Every business entity has to issue a UAE VAT Debit Note, whenever the goods delivered are less are or tax collected is less against the original issued invoice.

VAT to be implemented in UAE from 1st January 2018. Businesses will have to get ready for VAT billing system.

A Debit Note is a document issued by a vendor when actual supply made or taxes collected are less against the original VAT invoice.

Liability of tax paid to the government increased when a Debit note is issued.

Usually, VAT Collected on Sales + VAT on Debit Notes = VAT payable to the government.

To know more about the VAT you can visit the official website of Ministry of Finance – UAE www.mof.gov.ae

We have created an easy to use excel template of UAE VAT Debit note with predefined formulas. You can issue the Debit note with very little efforts.

Click here to download UAE VAT Debit Note Excel Template.

This template can be useful for accountants, accounting freelancers, accounts assistants etc.

Just download and change the company details in the header section like your company name, logo, address and VAT number.

Select the customer from the drop-down list. and enter the details to be debited against the specific invoice number.

You can download other accounting templates like UAE VAT Invoice Template, UAE Invoice Template in Arabic, and Cash Book with VAT from here.

Let us discuss the contents of the template in detail.

Contents of UAE VAT Debit Note Template

This template consists of 2 worksheets.

- UAE VAT Debit Note Template and

- Database Sheet

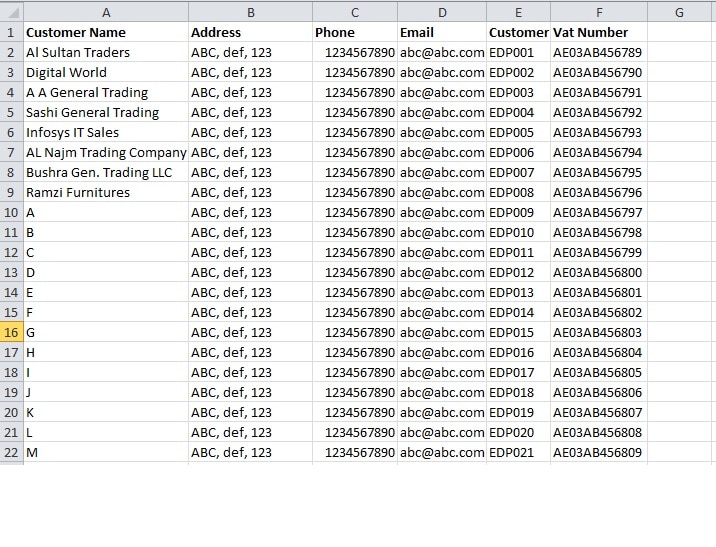

Database sheet contains the details of customers like customer id, customer name, customer address, customer phone, Customer VAT number and customer email address. The main purpose of creating this sheet to save time and simplify your work.

The main purpose of creating this sheet to save time and simplify your work.

This Database sheet is linked using VLOOKUP function to the Debit Note Template.

A drop-down list has been created using data validation function and you can select the customer name from it.

When you will select the customer name it will automatically select all the relevant customers.

These details include customer’s VAT number, address, phone number etc will be updated automatically.

The Debit Note Template consists of 4 sections:

- Header Section

- Customer Details Section

- Product Details Sections

- Other Details Section

1. Header

As usual, the Header section consists of the company logo, Company name, and heading of the template ” UAE VAT Debit Note”.

