UK VAT Progress Billing Invoice is a ready-to-use excel template that helps to issue a contract-based progressive billing invoice to your clients under the new VAT System.

Progress Billing Invoice is a type of invoice used to obtain part payment of the total contract amount from your clients as agreed in the contract. Such an invoice is quite different from standard invoicing.

Usually, a client pays the amount in full against the goods or services obtained against a standard invoice. Whereas under progress billing, the client releases payments at different stages according to the milestone completion as mentioned in the contract.

Generally, the duration of the contract is long and the contract amount is also big. Businesses like construction contractors, architects, landscapers, interior designers, IT system providers, consultants, etc use such progress billing for their clients.

Table of Contents

UK VAT Progress Billing Invoice Excel Template

We have created a ready to use UK VAT Progress Billing Invoice template in excel with predefined formulas and formating. All you need to do is to enter your company credentials in the header section and start using it.

Click here to download UK VAT Progress Billing Invoice Excel Template.

In addition to that, you can also download other UK VAT Templates like UK VAT Payable Calculator, UK VAT Debit Note, UK VAT Credit Note, UK VAT Invoice Template, UK VAT Multiple Tax Invoice Template, UK VAT Invoice Template With Discount, and many more from our website.

Let us discuss the contents of the template in detail.

Contents of UK VAT Progress Billing Invoice Template

This template consists of 2 sheets: UK VAT Progress Billing Invoice Template and Customer Database.

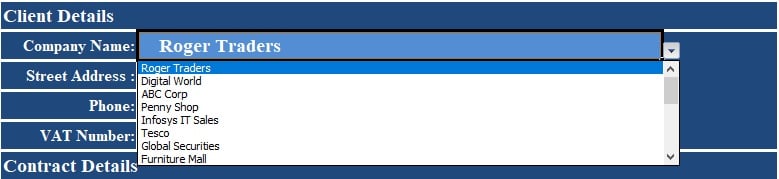

Customer Database

The customer database consists of client details such as name, address, contact details and VAT numbers of your existing and recurring customers. The user just needs to insert the details only once. This sheer is used to create a dropdown list on the invoice template for ease of access.

