It is mandatory to maintain records of sales and purchase under the new GST regime. Every registered person has to maintain GST Sales Register in order to calculate their Output tax and for GSTR-1.

Section 35 of the CGST Act and “Accounts and Records” Rules (hereinafter referred to as rules) provide that every registered person shall keep and maintain all records at his principal place of business.

Source: www.cbec.gov.in

To maintain the purchase records you can download GST purchase Register.

At the end of each month, when you file your GSTR-1 and GSTR-2, tax collected will be deducted from the tax paid on purchases.

You will have to just pay the difference amount.

For this purpose, we have created a template for GST Sales Register in Excel.

You can maintain the records of all your GST sales made during a particular month.

This template can be helpful to all small traders, wholesalers etc. that are registered under GST

Click here to Download GST Sales Register Excel Template.

Click here to Download All GST Excel Templates for ₹299.

You can also download other GST templates like GST Bill of Supply, GST Payment Voucher, and GST Export Invoice from here.

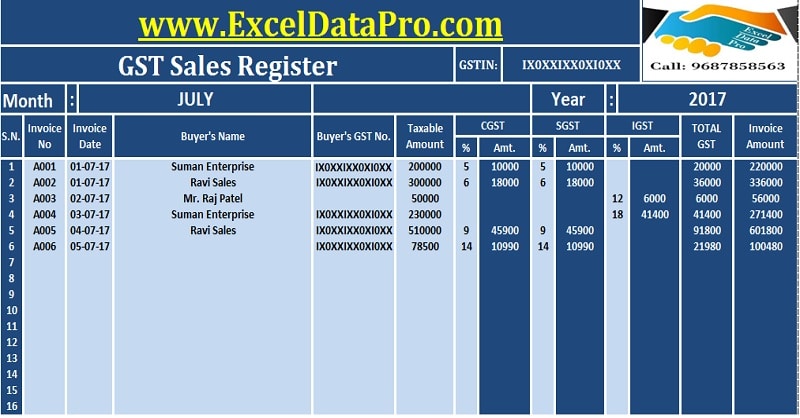

Let us discuss the content of the template in detail.

Contents of GST Sales Register

Similar to the GST purchase register this template also contains 2 sections:

- Header Section

- Sales Data Section

1. Header Section

This section consists of your company name, address, GSTIN, heading of the Sheet “GST Sales Register”, month and year for which it is prepared.

2. Sales Data Section

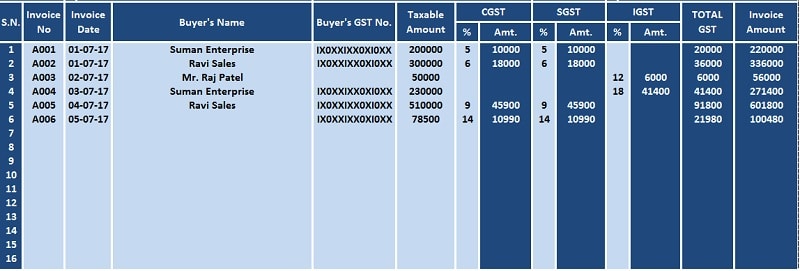

The sales data section consists of the following subheadings:

Sr.No.: Serial Numbers.

Invoice No: Invoice number of the sale made is entered here. The series of invoices have to be maintained as per the GST Law.

Invoice Date: Date of issue of the Sales Invoice.

Buyer’s Name: Name of the registered or non-registered company to which the sale has been made.

GST No.: GSTIN of the Buyer. If the buyer doesn’t have GSTIN leave it blank. It should be kept in mind that you will have to pay the GST under Reverse Charge Mechanism.

Taxable Amount: Amount after deducting discount. The taxable amount is the amount on which the tax is calculated.

CGST, SGST, and IGST: Just enter the applicable tax percentage tax of Central, State or Integrated and it will auto calculate the amount.

Total GST: Total GST = CGST + SGST + IGST.

Invoice Amount: Invoice amount = Taxable Amount + CGST + SGST + IGST.

At the end, there is the total of each column at the bottom.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.