The Debt Reduction Calculator is a ready-to-use Excel template designed to aid individuals in calculating their total outstanding debt and devising a strategic repayment plan for debt reduction.

Oftentimes, many individuals find themselves encumbered by various forms of debt, such as credit card balances, educational loans, automobile financing, or residential mortgages.

Debt represents a borrowing against one’s future earnings. While it may temporarily increase one’s possessions or purchasing power, it ultimately results in a significant burden of repayments and associated stress. However, by prudently managing one’s financial resources, it is possible to expedite the repayment of debts sooner than initially anticipated.

This user-friendly template facilitates the creation of a debt repayment and reduction plan with minimal effort.

The Debt Reduction Calculator Excel Template

We have developed a straightforward and easy-to-use Debt Reduction Calculator Excel Template, complete with predefined formulas. This template aids in the creation of a debt repayment plan while simultaneously reducing interest payments.

Click here to download the Debt Reduction Calculator Excel Template.

Click here to Download All Personal Finance Excel Templates for ₹299.You can also download other personal finance templates like Savings Goal Tracker, Household Budget, Credit Card Payoff Calculator and Personal Income Expense Tracker from our website.

It is essential to understand how to effectively utilize this template.

Contents of Debt Reduction Calculator Excel Template

This template consists of 2 templates:

- Debt Calculator

- Additional Accumulation Sheet

Important Note: Data input should be confined to the light blue-colored cells, as the dark blue cells contain formulas.

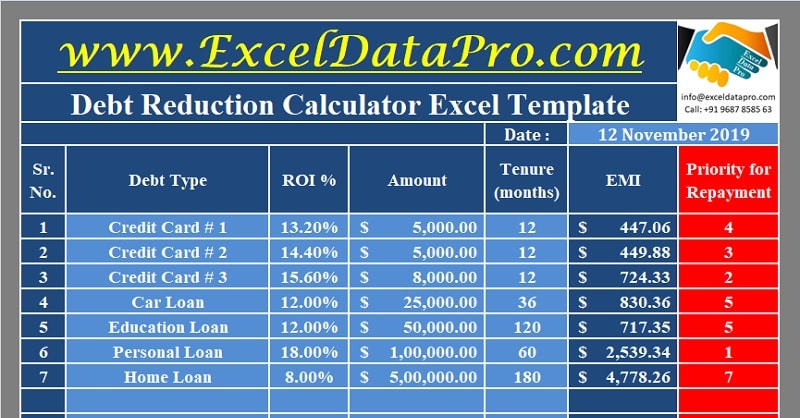

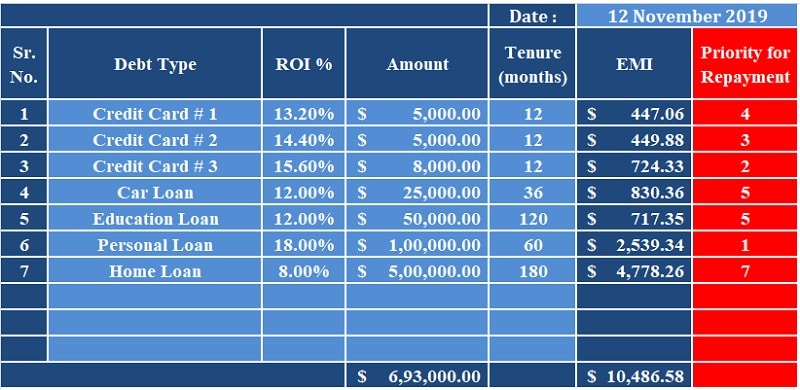

Debt Reduction Calculator

There are 2 sections in this sheet: Debt Calculation with monthly Installments and Debt Re-payment Fund Allocation.

Begin by entering the date on which you are calculating the debt repayment schedule.

Debt Calculation with monthly installments consists of the following columns:

Sr. No: This column displays the serial number and is automatically populated by predefined formulas as data is entered in the subsequent columns.

Debt Type: In this column, list all the types of debt you currently hold, such as credit card balances, home mortgages, automobile loans, personal loans, etc.

RIO %: Enter the applicable annual interest rate percentage for each type of debt.

Amount: Input the outstanding amount for each type of debt at the time of evaluation.

Tenure (Months): Specify the remaining tenure, in months, for each type of debt.

EMI: EMI stands for Equated Monthly Installments. This column utilizes a predefined formula to calculate the monthly installment amount using the PMT (Payment) function.

If the interest rate is unknown, you can directly enter the monthly installment amount.

Priority: This column automatically assigns priority levels for repayment, ranging from the highest to the lowest interest rates.

At the conclusion of this section, the total outstanding debt amount and the total monthly installments are displayed.

