Just a few days to go for the GST to be implemented. After the successful publishing of our GST Invoice Template and Bill of Supply, today we will publish the GST Receipt Voucher Excel Template.

Receipt Voucher is third among the 8 types of invoices and vouchers under the GST regime.

The government has defined some rules for issuance pertaining to the format of Receipt Vouchers.

Rules for GST Receipt Voucher

A receipt voucher referred to in clause (d) of sub-section (3) of section 31 shall contain the following particulars:

- Name, address, and GSTIN of the supplier

- A consecutive serial number not exceeding sixteen characters, in one or multiple series, containing alphabets or numerals or special characters unique for a financial year.

- Date of its issue.

- Name, address and GSTIN or UIN, if registered, of the recipient.

- Description of the goods or services.

- The amount of advance taken.

- The rate of tax (CGST, SGST, IGST, Union Territory tax or cess).

- The amount of tax charged in respect of taxable goods or services (CGST, SGST, IGST, Union Territory tax or cess).

- Place of supply along with the name of State and its code, in a case of a supply in the course of inter-State trade or commerce.

- Whether the tax is payable on reverse charge basis and

- Signature or digital signature of the supplier or his authorized representative.

Provided that where at the time of receipt of advance:

- If the rate of tax is not determinable, the tax shall be paid at the rate of 18%.

- If the nature of supply is not determinable, the same shall be treated as inter-State supply.

Source: www.cbec.gov.in

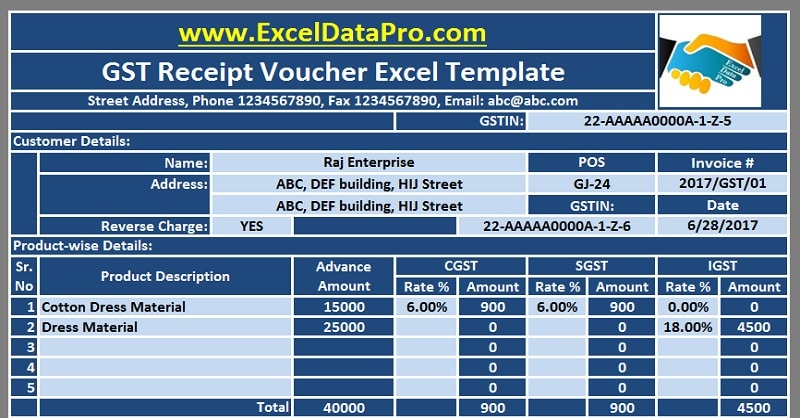

GST Receipt Voucher Excel Template

We have created an easy to use GST Receipt Voucher in Excel following the above guidelines. Just enter few details and the template will compute all the rest items Content for you.

This template helps you to efficiently and easily issue the voucher against the receipt of an advance amount for goods or services to be supplied in future.

It is useful for Accounts Assistant, Accountants, Audit Assistants etc.

Click here to Download All GST Excel Templates for ₹299.

Additionally, you can download other accounting templates like Petty Cash Book, Simple Cash Book, and Accounts Payable Excel Templates from here.

Let us discuss the contents of the template in detail.

Contents of the Receipt Voucher Template

This template consists of 4 sections

- Header Section.

- Customer Details.

- Product Details.

- Signature Section.

1. Header Section

Header section consists of the company name, company address, company logo, invoice number, GSTIN and the heading of the sheet “GST Receipt Voucher Excel Template”.

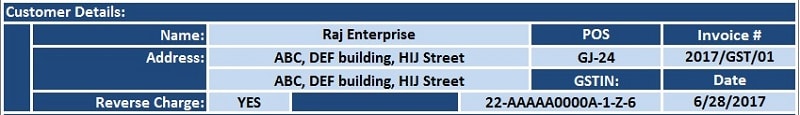

2. Customer Details

Customer Detail consists of details of a customer such as the name of the customer, address, GSTIN, POS(Place of Supply), Reverse charge applicability and Invoice Date.

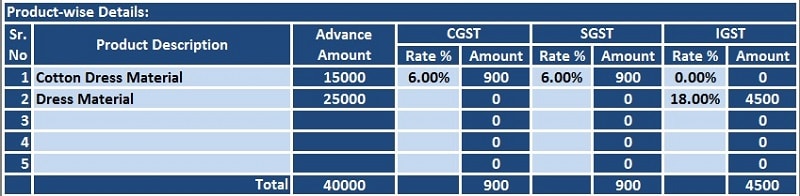

3. Product Details

This section consist of multiple subheadings which are as below:

Sr. No.: Serial number of items/products.

Product Description: Description of the Product.

Advance Amount: The amount of advance received.

SGST: The rate is the applicable rate of SGST which is to be entered manually. SGST amount is also calculated automatically where Advance amount X Rate of SGST.

IGST: The rate is the applicable rate of IGST which is to be entered manually. The Amount is the Advance amount X Rate of IGST.

Note: If IGST is applicable the CGST and SGST are not collected. Furthermore, if the rate and type of transaction are not known it will be considered as an inter-state transaction on which 18% IGST will be applicable.

Total: Below each column total of each head is made for easy calculation purpose.

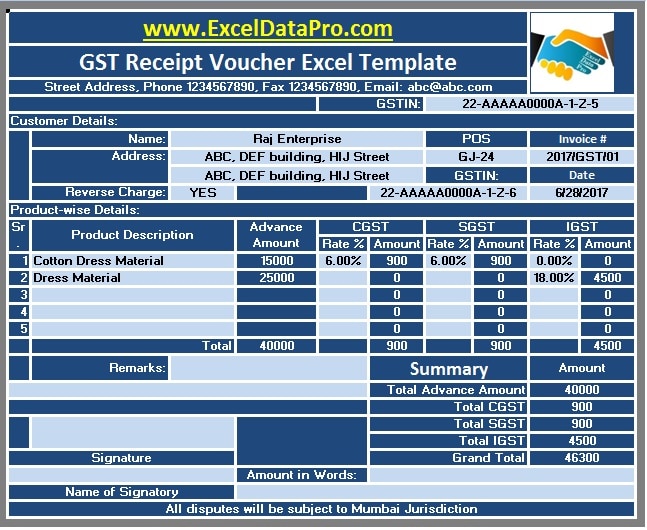

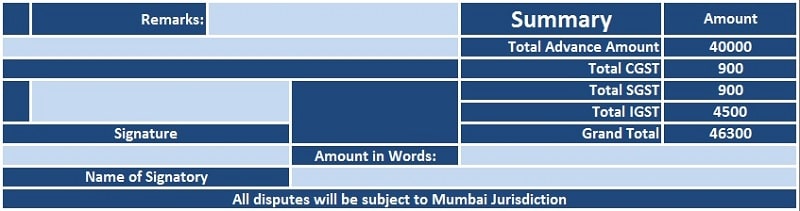

5. Signature and Summary Section

Signature Section consists of remarks, Signatures of the receiver and the name of the signatory.

The amount in words: The grand total of Receipt Voucher.

The summary consists of the total of receipt voucher by the customer.

Thus, Grand Total = Total Advance Amount + CGST + SGST + IGST.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.