A recipient liable to pay tax under reverse charge is required to issue a GST Payment Voucher at the time of making payment to the supplier.

Currently, people are searching for various formats like of GST compliance Tax Invoice, GST Bill format, Receipt Vouchers etc to carry on their business activities.

In our previous posts, we have discussed following 4 types of Invoices and vouchers under the GST Regime:

- GST Tax Invoice.

- GST Bill Format for Non-Taxable Items .

- Receipt Voucher under GST.

- GST Refund Vouchers for returning the advance.

Today we will discuss the 5th type that us the Payment Voucher.

Rules of GST Payment Voucher

A payment voucher referred to in clause (g) of sub-section (3) of section 31 shall contain the following particulars:

- Name, address and GSTIN of the supplier if registered.

- A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters -hyphen or dash and slash symbolized as “-” and “/”respectively, and any combination thereof, unique for a financial year.

- Date of its issue.

- Name, address, and GSTIN of the recipient.

- Description of goods or services.

- The amount paid.

- The rate of tax (central tax, State tax, integrated tax, Union Territory tax or cess).

- The amount of tax payable in respect of taxable goods or services (central tax, State tax, integrated tax, Union Territory tax or cess).

- Place of supply along with the name of State and its code, in the case of a supply in the course of inter-State trade or commerce.

- Signature or digital signature of the supplier or his authorized representative.

Source: www.cbec.gov.in

GST Payment Voucher Excel Template

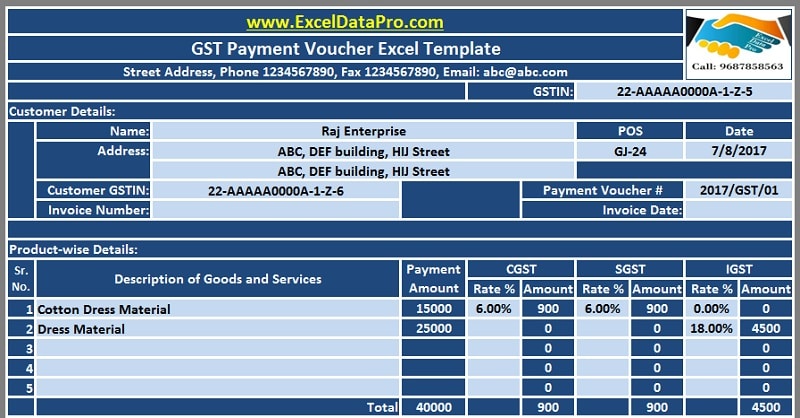

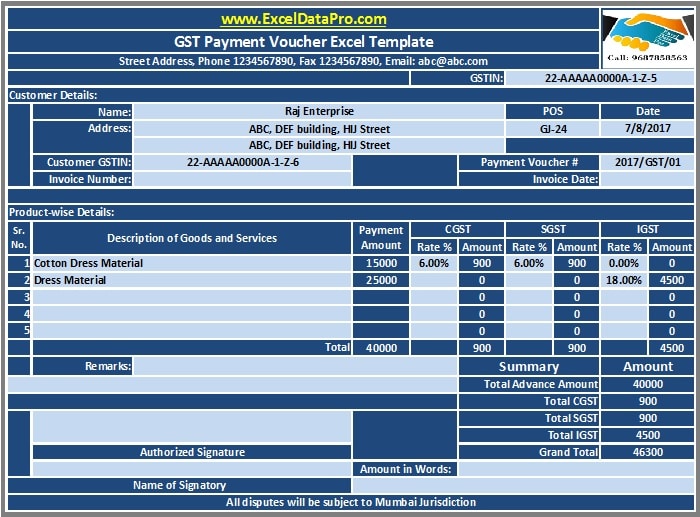

We have created an easy to use GST Payment Voucher Excel Template in compliance the above-mentioned rules. You just need to enter a few details and the template will compute all the rest items for you.

This template helps you to efficiently and easily issue the voucher for payment under Reverse charge to the supplier of goods or services.

It is useful for Accounts Assistant, Accountants, Audit Assistants etc.

Click here to Download GST Payment Voucher Excel Template for Payments Under Reverse Charge.

Click here to Download All GST Excel Templates for ₹299.

Additionally, you can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

Let us discuss the contents of the template in detail.

Contents of the Payment Voucher Template

This template consists of 4 sections

- Header Section.

- Customer Details.

- Product Details.

- Signature Section.

1. Header Section

Header section consists of the company name, company address, company logo, invoice number, GSTIN and the heading of the sheet “GST Payment Voucher Excel Template”.

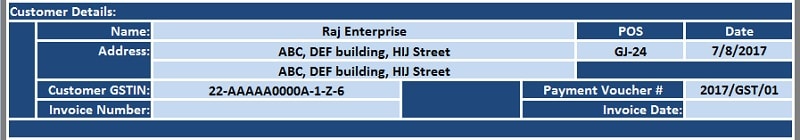

2. Customer Details

Customer Detail consists of details of a customer such as a date, the name of the customer, address, customer GSTIN, POS(Place of Supply), Invoice Number, Invoice date against which the payment is made.

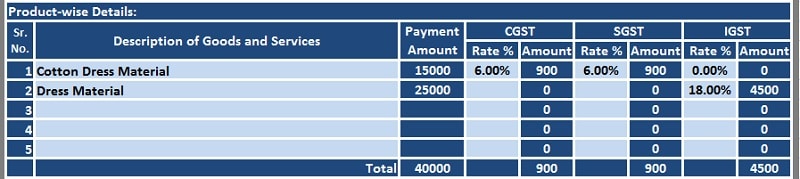

3. Product Details

This section consist of multiple subheadings which are as below:

Sr. No.: Serial number of items/products.

Product Description: Description of the Product.

Payment Amount: The amount of payment to be paid.

CGST: This column has 2 subdivisions. The Rate and the Amount. The rate is the applicable rate of CGST which is to be entered manually. The template calculates the amount of CGST automatically where Payment amount X Rate of CGST.

SGST: The rate is the applicable rate of SGST which is to be entered manually. SGST amount is also calculated automatically where Payment amount X Rate of SGST.

IGST: The rate is the applicable rate of IGST which is to be entered manually. The Amount is the Payment amount X Rate of IGST.

Total: Below each column total of each head is made for easy calculation purpose.

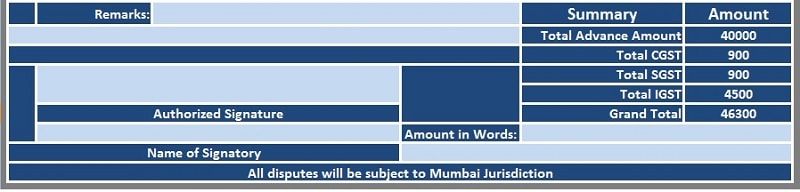

5. Signature and Summary Section

Signature Section consists of remarks, Signatures of the receiver and the name of the signatory.

The amount in words: The grand total of Payment Voucher.

The summary consists of the total of Payment voucher by the customer.

Thus, Grand Total = Total Payment Amount + CGST + SGST + IGST.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.