The Debt Repayment Fund Allocation section pertains to the allocation of funds remaining from your monthly income for debt repayment purposes.

Achieving financial stability and prosperity hinges on prioritizing debt clearance over savings.

It is advisable to allocate the maximum possible portion of your income towards expediting the repayment of debts.

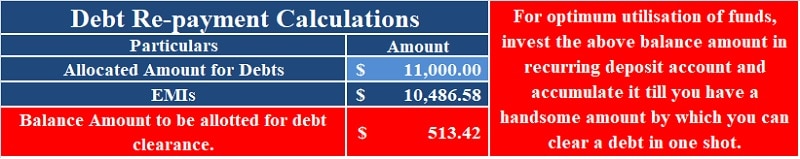

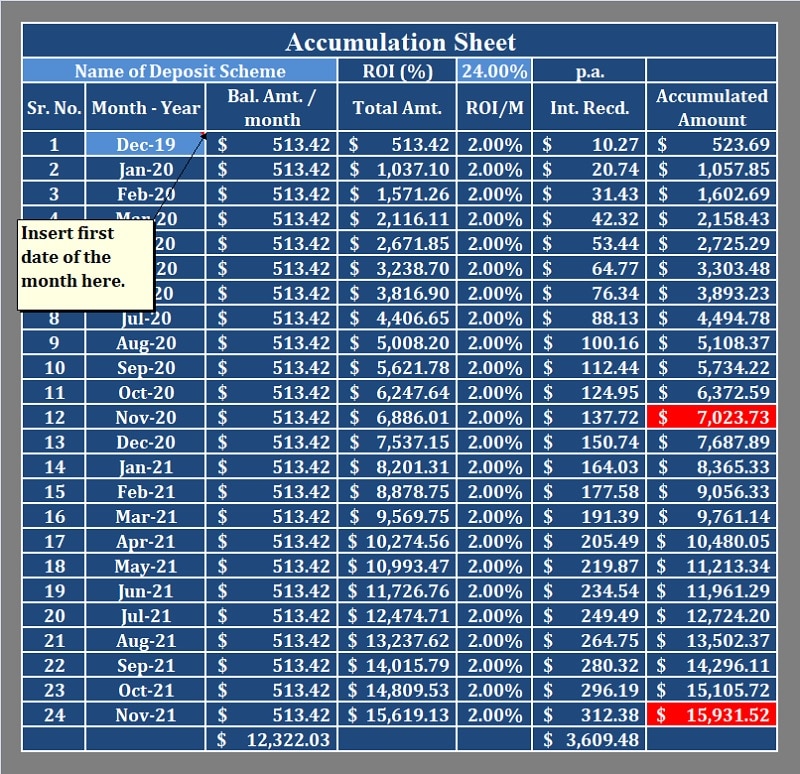

Additional Accumulation Sheet

If the allocated funds exceed the required installment amounts, you can plan for additional debt repayment by investing the remaining sum in a recurring balance savings scheme.

This approach not only accumulates the principal amount but also generates additional interest, enabling you to pay off your debts ahead of the scheduled tenure.

In this sheet, you need to provide the following three details:

- Name of the Recurring Deposit Scheme.

- Annual interest rate percentage.

- The month in which you initiate the recurring deposit.

This sheet incorporates predefined formulas that automatically fetch the remaining balance amount from the previous sheet after deducting installment payments.

Furthermore, it calculates the monthly interest earned, interest received, and the total accumulated amount at the end of every month.

Consequently, you can identify the month and the specific debt that can be paid off in its entirety using the accumulated funds.

My personal recommendation regarding debt repayment is to prioritize the repayment of credit card balances, as they typically bear higher interest rates and involve smaller outstanding amounts.

As exemplified in the provided data, the 12th and 24th months are highlighted, indicating the additional accumulated amounts.

According to this example, you can pay off your automobile loan in its entirety within the next 24 months, despite the original tenure being three years.

If you are unable to save and accumulate additional funds, and are merely meeting the minimum installment payments, the following tips may assist you in accelerating your debt repayment:

Tips for Debt Repayment

- Pick up a side hustle.

- Avoid any extras like going out to eat, cable television, or unnecessary spending.

- Sell off unnecessary possessions.

- Seek part-time employment opportunities.

- Negotiate with creditors for lower interest rates on credit cards and other bills.

- Consider transferring credit card balances to lower-interest rate options when available.

- Eliminate expensive habits, such as frequent restaurant lunches during work hours or fast food consumption.

- Monitor your shopping habits. Don’t buy unnecessary things.

We extend our gratitude to our readers for their engagement, including liking, sharing, and following us across various social media platforms.

If you have any queries or require further assistance, please do not hesitate to share them in the comment section below. We will be more than happy to address your concerns.