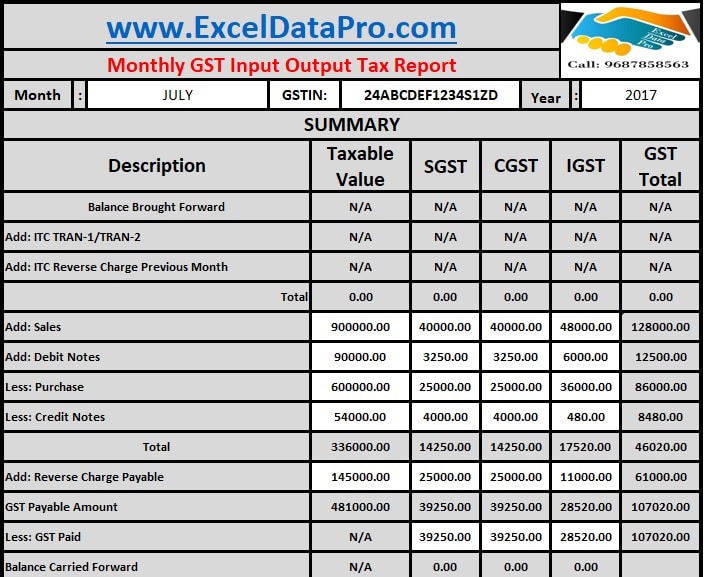

There is a minor difference in the first file which is for the month of July 2017. Reason for this difference is that in the first month you will not have prior data.

Thus, all such fields that are not applicable are marked with N/A.

It consists of column headings of SGST, SGST

There are 4 sections:

- Header Section

- Previous Month Balance and ITC

- Current Month Computations

- GST Payment and Balance Carried Forward

1. Header Section

Header section consists of your Company name, address, logo, and GSTIN.

2. Previous Month Balance and ITC

As mentioned above the taxable value, SGST, CGST, IGST and GST total column are applicable to all the subheadings.

Previous Month Balance and ITC section consist of following subheadings:

Balance Brought Forward: Here the cells take data from the previous sheet. They are linked to previous sheets Balance Carried forward cells for SGST, CGST, IGST and GST total.

ITC from TRAN-1/TRAN-2: As you might have files TRAN-1/TRAN-2 form, you will be eligible for availing the ITC on the sale of previous stocks. Enter these amount here.

ITC Reverse Charge of Previous Month: As we all know reverse charge has to be paid in cash. Once it is paid in the current month, you will get the ITC of the same in the preceding month.

You don’t have to enter the amounts here as this field is also linked to previous month’s payment of the reverse charge.

Previous Balance and ITC Total: Total of all the above three subheadings are given here.

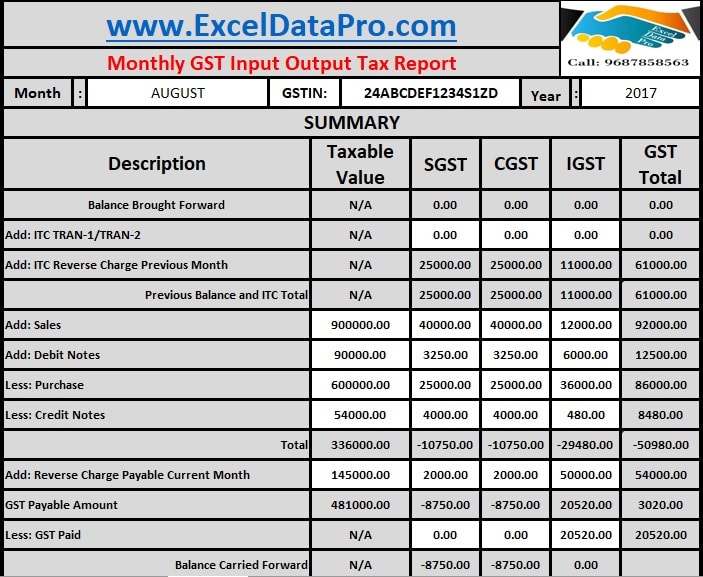

3. Current Month Computations

Either you can link the cells to the sheet in which you have maintained the daily data or you can copy and pasted to respective cells.

Data can be easily copied as they are in the same format.

Current month Computations consist of following subheadings:

Sales: Enter/Copy the taxable value of sales, SGST amount, CGST Amount and IGST amount.

Debit Notes: Enter/Copy the taxable value of the Debit notes, SGST amount, CGST Amount and IGST amount.

Purchase: Similar to sales, enter/copy the taxable value of purchases, SGST amount, CGST Amount and IGST amount.

Credit Notes: Similar to Debit notes, enter/copy the taxable value of purchases, SGST amount, CGST Amount and IGST amount.

Total: (Sales + Debit Notes – Purchase – Credit Notes) – Previous Balance and ITC Total.

Current Month Reverse Charge: Apart from Sales and Purchase, a taxpayer has to pay the reverse charge on purchase from unregistered. If the good that

The goods that are purchased for the furtherance of business then you are eligible for ITC. ITC is credited to your ledger in the preceding month.

This is amount is added you the total liability.

4. GST Payment and Balance Carried Forward

GST Payable Amount: In payment & Balance Carried forward section, if it is negative value it is your credit with GST. If it is positive value then that is your tax liability which is to be paid to the government.

GST Paid: You need to enter the payment amount manually. Please note that if it is a positive amount, full amount has to be paid. If you don’t pay the full amount, interest and late fee shall be applicable.

Balance Carried Forward: It is the end balance of GST. Any amount in this cell will be carried forward to next month’s sheet as Balance brought forward either negative or positive.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.