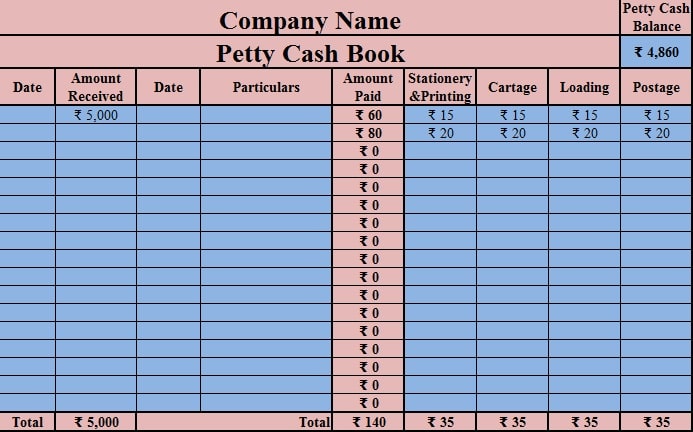

Petty Cash Book is a ready-to-use template in Excel, Google Sheets, and Open Office Calc to systematically record and manage your petty or small daily routine payments.

Large businesses maintain Petty Cash Book to reduce the burden of ‘Main Cash Book’ by recording sundry expenses like postal, stationery, pantry, loading, etc.

Table of Contents

What is a Petty Cash Book?

Petty Cash Book is a book of accounts to record sundry routine expenses of the business which are of small value. It is a type of cash book.

The Chief Cashier gives the Petty Cashier an amount of cash as an advance, to handle petty expenses for a fixed period.

When the petty balance is low or exhausted, the head cashier again allots the amount to the cashier. This process is either weekly or monthly.

Purpose of Maintaining Petty Cash Book

In big companies, the head cashier maintains the company’s general cash book. Payment and receipts of these amount to hundreds or thousands of dollars per day.

In addition to this, if the chief cashier has to maintain the sundry expenses in his book, his work increases and becomes hectic. Eventually hindering work efficiency.

Thus, to release his extra burden, handling of these small head expenses is given to assistant cashier, receptionist, or other reliable staff.

Types of Petty Cash Books

There are 2 types of Petty Cash Systems: Ordinary System and Imprest System

Ordinary or Simple Petty Cash

In the ordinary system, a sum of cash is given to the petty cashier. The petty cashier is responsible to record the sundry expenses.

Once the amount is spent, the record is presented to the head cashier for the review. The head cashier reviews the expenses and provides new funds to run the day to day expenditure again

Imprest Petty Cash

Under the Petty Cash Imprest System, the head cashier provides a fixed feasible amount depending on previous spend history to the petty cashier for a given period. It can be either a week or a month depending on the volume of transactions.

The petty cashier spends the money under the given budget. Upon the completion of the period, the petty cashier submits the report of petty expenses to the head cashier for review.

After reviewing the head cashier will reimburse the spent amount and the petty cash amount is again equal to the agreed fixed amount.

Download Petty Cash Book Template

We have created a simple and ready-to-use Petty Cash Book Template with predefined formulas that are useful for businesses of all sizes.

Excel Google Sheets Open Office Calc

Click here to Download All Accounting Excel Templates for ₹299.

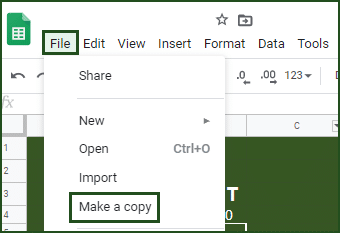

Important Note: To edit and customize the Google Sheet, save the file on your Google Drive by using the “Make a Copy” option from the File menu.

In addition to this, you can also download other accounting-related templates like Cash Book, Account Receivable, Accounts Payable, and Profit & Loss Account.

Let’s discuss in detail the contents of the template.

Contents of Petty Cash Book Excel Template

The Petty Cash Book template has 2 sections which are mentioned below: Header Section, and Petty Cash Entry Section.

