AGI or Adjusted Gross Income Calculator helps you calculate define your tax bracket as well as your tax liability.

AGI is is the basis of several tax thresholds. It also helps to determine the eligibility for certain tax credits. AGI is your total income less of allowable deductions.

We have created an easy and ready to use Adjusted Gross Income Calculator in excel. You can use this excel template to calculate your AGI.

You just need to enter your figures and it will automatically calculate your AGI.

Click here to download the Adjusted Gross Income Calculator Excel Template.

To download the same calculator in Numbers click the link below:

AGI Calculator Apple Numbers Template

You can download excel templates like Traditional IRA Calculator, Roth IRA Calculator and Income Statement Projection in Excel for easy calculations.

Let us discuss the contents of the template in detail.

Contents of Adjusted Gross Income Calculator Excel Template

The Adjusted Gross Income Calculator consists 4 sections.

- Header Section

- Gross Income Section.

- Allowable Deductions Section.

- Calculation of AGI

1. Header Section

The header section contains the heading ” AGI Calculator. If you are an advisory company you can add your company name or logo in the template.

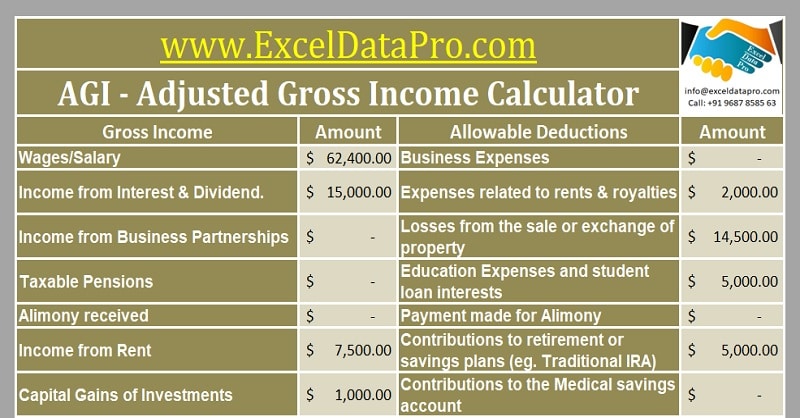

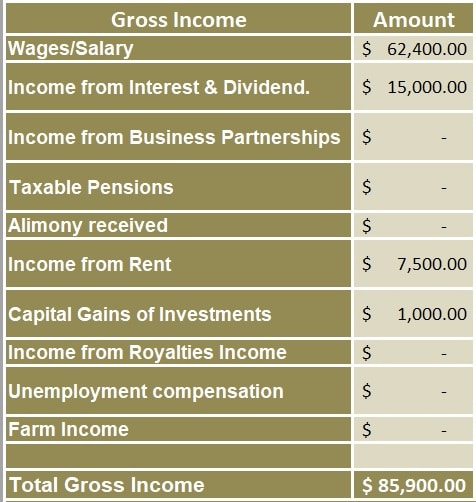

2. Gross Income Section

This section consists of income from different sources.

These sources include:

- Wages / Salary.

- Income from Dividends.

- Income from Business/Business Partnerships.

- Taxable Pension.

- Alimony Received.

- Rental Income.

- Capital Gains on Investment.

- Royalty Income.

- Income from Farming activities.

- Unemployed Compensations.

Enter amounts of all applicable incomes in the respective cell.

At the end, it will evaluate your Total Gross Income.

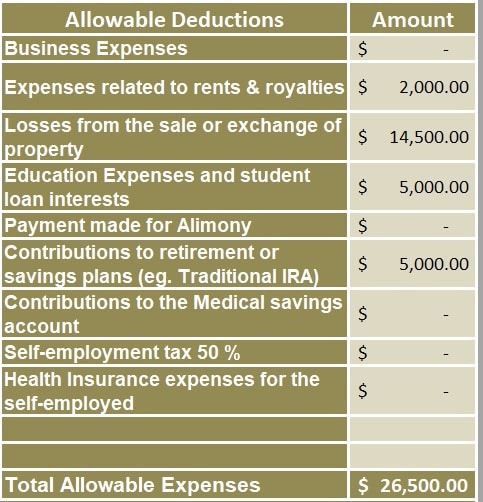

3. Allowable Deductions

These claimable deductions allowed by IRS include:

- Expenses made for Business Purposes.

- Expenses related to rent or royalties.

- Losses made during sale or exchange of properties.

- Student Loan Interests.

- Alimony paid.

- Contributions to IRAs.

- Contributions to Medical Saving Accounts.

- 50% of Self employment tax.

- Self-employed Health Insurance Expenses.

Enter amounts of all applicable incomes in the respective cell.

At the end, it will evaluate your Total Gross Income.

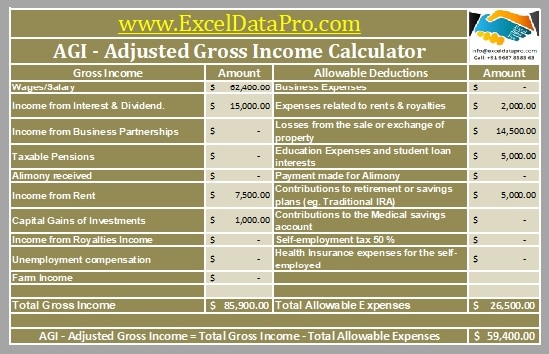

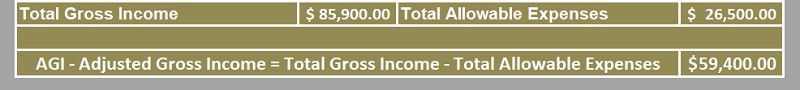

4. Calculation of AGI

The Calculation of AGI is a 3 step process.

- Adding income from all sources.

- Adding all applicable allowable expenses.

- The difference of Gross Incomes less of Allowable Deductions.

Formula:

AGI = Gross Income – Allowable Deductions

Gross Income is the total of your income from all sources.

Gross Income doesn’t consist of gifts, inheritances, tax-free Social Security benefits or tax-free interest from state or local bonds.

Allowable deductions are those claimable expenses allowed by IRS.

The allowable deductions used to derive AGI deducted prior to tax exemptions for military service, dependent status, etc.

Example of Calculating Adjusted Gross Income

Mr. X has a salary of 5200 per month. Thus, his annual salary is 5200 x 12 = 62400

Income of Mr. X

Annual Salary – $ 62,400

Interests – $ 15,000

Rental Income – $ 7,500

Capital Gains – $ 1,000

Thus, adding the above figures the Total Gross Income of Mr. X is $ 85,900.

Deductions for Mr. X

Rent and Royalty expenses – $ 2,000

Losses from Sale or Exchange of Property – $ 14,500

Education expenses and Student Loan Interests – $ 5,000

IRA Contributions – $ 5,000

When you add all the above deductions, Mr. X’s allowable deduction is $ 26,500.

Adjusted Gross Income of Mr. X

Gross Income – Allowable Deductions

= $ 85,900 – $ 26,500

= $ 59, 400

= Adjusted Gross Income of Mr. X

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply