401k Calculator is an excel template that helps you to calculate the total amount of money you could save during until your retirement age.

A 401k Retirement Plan is a savings and investing plan offered by employers to his employees that gives a tax break on money they set aside for retirement.

For the year 2017, the individuals can annually contribute up to $ 18,000 a year. If the individual is above the 50 years, he/she can contribute an additional amount of $ 6,000.

401k plans are subject to complex regulations and qualification requirements. Consult a qualified professional before making any decisions.

We have created 401k Calculator in excel with predefined formulas to help you easily calculate the total amount of money you can save through 401k retirement plan.

Just enter the required details in the white boxes and it will automatically calculate the results for you.

Click here to download 401k Calculator Excel Template.

You can download other excel templates like Simple Tax Estimator, Traditional IRA Calculator, Roth IRA Calculator and much more for easy calculations.

Let us discuss the contents of the template in detail.

Contents of 401k Calculator

401k Calculator consists of 3 sections:

- Header Section.

- Input Section.

- Output Section.

1. Header Section

The header section consists of company name and logo along with the heading of the sheet ” 401k Calculator”.

2. Input Section

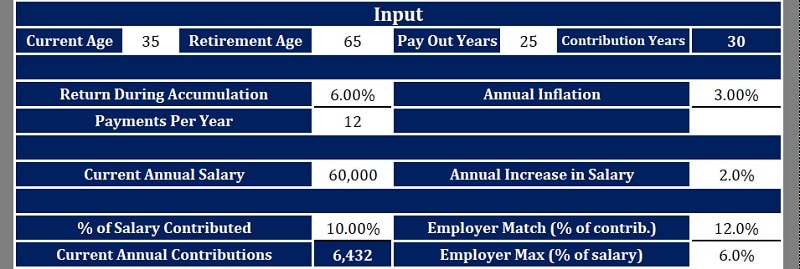

Input Section consists of details which you need to enter to derive the amount:

Enter your current age, retirement age, payout years and it will automatically calculate the number of years you will contribute.

In addition to the above, you need to enter the rate of return during accumulation, expected inflation rate, and the number of payments to be made per year.

You can select the number of payments from the dropdown list. It is configured using data validation.

Furthermore, enter your current annual salary and estimated percentage increase in salary per year.

You also need to enter the percentage of salary you wish to contribute. Usually, employers contribute 50% of your contribution.

As per the rules, the employer’s contribution should not be more than 6% of your salary.

As you enter the above data, the system will automatically calculate the total contribution amount. That is your contribution as well as employer’s contribution.

As in the example of the template, your salary is $ 60,000. The 10% of your salary is $ 6,000. 50% of your contribution amount is $ 3,000.

But as it is above the 6% limit for employers, Employer’s contribution is $ 1,800 and is added to your contributions.

Output Section

Entering all the above data in the input section will give you the final output. The output section calculates the final value of contribution at the time of retirement.

401k plans have been popular with employees for many reasons. The main reason is tax deferral gains. In addition to that, increased portability, employer matching contributions and the control over investments options are also the reason.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. I will be more than happy to assist you.

Leave a Reply