Header Section

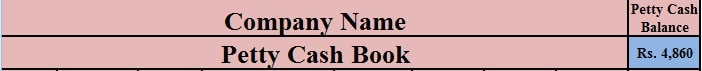

The header section consists of Your Company/Business Name and template heading “Petty Cash on Hand”.

The right-hand corner of the cell in blue display the amount of Petty Cash on Hand. It is derived by subtracting total expenses from the cash received from Chief Cashier in cell B21. See image below:

The Formula applied is =SUM(B4: B20)-SUM(E4: E20) or we can also use =SUM(B21-E21).

Both formulas reflect the same calculations.

If the totals of outward exceed against the totals of inward then the Petty cash on hand will be negative. Using conditional formatting the amount in cells turns red whenever there is a negative balance.

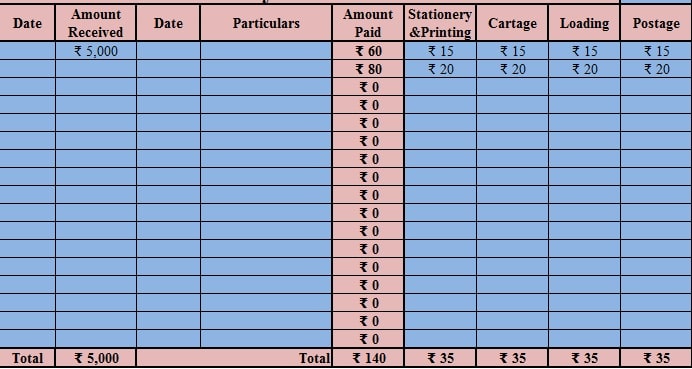

Petty Cash Entry Section

The petty cash entry section consists of 2 sides; debit and credit.

The Debit side has the date and cash received from Chief Cashier, whereas the Credit side has all types of petty expenses like stationaries and printing, postage, loading, etc.

See the image below to understand it better:

You can increase or decrease subheadings for expenses as per your requirement.

In the end, the last row displays the Totals of both inward and outward entries.

Petty Cash Journal Entries

Petty cash book has become a useful document to save time. Each payment made is under a particular head and not posted into the ledger separately. The head cashier enters this periodic total with a single entry as Petty Expenses in books of accounts.

Petty Cash Journal Entries While Adding Cash:

Petty Cash A/C – Debit

Cash A/C – Credit

Petty Cash Journal Entries While Recording Expenses:

Office Expenses A/C – Debit

Petty Cash A/C – Credit

Thus, in large businesses, both Cash Book and Petty Cash Book are very essential.

Tips and Tricks For Handling Petty Cash

- Allocate a reasonable amount of cash from your Main Cash for petty cash payments. It should not be excessive.

- Initially define the usage of petty cash.

- Instruct your employees handling petty cash to record everything.

- Do not handover excessive petty cash amounts to employees.

- Keep regular supervision on Petty Cash Funds.

- Ensure that the petty cashier disburses the cash against receipts as and when possible.

- Reimburse petty cash funds timely to avoid unnecessary chaos.

- Make sure that the initial petty cash deposit amount is enough to cover day to day expenses along with a little extra amount for some unforeseen circumstances.

We thank our readers for liking, sharing, and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Frequently Asked Questions

What Is Funding?

Funding is the process of adding cash to petty cash. Usually, it ranges from $100-$2000 depending on the size of the business.

What Is Petty Cash Custodian?

Petty Cash Custodian is the staff responsible for handling and recording petty cash expenses.

What Is Replenishment under Petty Cash?

Replenishment is the process refilling the petty cash balance after usage on the request of Petty Cash custodian.

What does negative and positive cash balance refer to in Petty Cash?

A negative balance refers to a shortage of funds and a positive balance refers to cash coverage.

What is the procedure to reconcile Petty Cash?

Take the closing balance. Calculate the total amount of expenses made from petty cash. Match them with the vouchers/receipts. Investigate the variances.