GST TRAN-2 return is filed by a dealers or trader that are currently registered under GST but were previously unregistered VAT/Excise.

As a matter of fact, these dealers will not have invoices with VAT or excise to support the claim. The Government has given a provision for transitional input for such dealers in GST TRAN-2.

Please note that GST TRAN-2 will not be filed by manufacturers or service providers.

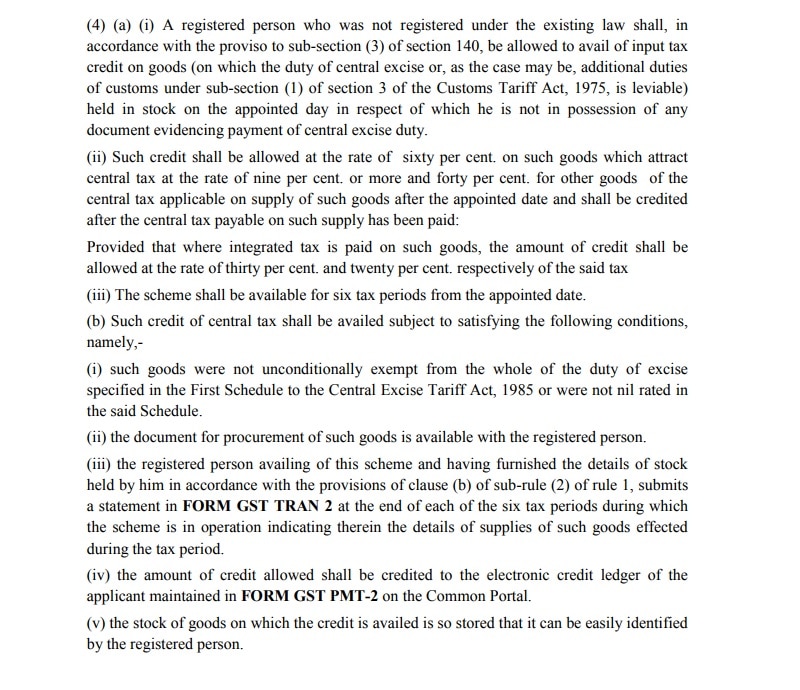

Ruling of Transitional Provision

Source: www.cbec.gov.in

Those dealer/traders opting for GST TRAN-2 will file this return at the end of every month

A dealer/trader should match the following conditions:

Goods in stock are not NIL rated or fall under the exempted category under VAT and Excise.

This scheme will be operative for 6 months only starting from the 1st of July 2017 and 31st December 2017.

Such stock has to be cleared within this duration of 6 months to claim the credit.

Documentary proof has to be presented to prove the procurement of such goods.

Such stock of goods on which the credit is claimed must be stored in a way that it can be easily identified.

We have created a replica of GST TRAN-2 form in Excel to help businesses claim the credit on the pre-GST stock.

Like TRAN-1, this form will also be filled online on GSTN Portal.

Click Here to Download GST TRAN-2 Return Excel Template

Click here to Download All GST Excel Templates for ₹299.

You can also download other GST templates like GST Bill of Supply, GST Payment Voucher, and GST Export Invoice from here.

Let us discuss the contents of this template in detail.

Contents of GST TRAN-2 Excel Template

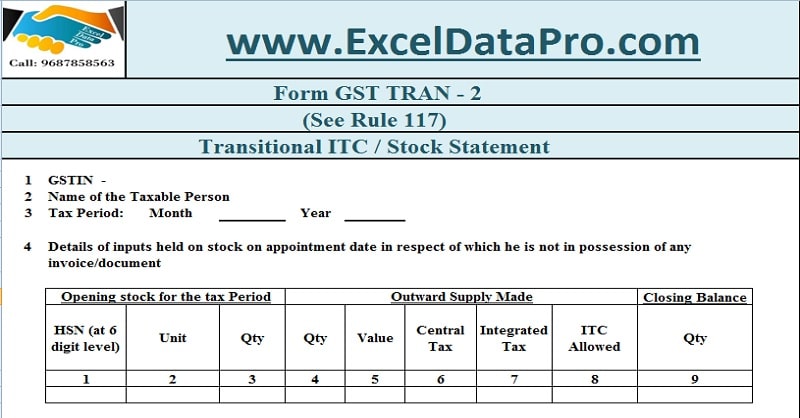

This form GST TRAN-2 consists of 5 points as mentioned explained below:

1. GSTIN

Your GSTIN number.

2. Name of Taxable Person

Your registered legal name in full.

3. Tax Period

The period for which you are filing the return in terms of month and year.

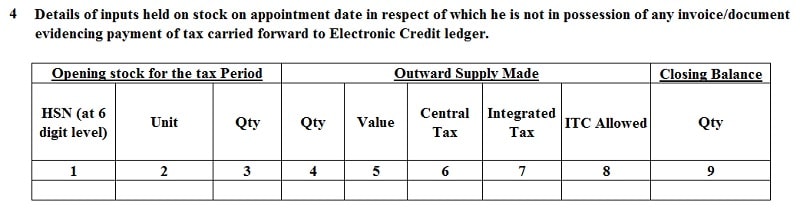

4. Details of inputs held on stock on appointment date in respect of which he is not in possession of any invoice/document evidencing payment of tax carried forward to Electronic Credit ledger.

In this section, you will enter the details of stock available with you for which there is no supporting document showing payment of Central Tax – Excise.

Total 9 columns are to be filled.

Column 1, 2 and 3 are related to the opening stock.

You need to mention the HSN code, unit of measurement and quantity of opening stock.

In Columns 4, 5, 6, 7 and 8 are related to sales made out of that stock.

Enter the value of goods that are sold in the month for which you are filing the return, the taxable value of the sold stock, CGST amount if sold intra-state, IGST amount if sold interstate and the amount of input credit.

If the amount of CGST paid in column 6 is equal to or more than 9%, then the Input Credit claimed will be sixty percent of the amount in column 6 or else it will be 40% of column 6.

If the amount of IGST paid in column 7 is equal to or more than 18%, then the Input Credit will be 30% of the amount in column 7 or else it will be 20% of column 6.

Column 9 will contain the balance of stock remaining after deducting the opening stock value less of stock sold recorded in column 4. Quantity in Column 3 – Quantity in Column 4.

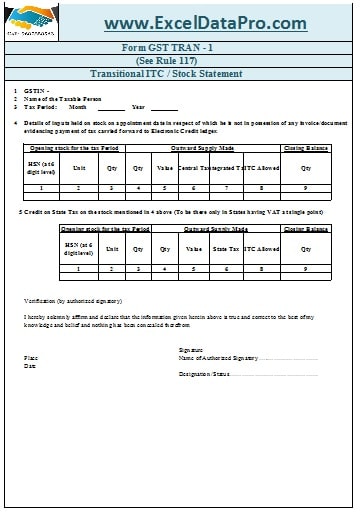

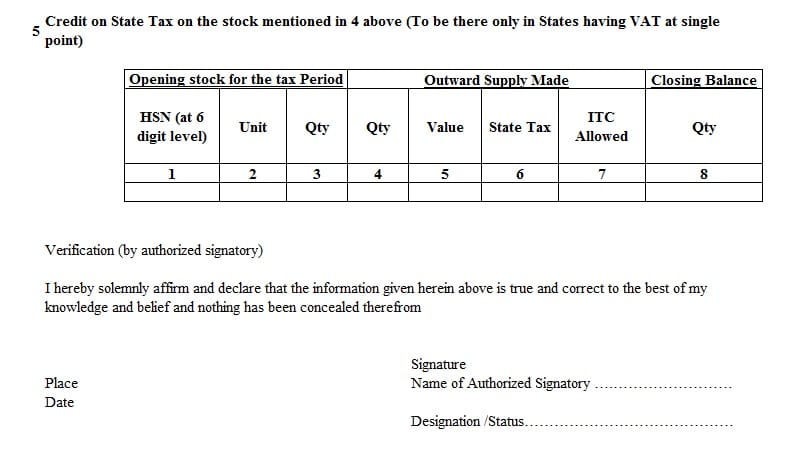

5. Credit on State Tax on the stock mentioned in 4 above (To be there only in States having VAT at single point)

In this section, you will record any credit of VAT on such stock. There are similar columns as in point 4. There we have 9 columns and here we have just 8 columns.

Difference is only the column 7 where the amount of SGST on sold goods will be mentioned.

At the end, you need to sign the declaration that the provided details are correct.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply