The Budget Template with Charts is a sophisticated financial planning instrument available in Excel, Google Sheets, and OpenOffice formats. This versatile tool facilitates the creation and management of detailed financial plans, enabling users to effectively oversee their fiscal resources and achieve predetermined financial objectives.

The template is particularly beneficial for financial professionals such as Accounts Assistants, Accountants, and Audit Assistants.

Table of Contents

What Is A Budget?

A budget is defined as a quantitative expression of a financial plan for a specified period. It encompasses projected sales volumes, revenue streams, expenses, and cash flows.

In essence, a budget represents the allocated resources for specific purposes and provides a comprehensive summary of intended expenditures.

Importance of Budgeting

Budgeting plays a crucial role in an organization’s financial health. It serves as a mechanism for controlling actual costs and acts as a plan of action to achieve quantified objectives.

Moreover, budgeting functions as a benchmark for evaluating a company’s performance.

It offers an in-depth understanding of expenditure patterns and aids in mitigating debt-related issues through meticulous planning and execution. Consequently, budgeting is regarded as one of the most essential administrative tools for effective financial management.

Types of Budget

There are mainly 5 types of budget. Master Budget, Operating Budget, Cash Flow Budget, Financial Budget, and Static Budget.

Master Budget

Utilized predominantly by large corporations, the Master Budget incorporates departmental budgets to provide a comprehensive overview of the company’s financial activities.

It encompasses various factors such as sales, operations, assets, and income streams, enabling the organization to establish financial goals and assess overall performance.

Operating Budget

This budget type is employed to forecast and analyze projected income and expenses over a specific timeframe.

Operating budgets are typically time-based and may be prepared on a weekly, bi-weekly, monthly, quarterly, or annual basis.

They include costs related to sales, production, labor, materials, overhead, manufacturing, and administration, assisting management in monitoring and controlling expenditures on regular and discretionary items.

Cash Flow Budget

The primary purpose of a Cash Flow Budget is to monitor the inflow and outflow of cash within an organization.

It aids management in making informed decisions regarding cash utilization and determines whether the company has sufficient liquidity to support its operating activities.

This budget type also facilitates the identification of investment opportunities that could generate future cash flows.

Financial Budget

A Financial Budget presents a strategic overview of asset management, cash flow, income, and expenses.

It provides a comprehensive representation of the company’s overall financial health, offering insight into spending patterns relative to revenues for core operating activities.

Static Budget

As the name suggests, a Static Budget remains fixed regardless of fluctuations in sales or revenue.

This budget type is particularly useful for recurring expenses that exhibit minimal variation over time, such as warehousing costs, cold storage fees, and rent.

Components of a Budget Statement

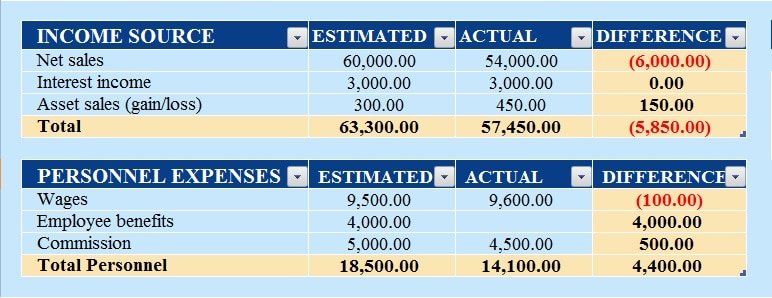

A typical budget statement comprises three principal components: Income, Personnel Expenses, and Operating Expenses. The statement includes both estimated and actual figures for each category, with a final column illustrating the variance between projected and actual expenditures.

This structure allows management to determine whether the budget is in surplus, balanced, or deficit.

When preparing a budget, the initial step involves defining the sources of income, which may include net sales, interest income, and gains or losses from asset disposals.

Subsequently, Personnel Expenses, such as employee salaries, benefits, and commissions, are incorporated. The final component encompasses all Operating Expenses, providing a comprehensive overview of the organization’s financial landscape.

Secondly, it includes Personnel expenses such as employee salaries, Employee Benefits Spends, and Commissions. Lastly, it includes all Operating expenses.

Budget Template (Excel, Google Sheets, OpenOffice)

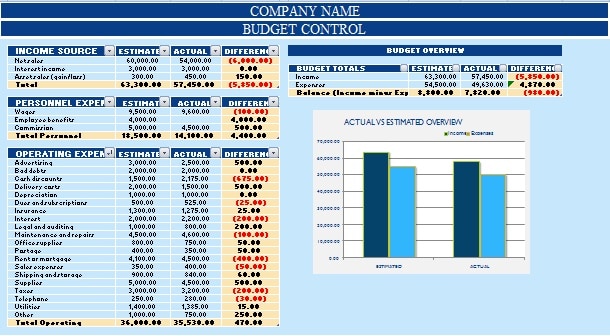

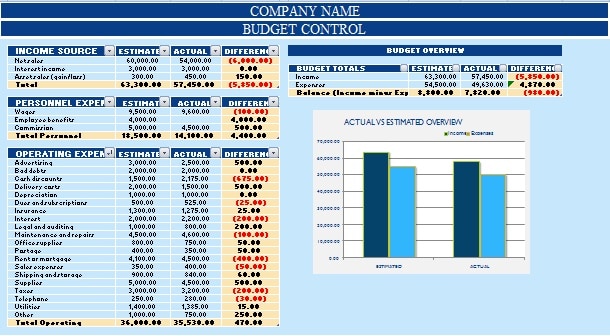

We have developed a comprehensive Budget Template incorporating a chart feature. This template is designed to assist in effective financial management and goal-setting.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

