The consignor issues a GST Delivery Challan in lieu of GST Tax Invoice at the time of removal of goods for transportation for the purpose of job work, the supply of goods from primary office to branch etc.

According to the rules provided by the government, rules for issuance of the delivery challan are as below:

1. For the purposes of

- supply of liquid gas where the quantity at the time of removal from the place of business of the supplier is not known,

- transportation of goods for job work,

- transportation of goods for reasons other than by way of supply, or

- such other supplies as may be notified by the Board,

The consigner may issue a delivery challan, serially numbered not exceeding sixteen characters, in one or multiple series, in lieu of invoice at the time of removal of goods for transportation, containing the following details:

- Date and number of the delivery challan,

- Name, address, and GSTIN of the consigner, if registered,

- Name, address, and GSTIN or UIN of the consignee, if registered,

- HSN code and description of goods,

- Quantity (provisional, where the exact quantity being supplied is not known),

- Taxable value,

- The tax rate and tax amount – central tax, State tax, integrated tax, Union Territory tax or cess, where the transportation is for supply to the consignee,

- Place of supply, in the case of inter-State movement, and

- Signature.

(2) The delivery challan shall be prepared in triplicate, in the case of supply of goods, in the following manner:–

(a) the original copy being marked as ORIGINAL FOR CONSIGNEE;

(b) the duplicate copy being marked as DUPLICATE FOR TRANSPORTER; and

(c) the triplicate copy being marked as TRIPLICATE FOR CONSIGNOR.

(3) Where goods are being transported on a delivery challan in lieu of invoice, the same shall be declared in FORM [WAYBILL].

(4) Where the goods being transported are for the purpose of supply to the recipient but the tax invoice could not be issued at the time of removal of goods for the purpose of supply, the supplier shall issue a tax invoice after delivery of goods.

(5) Where the goods are being transported in a semi-knocked down or completely knocked down condition.

(a) The supplier shall issue the complete invoice before dispatch of the first consignment.

(b) The supplier shall issue a delivery challan for each of the subsequent consignments giving reference of the invoice.

(c) Each consignment shall be accompanied by copies of the corresponding delivery challan along with a duly certified copy of the invoice; and

(d) The original copy of the invoice shall be sent along with the last consignment.

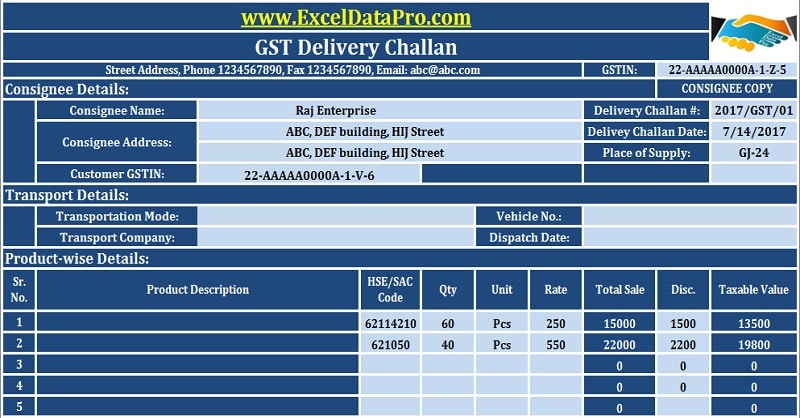

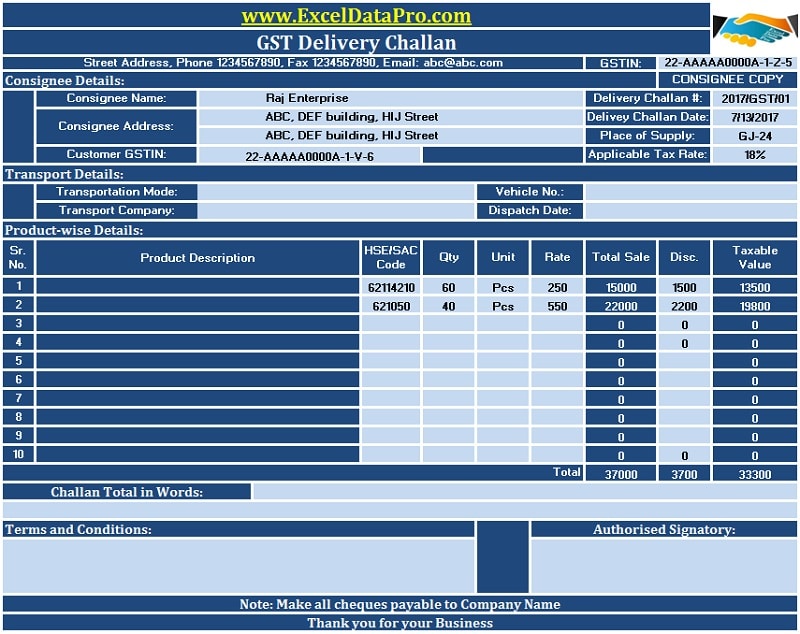

GST Delivery Challan Format

In accordance with the above-mentioned guidelines, we have created GST Delivery Challan. You just need to enter your company name, address, logo etc and start issuing the Delivery Challan.

With this template, you can issue delivery challan in triplicate copy for the purpose of transportation of goods for job work, the supply to branches from your preliminary office etc.

In respect of the rules, the first copy is for the consignee, second for the Transporter and the third for the consignor.

If the supply is full and final, it is better to issue the tax invoice. It is useful especially for textile, chemical and other similar industries where deliveries take place in installments.

Click here to Download All GST Excel Templates for ₹299.Additionally, you can download other accounting templates like Salary Sheet, Simple Cash Book, and Accounts Payable Excel Templates from here.

Let us discuss the contents of the template in detail.

Contents of the GST Delivery Challan Excel Template

The Delivery Challan Excel Template consists of 5 sections:

- Header Section.

- Consignee Details Section.

- Product Details Section.

- Signature and Remarks Section.

1. Header Section

On the top, the Header section will have the details like the company name, company address, company logo, GSTIN and the document heading “GST Delivery Challan”.

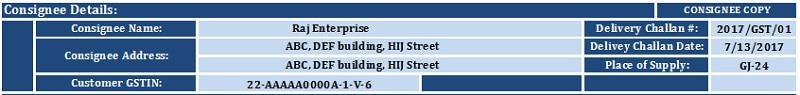

2. Consignee Details Section

The receiver of the goods is called the consignee in terms of transport. This section consists the details of the consignee such as the name of the consignee, consignee address, GSTIN, Delivery Challan Number, Place of Supply (POS) and the date of issue.

3. Transport Detail Section

Unlike other documents under GST, this section contains transport details such as transportation mode (air/sea/land), the name of the transport company, vehicle number or flight number and date of dispatch.

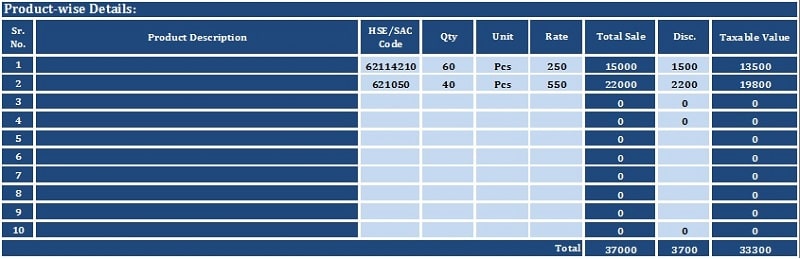

4. Product Details Section

Products details contains the following columns:

Sr. No.: Serial numbers.

Product Description: Description of the Product such as size, color, dimensions etc.

HSN/SAC Codes: Harmonized System Nomenclature code of Goods or Services Accounting Code of services.

Under GST, you have to mention the HSN?SAC code compulsory for the respective good or service.

To find HSN Code for your product, click on the link below:

To find SAC Code for your product, click on the link below:

Qty: Quantity of goods.

Units: Units of your product. It can be pieces, bags, meters etc.

Rate: Rate of the product.

The Total Sale: Total Sale = Quantity X Rate.

Disc.: Discounts if applicable.

Taxable Value: Taxable value column is auto calculated. The Total Sale – Discount = Taxable Value.

Totals: The total of each column for summary has been made.

A delivery challan doesn’t have tax columns. A tax invoice has to be mandatorily issued after delivery of goods.

5. Signature Section

The signature section consists of Challan total in words, the signature box for authorized signatory, remarks, and business greetings.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.