Income Statement Vertical analysis means the vertical evaluation of an Income Statement and other financial statements in terms of the relative percentage change in line items.

While performing Income Statement Vertical Analysis, all the amount from all 3 major categories of accounts in an Income Statement, viz; Incomes, Expenses, and Taxes are represented as the proportion of the total Sales Amount.

We have learned in our previous article for Balance sheet Vertical analysis, each amount from all 3 major categories of accounts in a balance sheet, viz; assets, liabilities and shareholder equities are represented as the proportion of the total balance of the respective account.

It is also known as a common-size analysis. It is one of the popular methods of financial statement analysis.

This Vertical Analysis of income statement shows each item as a percentage of the base figure within the Income Statement.

Generally, the total of Sales/Revenue is considered as the base figure for Income Statement Analysis. For an income statement, each line item can be representative of gross sales.

All the individual figures of an asset are shown as the percentage of the total asset amount.

Percentage = Individual line amount of Income statement/ Base amount (Total Sales/Gross Revenue from Sales).

To increase the usefulness of vertical analysis, you can use multiple years of data for comparative analysis.

Income Statement Vertical Analysis Excel Template

We have created a Profit & Loss Account/Income Statement Vertical Analysis Template with predefined formulas and categories of Incomes, Expenses, and Taxes. It is free to use and you can also customize it as per your need.

This template is useful for conducting the financial analysis of businesses.

Accounting professionals, individual investors, and auditors to evaluate the change in Revenue/Income Statement figures over a period of time.

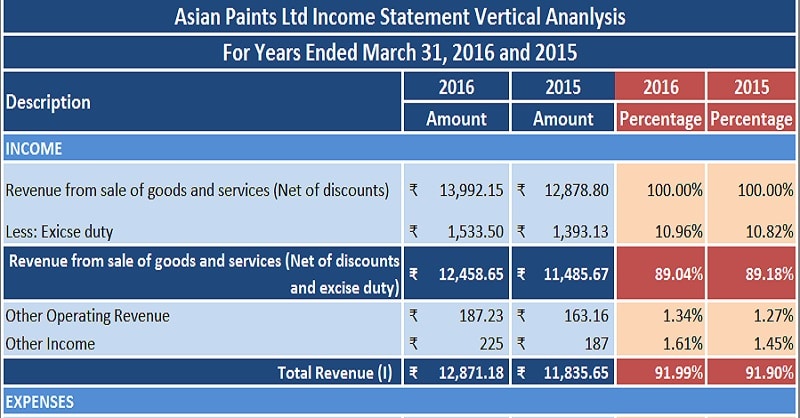

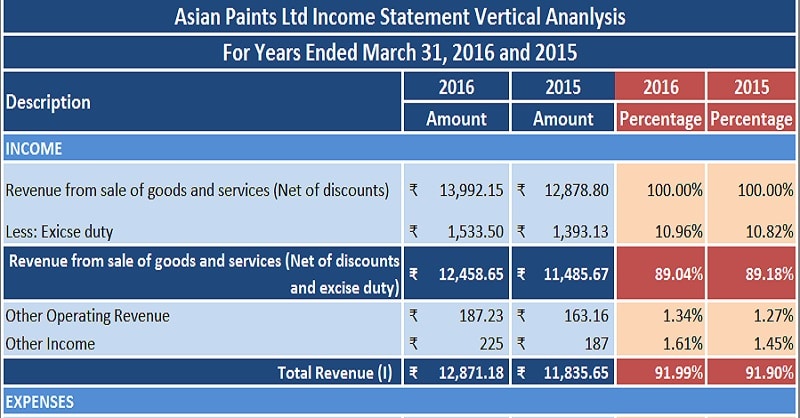

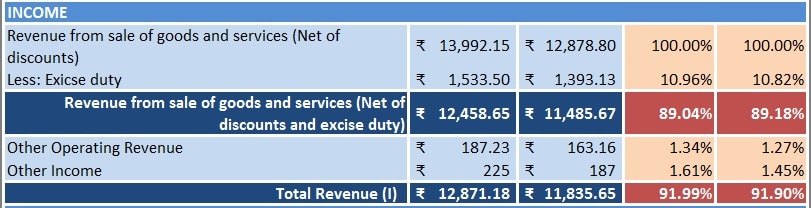

The data used in this template is real-time data of Asian Paints Ltd for the years 2015 and 2016. The data is taken from the annual reports of Asian Paints uploaded on BSEindia.com.

You just need to input the respective amounts of the income statement in the light blue columns. The template will automatically do the vertical analysis for you.

Click here to Download Income Statement Vertical Analysis Template.

Click here to Download All Financial Analysis Excel Templates for ₹299.Additionally, you can download other Financial Analysis templates like Break-Even Analysis Template, Business Net Worth Calculator, Break-Even Analysis Template, and Ratio Analysis Template.

Let us discuss the contents of the Income Statement Vertical Analysis Template in detail.

Contents of Income Statement Vertical Analysis Template

This template consist of 4 major sections:

1. Header Section

2. Incomes/Revenues Section

3. Expenses Section

4. Taxes Section

1. Header Section

The first row consists of Company Name followed by the heading of sheet ” Asian Paints Ltd Income Statement Vertical Analysis” along with years of comparison.

2. Incomes/Revenues Section

Income Section consists of revenue from sales of goods and services. The excise duty if applicable is deducted from the gross sales.

It also includes other operating revenues and other incomes.

3. Expenses Section

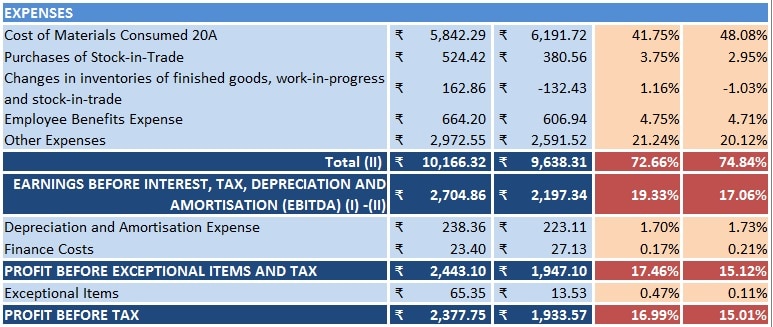

Expenses section includes the Cost of goods sold, inventory, work-in-progress, employee benefits, etc.

After deducting the expenses from income, you get the Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA). This is the earning capacity of the company with pure operations factors only

Deduct depreciation and other financial costs from the EBITDA to get the Profit Before Tax (PBT).

4. Taxes Section

Lastly, current taxes, previous years taxes(if any) are deducted, which gives you Net Profit or Profit After Tax.

The subheadings include are as per according to the figures of the Income statement that we have taken into consideration. It differs from cases to cases. You can add or remove subheadings are per your requirement.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply