Simple Tax Estimator is an Excel Template to help you compute/estimate your federal income tax. This template consists of computations of your adjustments, Tax credit, itemized deductions etc.

A user needs to input the in respective cells and it will automatically estimate your tax liability.

Filing deadline and due date for Federal Income Tax Returns for 2017 is 17th April 2018.

It is better for a taxpayer to prepare priorly for tax returns in advance. Filing near the deadline might cost you money.

You might forget some necessary deductions, tax credits, and other items which might increase your taxable income. Thus increasing your tax amount.

We have created a simple tax estimator in excel with predefined formulas. Enter the amounts in white cells only. Blue colored cells contain formulas and references related to calculations.

Click here to download Simple Tax Estimator Excel Template.

You can download the same in Numbers from the link below:

Simple Tax Estimator Apple Numbers Template

You can download other excel templates like Traditional IRA Calculator, Roth IRA Calculator and Income Statement Projection and much more for easy calculations.

Let us discuss the contents of the template in detail.

Contents of Simple Tax Estimator

Simple Tax Estimator consists of 2 sections.

- Taxability Details

- Assumptions

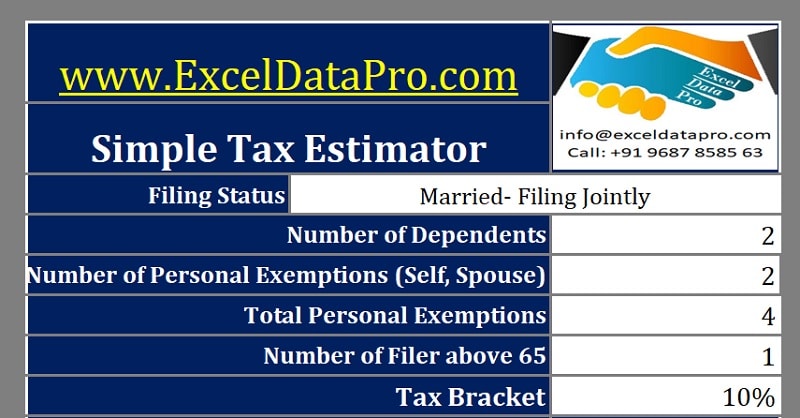

1. Taxability Details

Taxability details consist of following:

- Filing Status.

- Number of Dependents.

- Number of Personal Exemption.

- Total Personal Exemptions.

- Number of Filer Above 65 years of Age.

- Tax Bracket.

Select your filing status from the drop-down list. Single, Married filing jointly, married filing separately or Head of Household.

The personal exemption for the year 2017 is $ 4,050. In addition to the itemized or standard deduction, if the filer is above 65 you are entitled to Standard Deduction of $ 1,550.

Tax bracket is according to your taxable income. Click on the link below to know your tax bracket.

2017 Federal Income Tax Brackets

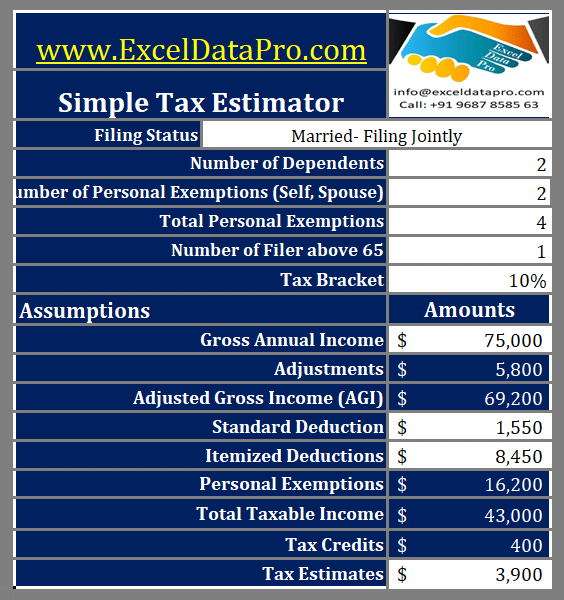

2. Assumptions

Assumptions consist of the following:

- Gross Annual Income

- Adjustments

- AGI – Adjusted Gross Income

- Standard Deductions

- Itemized Deductions

- Personal Exemptions

- Total Taxable Income

- Tax Credits

- Tax Estimates.

Gross annual income is the total of income from all sources.

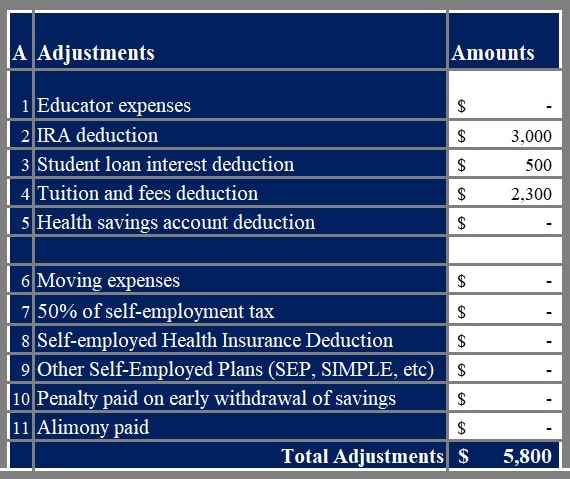

Adjustments

To calculate your adjustments use the table given beside the Simple Tax Estimator. Just enter the amounts applicable to you.

It will automatically reflect in the template as it has been referenced to the respective cell.

Adjustments include following details:

- Educator expenses.

- IRA deduction.

- Student loan interest deduction.

- Tuition and fees deduction.

- Health savings account deduction.

- Moving expenses.

- 50% of self-employment tax.

- Self-employed Health Insurance Deduction.

- Other Self-Employed Plans (SEP, SIMPLE, etc).

- Penalties paid for early withdrawal of savings.

- Alimony paid.

See image below for reference:

Adjusted Gross Income

AGI = Gross Income – Adjustments

The filer can choose Standard Deduction or itemized deductions. Standard Deduction is an amount fixed by IRS. Itemized deductions are actual expenses.

If your itemized deductions are higher then only go for them. Otherwise, a standard deduction is a better option.

As mentioned earlier, if the filer is above the age of 65 years, then he/she can additionally take $ 1,550 as a Standard Deduction.

It will automatically calculate the amount as per the number of dependents.

The Personal exemption amount for the year 2017 is $ 4050. You can claim according to the number of dependants and spouse on a conditional basis.

Read the below article for more details on personal exemptions.

Total Taxable Income

= AGI – Standard Deductions – Itemized Deductions – Personal Exemptions.

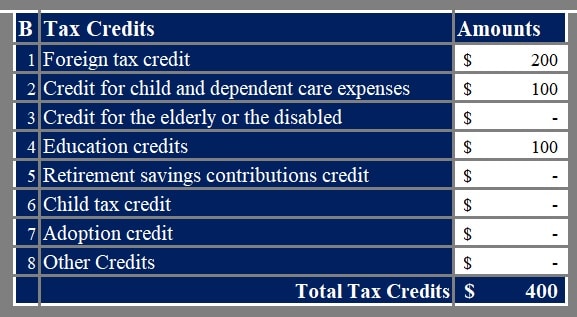

Tax Credits

At the end, there are tax credits. If you are entitled to tax credits then you can calculate your tax credit in the section below adjustments.

You need to enter your applicable tax credit. It will automatically reflect in the template through cell reference.

Lastly, there is the tax estimate.

Tax Estimate = Taxable income X Tax Bracket – Tax Credits.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply