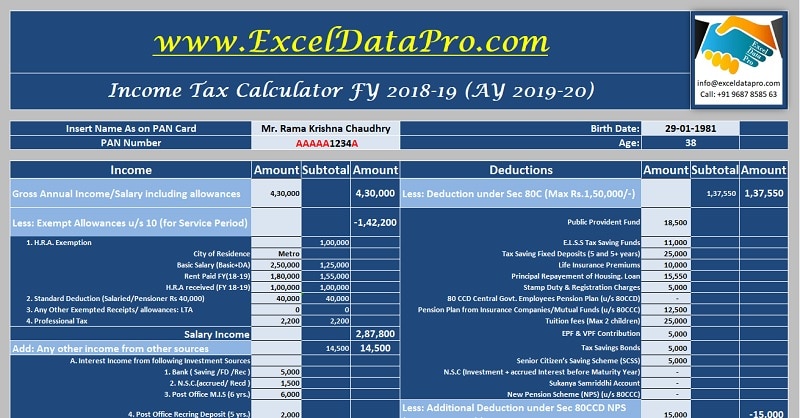

Income Tax Calculator FY 2018-19 (AY 2019-20) is a simple tax estimator for Indian taxpayers with calculations of gross incomes from multiple sources, all allowed and possible deductions.

Usually, people consider income tax calculation to be a complex task. But in actual sense, it is not complex. The main thing here is to understand the heads and enter the appropriate amount.

Excel is a great tool and simplifies your work in many ways. My personal opinion on excel is that I have used excel in many of my complex calculations and it has helped me a lot.

Income Tax Calculator FY 2018-19 Excel Template

To help you easily calculate income tax liability with maximum possible deductions, we have created a simple and ready-to-use Income Tax Calculator FY 2018-19 excel template.

Click here to Download Income Tax Calculator FY 2018-19 Excel Template.

Click here to Download All Personal Finance Excel Templates for ₹299.You can download other personal finance templates like Debt Reduction Calculator, Monthly Household Budget, Credit Card Payoff Calculator, Savings Goal Tracker, and Personal Income-Expense Tracker.

Let us understand each head of this template to define your tax liability with the maximum possible accuracy.

How To Use Income Tax Calculator FY 2018-19 Excel Template

Firstly, insert personal information like your name, your PAN number, and Date of Birth. This date of birth will define your age using the DATEDIF function.

This age will be used to calculate your income tax liability according to the age bars set in the Income Tax Act.

There are 3 steps to calculate Income tax liability:

- Calculate your Gross Income

- Deduct Allowed/Applicable Deductions

- Calculate Tax Liability

This template mainly consists of 3 sections:

- Incomes

- Deductions

- Tax Calculations

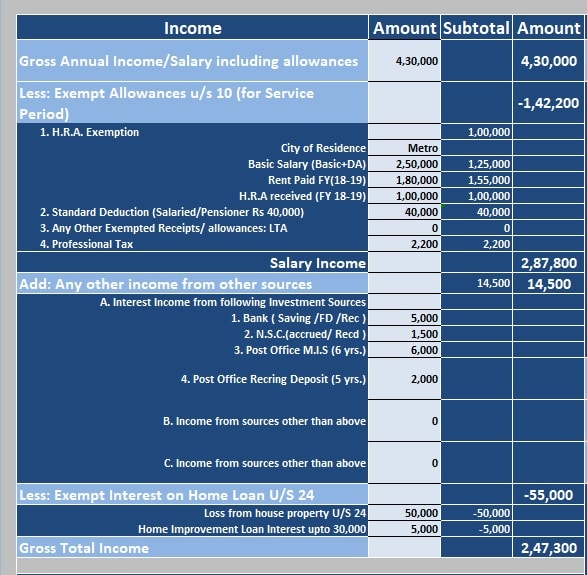

1. Incomes

Incomes section further consists of 3 subsections: 1) Gross Annual Income/Salary including allowances, 2) Exempt Allowances & Standard Deductions 3) Income from other sources and 4) Exempt Interest (Section 24) on House Loan.

Gross Annual Income/Salary Including Allowances: Gross income of individual doing business or total of yearly take-home salary for salaried individuals.

Exempted Allowances & Standard Deductions:

The minimum of the following can be claimed as HRA exemption:

- Total HRA received from your employer

- Rent paid less 10% of (Basic salary +DA)

- 40% of salary (Basic+DA) for non-metros and 50% of salary (Basic+DA) for metros

The standard deduction amount for individuals for FY 2018-19 is Rs. 40,000.

There is a provision for an LTA exemption for salaried employees. It is restricted to travel expenses made by them during their leaves. This exemption doesn’t all include expenses made during the entire trip. Expenses such as shopping, food expenses, entertainment, and leisure don’t fall under this.

Income from Other Sources: Income from other sources includes any other income except the above mentioned. Consists of Interest from Bank Fixed Deposits, Accrued or received interest from National Saving Scheme (N.S.C.), Interest from Post Office Monthly Income Scheme (MIS) and any other income not mentioned or added in the gross income section.

Exempted Interest on Home Loan U/S 24: Loss of Income from Home purchased on loan is claimable up to maximum Rs. 200,000 under section 24 of the Income Tax Act and interest on home improvement loans are deducted from your gross income.

Gross Income: Gross income is equal to Net Salary Income + Income from other sources – Exempt Interest on Home Loan U/S 24.

