Use this Online Profit Per Employee Calculator to get the desired metric in just a few clicks or download a free template in Excel.

| Profit Per Employee Calculator | |

|---|---|

| Total Revenue of the Company | |

| Operating Expenses | |

| Total Number of Full Time Employees (FTEs) | |

| Profit Per Employee : | |

Profit Per Employee Calculator is a ready-to-use excel template to measure the monthly, quarterly, half-yearly, and yearly Profit Per Employee (PPE) of an organization.

In this article, we will discuss the ready-to-use excel template Profit per employee Calculator, what it is, and how to use this template.

What is Profit Per Employee?

Profit Per Employee is an HR Metric as well as an accounting ratio used to measure the efficiency of employees and the performance of the company over a period. This is a primary metric that emphasizes the return on talent.

Profit Per Employee is a conservative and output based measure this metric helps the higher management to focus on increasing profit relative to their workforce.

Profit per employee focuses on intangible-intensive value propositions on talented people. In simple terms, the workforce with some investment in upgrading skills or knowledge can create a high profit earning workforce.

How to Calculate Profit Per Employee?

Profit per employee is the total revenue less of operating expenses divided by the Total number of Full-time employees. If a company employs a high proportion of part-time workers, employee numbers will have to be adjusted to full-time equivalent numbers.

The formula to Calculate Profit Per Employee:

Revenue – Operating Expense

No. of Full Time Employees (FTE’s)

Profit Per Employee Calculator Excel Template

We have created a simple and ready-to-use Profit Per Employee Calculator in Excel with predefined formulas. This template will help you calculate Profit Per Employee on a monthly, quarterly, half-yearly, and yearly basis.

You just need to enter your monthly revenue, monthly operating expenses, and FTE’s per Month with the addition or reduction in the workforce during that particular month, and it will automatically calculate the Profit Per Employee for you.

Click here to download Profit Per Employee Calculator Excel Template.

Click here to Download All HR Metrics Excel Templates for ₹299.You can download other useful HR Metrics Templates like Revenue Per Employee Calculator, Cost Per Hire Calculator, Human Capital ROI Calculator, and many more from our website.

How To Use Profit Per Employee Calculator Excel Template?

Profit Per Employee Calculator or PPE Calculator is a very simple and easy-to-use template. Similar to Revenue per Employee Calculator, this template also consists of 3 sections:

- Company Details

- Monthly Data

- Quarterly, Half-Yearly, and Yearly PPE Calculations

1. Company Details

Company details consist of the company name, the company logo, and the heading of the sheet. If you are an independent HR analyst then you can make multiple sheets for sheets and enter the company name of your clients in this section.

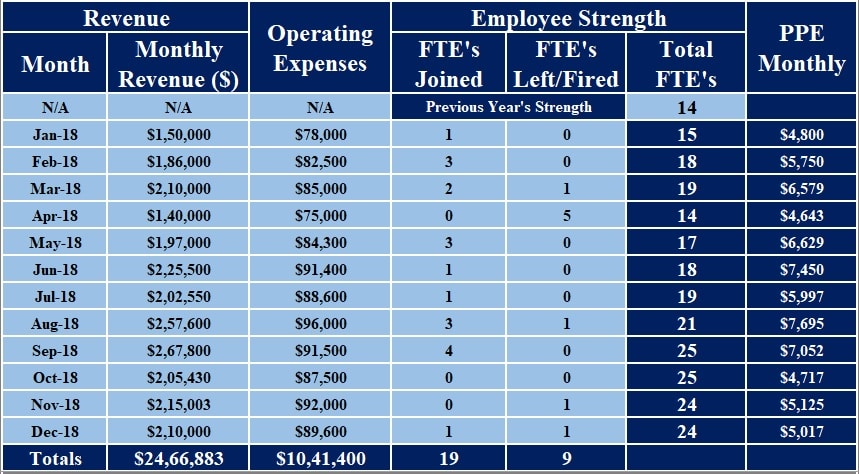

2. Monthly Data

Monthly Data consists of monthly revenue, monthly operating expenses of the company as well as the addition/deduction of Full-time employees during that particular month.