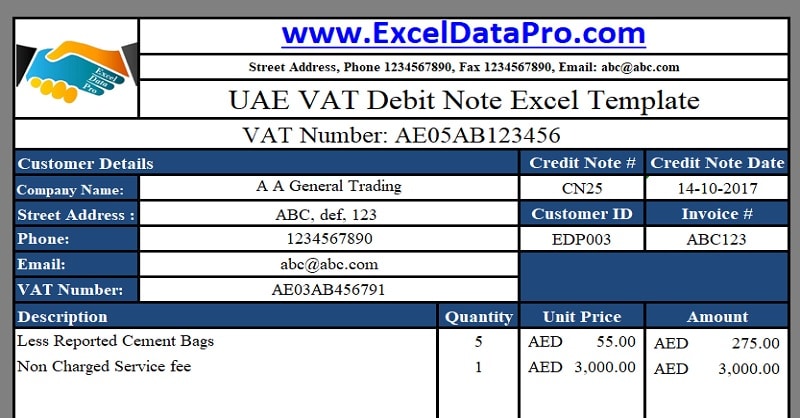

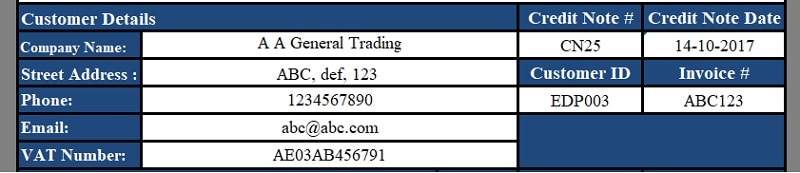

2. Customer Details

The second section is Customer details section. It is interlinked with data validation and VLOOKUP function to the database sheet.

You need to update the database sheet once with your customer details according to your need.

You need to enter the Debit Note number, Debit note date, and Invoice Number against which the Debit note is issued on the right-hand side of Customer Details Section.

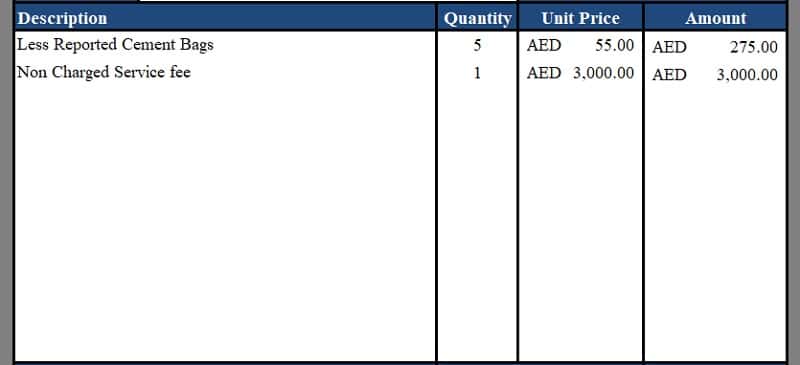

3. Product Details

Product details consist of details of goods like Description, Quantity, Unit Price and Amount. Simple mathematical computations are applied.

Quantity X Unit Price = Amount.

The Subtotal is given at the end of Product details section. SUM Function is used here for making totals.

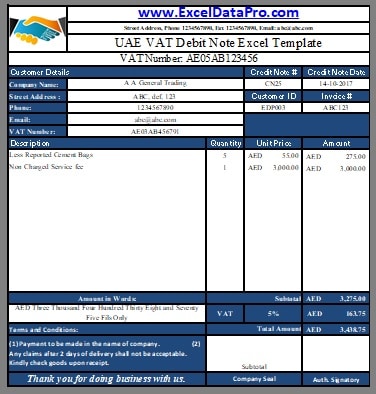

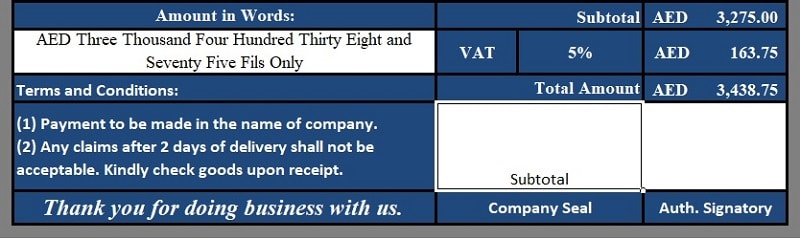

4. Other Details

Other details section consists of following 7 subheadings:

- Amount in words

- Terms and Conditions

- Business Greeting

- VAT Calculations

- Invoice amount

- Company Seal/Stamp

- Authorized Signatory Section

The cell of the VAT amount is pre-formulated. Thus, it will automatically calculate 5 % VAT amount on the total amount of the bill.

We thank our readers for liking, sharing and following us on different social media platforms.

If you have any queries please share in the comment section below. We will be more than happy to assist you.

Leave a Reply