Additionally, you can download other accounting templates like Accounts Payable Template with Aging, Accounts Receivable Template with Aging, and Invoice Excel Templates.

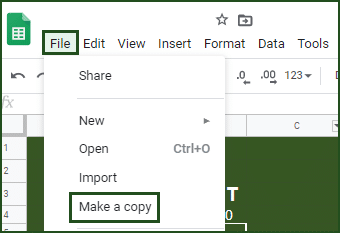

Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

Let’s discuss the template contents in detail.

Contents of Budget Template

This template consists of three sections: Header Section, Data Input Section, and Charts.

Header Section

The Header section consists of the Company name and heading of Budget Control.

Data Input Section

This section consists of four parts.

Income Sources, Personnel Expenses, Operating Expenses, and Budget Overview.

Income Sources: This component records both estimated and actual income. It encompasses revenue from various streams, including sales and interest income, for a specified period.

Personnel Expenses: This segment documents estimated and actual expenses related to human resources, including wages, employee benefits, and commissions.

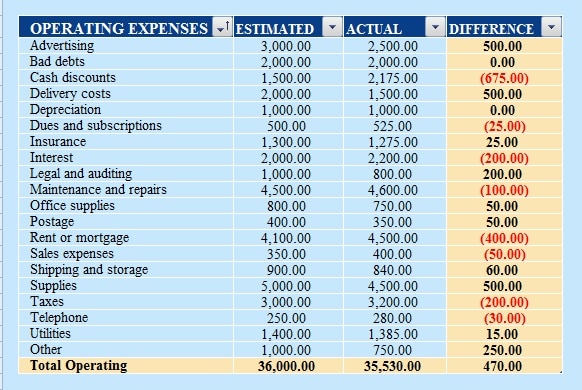

Operating Expenses: This portion captures estimated and actual operating costs. It includes expenditures such as legal and auditing fees, maintenance and repairs, office supplies, postage, and rent or mortgage payments.

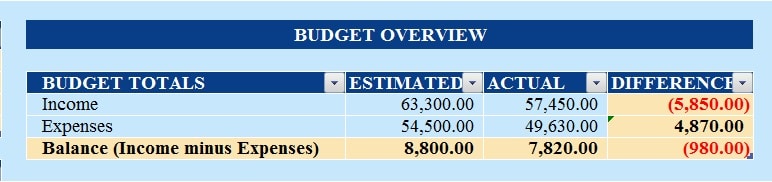

Budget Overview: This component provides a comprehensive summary of estimated and actual incomes versus expenses.

Note: The “Estimate” column contains budget projections for a specific period, while the “Actual” column reflects the real income or expenditure for that period. The “Difference” column calculates the variance between estimated and actual figures.

These variances are crucial for identifying discrepancies between projected and realized budget amounts.

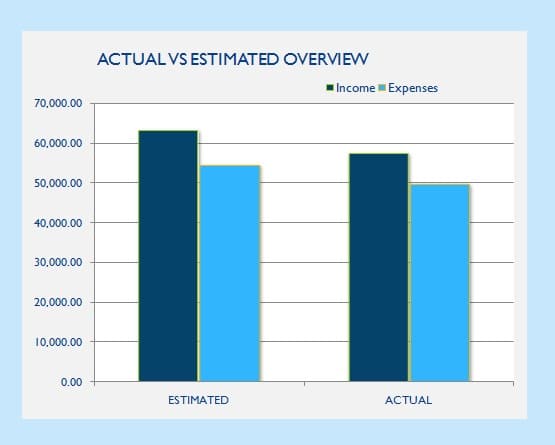

Charts Section

This section consists of a graphical representation of the data of Budget Overview.

Budget Conclusions

There are three kinds of budget results: Surplus, Balanced, and Deficit.

- A surplus budget indicates that actual expenditure is less than estimated.

- A balanced budget occurs when estimated and actual expenditure are equal.

- A deficit budget signifies that actual expenditure exceeds estimates.

A surplus budget generally suggests potential profits, while a balanced budget indicates a need for improved execution. A deficit budget may signal anticipated losses.

Consequently, it is imperative for companies to meticulously prepare, plan, and execute budget plans that aim to achieve a surplus budget.

Uses of Budget Statement

- Facilitates reduction of unnecessary business expenditure and promotion of income growth.

- Enables prioritization of financial spending and establishment of pertinent sales or revenue targets.