Simply enter the monthly revenue and operating expenses against the respective month.

Employees added to the workforce will be entered in the “FTE’s Joined” column. Employees left or fired during that particular month will be entered in the “FTE’s Fired/Left” column.

Entering the FTE’s data will automatically update the “Total FTE” which will be used in Profit Per Employee Calculations.

In addition to the above, this section also consists of a column for Monthly Profit Per Employee (PPE). The formula to calculate monthly PPE is as follows:

PPE Monthly:

Monthly Revenue – Operating Expense

No. of Full Time Employees (FTE’s) at the end of that month

The line total for each column has been given at the end of this section. Sum Function has been used for totals.

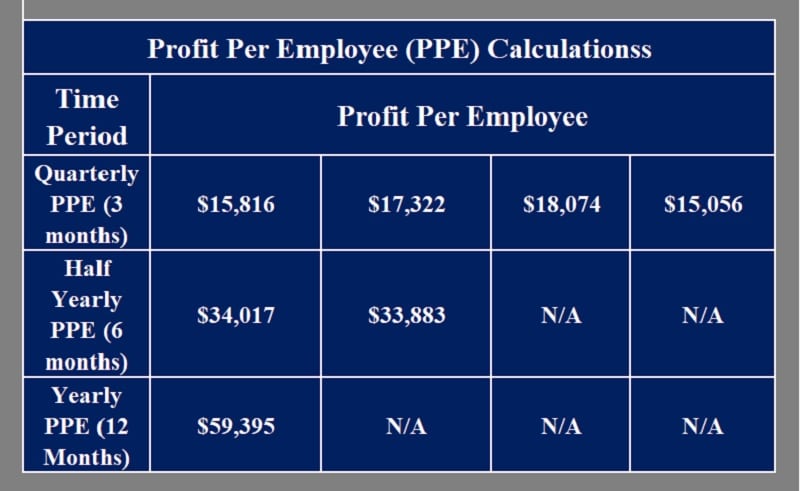

3. Quarterly, Half-Yearly, and yearly PPE Calculations

This section includes 4 quarterly PPE calculations, 2 half-Yearly PPE calculations as well as 1 yearly PPE calculation. The formulas used to calculate each of them has been given below for your ready reference:

1. PPE Quarterly:

Total Revenue per Quarter – Total Operating Expense per Quarter

No. of Full Time Employees (FTE’s) At the end of Each Quarter

2. PPE Half Yearly:

Total Half Yearly Revenue – Total Half Yearly Operating Expense

No. of Full Time Employees (FTE’s) at the end of 6 Months

3. PPE Yearly:

Total Revenue Per Annum – Total Operating Expense Per Annum

No. of Full Time Employees (FTE’s) at the end of the year

Important Points to Consider While Calculating Profit Per Employee

Similar to RPE, PPE also differs in different industries according to the intensity of labor.

In labor-intensive industries, the PPE is less whereas in the high tech it is high as they are low labor-intensive companies. This doesn’t define the success of any company.

The reason behind this is because some businesses need more employees by nature, to drive their revenue and profits than others.

It can be a very useful tool in this digitally driven world. This metric will help you get the best return on talents, especially in talent-intensive industries compared to labor-intensive industries.

In simple terms, rather than focusing only on return on capital an organization should also focus on the profit from its workforce.

This profit is gained by the talent of the employees that work in the company and turn the capital into such profits. You can also compare PPE for your competitors and your historical data for better insights.

Company age affects the PPE of a company. New startups will have small revenues, operating expenses. They will also have a high recruiting ratio. This will eventually decrease the PPE.

Established and old companies will have high PPE as they have less recruitment ratio and high revenues.

This template can be useful to HR analysts, HR professional, HR assistants, and also to small business owners

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries or suggestions please share in the comment section below. I will be more than happy to assist you.

Leave a Reply