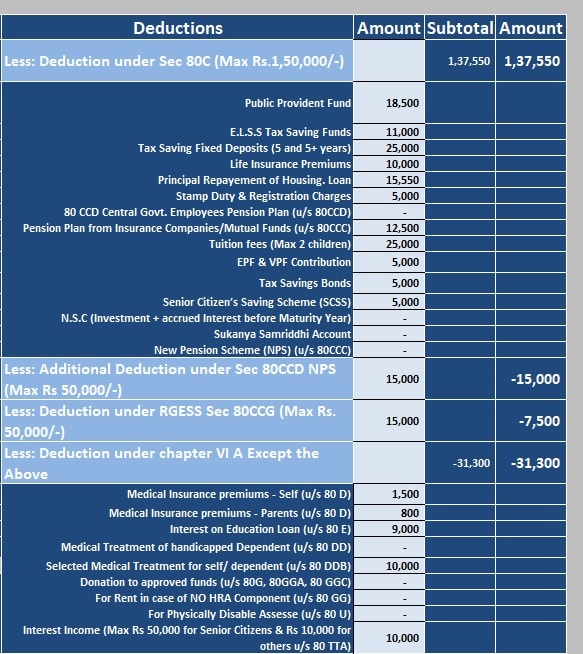

2. Deductions

This Section consists of 4 types of deductions: Deductions U/S 80 C, Deductions U/S 80 CCD, Deductions U/S 80 CCG, and Deductions Chapter VI-A.

Deductions Under 80 C: 80 C includes;

- Public Provident Fund

- E.L.S.S Tax Saving Funds

- Tax Saving Fixed Deposits (5 and 5+ years)

- Life Insurance Premiums, Principal Repayment of Housing Loan

- Stamp Duty & Registration Charges

- Central Govt. Employees Pension Plan (u/s 80CCD)

- Pension Plan from Insurance Companies/Mutual Funds (u/s 80CCC)

- Tuition fees (Max 2 children)

- EPF & VPF Contribution

- Tax Savings Bonds

- Senior Citizen’s Saving Scheme (SCSS)

- N.S.C (Investment + accrued Interest before Maturity Year)

- Sukanya Samriddhi AccountNew Pension Scheme (NPS) (u/s 80CCC) maximum up to Rs.150,000.

Deduction Under 80 CCD: Contributions made towards National Pension Scheme (NPS) maximum up to Rs.50,000.

Deduction Under RGESS Sec 80CCG: RGESS is Rajiv Gandhi Equity Saving Scheme under which you can claim deductions maximum up to Rs. 50,000.

Deduction under chapter VI A Other than Above: These deductions include;

- Medical Insurance premiums – Self (u/s 80 D)

- Medical Insurance premiums – Parents (u/s 80 D)

- Interest on Education Loan (u/s 80 E)

- Medical Treatment of handicapped Dependent (u/s 80 DD)

- Selected Medical Treatment for self/ dependent (u/s 80 DDB)

- Donation to approved funds (u/s 80G, 80GGA, 80 GGC)

- For Rent in case of NO HRA Component (u/s 80 GG)

- For Physically Disabled Assesse (u/s 80 U)

- Interest Income (Max Rs 50,000 for Senior Citizens & Rs 10,000 for others u/s 80 TTA)

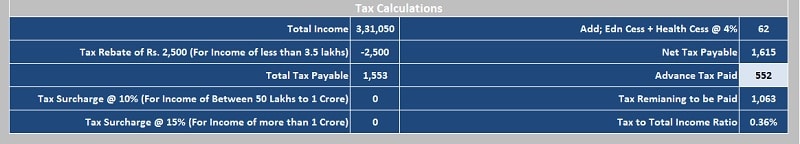

3. Tax Calculations

Tax Calculation section consists of predefined formulas except for one cell of the advance paid tax. If you have any advance tax paid you can manually enter the amount in the cell.

If your income is less than 3.5 lakhs you will be eligible for an additional tax cut of Rs. 2,500. AN additional surcharge of 10% is applicable if income is Rs. 50 lakhs to 1 Crore and 15% if it is above 1 Crore. 4% of Education Cess and Health Cess applies to all.

In the end, the template shows Tax to income ratio in the percentage. The formula applied here is:

Net Payable Tax / (Gross income from Business or Salary + Income from other Sources)

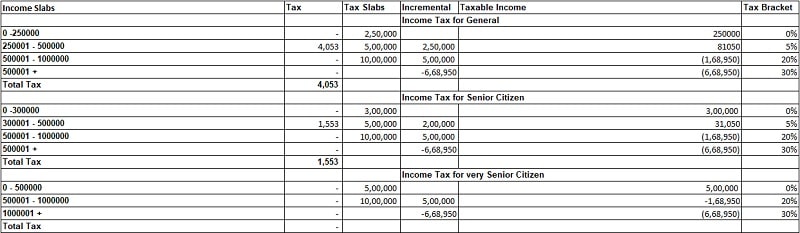

Income tax slabs for FY 2018-19 (AY 2019-20) is as follows:

Disclaimer: This template has been created for educational purpose. Before submitting your Income Tax Return please refer it to a tax consultant.

We thank our readers for liking, sharing and following us on various social media platforms.

If you have any queries or suggestions, please share in the comment section below. We will be more than happy to assist you.

Leave a Reply