- Assists in resource allocation and assignment of responsibilities to department heads or managers for optimal departmental operations.

- Enhances cash flow through improved financial management.

- Contributes to asset and wealth building strategies.

Benefits of Maintaining a Budget Statement

- Facilitates achievement of financial goals through proper budget allocation.

- Mitigates unnecessary spending.

- Promotes efficient savings practices.

- Establishes financial reserves for unforeseen expenses.

- Aids in debt reduction through strategic and feasible budgeting.

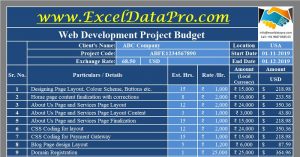

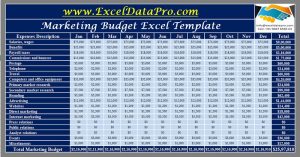

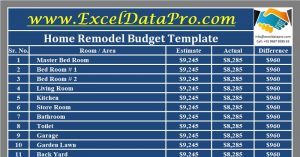

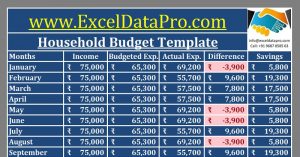

Other Budget Templates

Business Budget Templates

Personal Budget Templates

We thank our readers for liking, sharing, and following us on different social media platforms, especially Facebook.

If you have any queries or questions, share them in the comments below. I will be more than happy to help you.

Frequently Asked Questions

What is the 50:30:20 Budget rule?

The 50:30:20 rule is a financial guideline that recommends allocating one’s after-tax income in specific proportions.

This budgeting strategy suggests the following distribution:

50%: Essential needs, including groceries, housing, utilities, health insurance, and transportation.

30%: Discretionary expenses or “wants,” such as shopping, dining out, hobbies, and personal development activities.

20%: Savings, debt repayment, and financial goals.

What is the 30 days rule in budgeting?

The 30-Day Rule is a prudent approach to managing impulse purchases and controlling spending habits. This strategy involves a deliberate waiting period before making non-essential purchases. When considering a purchase, one should pause and reflect for 30 days before deciding. If the desire to acquire the item persists after this period, it may be deemed a justifiable expense.

However, if the urge diminishes, it is advisable to forgo the purchase, thereby potentially reducing unnecessary expenditures and promoting more thoughtful consumption.

What are the 7 types of budgeting methods?

There are seven primary budgeting methods, each offering unique approaches to financial management:

- The Balanced Money Formula or 50:30:20 Ratio Formula

- Cash-Only Spend Formula.

- Zero-Based Formula.

- 6o:10:10:10 Ratio Formula Or 60% Solution Formula.

- Automated Banking Formula or No Budget Formula.

- Value-Based Formula.

- Mixed Formula.

What is Cash-Only Spend Formula in Budgeting?

The Cash-Only Spend Formula is a tangible budgeting method that involves categorizing expenses and withdrawing corresponding amounts of cash for each category. This approach requires careful planning and allocation of funds to specific envelopes, each representing a different spending category. By limiting expenditures to the cash available in each envelope, individuals can more easily track their spending and avoid overspending in any particular area.

What is Zero-Based Formula in Budgeting?

Zero-Based Budgeting is a meticulous budgeting technique where every dollar of income is assigned a specific purpose, resulting in a balance of zero. This method requires individuals to allocate their entire income to various expense categories, savings, and financial goals, ensuring that income precisely matches outgoing funds. This approach promotes conscious spending and helps eliminate wasteful expenditures by requiring justification for each expense.

What is the 60% Solution method of budgeting?

In this method, you allocate 60% of your income to committed expenses. Then divide the remaining 40% into slots of 10% each. Allocate each 10% to long-term savings, short-term savings, retirement, and leisure expenses.

What is the “No Budget” method of budgeting?

The “No Budget” method, also known as the Automated Banking Formula, is a simplified approach to financial management. This method relies heavily on automation and regular monitoring of one’s bank account balance. Instead of meticulously tracking every expense, individuals set up automatic payments for recurring bills and expenses. While this approach offers convenience, it requires discipline and a solid understanding of one’s financial situation to ensure that spending remains within appropriate limits.

What is the Value-Based formula of budgeting?

The Value-Based Formula is a personalized budgeting approach that aligns spending with an individual’s core values and priorities. This method involves identifying one’s fundamental values and allocating financial resources accordingly. By prioritizing expenditures that align with personal values, individuals can ensure that their spending habits reflect their most important life goals and aspirations, potentially leading to greater financial satisfaction and fulfillment.

What is the Mixed Formula of budgeting?

The Mixed Formula is a flexible and customizable approach to budgeting that incorporates elements from various budgeting methods. This approach allows individuals to tailor their budgeting strategy to their specific financial situations and goals. Implementing a Mixed Formula requires thorough research and self-reflection to determine which aspects of different budgeting methods are most effective for one’s unique circumstances. This adaptable approach can be particularly beneficial for those with complex financial situations or those who find that a single budgeting method does not fully address their needs.