UK VAT Progress Billing Invoice Excel Template

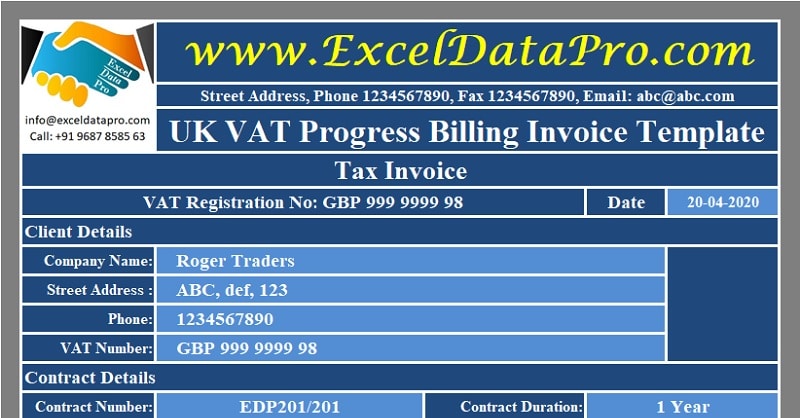

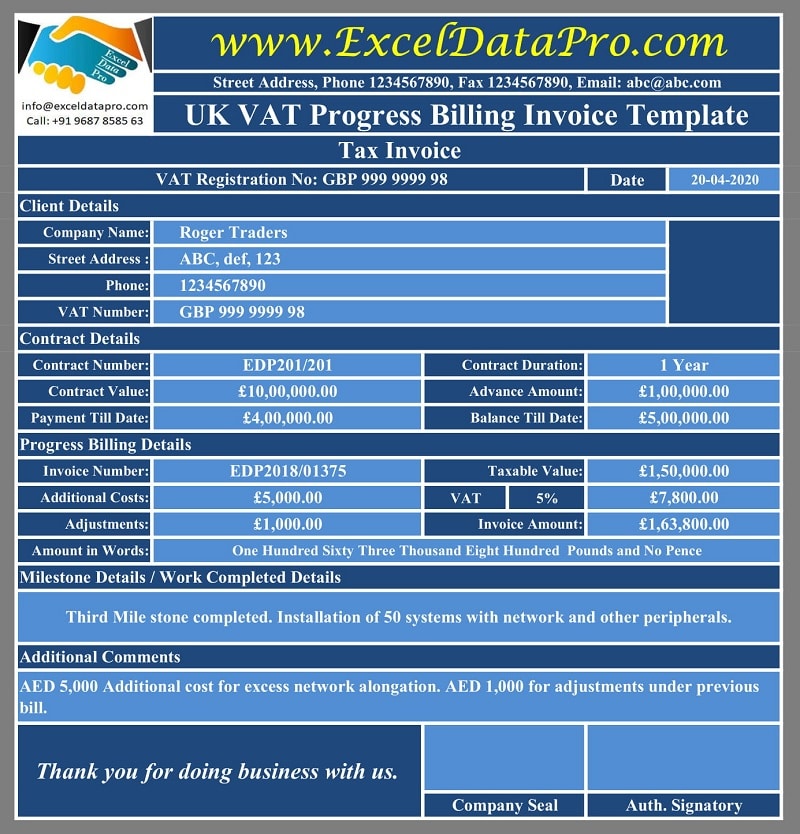

This template consists of 5 sections: Supplier Details, Client Details, Contract Details, Progressive Billing Details, and Other Details.

Supplier Details

Supplier Details section consists of supplier details like company name, logo, address, VAT number, etc. The template fetches the current date automatically as it is configured the TODAY Function. It will display the system date. To issue a date different from the current date, you need to insert it manually.

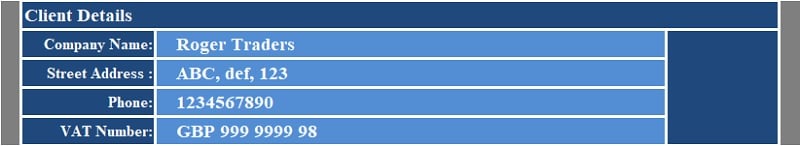

Client Details

The client details section consists of the following:

Company Name

Address

Contact Number

VAT number

The user doesn’t need to enter any detail manually in this section. Select the name of the client from the dropdown. It automatically fetches other relevant details.

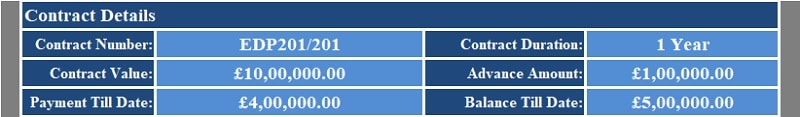

Contract Details

The contract details section consists of the following:

Contract number

Duration of Contract

Value of Contract

Advance Amount

Payments Till Date

Balance Amount

The balance amount is calculated using the below formula:

Balance Amount = Contract value – Advance Amount – Payments Till date

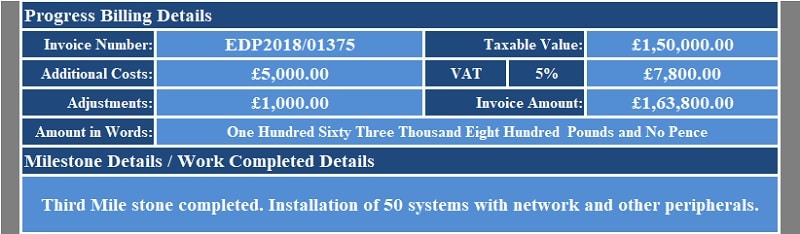

Progress Billing Details

Progress Billing details consist of the following:

Invoice Number

Taxable Value

Additional Costs (if any)

Adjustment Amounts (if any)

VAT Calculations

Total Invoice Amount

Amount In Words

VAT Amount is calculated using the below formula:

VAT Amount = (Taxable Amount + Additional Costs + Adjustments) X VAT %

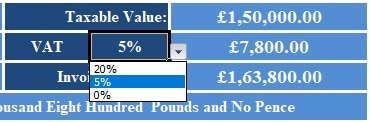

Select VAT % from the dropdown list.

Enter a negative amount in adjustments to reflect an excess received amount. The amount in words is auto-filled using the SpellNumber Great Britain Pound Function.

Insert the milestone detail as per your original contract that has been completed or the amount of work completed under milestone details.

Other Details

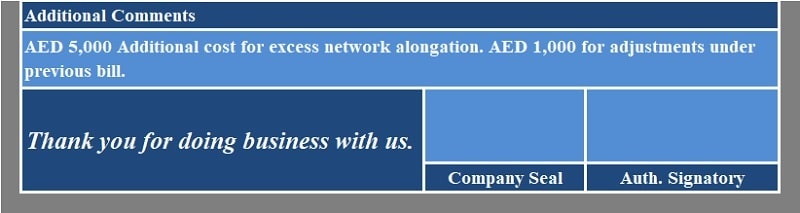

You can enter clarification, if any, in the Additional comments section. Lastly, the invoice template consists of Thank You Message along with the space for company seal and authorized signatory.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply